The traditional e-commerce dividend is gradually dissipating, unable to meet the demands of both supply and demand in the new consumer era in terms of fulfillment timeliness, service quality, etc. High timeliness instant retail has become a new "game point" for express logistics players, and the homogenization competition in the same-city instant delivery industry is becoming increasingly fierce.

Among them, FLX.US, a company specializing in "one-to-one urgent delivery" for ten years, is somewhat different. As an author who focuses on this platform, I found that it has unique competitiveness in the market, with distinctive rules for survival, enabling it to break through successfully in competition.

It is worth noting that FLX.US has recently successfully listed, setting an industry sample and investment target worth focusing on.

"One-to-one" highlights differentiation advantages and significant scarcity value.

What is the "one-to-one urgent delivery" model that FLX.US has focused on for the past ten years?

What is the "one-to-one urgent delivery" model that FLX.US has focused on for the past ten years?

In the instant delivery service, the "one-to-one urgent delivery" model refers to the process where a delivery person serves only one complete order from pickup to delivery, ensuring direct delivery point to point. Each consumer or merchant more or less needs rapid, safe delivery of urgent high-value items, which determines that "one-to-one urgent delivery" is a necessity in the market.

In contrast to the "one-to-one urgent delivery" model, which FLX.US adopts, the industry's other players generally adopt a bulk order model. The advantage of the latter is lower cost, delivering within a few kilometers of the business district, meeting the requirements of high-frequency single-point merchants with low delivery costs, but the disadvantage is the relatively uncontrollable service timeliness and item security. The "one-to-one urgent delivery" model adopted by FLX.US has leading advantages in delivery process, timeliness guarantee, safety, etc., and can currently achieve an average pickup time of 7 minutes and citywide delivery in 27 minutes.

In the author's opinion, this does not completely negate the group order model, but if the group order model takes on the urgent delivery demand, undoubtedly there will be a situation of "not being well-received". With the business of flash delivery in the current trend of diversified instant retail demand, the practical value it brings to users is indispensable, with great development potential.

To evaluate the actual value of 'one-on-one urgent delivery', consider the following three important scenarios that individual users often encounter:

First is the urgent delivery at important moments. For example, at rare life moments like weddings, missing a bouquet of flowers for decoration would be a great regret. Since flash delivery does not consolidate orders, delivering an item will be faster and more timely, truly coming to the rescue in urgent times. So, whenever users encounter critical moments, they will consider choosing flash delivery. In the long run, the platform will have quite high user stickiness.

Next is giving gifts to important people. For example, birthday cakes, anniversary gifts that carry the user's sentiments, flash delivery, relying on the 'one-on-one' service model, not only delivers items to the users promptly but also conveys emotions. Bringing emotional value to users, the platform undoubtedly establishes a deep connection with users. Against the backdrop of users' mindset changes due to economic uncertainties, flash delivery will be the preferred platform for users to send gifts to important people.

Lastly, it is the delivery of important items. For example, emergency medicine, surgical medical equipment, valuable items, etc. These items require high security in delivery, with no room for error. Flash delivery's one-on-one escort significantly improves the fault tolerance during the delivery process, providing a safer guarantee.

