Cui Dongshu stated that with the national call to stop the trend of 'involution', terminal prices stabilized in the third quarter, further efforts were made in scrappage renewal policies, local policies for replacing old vehicles with new ones were successively introduced, consumer wait-and-see sentiment further eased, and overall interest in new energy vehicles picked up.

According to the Securities Times app, Cui Dongshu stated that with the national call to stop the trend of 'involution', terminal prices stabilized in the third quarter, further efforts were made in scrappage renewal policies, local policies for replacing old vehicles with new ones were successively introduced, consumer wait-and-see sentiment further eased, and overall interest in new energy vehicles picked up. In October, wholesale sales of new energy passenger vehicles reached 1.37 million units, showing a good performance with a year-on-year growth rebound to 54%, which was a strong increase compared to the 33% growth from January to September, with a fast 17% month-on-month increase in October. The production and sales trend of new energy vehicles in October was strong, with breakthroughs in sales by new energy manufacturers, domestic retail, production, achieving historical highs, reflecting the clear substitute effect of new energy vehicles for fuel vehicles. The recovery growth of micro electric vehicles further expanded the consumption space of the auto market, achieving better comprehensive growth.

I. Overall trend of new energy passenger vehicles

In October 2024, wholesale sales of new energy vehicles were very strong.

In October 2024, wholesale sales of new energy vehicles were very strong.

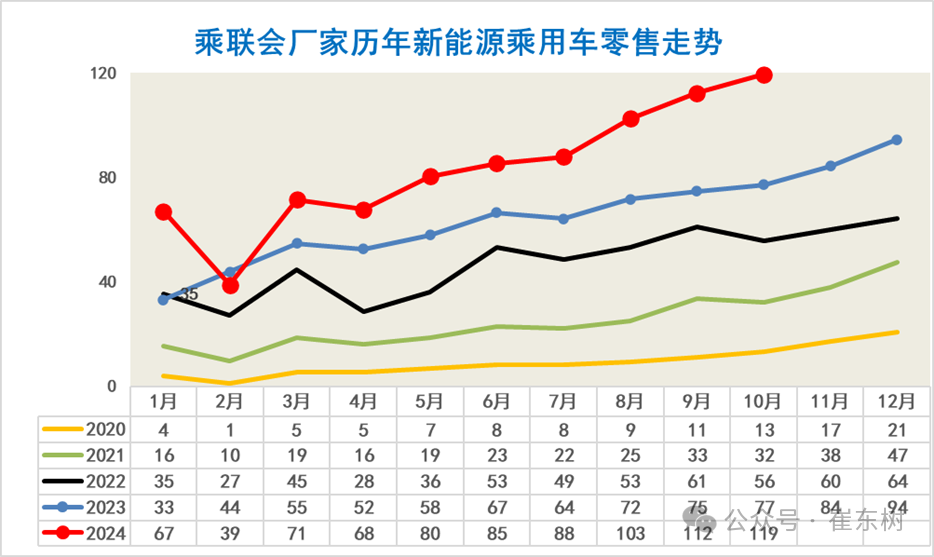

In October 2024, wholesale sales of new energy passenger vehicles reached 1.37 million units, surpassing historical highs. Due to the Spring Festival and price cuts, there was a significant decline in February, with gradual recovery growth from March to August. Huge month-on-month growth in September and October was driven by policy subsidies, continuing to break monthly historical highs.

Since 2023, the decline in raw materials such as lithium and nickel has led to a downward trend in the price of power batteries. The low sales volume at the beginning of the year helped companies reduce production and clear historical inventory. Starting in March, there was a continuous increase in sales of new products.

In October, wholesale sales of new energy passenger vehicles reached 1.37 million units, showing a good performance with a year-on-year growth rebound to 54%, which was a strong increase compared to the 33% growth from January to September, with a fast 17% month-on-month increase in October. Wholesale growth in October was relatively faster than retail, reflecting a market-driven production and sales effect.

