Source: Yaya Hong Kong Stock Circle

Author: Kyle

In the first half of this year, statistics show that at least 180 Hong Kong stock companies have implemented share buybacks, with a total amount of HKD 121 billion, setting a new high in the same period of history. Especially in the Internet companies, almost every shareholder return program has been significantly improved, which can be said to have opened a new era of Internet shareholder returns.

Among these companies, Tencent, the "North Star" of Hong Kong stocks, is undoubtedly the most prominent. In the first half of this year, it contributed more than 40% of the repurchase volume of the Hong Kong stock market, firmly occupying the seat of the "repurchase king" of the Hong Kong stock market. In the second quarter, Tencent's single-quarter repurchase amount reached HKD 37.5 billion, which doubled from the first quarter's HKD 14.8 billion. The repurchase average price increased from HKD 290.6 to HKD 361.8, an increase of nearly 25%. It is worth mentioning that Tencent's repurchase amount this year will exceed HKD 100 billion, doubling from last year's HKD 49 billion. What is the concept of a one trillion repurchase plan? This amount is the sum of Tencent's total repurchase amount in the past ten years, which proves the management's confidence in future development and attaches importance to the demands of investors. Through various means such as repurchase cancellation, dividends, and physical distribution, Tencent has truly given back to shareholders in the capital market while achieving performance growth.

One, the significance of a trillion repurchases is actively emerging.

Looking back at the past two years, since Tencent's major shareholder Prosus began to reduce its holdings, the stock price has been somewhat suppressed. In particular, there have been regular trading behaviors in the market when Hong Kong stocks perform poorly. For example, Hong Kong-listed companies have a "silent period for repurchase" in the month before the financial report is released, during which repurchase is not allowed. This caused great upward pressure on the stock price whenever Tencent entered the repurchase silent period before last year.

As can be seen from the following data, of the five silent periods before the end of 2023, only Tencent's stock price in October-November 2022 rose, and in other times it fell. However, since the end of last year, Tencent's stock price has risen during two consecutive silent periods. Especially after the launch of the trillion-dollar repurchase plan this year, the repurchase volume has far exceeded the number of shares sold by major shareholders. Therefore, whether it is on normal trading days that can be repurchased, or during silent periods, the impact brought by the sale of major shareholders can be ignored, and this point is being formed by market consensus. For example, during the repurchase silent period from January to March this year, which happened to be the worst half-year Hong Kong stock market, the Hang Seng Index fell to 14,800 points. Tencent's performance during this period was significantly better than before. Even though the short selling ratio once reached 20%, the stock price did not fall, and the final interval increase was 6%. After the release of the better-than-expected 2023 annual report and the restart of the repurchase at the end of March, Tencent's stock price performed even better in the second quarter, with an increase of nearly 25%. During the same period, the Hang Seng Index and the Shanghai and Shenzhen Composite Indexes fell significantly, with gains of only 8% and 4%, respectively, while Tencent significantly outperformed the Hong Kong stock market with a gain of 25%.

Behind this phenomenon, there is no doubt that the trillion-dollar repurchase plan, which has doubled from last year's amount, has played an important role.

More importantly, after the repurchased shares are cancelled, Tencent's share capital has been declining for three consecutive years. Since 2021, Tencent's total share capital has decreased from 9.608 billion shares to 9.355 billion shares. In the first quarter of this year, Tencent issued ordinary shares decreased by 1.1% compared to the previous quarter, and the repurchased shares have also been gradually cancelled since this year. This trend will continue to increase earnings per share and further enhance shareholder value. (Caption) Starting in 2022, Tencent has increased its repurchase efforts. With the repurchase cancellation, the company's total share capital has gradually decreased.

Author: Chongfeng

The previous financial fraud believed that Luckin Coffee, which did not think there would be a tomorrow, now has a quarterly revenue exceeding 10 billion, all within the past 4 years.

A while ago,$Luckin Coffee (LKNCY.US)$Announced financial report, achieving a single-quarter revenue breakthrough of over 10.181 billion yuan, a year-on-year increase of 41.4%. Profits also reached a new historical high, with net income exceeding 1.3 billion yuan this quarter, compared to 0.988 billion yuan for the same period last year.