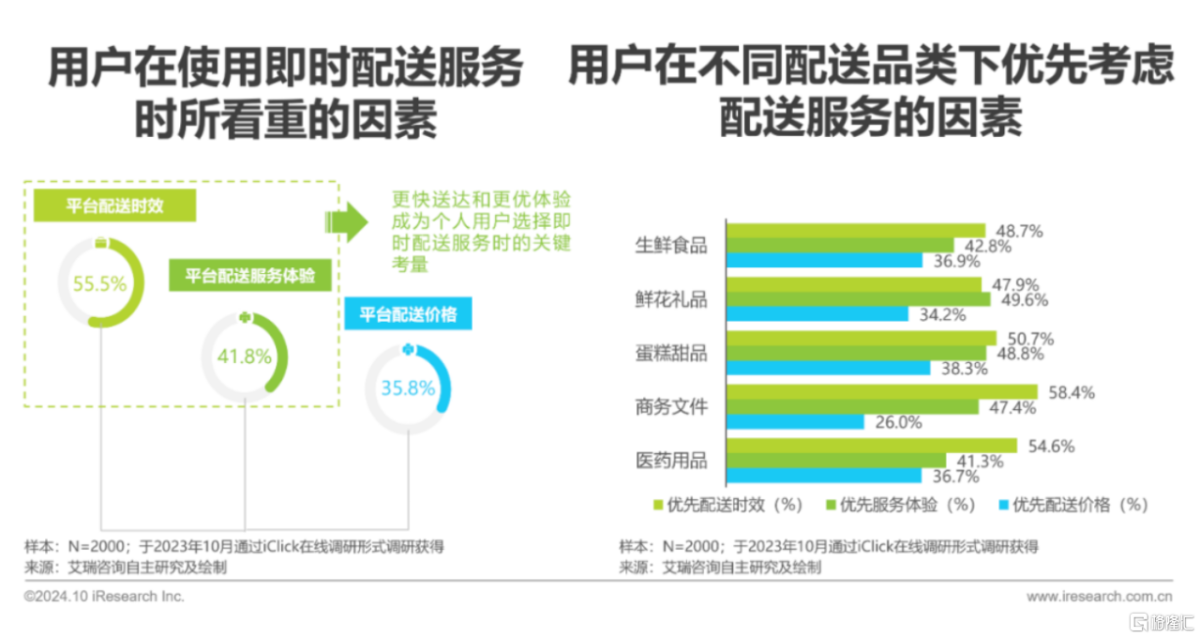

It can be seen that flash delivery truly addresses user pain points, better meeting consumers' new demands for faster delivery time, higher delivery security, and superior delivery service experience. It possesses "scarcity" for users and the market.

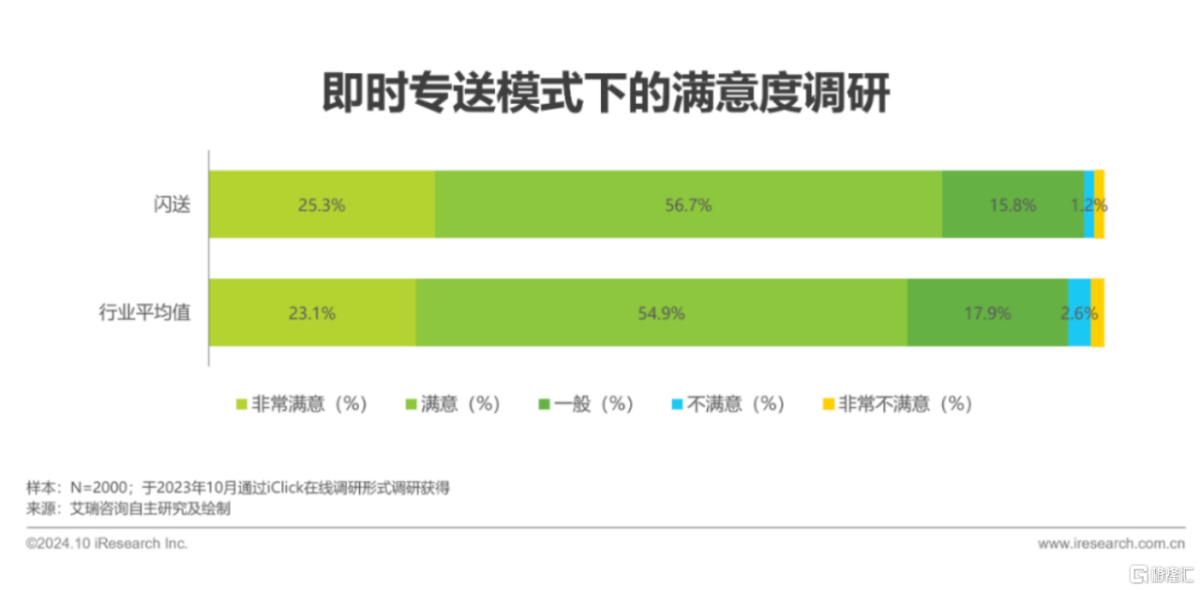

According to the user survey conducted by iResearch in October last year, user satisfaction with flash delivery based on personal experience is overall better than the industry average, with 82.0% of satisfied and very satisfied users. In addition, 30.2% of users are very willing to recommend flash delivery to other users, and the customer conversion rate is also higher than the industry average.