2. National penetration rate of new energy - wholesale

In October, the wholesale penetration rate of new energy vehicle manufacturers was 50.1%, an increase of 14 percentage points from the 36% penetration rate in October 2023.

In October, the penetration rate of self-owned brand new energy vehicles is 65%; the penetration rate of new energy vehicles in luxury cars is 35%; while the penetration rate of new energy vehicles in mainstream joint venture brands is only 6%.

3. In October 2024, the retail growth rate of new energy vehicles is strong.

In October 2024, the new energy vehicle market retails 1.19 million vehicles, showing a strong growth trend in October, reaching a historical monthly high of 1.19 million vehicles.

Due to the issuance of license plates in Peking, the effect of the release of new demand from June to October is obvious, and some price-watching groups have started purchasing vehicles, while the policy effect of scrapping and updating is gradually emerging, increasing the enthusiasm for purchases.

In 2023, the cumulative retail sales were 7.75 million vehicles, a year-on-year increase of 36%. The outstanding performance of a 55% growth rate in October surpassed expectations. From January to October 2024, the retail of new energy vehicles reached 8.33 million vehicles, with a 40% increase, showing a relatively strong trend compared to 34% growth in 2023, which is a very good performance.

4. The national penetration rate of new energy in retail.

10月新能源车国内零售渗透率52.8%,较去年同期渗透率提升15个百分点。

In October, the penetration rate of electric vehicles in domestic retail sales was 74.6% for independent brands; 24.9% for luxury cars; and only 6.2% for mainstream joint venture brands.

The export volume of electric vehicles in October 2024 dropped significantly compared to May 2024.

In October 2024, the export volume of electric vehicles was 0.12 million units, showing a slight month-on-month increase. The export performance in January to February was sluggish, possibly due to factors such as marine transportation. Independent exports grew significantly in March, while from April to June, independent exports faced weakening demand in Europe and proactively adjusted. Independent exports continued to strengthen from July to October.

More and more Chinese-made new energy products are going abroad. Due to the continuous improvement of overseas recognition and the improvement of service networks, domestic brand pure electric vehicles are mainly facing the market in developed countries. At present, there are phenomena of blocking Chinese new energy abroad, which is completely wrong, but we should also face it calmly.

From January to October 2024, the cumulative export volume reached 1.01 million units, an 18% year-on-year increase. Recent monitoring of overseas retail data for independent brands in Europe showed moderate performance. Apart from the impressive performance of traditional export companies in some overseas regions, emerging forces have gradually started exporting, with improving export performances in regions like South America. The export growth of independent plug-in hybrid models has also begun. The high export base in October 2023 had little impact on exports, and the impact of additional tariffs by the EU is gradually diminishing. China's cost competitiveness remains significant, and it is expected that the annual export of new energy vehicles will continue to grow significantly in the coming months.

