The ai strategy of Gulf countries is not groundless.

In terms of major technology investments, the wealthy Gulf countries have had a complex history. After all, the latest investment records show that sovereign wealth funds from the UAE and Saudi Arabia invested as much as $60 billion in SoftBank's first Vision Fund under Masayoshi Son, but the return was very meager. However, in the field of artificial intelligence - a very real risk for global institutional investors is losing a large amount of money - the wealth funds in Abu Dhabi and Riyadh particularly need to have effective investment strategies in place.

In the eyes of Wall Street investment banks, artificial intelligence is still in its early stages. However, there are reasons to believe that the two largest economies in the world - China and the USA - will both become superpowers in artificial intelligence in the future. For the wealthy Gulf countries, they naturally do not want to miss the historic opportunity to become a powerhouse in AI. They hope to transition from being oil-rich nations to becoming high-tech nations attracting global funding. Yet, almost all emerging AI plans in the Gulf countries, including Saudi Arabia and the UAE, face the same infrastructure issue - a severe lack of AI chips widely used in data centers, including Nvidia's H100/H200.

Taking OpenAI as an example, this AI startup, with its AI chatbot tool ChatGPT based on large language models, has a staggering valuation of $157 billion. The valuation of this startup even surpasses that of the well-established US chip giant Intel. As for the unrivaled leader in the AI chip sector, Nvidia, the company has released the heavyweight H100/H200 and high-performance AI GPUs based on the Blackwell architecture. These AI hardware products from Nvidia are essential for building the AI infrastructure needed for large AI models. Leveraging its significant shareholder status in OpenAI, Microsoft launched Azure OpenAI Studio cloud service based on the core technology of ChatGPT, equivalent to a new AI-enhanced version of Azure. Microsoft embeds the GPT series large models that OpenAI is proud of into its flagship software products like Office, achieving growth in performance and stock price. Microsoft had long held the title of the 'world's most valuable company'.

Taking OpenAI as an example, this AI startup, with its AI chatbot tool ChatGPT based on large language models, has a staggering valuation of $157 billion. The valuation of this startup even surpasses that of the well-established US chip giant Intel. As for the unrivaled leader in the AI chip sector, Nvidia, the company has released the heavyweight H100/H200 and high-performance AI GPUs based on the Blackwell architecture. These AI hardware products from Nvidia are essential for building the AI infrastructure needed for large AI models. Leveraging its significant shareholder status in OpenAI, Microsoft launched Azure OpenAI Studio cloud service based on the core technology of ChatGPT, equivalent to a new AI-enhanced version of Azure. Microsoft embeds the GPT series large models that OpenAI is proud of into its flagship software products like Office, achieving growth in performance and stock price. Microsoft had long held the title of the 'world's most valuable company'.

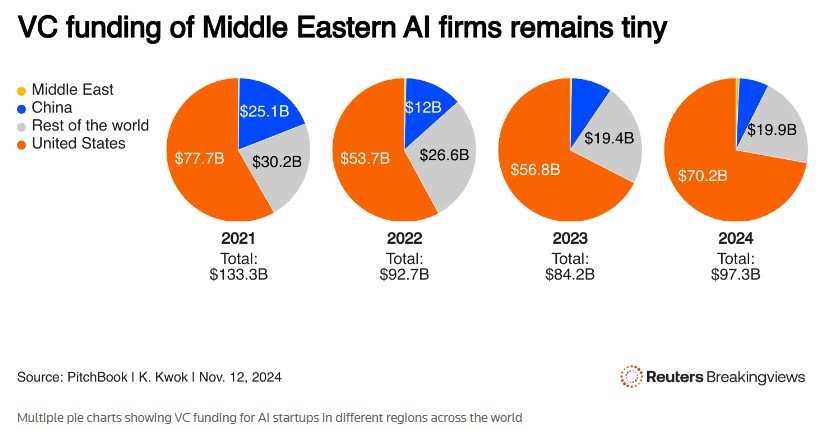

According to statistical data from PitchBook, AI startups in the US have raised approximately $70 billion from investors globally so far this year.