According to Shangpu market research, after multiple cross-validations, it has certified the market position of Flash Delivery as the leading brand in one-on-one urgent delivery for ten consecutive years. User surveys in the report show that in the one-on-one instant delivery industry, Flash Delivery's brand awareness, satisfaction, and recommendation are all ranked first in the industry. From 2020 to 2023, Flash Delivery's user positive rating steadily increased from 98.6% to 99.1%.

Ultimately, the products and services are judged by the market. While Flash Delivery has been fully recognized by the market, it will also seize more growth opportunities.

The platform capabilities that are difficult to imitate and reproduce build a strong competitive barrier.

Flash Delivery's "one-on-one urgent delivery" service model represents a higher entry barrier. The industry landscape is now basically stable and difficult to break in the short term. Flash Delivery has become the "leader" on the track. Based on this, Flash Delivery's large-scale one-on-one delivery capacity and high-density service network coverage are core competencies that cannot be ignored.

According to the prospectus, as of June 30, 2024, Flash Delivery's services cover 295 cities in China. The number of registered riders increased from approximately 1.1 million in 2021 to approximately 2.7 million in June 2024, indicating a higher coverage density for Flash Delivery.

This is the underlying foundation for Flash Delivery to achieve faster and more timely "one-on-one urgent delivery." By continuously enhancing and improving the instant delivery network, focusing on users, strengthening the construction of user-centric experience-enhancing services, it can meet the diversified instant consumption needs of more users. Facing the B-end, Flash Delivery can also continuously improve business efficiency and the ability to serve users, helping businesses achieve omni-channel growth, thereby strongly promoting the integration of various industries and achieving rapid development.

According to the prospectus, Flash Delivery's completed order volume increased from 0.159 billion in 2021 to 0.271 billion in 2023, and from 0.125 billion in the first half of 2023 to 0.138 billion in the first half of 2024, maintaining a good growth trend.

The growth in order volume has driven Flash Delivery's performance to steadily increase. From 2021 to 2023 and the first half of 2024, Flash Delivery's total revenue was 3.04 billion yuan, 4.003 billion yuan, 4.529 billion yuan, and 22.84 billion yuan, with net profits of -0.291 billion yuan, -0.18 billion yuan, 0.11 billion yuan, and 1.24 billion yuan respectively. Profitability has significantly improved, and Flash Delivery's business model and external value proposition have been well verified.

The main reasons behind this can be attributed to the continuous improvement in operational efficiency, accompanied by the release of network effects and economies of scale, thereby demonstrating significant operating leverage. Based on the large scale of the number of riders, Flash Delivery has formed a deep platform barrier, which is difficult for competitors in the industry to imitate and replicate, making it arguably unique within the industry.

Due to the characteristics of customers' immediate, highly dispersed, and personalized demands, the "one-to-one express delivery" service model's capacity structure is distributed throughout the city in a flexible and scattered network form, rather than limited to within business districts. New entrants aiming to achieve the service quality and efficiency guarantee of Flash Delivery must first subsidize a huge city-wide and mobile workforce, as the demand for "one-to-one express delivery" is generally unpredictable and cannot be quickly scaled up through subsidies or advertising.

It is foreseeable that Flash Delivery is expected to continue to maintain its industry-leading position, with competition barriers continuously thickening.

The author observed that at the time of its IPO, Flash Delivery received recognition from the capital markets. With an issue price of $16.5 per share, the total funding reached $66 million. After opening, the stock price once rose by over 23%, reaching $21.95, showing strong performance. This indicates investors' bullish view on Flash Delivery's business model and future development prospects.

Sullivan previously released the '2023 China Instant Delivery Industry Trends White Paper', mentioning that compared to standardized instant delivery services, consumers show a higher willingness to pay a premium for courier services that provide added value and personalized experiences. Based on its leading position, Flash Delivery is expected to enjoy more market dividends and its profitability is expected to continue to increase.

The trillion-dollar market for instant retail offers vast long-term growth potential for instant delivery services.

Looking ahead, the question remains whether Flash Delivery will become profitable and crack the business model, does it have significant future potential? In the author's opinion, this depends on two key variables: scale and operational efficiency.

