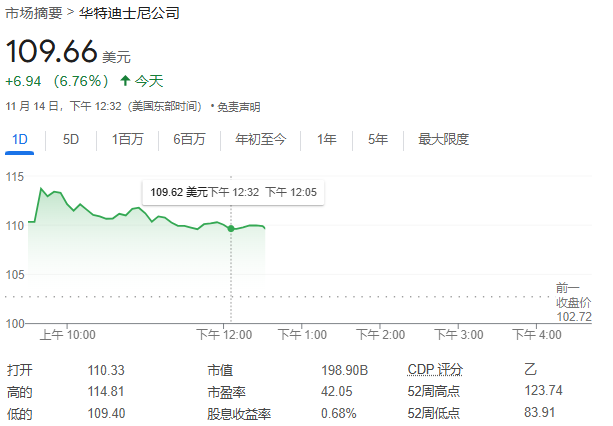

Disney not only exceeded Wall Street expectations for EPS and revenue in the fourth quarter, but its direct-to-consumer (DTC) streaming business turned a profit, and the strong performance guidance for the next two years also sparked optimism among investors, with the stock price temporarily rising nearly 12%.

Disney's fourth-quarter profit exceeded expectations, with strong growth in the direct-to-consumer (DTC) streaming business being the main driving force.

On Thursday, November 14, Disney released its fiscal year 2024 fourth quarter and full-year financial report for the period ending September 28, 2024:

1) Key Financial Figures:

1) Key Financial Figures:

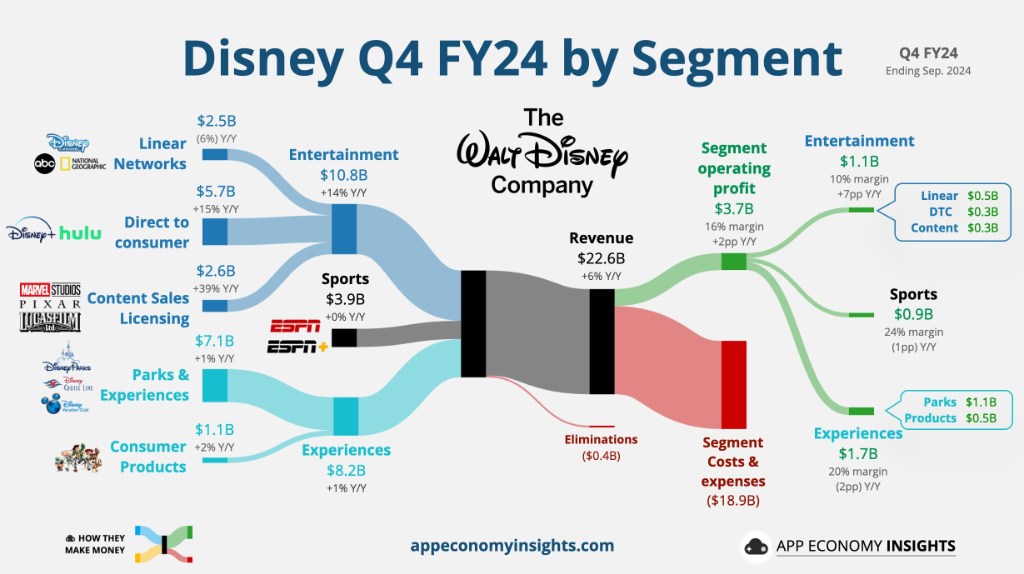

- Revenue: Fourth quarter revenue increased by 6.3% year-on-year to $22.57 billion, compared to the estimated $22.47 billion. Full-year revenue grew by 3% year-on-year to $91.4 billion.

- Earnings per share: Fourth quarter earnings per share (EPS) increased by 79% year-on-year to $0.25. Full-year EPS doubled from last year's $1.29 to $2.72. Adjusted earnings per share for the fourth quarter rose by 39% year-on-year to $1.14, compared to the estimated $1.10. Full-year EPS increased by 32% year-on-year to $4.97.

- EBIT: Fourth quarter EBIT declined by 6% year-on-year to $0.9 billion. Full-year EBIT increased by 59% year-on-year to $7.6 billion.