II. Analysis of the market structure of new energy passenger vehicles

1. The structural design of electric vehicles

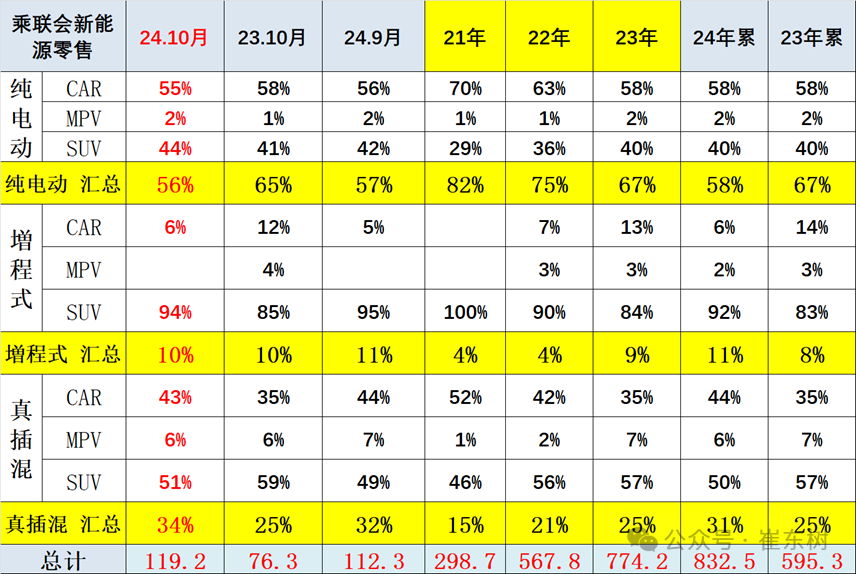

The growth of various powertrains in October was relatively good. Among them, pure electric retail sales in October reached 0.67 million units, an increase of 36% year-on-year and 4% month-on-month; narrowly-defined plug-in hybrid sales in October reached 0.404 million units, showing a 112% year-on-year increase and 11% month-on-month growth.

In October, the new energy retail structure was: pure electric 56%, narrow plug-in hybrid 34%, extended-range 10%. In October 2023, it was pure electric 65%, narrow plug-in hybrid 25%, extended-range 10%. New energy wholesale structure for the full year of 2023: pure electric 67%, narrow plug-in hybrid 25%, extended-range 8%. Significant improvement in plug-in hybrids and pure electric vehicles in October.

2. The level of new energy vehicles - relatively balanced at all levels.

In October, there was differentiation in sales volume of electric vehicles at various levels, showing a good trend of consumption upgrade. Micro electric vehicles showed strong growth. Demand for small electric vehicles was weak, while demand for the second family car was average. High-end SUVs represented by Xiaomi showed strong growth.

Due to the expiration of the tax exemption policy for micro electric vehicles below 200 kilometers at the end of May, the market saw a sharp decline in short-range electric vehicles with over 20,000 units sold per month from June to July, leading to a slump in the pure electric vehicle market from June to July. With the increase in subsidies and driven by the scrappage renewal policy, the A00 entry-level pure electric vehicle market gradually recovered in September and October. The scrappage renewal subsidy further diverted demand from fuel vehicles to plug-in hybrid models.

3. The performance of self-owned and new energy vehicles continues to be strong.

From the monthly domestic retail sales volume perspective, the performance of pure electric vehicles from self-owned and new energy brands was very strong in October. The market scale of mainstream joint venture carmakers and traditional luxury cars is far below that of Tesla.

New energy vehicle companies like NIO, Neta, Xpeng, and Leapmotor showed relatively strong year-on-year and month-on-month sales performance overall, especially NIO and Xpeng, highlighting their advantage in the segmented market race.

The self-owned brands have a significant advantage in the pure electric vehicle market, with Tesla leading in the high-end segment. Recently, self-owned plug-in hybrids are increasingly dominant, while extended-range vehicles have become the exclusive domain of self-owned and new energy brands.

3. In October 2024, there was differentiation among leading manufacturers of electric vehicles.

In terms of product introduction, with the diversified development of independent car companies on the new energy route, the market foundation continues to expand, and the number of manufacturers with monthly wholesale sales volume of new energy exceeding 10,000 vehicles continues to increase.

In terms of product launches, with the implementation of the diversified strategy by independent car companies in the new energy route, the market foundation continues to expand, and the number of manufacturers with monthly wholesale sales of new energy vehicles exceeding 10,000 vehicles is increasing.

Independent companies hold an absolute dominant position, but some car makers continue to experience sustained pressure with a decline in cumulative sales.

This year's and last year's changes in the leading electric vehicle companies are not significant. BYD, the leader, remains unchanged, but Geely and Tesla have achieved a turnaround. Wuling and Changan, which show strong performance in pure electric vehicles, have shown a month-on-month upward trend.

2. Wholesale performance of new energy passenger vehicle models.

The trend of new energy vehicle models is relatively strong, with sales of leading models all above 0.03 million, but there are models with significant year-on-year and month-on-month declines.