Among them, the scale depends on the industry ceiling, the stage it is in, and Flash Delivery's latest positioning.

Currently, the industry is still in a rapid growth stage, with Shansong's performance itself being the best proof. According to iResearch's calculation in March 2024, the instant delivery industry in China is expected to have an average annual growth rate of up to 19.1% between 2023 and 2028. It is forecasted that by 2028, the overall industry size could increase to 809.64 billion yuan.

Current instant retail is expected to become the next trillion-level digital retail segment track, with instant delivery being the core infrastructure of instant retail and needing to meet consumers' "instant demand, instant satisfaction". The efficiency of instant delivery directly determines whether instant retail business can meet the market's expectations for "instant" service.

Pursuing efficient and high-quality service in instant delivery will benefit from the growth opportunities brought by the trillion-level instant retail market. At the same time, data indicates that the mobile internet users in the sinking market exceed 0.7 billion, with over 0.25 billion potential users for instant retail, corresponding to considerable potential in the same-city instant delivery market.

The digital economy is thriving and is changing lifestyles and business models at an unprecedented speed, coupled with the continuous warming of consumption promotion and stable growth. The future market space for instant delivery is undoubtedly huge.

Furthermore, instant retail is gradually evolving towards an emerging format that caters to all customer groups, all regions, all categories, all scenarios, all hours, and all demands.

With its strong operational efficiency, Shansong extensively covers various delivery needs. By providing high-quality and efficient services and customized delivery capabilities, Shansong will gain the trust of businesses and users, increasing platform stickiness. At the same time, Shansong offers diversified and personalized high-quality delivery services, continuously expanding volume on both the B-side and C-side.

It is understood that Shansong has established cooperation with Douyin's local life, Meituan, and other new retail platforms, as well as undertakes the end delivery needs of China Railway Express and Sichuan Airlines Logistics and other traditional express logistics companies.

With the layout of Douyin Local Life and Meituan, the local life consumption demand is further activated, and Shansong's capacity has a significant boosting effect. It is foreseeable that Shansong will achieve a higher level of business scale as the local life market expands in the future.

From the cooperation established by Shansong with various parties, it can be seen that its platform positioning allows for possible further access to more traffic platforms in the future. This means that with the entry of giants, the competition in the local life sector is becoming increasingly fierce, benefiting Shansong even more. In addition, there is also the possibility of connecting with other partners in the future.

From the perspective of demand, the current market delivery demand is accelerating in stratification, with high-efficiency, high-premium delivery demands expanding. Research conducted by iResearch in October 2023 showed that 70.4% of surveyed users believed that they actively used instant delivery platforms more frequently than before 2022.

At the same time, there is a trend of mutual conversion between C-end and B-end demands. According to user surveys, nearly 40% of users believe that work-related delivery needs exceed 20% of the total demand. This not only leads to gradual acceptance and usage of instant delivery by corporate customers, increasing the popularity of instant delivery among enterprise users; but also, enterprise users choose these companies in scenarios requiring immediate courier services to improve consumer experiences, enhance their service levels, indirectly strengthening the trust of ordinary users in instant delivery brands.

Based on the new situation mentioned above, Shansong, with its unique positioning, omnichannel, and customization advantages, will better grasp the initiative and discourse power of the competition, fully meet customer needs, and is expected to maximize development dividends in the race. In the long term, Shansong will maintain high-quality growth, thereby winning more favor from value investors.

Conclusion:

In general, Flash Delivery's "one-to-one express delivery" has significant advantages in terms of delivery process, timeliness guarantee, safety, etc., building a strong competitive barrier on the platform through network effects and economies of scale. The word "fast" is by no means all about instant delivery. In the fierce competition, Flash Delivery's multidimensional core competitiveness gradually wins market and social recognition.

In the long-term view, the consumption track is like a "long hill and deep snow", seen as a key driver of domestic demand at the policy end, and instant retail is a future growth track with high certainty. Therefore, the development potential of intra-city instant delivery has sustainable momentum support, and the future of Flash Delivery is worth anticipating.

闪送这十年专注的“一对一急送”模式是什么?

闪送这十年专注的“一对一急送”模式是什么?