Wall Street expects that in October, the core CPI will increase by 3.3% year-on-year, remaining unchanged from the previous value, with a month-on-month growth rate staying at the level of 0.3% for the third consecutive month. Inflation remains sticky, and the possibility of a 25 basis point rate cut in December has decreased from around 80% before the election to about 60%. In addition, the market is concerned that Trump's policies may hinder inflation returning to the Federal Reserve's target, requiring interest rates to return to a neutral level more slowly.

According to Wall Street's forecast, the U.S. CPI inflation to be announced tonight is expected to remain strong for the third consecutive month, casting a shadow over the prospect of Fed rate cuts in the coming months.

At 21:30 on Wednesday, Beijing time, the US Bureau of Labor Statistics will release the October CPI data. Market consensus expectations:

In October, the CPI rose by 2.6% year-on-year, an increase of 0.2 percentage points from the previous month's 2.4%, hitting the highest record in three months, with a flat month-on-month change of 0.2%.

Core CPI rose by 3.3% year-on-year, holding steady from the previous period, with a month-on-month increase remaining at 0.3% for the third consecutive month.

As pointed out by Bank of America Merrill Lynch, after a significant decline in inflation for some time, it is currently showing a trend of sideways fluctuations. The institution's latest forward-looking report predicts that the year-on-year and month-on-month core CPI in October will remain at 3.3% and 0.3% (not rounded to 0.26%), in line with Wall Street's consensus forecast.

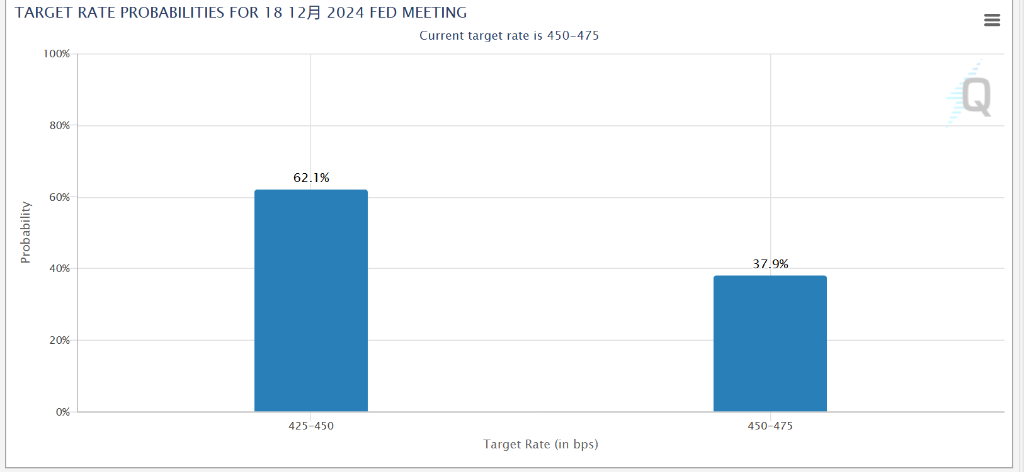

Meanwhile, the stubborn inflation may weaken the Fed's confidence in continuing rate cuts in December, especially after already cutting rates by 75 basis points (45 points in September and 25 points in November). CME's Fed observation tool shows that the probability of a 25 basis point rate cut in December has decreased from around 80% before the election to about 60%.

Household inflation resurgence, used car prices rebounding.

Owners' equivalent rent (OER), as the largest single component of CPI, is crucial for determining the basic trend of the index. Previously, OER inflation accelerated in July and August, causing concerns that the downward inflation trend in the first half of the year would be overturned, but slightly slowed down in September.

Morgan Stanley believes that OER may see a slight increase again in October before resuming its downward trend. The institution's analyst team, Diego Anzoategui, released a research report last week stating:

OER in September declined due to seasonal factors, and we do not expect a similar trend this quarter. However, new lease and renewal inflation rates (leading indicators in our model) remain lower than housing inflation, indicating a continued deceleration in the future.

Even if rental inflation remains stable, housing prices could rise due to the impact of hurricanes.

