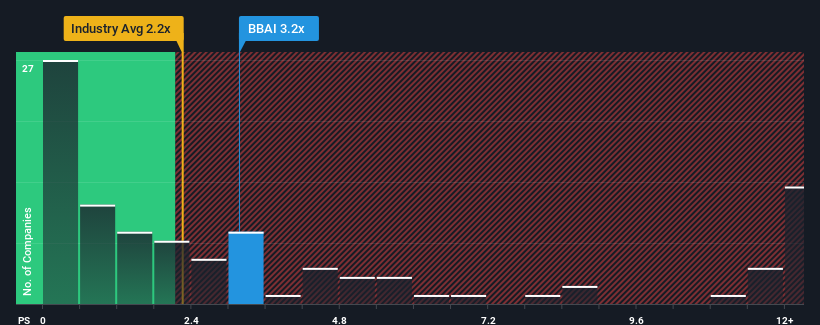

When you see that almost half of the companies in the IT industry in the United States have price-to-sales ratios (or "P/S") below 2.2x, BigBear.ai Holdings, Inc. (NYSE:BBAI) looks to be giving off some sell signals with its 3.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

How BigBear.ai Holdings Has Been Performing

With revenue growth that's inferior to most other companies of late, BigBear.ai Holdings has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think BigBear.ai Holdings' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, BigBear.ai Holdings would need to produce impressive growth in excess of the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Fortunately, a few good years before that means that it was still able to grow revenue by 11% in total over the last three years. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Fortunately, a few good years before that means that it was still able to grow revenue by 11% in total over the last three years. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 20% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 10% growth forecast for the broader industry.

With this in mind, it's not hard to understand why BigBear.ai Holdings' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On BigBear.ai Holdings' P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that BigBear.ai Holdings maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the IT industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 3 warning signs for BigBear.ai Holdings you should be aware of, and 1 of them shouldn't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.