And in terms of store openings, there has been no let-up. Luckin Coffee opened a net 1382 new stores in the third quarter. As of the end of the third quarter, the total number of Luckin Coffee stores reached 21,343, including 13,936 self-operated stores and 7,407 joint-operated stores. In the international market, this quarter added 8 new stores in Singapore, bringing the total number of stores to 45 at the end of the quarter.

Meanwhile, another coffee giant$Starbucks (SBUX.US)$Also released financial report. In the fourth quarter of the 2024 fiscal year, Starbucks' sales performance was relatively weak.

Meanwhile, another coffee giant$Starbucks (SBUX.US)$Also released financial report. In the fourth quarter of the 2024 fiscal year, Starbucks' sales performance was relatively weak.

In the fourth quarter, the company's revenue was $9.07 billion, a year-on-year decrease of 3.2%; net income attributable to the listed company was $0.91 billion, a year-on-year decrease of 25.4%.

Among them, Starbucks China achieved revenue of $0.784 billion, a 7% year-on-year decrease, a 6% increase month-on-month; comparable store sales fell by 14%, average customer price fell by 8%, and order quantity declined by 6%. In terms of store scale, there are highlights. In the fourth quarter, Starbucks added a net of 290 new stores, covering 78 county-level markets. In the full 2024 fiscal year, Starbucks China added a net of 790 new stores, with a total of 7,596 stores nationwide, a year-on-year increase of 12%, setting a record for the highest store opening speed in history.

Overall, in the domestic market, Luckin Coffee has long been dominating Starbucks across the board in terms of data. However, Luckin Coffee's market cap is far below that of Starbucks.

Although Starbucks has over 40,000 stores worldwide, given Luckin Coffee's momentum, is the gap in market cap between the two too big?

1. Luckin and Starbucks, one advancing and one retreating.

The transformation of China's coffee development relies on the drive of three players: Nestle, Starbucks, and Luckin.

Nestle has cultivated the foundation of China's coffee market through instant coffee, Starbucks has brought the chain model of freshly brewed coffee, while Luckin Coffee has popularized freshly brewed coffee.

Currently, the domestic coffee market is in a phase where the newcomer Luckin Coffee is challenging the established Starbucks.

Starbucks introduced the culture of freshly brewed coffee to China, establishing a high-end brand image. The concept of the third place represents a refined, elegant, and tasteful lifestyle in the minds of consumers.

Coffee is just a side product, the sense of superiority in posing is Starbucks' real product.

Therefore, Starbucks charged an additional premium for coffee, making it seem like a privilege for the elite.

Luckin Coffee's emergence shattered this perception, telling you it's just a beverage, good coffee doesn't have to be expensive. Then, it pointed out that the everyday demand for coffee exceeds the need for posing created by Starbucks. Luckin directly integrated the sense of superiority in coffee into the daily lives of the masses, making it a universal daily requirement.

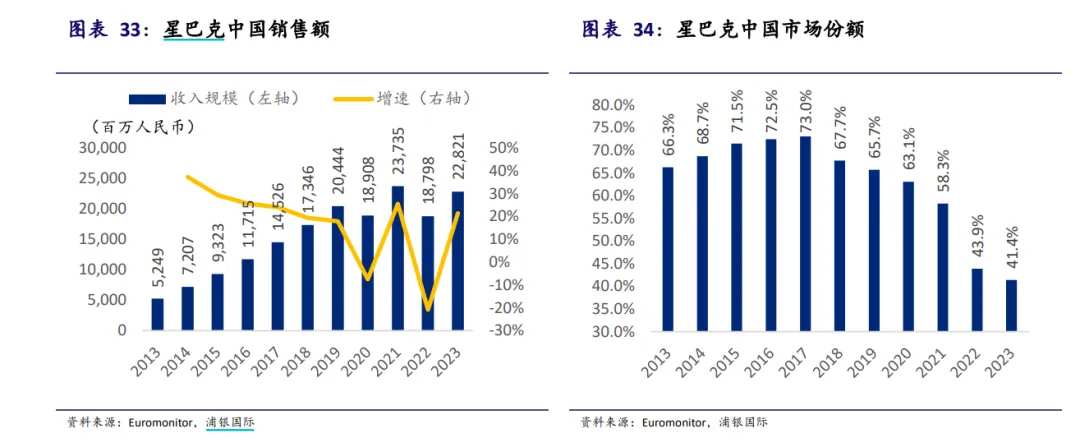

As more high-end boutique coffees emerged, the pretentious feeling of Starbucks faded. Simultaneously, with the appearance of cost-effective coffee options like Luckin, Starbucks was forced to transition from high-end to a mid to high-end coffee chain brand. Although it still upholds the vision of the third place, numerous milk tea shops can achieve the same. Starbucks' market share in China has sharply declined since 2017.