Hurricanes Helen and Milton have caused massive damage to various southeastern states in the USA, forcing residents along the storm's path to seek shelter in hotels elsewhere, which could lead to a significant increase in lodging prices in the housing index. However, analysts point out that the U.S. Bureau of Labor Statistics has seasonally adjusted the lodging index to account for the slowdown in tourism after the peak summer season.

Hurricanes may also push up used car prices. In the past 16 months, the U.S. CPI growth slowed down in 14 months due to the decline in used car prices. Excluding used cars, the price of core goods was mixed, with slowdowns occurring in only 9 of the past 16 months.

Wells Fargo & Co analysts Sarah House and Aubrey Woessner stated in the forward-looking report released last week:

The recent rebound in used car auction prices indicates that the used car prices in the CPI index may experience the largest month-on-month increase in about a year.

We still believe that the benefits of supply chain repairs and colder weather have not been fully realized, but the inflation slowing trend brought by new and used cars may gradually fade away in the last few months of this year—especially as the damage caused by Hurricanes Helen and Milton increases the demand for replacement vehicles and parts.

Regarding wages and energy, analysts such as Stephen Juneau from Bank of America Merrill Lynch pointed out in the latest research report that as financial conditions ease driving economic and employment conditions to strengthen again, average hourly wages are experiencing a significant rebound on a month-on-month basis; furthermore, energy prices will continue to decline, partly due to the decrease in gasoline prices.

Can interest rates be cut in December?

Last week, the Federal Reserve unanimously decided to cut interest rates by 25 basis points, meeting expectations. Powell stated in a press conference after the meeting that the battle against inflation is not over, core inflation remains somewhat high, and the job market continues to cool very slowly. The Fed will continue to cut rates, but at a slower pace if inflation cools and the economy remains strong.

Bank of America Merrill Lynch believes that based on Powell's speech last week, this CPI data does not change the possibility of the Fed cutting interest rates by 25 basis points again in December. Before the December interest rate decision, the Fed will receive another CPI report.

Although the Federal Reserve did not hint at pausing its actions next, Wall Street's bet on slowing rate cuts is quietly heating up. Goldman Sachs currently predicts that the Fed will cut interest rates by 25 basis points at its meetings in December, January, and March, and then cut by 25 basis points in June and September next year. Previously, Goldman Sachs predicted cuts in May and June of 25 basis points each.

It is worth noting that Goldman Sachs and JPMorgan have both changed their interest rate cut forecasts after March. Some are concerned that Trump, who has already secured the presidency, may hinder the return of inflation to the Fed's target with his policies, so interest rates may need to return to neutral levels more slowly.

Looking ahead, Goldman Sachs expects the core CPI growth rate for the remaining year to be around 0.2%, taking into account the re-balancing of autos, house rental, and labor market, inflation will further decline. Goldman Sachs predicts that the year-on-year core CPI growth rate in December will further decrease to 3.1%.

Tonight, the market doesn't need to be too nervous.

As is customary, if tonight's CPI report significantly exceeds expectations, the market will clearly not accept it. According to Goldman Sachs stock derivatives specialist Cullen Morgan's calculations:

If core CPI month-on-month increase is greater than 0.4%, $S&P 500 Index (.SPX.US)$it may drop by 1.5%;

With growth between 0.35% - 0.4%, the S&P index may drop by 0.8%;

With growth between 0.31% - 0.34%, the S&P index will experience a slight shake;

With growth between 0.25% - 0.3%, the S&P index will rise 0.8%;

If the increase is less than 0.25%, the S&P index may increase by over 1.2%.

It is worth noting that, as Trump has just won the election, traders have become confused about the future inflation expectations in the USA. Therefore, the tension in the market for today's CPI report is far less than before. Goldman Sachs data shows that the implied closing price change of the S&P index based on option straddle structure is only 0.55%, about half of the recent CPI report.

Goldman Sachs senior market advisor Dom Wilson stated in the report:

Market focus – and most of the volatility – apparently comes from the post-election transition. In November, the FOMC delivered a message of 'steady as she goes,' so we may need a real surprise to significantly drive the market.

The market has already digested much of the expectations for easing in 2025, so truly weak data will create some room for inflation relief and upward movement in the stock market.

Editor/Rocky

10月CPI同比上涨2.6%,较前月的2.4%上升0.2个百分点,

10月CPI同比上涨2.6%,较前月的2.4%上升0.2个百分点,