The essence of trading is survival, followed by profit. So, before each operation, think clearly about whether your actions are rational, whether your capital is safe, and you need to form your own trading mindset, continuously optimize and improve. Although the advice of the Bitcoin circle expert may not make you rich overnight, it can ensure that they are always there for you. Only those who survive in the Bitcoin circle for a long time and persist until the end can achieve the results they want. I hope you can understand.

I am a warrior protecting the rookies in the Bitcoin circle, wishing my fans to achieve financial freedom in 2024. Let's work together!

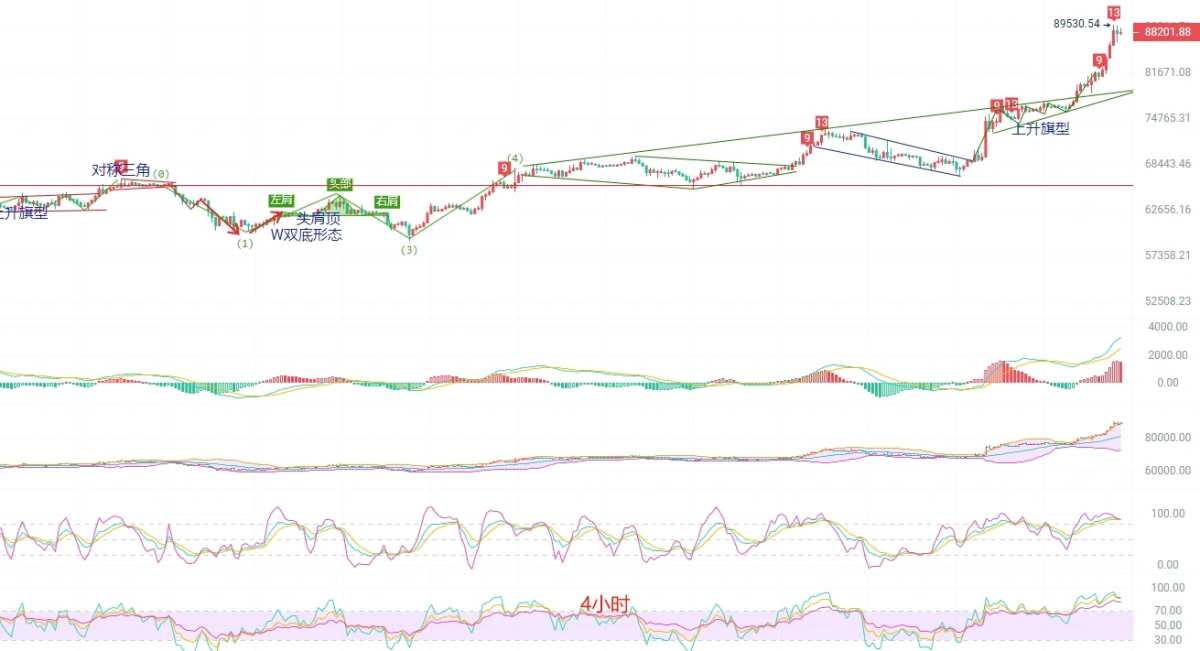

Cryptocurrency academic: Latest market analysis of bitcoin (BTC) on November 12, 2024.

Bitcoin is currently priced at 88350. It is now half past two in the afternoon peking time. After staying up all night for a week and just waking up, let's review yesterday's live trading first. Everyone knows about the contrarian short position at 73000, always adjusting the position to the average cost, and finally adjusted to 82100. Originally, it fell below 82000 around ten forty-five last night, thinking the shorts were safe, but unexpectedly the ultra-short indicators stretched back above 82000. Helpless, could only choose to exit to break even, then went long at 82200 with a take profit target of 85000. By two thirty-nine in the morning, the target was reached, and it is almost certain that this is a crazy bull run.