In contrast, within just three years, Luckin Coffee transformed from a consistently loss-making, reputation-damaged company into the coffee chain brand with the most stores and widest coverage in China.

Luckin Coffee has brought many innovative ways and ideas to the coffee industry.

1. High cost performance, targeting the mass market.

Before Luckin Coffee, coffee was only accepted by a small number of consumers in economically developed areas of China. Luckin Coffee's emergence, with Starbucks quality but at prices acceptable to the masses, actually follows the trend of market development.

The addictive and functional nature of coffee easily generates continuous demand from users, yet most people in China do not consume at the level to afford Starbucks regularly. After many years of education from Starbucks and other brands, many people actually have the potential to accept coffee, but what they cannot accept is the price. Starbucks' high prices make white-collar workers who want to continue buying coffee feel the pinch.

The market needs a coffee brand with high cost performance, and the target users are very clear, which are white-collar workers who have experienced an upscale lifestyle but cannot keep up with their consumption levels. However, brands like Costa, Pacific Coffee, and others have followed Starbucks' path without addressing the needs of more people.

Luckin Coffee entered through first-tier city white-collar workers, opening up the mass market for coffee. The lower pricing also allows Luckin Coffee to differentiate itself significantly in market positioning from the industry leader Starbucks, thus creating differential competition.

The low price makes Luckin Coffee's trial very accessible, with no loss to try a cup. Once users believe in Luckin Coffee's quality like Starbucks, the cost-effective feature will open up a larger market and encourage daily customers to make repeat purchases.

2. Strategies in the Internet era.

You say luckin coffee is a coffee company, but it may actually consider itself as an internet-related company. It was born with an internet mindset to operate and improve efficiency.

In the early days of its establishment, luckin coffee first launched its app and WeChat official account for ordering, providing consumers with a convenient and fast purchasing experience, creating daily consumption scenarios. As the consumer base grows, luckin coffee began to build user private traffic pools through a large number of corporate WeChat communities, and adopted reward mechanisms such as points, coupons, discounts to increase user stickiness, and improve user repurchase rate.

According to the Meituan Research Institute's "2024 China Urban Coffee Development Report", the annual compound growth rate of the Chinese coffee industry has been 17.14% in the past three years. The digital coffee consumption trend is continuously growing, with Meituan data showing that the compound annual growth rate of online coffee consumption in the past three years has reached 60%, exceeding the 30% growth rate of online tea consumption. Perhaps luckin coffee contributed to a large portion of this growth.

One characteristic that the internet brings to luckin coffee is that the store locations are relatively casual.

Luckin coffee's locations are typically in areas with high pedestrian traffic such as office buildings, commercial districts, and communities. They are not necessarily in very prominent locations. Even if it is located in the corner of an area, it can survive. This is because luckin coffee mainly focuses on dine-in and take-out scenarios, similar to a takeout store, which can greatly reduce the store's operating costs and increase its survival rate.

Another characteristic is that luckin coffee stores can be densely located to an extraordinary extent.

Luckin coffee stores are more densely located in high-tier cities than in low-tier cities, especially in first-tier cities, where the proportion of densely located stores (calculated with a density distance of 500 meters) reaches as high as 79.2%. It is the most densely located among all coffee and tea beverage brands. Most first-tier city stores are self-operated stores. Even though diverting store traffic may affect the profitability of individual stores, luckin coffee continues to increase store density.

On one hand, you may be surprised that these densely located stores, many of which are not very particular about their locations (only care about the regional positioning, not necessarily the storefront location), yet almost every store can still make money.

On the other hand, Luckin Coffee's encryption has reached a level where other less capable brands, upon seeing several Luckin Coffee stores within a kilometer radius, choose not to get involved, allowing Luckin Coffee to achieve regional monopoly. Although Luckin Coffee's extensive coverage is largely due to Ku Di's intervention, even after the encryption, it seems that it has not reached its limit.

