According to the AI Financial APP, the research team from Citigroup on Wall Street stated in a report on Tuesday that despite the start of the third quarter US stock earnings season,$Taiwan Semiconductor (TSM.US)$、$NVIDIA (NVDA.US)$While a few chip stocks that benefit significantly from the AI trend have performed strongly, the entire US chip sector has experienced an overly exaggerated selling wave due to weak non-AI demand.

In the view of the Citigroup research team, it is almost time for market funds to buy chip stocks on dips again. This also means that one of the core drivers leading the US stock market into a bull market since 2023 - chip stocks, is expected to regain global fund favor after the earnings season sell-off and may once again start a super bullish trend, becoming the focus of the US stock market.

Citigroup analyst Christopher Danley's team wrote in a report to clients: 'During the chip company earnings season, consensus expectations have fallen by about 11%,$PHLX Semiconductor Index (.SOX.US)$Dropped nearly 10% significantly, mainly due to weak demand for analog and microchips, leading to$Microchip Technology (MCHP.US)$、$NXP Semiconductors (NXPI.US)$and $Intel (INTC.US)$the sharp decline in stock symbols.

"However, we believe that this irrational decline/selling is almost over, and people's attention is gradually shifting to 2025. We expect the overall global semiconductor market sales in 2025 to increase by about 9% year-on-year, with an expected 17% year-on-year growth in 2024 compared to the relatively weak previous year." Citigroup added in the above report.

"However, we believe that this irrational decline/selling is almost over, and people's attention is gradually shifting to 2025. We expect the overall global semiconductor market sales in 2025 to increase by about 9% year-on-year, with an expected 17% year-on-year growth in 2024 compared to the relatively weak previous year." Citigroup added in the above report.

The Citigroup research team led by Christopher Danley stated that the long-term downward trend in demand for industrial terminal chips, which is currently the weakest segment in the chip sector, should "soon disappear," and they expect another long-term weak market - the chip inventory adjustment in the automotive market to end in the first half of 2025.

"Conversely, the chip market in niche areas such as PCs, smart phones, and data center servers, which account for the remaining 75% of chip market demand, continues to show 'steady growth.' Investors should now build positions in chip industry stocks and 'transition to a more aggressive configuration exposure' in the first quarter of 2025, partly driven by.$Amazon (AMZN.US)$、$Alphabet-A (GOOGL.US)$and $Microsoft (MSFT.US)$massive AI-related expenditures by large-scale technology companies." Citigroup's research team added.

In this research report, the Citigroup research team continues to adhere to the investment firm's belief in$Advanced Micro Devices (AMD.US)$、$Analog Devices (ADI.US)$、$Broadcom (AVGO.US)$、$Micron Technology (MU.US)$、$Microchip Technology (MCHP.US)$、$Texas Instruments (TXN.US)$、$NVIDIA (NVDA.US)$And.$KLA Corp (KLAC.US)$The 'buy' rating.

AI chips and storage chips support the "half of the sky" of the semiconductor market.

The current datacenter servers AI chips, as well as storage chip demand, are very strong, and may remain so for a long time in the future.