For the wealthy Gulf countries, there is a severe lack of private companies with strong technological or financial influence in the AI field. PitchBook indicates that venture capital firms have invested only around $0.7 billion in AI startups in the Middle East so far this year. It is undeniable that these countries do have massive sovereign wealth funds to support the development of AI startups in the region or to support tech giants like Nvidia, Microsoft, and Google in deepening their presence in the Gulf market.

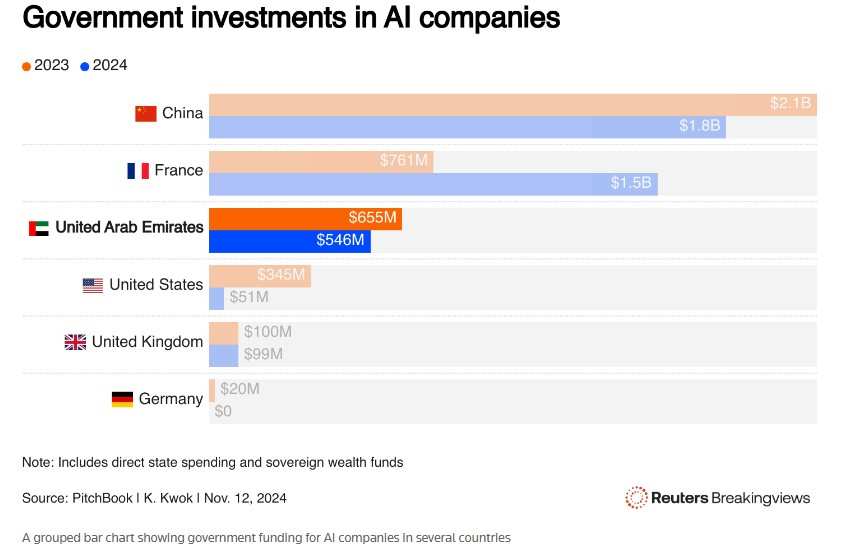

This year, the UAE announced the establishment of a $100 billion fund called MGX, including $30 billion in equity provided by US asset management giant BlackRock, tech giant Microsoft, and Abu Dhabi. It is understood that MGX is actually a 'technologized version' of the UAE's more mature $300 billion sovereign wealth fund Mubadala, focusing solely on rapid investments in cutting-edge AI companies around the world, such as OpenAI. Mubadala, on the other hand, invests across all sectors. Saudi Arabia is also planning to establish a similar-scale fund, and the country has already announced a comprehensive partnership with the US tech giant Google's parent company Alphabet to establish a large-scale AI center.

Consulting firms generally believe that the UAE government is about two years ahead of Saudi Arabia in terms of AI investments and development. They see MGX as a crucial aspect of the comprehensive AI strategy. Another key component is G42, a large company with 25,000 employees that the Abu Dhabi government hopes will establish massive data centers and cloud computing infrastructure in the Gulf region and Africa. Through subsidiaries like M42, Space42, and Core42, G42 develops important AI applications in healthcare, space, and data fields.

In the AI puzzle of Gulf countries such as Saudi Arabia and the United Arab Emirates, the most crucial piece can be said to be the academic community. Researchers at the Technology Innovation Institute (TII), funded by the UAE government, represent a part of the "Abu Dhabi Artificial Intelligence Company," a UAE government-supported AI company that developed Falcon. It, along with the Mistral from a French AI startup company and Llama, a large language model developed by Meta Platforms, has almost equal influence, and is one of the most advanced open-source large models in the world. Consultancy firms have indicated that TII is a key player in Abu Dhabi, distinguishing itself from mere cash and speculation institutions, becoming a significant global AI participant.

However, almost all emerging AI initiatives in Gulf countries face the same infrastructure issue. Despite Mubadala holding over 82% of the shares of the chip manufacturer GlobalFoundries—valued at 24 billion USD, this entity does not provide the core high-performance AI chips similar to Nvidia's Blackwell, crucial for training one of the most advanced large language models vital to the AI ambitions of Gulf countries.