The internet-based approach has expanded Luckin Coffee's single-store coverage beyond physical distances, combined with Luckin Coffee's digital capabilities, the cost and efficiency of single stores perform much better than traditional coffee shops.

At the same time, in terms of marketing, the internet-based approach amplifies Luckin Coffee's influence multiple times. Luckin Coffee closely follows trends and topics, actively cooperates with cross-border brands, and increases the brand's visibility and exposure effectively on the internet. For example, in September 2023, Luckin Coffee collaborated with Kweichow Moutai to launch a new product called 'Sauce Fragrant Latte,' which became a phenomenal product and trend. In the third quarter of this year, around popular domestic game IPs, Luckin Coffee successfully launched multiple co-branded activities such as 'Black Myth: Wukong,' 'Zan Meng Lu Bi,' 'Butter Bear,' etc., which were also loved and supported by consumers. As of September this year, Luckin Coffee has launched a total of 21 co-branded events.

These internet marketing strategies have also effectively helped Luckin Coffee attract and engage users. As of the end of the third quarter, Luckin Coffee's cumulative transactional customer base exceeded 0.3 billion, with an average monthly transaction customer base of 79.85 million in the third quarter, a year-on-year increase of 36.5%, reaching a historical high.

3. Product Innovation

Luckin Coffee's innovation in coffee products has also subverted the traditional coffee consumers' perception.

Whether it's the earliest Coconut Latte and Coconut Cloud Latte, or last year's Sauce Fragrant Latte, they have broken the boundaries of traditional coffee products and become phenomenal topics on social media.

In the past, adding milk to coffee to make a latte was already a breakthrough. Luckin Coffee dares to add anything and while most of it is done well.

Luckin Coffee's ability to launch new products is in an absolute leading position in the instant coffee industry. Luckin Coffee launched 113, 140, and 102 new products in 2021, 2022, and 2023, respectively. In 2024, Luckin Coffee released a total of 80 new products, including 22 in the first quarter, 30 in the second quarter, and 28 in the third quarter.

Now, Luckin Coffee wants to broaden its consumer scenarios, entering the arena of milk tea with the concept of 'morning coffee, afternoon tea,' which is indeed very innovative. Both coffee and milk tea seem to have smoothly become the main products. The 'Light Jasmine Light Milk Tea' sold over 44 million cups in its first month.

It can be said that Luckin Coffee has quickly established dominance in the coffee market through innovative ideas. Looking back, it is now evident that Starbucks is a follower in terms of strategies rather than the innovator it used to be. The new era's strategies may be somewhat challenging to adapt to, but in order to maintain its position and advantages, Starbucks is also making efforts to learn.

2. Crazy Kudy

One current factor affecting Luckin's development is the escalating price war and the ceiling of market penetration rate.

In the past two years, Luckin seems to be sprinting, but it's actually not very comfortable.

Luckin Coffee has always believed that its only competitor is Starbucks, but Luzhengyao's Kudy Coffee has dragged the entire industry into an escalating price war. Luckin launched a 9.9 yuan challenge, intensifying the price war. The mainstream competitive price range has dropped to 10-15 yuan.

However, for a large-scale company like Luckin, it is actually very difficult to make money at 9.9 yuan. After the price war began, Luckin's gross margin dropped from 41.79% to the lowest 23.9% in the first quarter of this year, and the net margin directly turned negative to -1.32%.

Luckin Coffee is not making any money, and KFC will be even less likely to make any money. Continuing to compete at 9.9 RMB will only result in both sides getting hurt.

During intense times, according to some investors, around 20–30% of the co-branded businesses in KFC are profitable, about 20–30% break even, and the vast majority are incurring losses. Some store closures were taken away by Luckin Coffee's strategic site selection.

Luckin Coffee's 9.9 RMB pricing here is forced to step back. In February this year, some netizens found that Luckin Coffee's 'Whole Store 9.9' has shrunk to 'Limited 8 selected drinks for 9.9'. Currently, on the Luckin Coffee mini program, there are only 5 drinks participating in the '9.9 per week' promotion: Light Jasmine, Light Oolong, Latte, Oat Latte, and Americano.

