Author: Nancy Lubale, CoinTelegraph; Translation: Tao Zhu, Golden Finance

With Donald Trump winning the presidential election, interest in the crypto-friendly business environment in the USA is growing, leading to Ethereum's price rising over 37% in the past seven days to its highest level since July 24.

eth/usd daily chart. Source: TradingView

At the time of writing this article, the trading price of Ethereum is $3,392, driven by increasing demand for spot Ethereum ETFs and on-chain indicators indicating that the altcoin's upward trend remains intact.

At the time of writing this article, the trading price of Ethereum is $3,392, driven by increasing demand for spot Ethereum ETFs and on-chain indicators indicating that the altcoin's upward trend remains intact.

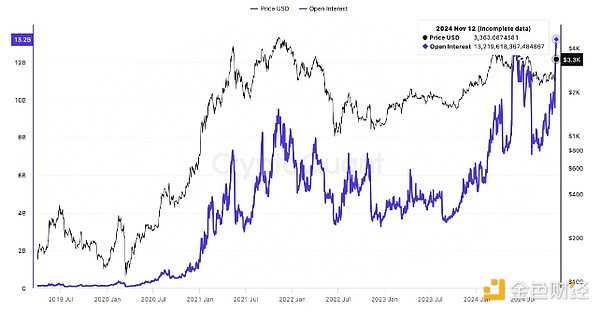

Record high in Ethereum's open interest contracts

In the week leading up to Ethereum's rise, there was an increase in long positions in the ETH futures market. Data from on-chain market intelligence company CryptoQuant shows that the total open interest of Ethereum in the derivatives market increased from 9.8 million ETH on November 5 to a historical high of 13.2 million ETH on November 11.

Open interest of ETH perpetual contracts on all exchanges. Source: CryptoQuant

"ETH has finally set a new historical high in futures open interest, indicating a resurgence of interest in the leading altcoin," trader Alan said in an article on X, adding that the market should never overlook ETH.

Trader Olek believes that the continuous rise in Ether's open interest indicates "increasing liquidity and market participation."

Olek added:

"Ethereum is signaling a recovery, with the increase in its activity indicating that the market is ready for action."

Increase in demand for ETH

CryptoQuant data shows that with the increase in on-chain activity, demand for ETH seems to be gaining attention once again, as evidenced by the daily active addresses (DAA) on the Ethereum blockchain. The graph below shows that Ethereum's DAA increased from 306,751 on November 5 to 388,350 as of November 12 when this article was written. This number grew by 26% after Donald Trump won the 2024 U.S. presidential election last week.

The number of active addresses on ethereum. Data source: CryptoQuant.

Therefore, on-chain data shows that users are increasingly interacting with the layer 1 blockchain, indicating an increase in ethereum trade volume.

According to DappRadar's data, the active addresses of ethereum DApps increased by 8% in the past seven days. Overall, considering other defi indicators (such as total locked value, number of trades, and NFT trade volume) have also seen significant growth in the past week, these data are encouraging.

Top layer 1 blockchain; 7 days of DApp activity. Data source: DappRadar.

The network growth of ethereum needs to continue, which will generate the demand needed to drive ETH up to $4,000.

In the USA, the inflow of ethereum ETF reached 0.295 billion USD.

After Trump's victory, ethereum began to recover, with the spot ETH ETF funds flowing positively, with a net outflow of 73 million USD in the two days before the November 5th election.

According to SoSoValue data, these investment products recorded the highest single-day inflow since July 23rd, with inflows exceeding $0.295 billion on November 11th.

Ethereum ETF spot liquidity. Data Source: SoSoValue

Fidelity Ethereum Fund (FETH) led with a record inflow of $0.1155 billion, while Blackrock's iShares Ethereum Trust ETF (ETHA) ranked second with an inflow of $0.101 billion.

Grayscale Ethereum Mini Trust ETF (ETH) ranked third with an inflow of $63.3 million, while Bitwise Ethereum ETF (ETHW) recorded $15.6 million. The inflows of all other U.S. spot Ethereum ETFs were zero.

According to additional data from CoinShares, as of the week ending November 8th, the total inflow of Ethereum investment products reached $0.157 billion, bringing the year-to-date inflow to $0.915 billion and asset management scale to $12 billion.

CoinShares stated in accompanying comments that this is the largest inflow since the ETF launch in July this year, indicating a significant improvement in market sentiment.

The latest fund inflows continue a significant trend that started a week ago, indicating a continued increase in institutional demand for Ethereum investment products, which may drive its price to above $4,000 on March 12th.

在撰写本文时,以太坊的交易价格为 3,392 美元,通过现货以太坊 ETF 的需求不断增加,并且链上指标表明山寨币的上升趋势仍然完好。

在撰写本文时,以太坊的交易价格为 3,392 美元,通过现货以太坊 ETF 的需求不断增加,并且链上指标表明山寨币的上升趋势仍然完好。