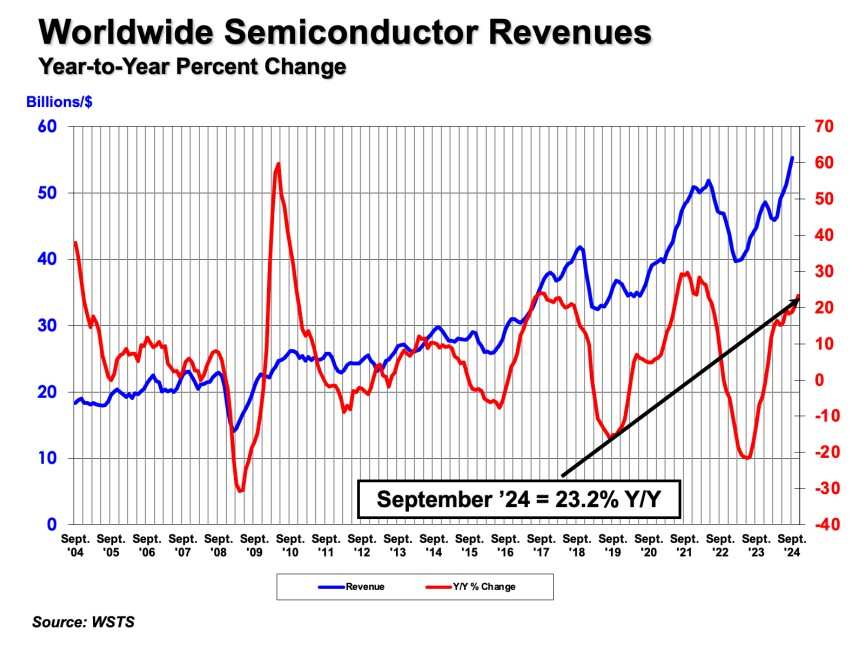

The latest statistics released by the Semiconductor Industry Association (SIA) show that driven by strong demand for NVIDIA H100/H200 and other datacenter servers AI chips, the global semiconductor market sales in the third quarter of 2024 reached a high of $166 billion, a 23.2% year-on-year increase compared to the third quarter of 2023, and a 10.7% increase compared to the already strong sales in the second quarter of 2024. The single-month sales of the global semiconductor market in September 2024 were approximately $55.3 billion, a 4.1% increase compared to August 2024's semiconductor market sales of $53.1 billion.

According to Gartner's latest forecast, the global semiconductor market is expected to reach approximately $717 billion in overall sales in 2025, a 14% increase from 2024. This growth is mainly driven by the demand for datacenter AI-related semiconductors and the recovery of consumer electronics products integrated with edge AI.

Gartner predicts that this year, the global semiconductor market sales may reach $630 billion, indicating a significant increase of 18.8% from the previous year. Gartner predicts that the storage chip market will perform strongest in 2025, expected to grow by 20.5%, with sales reaching $196.3 billion, where enterprise NAND flash and DRAM will be the main drivers.

The spring outlook data for the semiconductor industry released by the World Semiconductor Trade Statistics Organization (WSTS) shows that a very strong recovery trend is expected in the global semiconductor market in 2024. WSTS expects a significant upward revision in the scale of semiconductor market sales for 2024 compared to the year-end forecast for 2023. For 2024, WSTS forecasts a market size of 611 billion USD, indicating a substantial increase of 16% compared to the previous year, which is a significant upward revision from the end of 2023 forecasts.

Looking ahead to 2025, WSTS predicts that the global semiconductor market sales are expected to reach 687 billion USD, which means that the global semiconductor market is expected to grow by about 12.5% on top of the already very strong recovery trend in 2024. WSTS expects this growth to be mainly driven by the storage chip category and the artificial intelligence logic category, with the overall scale of these two categories expected to soar to over 200 billion USD in 2025 with the help of the AI boom. Compared to the previous year, WSTS predicts that the sales growth rate for the storage chip category dominated by DRAM and NAND will exceed 25% in 2025, and the sales growth rate for the logic chip category, including CPUs and GPUs, is expected to exceed 10%. WSTS also forecasts that the growth rates for all other submarkets including discrete devices, optoelectronics, sensors, and analog semiconductors will be in the single digits.

WSTS predicts that the market size of analog chips, which occupy a significant share in the chips needed for electric vehicles (EVs) and industrial applications, remains sluggish. The market size is expected to shrink by 2.7% in 2024 following an 8.7% contraction in 2023. However, WSTS forecasts that the overall market size of analog chips is likely to expand by 6.7% in 2025, indicating a slow start to the recovery of analog chips next year. Analog chips play an indispensable role in various key function modules and systems of electric vehicles, including power management, battery management, sensor interfaces, audio and video processing, and core control systems for electric motors.

Editor/ping

“然而,我们认为这种非理性地下跌/剧烈抛售几乎结束,人们的注意力逐渐将转向2025年。我们预计2025年全球半导体市场的整体销售额将同比增长约9%,预计2024年有望在去年相对疲软的基础上同比增长17%。”花旗在上述报告中补充表示。

“然而,我们认为这种非理性地下跌/剧烈抛售几乎结束,人们的注意力逐渐将转向2025年。我们预计2025年全球半导体市场的整体销售额将同比增长约9%,预计2024年有望在去年相对疲软的基础上同比增长17%。”花旗在上述报告中补充表示。