In addition to Luckin Coffee, Starbucks is also reducing its promotional activities. Recently, the topic of 'Starbucks giving up the price war' trended on Weibo. Starbucks' new CEO, Niekol, believes that these low-price strategies not only fail to effectively improve long-term performance but also damage Starbucks' brand image and high profit margins. Liu Wenjuan, CEO of Starbucks China, clearly stated that Starbucks China will not participate in price wars but will continue to focus on the high-end coffee market, pursuing high-quality, profitable, and sustainable growth.

Price wars are beneficial to no one, but when one retreats from the market, KFC steps in.

On October 22nd, KFC announced that it had broken 10,000 stores, taking only 2 years. Luckin Coffee took more than 5 years to break the 10,000 store mark. KFC plans to open 0.05 million stores by the end of 2025. According to the data disclosed in an internal memo by Qian Zhiya on October 22nd, KFC's store cash flow rate has remained stable at over 97% for the past 5 months.

Only KFC's price war continues, not by lowering prices, but by cutting costs. KFC is taking a more extreme path than Luckin Coffee.

KFC itself operates on a co-branded model, with significantly lighter assets and expenses than Luckin Coffee. KFC subsidizes part of the co-branded income into the store's price wars, expanding its scale even if it earns less or even nothing. Lu Zhengyao will renegotiate prices with suppliers every 3 months.

At the same time, Kudi compresses costs to the extreme by opening some store-in-store concepts. The cooperative model of 'store-in-store' does not incur additional rental or labor costs. By attracting customers with coffee, according to Li Yingbo, over 30% of customers entering the store will spend on other products. It's like adding a category in the store, not opening a new one.

As long as Kudi is not completely suppressed, it seems to spring up from every corner. Kudi's madness makes it impossible to ignore Lu Zhengyao's determination for revenge.

Luckin's 9.9 yuan price rollback indicates that Luckin currently has no way to deal with Kudi. Now, besides price adjustments, the new strategy is store expansion and densification. When the coffee penetration rate in China reaches a bottleneck, it is inevitable that new battles will begin.

When it comes to penetration rates, it cannot be looked at in a general nationwide manner, as there is a significant difference in coffee penetration rates between first-tier and lower-tier cities.

The distribution of coffee consumption in China is extremely uneven. According to Deloitte's data, the per capita coffee consumption in high-tier Chinese cities has basically reached the level of Europe, the US, Japan, and South Korea, while the coffee market in third-tier cities and below is just beginning to take off.

Recently, including Starbucks, many are accelerating their store expansion. However, Starbucks' 'third place' concept is asset-heavy, lacking the flexibility seen in Luckin and Kudi.

Luckin's biggest competitor may not be Starbucks anymore, but Kudi.

Luckin continues to densify its locations in high-tier cities, ensuring they have the best resources on hand, while also using franchising to expand into lower-tier markets. The domestic price war may evolve into a battle for market positioning in the lower-tier markets.

At the same time, both sides are also testing the waters to go overseas. Luckin Coffee has reached 45 stores in Singapore. The overseas instant coffee market is still in the early stage, and Luckin Coffee also has the opportunity to play a disruptive role in the overseas market. However, currently Luckin Coffee has not adopted a low-price strategy in the overseas market, but instead benchmarked Starbucks and then sold at a certain discount, showing a cautious approach.

Kudi is still expanding aggressively in Southeast Asia, with activity prices in Thailand, Indonesia, and South Korea mostly below 10 RMB.

Luckin Coffee and Kudi will probably be opponents for a long time and coexist.

Conclusion

If Luckin Coffee can't eliminate Kudi, it can only return to its own pace, stabilize earnings on one side, and continue to expand on the other.

Without Kudi, the market actually expects Luckin Coffee to become the next Starbucks or even surpass Starbucks. However, Kudi, the disruptor, has consistently exceeded market expectations, causing disruptions to the original long-term prospects.

While the aggressive expansion of stores continues, there are likely internal issues within Kudi. Until the day it faces major problems, it will continue to erode Luckin Coffee's future market share. Meanwhile, due to accelerated competition and expansion, Luckin Coffee still needs to maintain relatively high capital expenditures, leading to a stagnant valuation.

Although the price war has come to an end, the competition is still ongoing. Once Luckin Coffee becomes more comfortable, market expectations will improve.

Editor/ping

而开店情况方面,依旧没有停下脚步。瑞幸第三季度净新开门店1382家。

而开店情况方面,依旧没有停下脚步。瑞幸第三季度净新开门店1382家。