Although Gulf countries, rich in oil resources, low in taxes, and abundant in sunlight, they evidently cannot create a Silicon Valley-style AI ecosystem from scratch, composed of innovative and competitive top AI experts.

The good news is that Saudi Arabia and Gulf countries like the United Arab Emirates are addressing these challenges with their enormous startup funding advantage, capable of attracting global cloud computing giants to build large-scale data centers in the region. These cloud giants do not need to worry about potential U.S. government pressure on cutting-edge hardware like AI chips. Companies like Amazon and Google, key customers of Nvidia, have the highest priority for AI GPU supply, thus possessing vast AI training/inference computational resources.

For the three tech giants Microsoft, Google, and Amazon, the market believes that they are benefiting as secondary to the AI chip leader Nvidia in the frenzy of artificial intelligence. Since the AI wave swept the globe in 2023, these three market-leading global cloud computing giants, far ahead of other cloud computing participants, have made large purchases of Nvidia's high-performance AI GPUs, intensively deploying B-end and C-end software application developers in the AI field, aiming to comprehensively reduce the IT technical thresholds for various industries to develop AI application software. Therefore, in the eyes of investors, it is undoubtedly that the three major tech giants, with a huge share in the cloud computing field, are able to enjoy the huge software spending scale brought about by the global layout of generative AI and the spending scale of cloud-based AI training/inference capabilities.

Amazon AWS, Google under Alphabet, and Microsoft, among other large-scale cloud service providers, are undoubtedly interested in providers of large language models (LLM) like OpenAI and Anthropic. Their direct business opportunity lies in attracting large companies like G42 to connect to their incredibly large data center systems, fully constructing, testing, operating, and driving all AI development and deployment, even cloud-based AI inference computing resources on their cloud computing ecosystems.

Meanwhile, the U.S. government hopes that emerging Gulf centers like Abu Dhabi do not get too close to China, their primary AI competitor. This explains why Microsoft announced investments in G42 and MGX this year and why the UAE is fully opening its data center market to U.S. large-scale cloud computing service providers preparing to enter the region. The implicit condition is that Gulf countries like the UAE will firmly stand in the American AI camp rather than the Eastern camp. This exchange also makes it easier for Gulf countries like the UAE and Saudi Arabia to access Nvidia's AI computational resources on a large scale, whether by directly purchasing Nvidia AI GPUs or borrowing from the cloud giants.

Nevertheless, even if Saudi Arabia and the UAE can obtain all the necessary chips for AI development, they must decide on the purpose of their AI capabilities. In this respect, Abu Dhabi seems to have a plan in place. According to AI experts interviewed by "Breakingviews" in Riyadh and Abu Dhabi, the leaders of Abu Dhabi realize that competing with OpenAI supported by Microsoft or Anthropic supported by Amazon, chasing the next global flagship large language model, may burn through significant funds. While Gulf countries may have nearly the same hundreds of billions of dollars in reserves as large-scale data centers for data center capital expenditures and power, all these participants face the risk of their large language models (LLM) not having sufficient appeal and being incompatible with Arabic, leading to dismal capital ROI.

This is why the United Arab Emirates is focusing on a less ambitious path. Instead of directly participating in the global ai competition, the UAE's focus is on Arabic content and localized services, aiming to serve the Arabic market rather than challenging the dominant share of global English and Chinese content. It is understood that over half of the online content is in English, while Arabic content constitutes less than 1% of the content on the World Wide Web. The extreme scarcity of high-quality Arabic content has given Gulf countries a reason to establish their own ai databases and customized ai large models. That's why researchers from the Inception core department under G42 have been trekking through libraries in the region, scanning Arabic texts page by page, with the scale and cost of this data processing much lower than that of English content, ultimately used to build their own customized large model JAIS.