2) Main business:

- The entertainment segment reported a significant improvement in revenue for the fourth quarter, reaching 1.1 billion dollars, an increase of 0.8 billion dollars year-on-year. In Q4, disney's direct-to-consumer (DTC) streaming business, including Disney+, Hulu, and ESPN+, generated a revenue of 0.321 billion dollars. In contrast, there was a loss of 0.387 billion dollars in the same period last year.

- Streaming user growth: The company had 0.174 billion Disney+ Core and Hulu subscribers at the end of the fourth quarter, of which 0.12 billion were paid subscribers to Disney+ Core, an increase of 4.4 million from the previous quarter.

- Box office revenue: Pixar's 'Inside Out 2' and Marvel's 'Deadpool and Wolverine' broke several box office records, contributing 0.316 billion dollars in revenue for content sales, licensing, and other businesses.

- The sports segment's revenue was 0.9 billion dollars, a year-on-year decrease of 0.01 billion dollars. ESPN's domestic advertising revenue grew by 7% year-on-year in the fourth quarter.

- The experiences segment saw a revenue increase of 0.1 billion dollars, a growth of 1%, with revenues totaling 1.7 billion dollars, down 0.01 billion dollars year-on-year (a 6% decrease). Domestic theme parks and experiences saw increased revenue in the fourth quarter, although visitor numbers were similar to last year, higher visitor spending generated more revenue, while new visitor experiences (such as disney cruise) also incurred higher costs. International theme parks and experiences saw decreased revenue in the fourth quarter.

3) Performance Guidance:

EPS: It is expected that adjusted earnings per share will achieve 'high single-digit' growth in 2025, exceeding the expected 4%, and profit growth should reach double digits by 2026 and continue through 2027.

By 2025, the company also plans to repurchase $3 billion in stocks and achieve "dividend growth in line with earnings growth."

After the financial report was released, Disney's stock price initially rose nearly 11.8% but later halved its gains.

Disney's streaming business has turned profitable.

As consumers gradually shift from traditional pay TV to streaming services, Disney and other media giants face pressure to transform. To adapt to this trend, Disney raised prices on several streaming subscription plans in mid-October, aiming to improve the profit margins of its direct-to-consumer (DTC) business to offset the decline in traditional linear television revenue.

In its latest financial report, Disney stated that it expects its DTC business to achieve approximately $0.875 billion in revenue for fiscal year 2025. Analysts noted that this target reflects Disney's confidence in the profitability of streaming, especially against the backdrop of rising subscription prices and cost optimization, making this revenue forecast more realistic.

Disney CFO Hugh Johnston mentioned in the earnings call that the growth of streaming can "naturally offset" the decline of linear television business. Over the past year, linear television revenue declined by 6% year-on-year, with segment operating income dropping by 38%.

Disney's management warned that as more consumers abandon cable TV packages, revenue from linear television networks is expected to continue to decline. Viewing habits are rapidly shifting toward streaming services, which is also one of the reasons the company is shifting its business focus toward streaming.

In terms of leadership, under the current backdrop of industry changes, Disney is looking for a new CEO successor. Current CEO Bob Iger plans to officially step down by the end of 2026. According to The Wall Street Journal, Disney announced that it will officially reveal the new CEO candidate in early 2026, with current board member and former Morgan Stanley CEO James Gorman leading this effort, starting as Chairman of the Board of Directors of Disney on January 2, 2025.

How does Wall Street look at this?

JPMorgan analyst David Karnovsky expressed optimism about Disney's mid-term prospects in a report to clients. He believes that besides the linear television business, Disney's overall development momentum is positive, and cost-cutting measures are expected to somewhat slow down the decline of the linear television business.

He also noted that Disney's box office performance this year has been strong, with many new releases surpassing the previous performance of the franchise, enhancing the market demand for Disney+, especially ahead of the upcoming shared password restrictions and price increases, which are expected to bring more subscribers and revenue growth.

Karnovsky believes that Disney's box office success has increased confidence in future productions, which will provide further momentum for the streaming platform's development. Therefore, he maintains an "overweight" rating on Disney's stocks, equivalent to a "buy" rating, and is bullish on its stock performance.