The US Department of Labor released data on the evening of (13), showing that the US CPI (Consumer Price Index) for October rose 2.6% from the same period last year, and slightly increased 0.2% from September this year. Both are in line with previous expectations.

Meanwhile, the core CPI excluding food and energy remained in line with September at 3.3%, with an annual increase of 3.3%, all in line with market expectations.

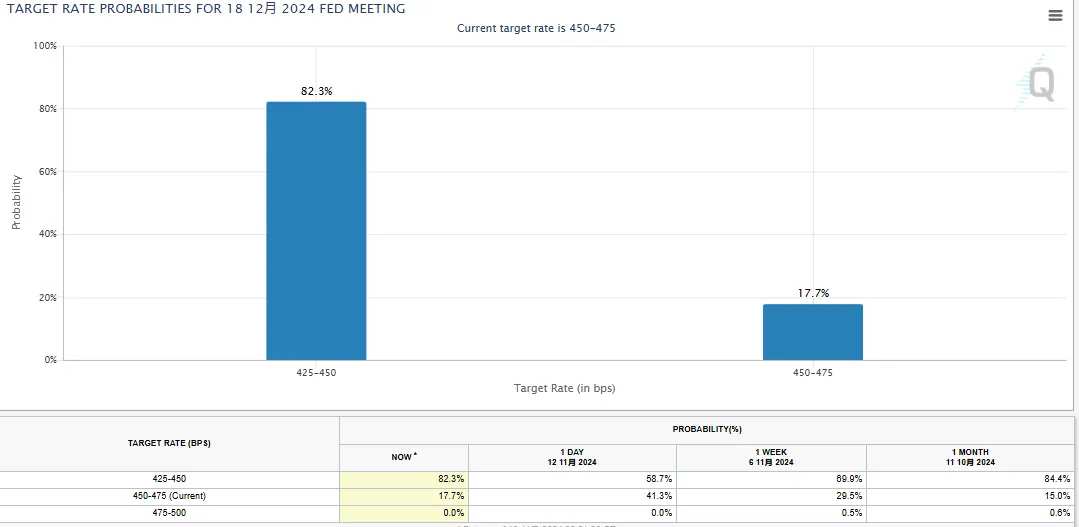

The probability of interest rate cuts in December rose to 82.3%

Previously, due to Trump's victory in the US election, the market anticipated that Trump's economic policies after coming to power might slow down the pace of interest rate cuts by the US Federal Reserve (Fed).

However, after the October CPI was announced, according to the CME Fed Watch tool, the market believes that the probability that the Fed will cut interest rates by 1 yard in December has risen from 58.7% the previous day to 82.3% now, and believes that the probability of keeping interest rates unchanged in the 4.75% to 5% range has dropped to 17.7%.

However, after the October CPI was announced, according to the CME Fed Watch tool, the market believes that the probability that the Fed will cut interest rates by 1 yard in December has risen from 58.7% the previous day to 82.3% now, and believes that the probability of keeping interest rates unchanged in the 4.75% to 5% range has dropped to 17.7%.

Bitcoin once surpassed $93,000

With the release of CPI data, which strengthened expectations for continued interest rate cuts in December, Bitcoin gained strength again last night, breaking through the $93,000 mark at 00:15 today (14), reaching a maximum of $93,263.

However, then selling pressure surged, and earlier it fell back to 0.088 million dollars, leaving many users who saw a break in a new high and then chase the rise.

According to Coinglass data, in the past 24 hours, the total amount of cryptocurrency liquidated positions reached 0.847 billion US dollars, with more than 0.52 billion dollars, and short orders liquidated 0.326 billion dollars. More than 0.25 million people were liquidated, which can be described as a double kill for long and short.

Bitwise's long investment: $0.5 million is a sign of Bitcoin's maturity

With regard to the current crazy rise in Bitcoin, many investors are beginning to fear that liquidation will occur at any time. However, Bitwise Investment Director Matt Hougan recently stated that it is still in the early stages of discovering the value of Bitcoin, and we will not be able to call Bitcoin mature until 0.5 million dollars:

Bitcoin recently hit record highs several times with the positive sentiment brought about by Trump's victory, and a breakthrough of 0.1 million dollars is imminent.

The demand to view Bitcoin as a gold-like store of value will continue to increase, particularly as the government continues to widen its deficit.

Although the central bank currently holds about 20% of the world's gold reserves, its Bitcoin holdings are less than 2%. If the US government plans to establish a Bitcoin reserve, Bitcoin will achieve the $0.5 million target, equal to the position of gold in the stored value market.

However, Ki Young Ju, founder of CryptoQuant, recently reminded investors that although Bitcoin will continue to rise in the long run, Bitcoin's current U-standard market leverage ratio has reached a record high of 2.7. If liquidation comes, it will probably be unimaginable pain.

US stocks had mixed ups and downs

However, although US stocks were also encouraged in the short term, subsequent selling pressure surged. The performance of the four major indices after opening last night was as follows:

The Dow Jones Industrial Average rose 47.21 points, or 0.11%, to close 43958.19 points

The S&P 500 rose 1.39 points, or 0.02%, to close 5985.38 points

The Nasdaq index fell 50.66 points, or 0.26%, to close at 19230.74 points

The Philadelphia Semiconductor Index fell 102.34 points, or 2.00%, to close 5006.29 points.

In terms of individual stocks, Meta, Huida, and Alphabet, which are the seven biggest players in the US, also experienced a slight decline.

不过10 月CPI 公布后,据芝商所Fed Watch工具显示,市场认为12 月Fed 降息1 码的机率,已经从前一日的58.7% 上升至目前的82.3%,认为维持利率水平在4.75% 至5 % 区间不变的机率已降至17.7%。

不过10 月CPI 公布后,据芝商所Fed Watch工具显示,市场认为12 月Fed 降息1 码的机率,已经从前一日的58.7% 上升至目前的82.3%,认为维持利率水平在4.75% 至5 % 区间不变的机率已降至17.7%。