4. Analysis of the pure electric vehicle market in October 2024.

1. Sales Trends of Major Pure Electric Vehicle Manufacturers

In recent years, the pure electric passenger vehicle market is still dominated by BYD, Tesla, and traditional independent brands, but recently the performance of new forces has improved significantly. In October 2024, the new energy passenger vehicle market diversified its efforts, with large groups showing differentiated performance in new energy. In October 2024, the strong performers in the pure electric vehicle sector are BYD, Geely Auto, Wuling, Tesla, Changan Automobile, etc. Joint venture pure electric vehicle manufacturers are relatively weak.

The overall trend of new forces is diverging, NIO, Xiaopeng, and Leapmotor are relatively strong, while some pure electric new forces have generally average performance.

2. In October 2024, block orders of pure electric vehicles

In October 2024, the relatively strong performers in pure electric vehicle models are Seagull, MODELY, Hongguang Mini, Model 3, BYD Yuan, and other products.

BYD Seagull, a micro electric vehicle, is extremely powerful, catering to entry-level demand. Although the early trend of Wuling Hongguang Mini was relatively weak, recently Hongguang Mini and Changan Lumin have improved significantly. Additionally, Bin Guo and others have shown a significant increase. Geely's Panda Mini and Star Shuttle, among other new products of micro electric vehicles, have performed well.

V. Analysis of the Plug-in Hybrid Electric Vehicle Market

1. Improvement of Plug-in Hybrid New Energy Vehicle Enterprises Performance

In October 2024, the market trends of plug-in hybrid vehicles have diverged. BYD is in an absolute leading position, with Geely, Great Wall Motors, Changan Automobile, and SAIC-GM Wuling following BYD in the development of plug-in hybrids due to its high sales volume. The competitive products actively follow BYD's plug-in hybrid increments. Recently, Geely and Great Wall's new plug-in hybrid products are very competitive.

Plug-in hybrid models embody the characteristics of traditional domestic enterprises' products. Recently, BYD Song, BYD Qin, destroyer 05 and other products have good sales volume. BYD's product matrix is rich, and the trend has relatively large coverage. European and American companies do not attach much importance to luxury plug-in hybrids, and their sales trends are relatively stable.

2. Strong Wholesale of Plug-in Hybrid Mainstream Vehicles in May 2024

Plug-in hybrid models reflect the characteristics of traditional domestic enterprises as the main players. Recently, BYD's Song, BYD Qin, and Destroyer 05 have good sales performance. BYD's product portfolio is rich, with relatively wide coverage. European and American companies lack sufficient focus on the luxury plug-in hybrid market, with relatively stable sales trends. Recently, the performance of pure electric and plug-in hybrid export models entering the European market has been good, with BYD exports such as the Dolphin contributing significantly to the European new energy market pull from Chinese plug-in hybrids.

VI. Analysis of Extended-Range Electric Vehicle Market

1. Performance of Extended-Range New Energy Vehicle Enterprises

Extended-range new energy vehicle companies have shown strong performance recently, with Ideal and Seres and other car companies experiencing a phase of explosive growth characteristics. Ideal's performance in October is very good. Changan Automobile and Leapmotor and other extended-range products continue to grow rapidly.

2. Performance of Extended-Range New Energy Vehicle Models

Jinkang Sokon's extended-range performance is very strong, recently becoming a dark horse. Ideal Auto is driving the growth of extended-range mode, but the actual user demand is still for pure electric mode.

In October 2024, the main model Ideal L6 continues to be the leading model, while the Wanjie M7 has a good performance. The competition in the main model market is gradually intensifying, with models selling over tens of thousands per month already facing sufficient competition, and Changan series is also performing well in growth.

The extended-range electric vehicle, Ideal L6, has become the leading consumer model, while the performance of Ideal L9 is gradually slowing down, and the sales structure is shifting towards L7. This shows that consumers still have a good acceptance of the low stock price for extended-range options, and the cost-effectiveness of such vehicles is still important. Recently, Chang'an's deep blue extended-range and Qiyuan's pure electric vehicles have also started, forming distinctive differences.