The logic is simple: According to companies developing generative ai solutions similar to ChatGPT in the region, training a large English language model and then translating it into Arabic costs a third more than only training a large model with Arabic input. Additionally, this eliminates inherent Western biases in most large ai models. Meanwhile, Saudi Aramco has claimed that compared to the average electricity cost of 7.8 cents per kilowatt-hour in US data centers, it can provide about 13% cheaper electricity domestically. As a result, ai participants in the Gulf region may be able to train their ai large models in a more cost-effective way, thus providing significant opportunities to market their flagship products to the Arabic market with a population of 0.4 billion when they start to profit from the overall ai industry.

Another part of Abu Dhabi's strategy is expected to yield more direct dividends. The UAE is more interested in improving the efficiency of its business rather than chasing the 'business-to-consumer' market dominated by Google search or ChatGPT. The joint venture AIQ between Abu Dhabi oil giant ADNOC, G42, and Presight has developed a dedicated ai software called 'RoboWell' to increase the labor productivity of its gas wells through autonomous adjustments based on real-time ai technology, a move that has increased production by at least 5% and saved costs equivalent to about 30% of operating profit. Malaysia's national oil company has signed up to use a range of AIQ's technologies. Meanwhile, G42 and Mubadala's healthcare business M42 have built a medical ai large model that scored 95 in the US medical exam, and established an ai solution to screen for early signs of diseases, helping to reduce the costs of radiologists by 20%.

According to the latest forecast from leading research firm IDC's 'Global AI and Cognitive AI Spending Guide,' the organization expects that by 2028, global spending related to artificial intelligence (AI) (with a focus on AI-supported applications, ai chips and other ai infrastructure, as well as related IT and business services) will at least double from the current level, reaching around $632 billion. IDC points out that software or applications will be the largest category of AI technology spending, accounting for over half of the entire ai market in most forecasts. IDC expects the five-year compound annual growth rate of ai software to reach 33.9% (2024-2028).

Ai competitions have sensitive geopolitical implications, and the ongoing demand in Gulf countries for ai chips and core ai technologies means that the United Arab Emirates and Saudi Arabia may find it hard to become absolute leaders in the global ai field. However, the UAE seems to be making particularly wise decisions to become meaningful participants. If it sticks to wiser niche markets, ai investments may not just be built on sand.

以OpenAI为例,这家人工智能领域的初创公司,凭借所开发出的基于大型语言模型的AI聊天机器人工具ChatGPT,估值已经高达惊人的1570亿美元,该初创公司估值甚至超越美国老牌芯片巨头英特尔(INTC.US);至于AI芯片领域当之无愧的霸主英伟达(NVDA.US),该公司重磅推出H100/H200以及基于Blackwell架构的高性能AI GPU,英伟达的这些AI硬件产品对于构建人工智能大模型所需要的AI基础设施而言,可谓是最核心硬件。凭借OpenAI大股东身份的微软去年推出基于ChatGPT核心技术的Azure OpenAI Studio云服务,相当于Azure全新AI强化版本,并且将OpenAI引以为傲的GPT系列大模型全面嵌入旗下的Office等旗舰软件产品,实现业绩与股价齐增,微软曾长期稳坐“全球最高市值公司”宝座。

以OpenAI为例,这家人工智能领域的初创公司,凭借所开发出的基于大型语言模型的AI聊天机器人工具ChatGPT,估值已经高达惊人的1570亿美元,该初创公司估值甚至超越美国老牌芯片巨头英特尔(INTC.US);至于AI芯片领域当之无愧的霸主英伟达(NVDA.US),该公司重磅推出H100/H200以及基于Blackwell架构的高性能AI GPU,英伟达的这些AI硬件产品对于构建人工智能大模型所需要的AI基础设施而言,可谓是最核心硬件。凭借OpenAI大股东身份的微软去年推出基于ChatGPT核心技术的Azure OpenAI Studio云服务,相当于Azure全新AI强化版本,并且将OpenAI引以为傲的GPT系列大模型全面嵌入旗下的Office等旗舰软件产品,实现业绩与股价齐增,微软曾长期稳坐“全球最高市值公司”宝座。