Bitcoin is currently priced at 88350. It is now half past two in the afternoon peking time. After staying up all night for a week and just waking up, let's review yesterday's live trading first. Everyone knows about the contrarian short position at 73000, always adjusting the position to the average cost, and finally adjusted to 82100. Originally, it fell below 82000 around ten forty-five last night, thinking the shorts were safe, but unexpectedly the ultra-short indicators stretched back above 82000. Helpless, could only choose to exit to break even, then went long at 82200 with a take profit target of 85000. By two thirty-nine in the morning, the target was reached, and it is almost certain that this is a crazy bull run.

Yesterday's daily candlestick had a low of 80200 and a high of 89530. Today's opening price until now has seen a daily high of 89470 and a low of 86560. Currently, the price remains at an extremely high level, unable to hold the 0.09 million mark, and even retail investors are hesitant to chase higher prices. All that's left is to watch the block orders perform. The EMA trend's 15-period moving average has reached 76750, and all trend indicators are rising.MACDIncreased volume in an upward trend, DIF and DEA diverged, Bollinger Bands expanding outward, K-line broke through the upper rail of 86100 and did not return before the article was published.Bollinger BandsInside,KDJThe upward diffusion is forming pressure, and it is expected that the ninety-thousand level will experience very exciting fluctuations.

Four-hour K-line showing a bullish trend of double positive covering negative, it is a good time to enter a short position at the current price, with a stop loss at 88000; EMA15 support continuing to rise to 83300, MACD volume increasing with a divergence in funds, Bollinger Band upper band.Support level.Keep an eye on 89400. KDJ continues to expand upwards, with a strong bullish trend. The block orders are celebrating, having already cleared out most of the retail investors. At this point, it is only advisable to watch as both long and short chasing involve risks. When the risks outweigh the gains, it is recommended to wait and see. Aggressive traders may consider chasing long positions.

Layout reference: Since the market is not always one hundred percent predictable, it is crucial to set up a good stop-loss strategy. Safety comes first - small losses are better than aiming for big profits.

Aggressive traders can consider shorting at the current price, with a target of 89000 to 89500. If it breaks through, watch for 90000. Stop loss at 88000, if it breaks nine thousand, it is recommended to sit back and observe. Focus on preserving the chips on hand and stay afloat.

The specific operation is mainly based on real-time data of the order book. For more details, you can consult the author for more news. There may be delays in article publication, so it is recommended for reference only, and risks are self-managed.

This article is exclusively provided by the academician of the cryptocurrency circle, representing the academician's exclusive views. In-depth research on BTC, ETH, DOGE, DOT, FIL, EOS, etc. Due to the timing of article publication, the above views and suggestions are not real-time, for reference only. Take risks at your own expense, repost with proper attribution, control your position reasonably, and do not overexpose or fully expose your position. The academician also hopes that all investors understand that the market is always right. If you're wrong, reflect on your own issues. Don't let the profits slip away. Investing doesn't need to be smarter than the market. When the trend comes, follow it; when there's no trend, observe and wait. Wait until the trend is clear before taking action. Tomorrow's success stems from today's choices. Heaven rewards diligence, earth rewards kindness, humanity rewards sincerity, commerce rewards trust, industry rewards excellence, artistry rewards heart. Gains and losses are sometimes unforeseen. Develop the strict habit of setting stop-loss and take-profit for every trade. The cryptocurrency academician wishes you a pleasant investment experience!

比特币现价88350,现在是北京时间下午两点半,熬了一个星期的通宵刚睡醒先来复盘一下昨日实盘,大家都知道73000的空大逆势单,一直在调仓拉均价,最后调到了82100,原本在昨晚十点四十五跌破82000空以为稳了,没想到最后超短指标拉伸又回到了82000之上,无奈只能选择保本离场,反手82200开多,带了85000的止盈,凌晨两点三十九抵达目标,已经基本可以判断这是一波疯牛

比特币现价88350,现在是北京时间下午两点半,熬了一个星期的通宵刚睡醒先来复盘一下昨日实盘,大家都知道73000的空大逆势单,一直在调仓拉均价,最后调到了82100,原本在昨晚十点四十五跌破82000空以为稳了,没想到最后超短指标拉伸又回到了82000之上,无奈只能选择保本离场,反手82200开多,带了85000的止盈,凌晨两点三十九抵达目标,已经基本可以判断这是一波疯牛