Whales with a lot of money to spend have taken a noticeably bearish stance on Visa.

Looking at options history for Visa (NYSE:V) we detected 53 trades.

If we consider the specifics of each trade, it is accurate to state that 33% of the investors opened trades with bullish expectations and 39% with bearish.

From the overall spotted trades, 35 are puts, for a total amount of $1,795,036 and 18, calls, for a total amount of $1,247,850.

From the overall spotted trades, 35 are puts, for a total amount of $1,795,036 and 18, calls, for a total amount of $1,247,850.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $145.0 to $380.0 for Visa over the recent three months.

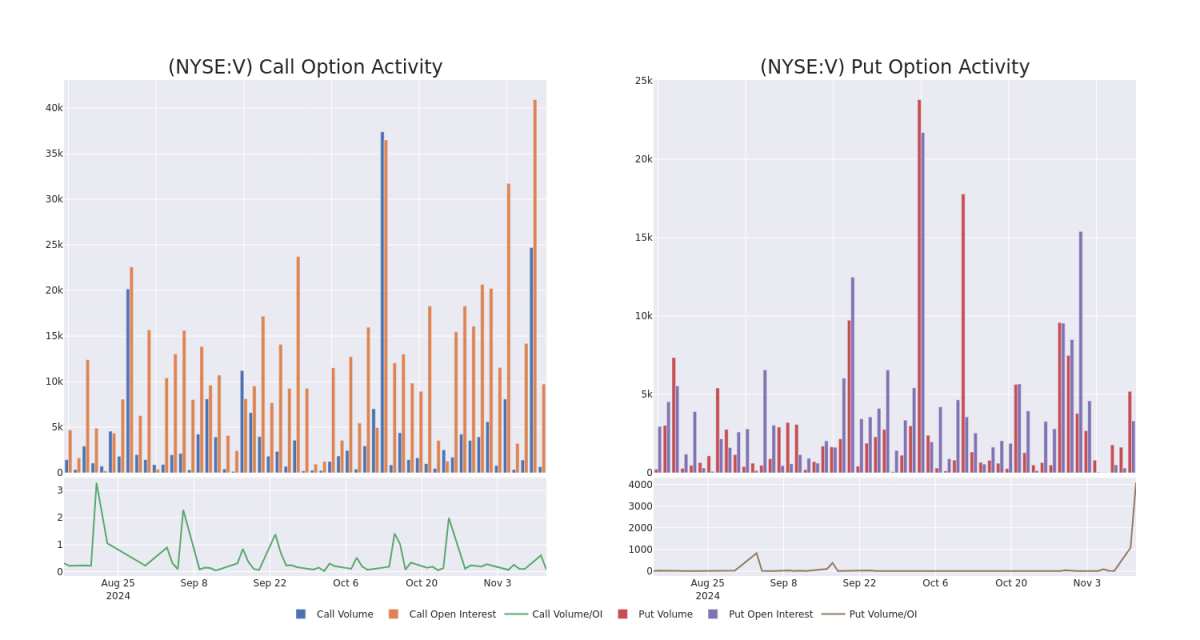

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Visa options trades today is 724.61 with a total volume of 5,846.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Visa's big money trades within a strike price range of $145.0 to $380.0 over the last 30 days.

Visa 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| V | CALL | SWEEP | NEUTRAL | 11/15/24 | $26.05 | $24.15 | $25.11 | $285.00 | $100.4K | 117 | 41 |

| V | PUT | TRADE | BEARISH | 01/15/27 | $72.1 | $71.9 | $72.1 | $380.00 | $79.3K | 1 | 355 |

| V | PUT | TRADE | BULLISH | 01/15/27 | $72.8 | $71.9 | $72.1 | $380.00 | $79.3K | 1 | 354 |

| V | PUT | TRADE | NEUTRAL | 01/15/27 | $72.85 | $71.25 | $72.05 | $380.00 | $79.2K | 1 | 260 |

| V | PUT | TRADE | BULLISH | 01/15/27 | $73.25 | $71.15 | $72.0 | $380.00 | $79.2K | 1 | 243 |

About Visa

Visa is the largest payment processor in the world. In fiscal 2023, it processed almost $15 trillion in total volume. Visa operates in over 200 countries and processes transactions in over 160 currencies. Its systems are capable of processing over 65,000 transactions per second.

After a thorough review of the options trading surrounding Visa, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Visa Standing Right Now?

- Currently trading with a volume of 2,162,856, the V's price is down by -0.46%, now at $308.91.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 72 days.

What Analysts Are Saying About Visa

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $329.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Consistent in their evaluation, an analyst from Baird keeps a Outperform rating on Visa with a target price of $340. * An analyst from Baird persists with their Outperform rating on Visa, maintaining a target price of $330. * Consistent in their evaluation, an analyst from Jefferies keeps a Buy rating on Visa with a target price of $330. * An analyst from Citigroup has decided to maintain their Buy rating on Visa, which currently sits at a price target of $326. * Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for Visa, targeting a price of $322.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.