Deep-pocketed investors have adopted a bullish approach towards Palo Alto Networks (NASDAQ:PANW), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PANW usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 16 extraordinary options activities for Palo Alto Networks. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 25% bearish. Among these notable options, 3 are puts, totaling $337,320, and 13 are calls, amounting to $676,124.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $200.0 to $410.0 for Palo Alto Networks over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $200.0 to $410.0 for Palo Alto Networks over the recent three months.

Volume & Open Interest Trends

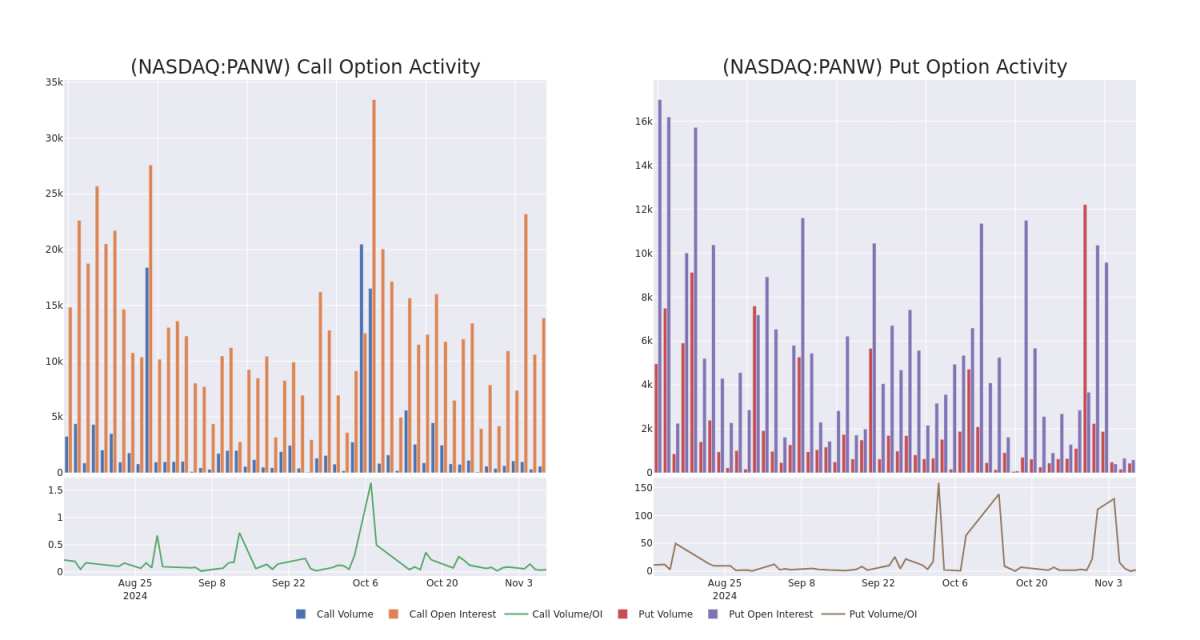

In today's trading context, the average open interest for options of Palo Alto Networks stands at 904.62, with a total volume reaching 1,023.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Palo Alto Networks, situated within the strike price corridor from $200.0 to $410.0, throughout the last 30 days.

Palo Alto Networks Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PANW | PUT | TRADE | BULLISH | 03/21/25 | $46.85 | $45.3 | $45.3 | $410.00 | $199.3K | 48 | 44 |

| PANW | CALL | SWEEP | BULLISH | 12/20/24 | $16.35 | $16.15 | $16.35 | $400.00 | $117.5K | 1.7K | 117 |

| PANW | PUT | TRADE | BULLISH | 11/15/24 | $3.4 | $3.1 | $3.1 | $380.00 | $108.5K | 342 | 375 |

| PANW | CALL | TRADE | BULLISH | 01/15/27 | $173.0 | $170.35 | $173.0 | $260.00 | $86.5K | 10 | 5 |

| PANW | CALL | TRADE | BULLISH | 01/17/25 | $115.0 | $109.0 | $115.0 | $280.00 | $80.5K | 4.4K | 7 |

About Palo Alto Networks

Palo Alto Networks is a platform-based cybersecurity vendor with product offerings covering network security, cloud security, and security operations. The California-based firm has more than 80,000 enterprise customers across the world, including more than three fourths of the Global 2000.

Having examined the options trading patterns of Palo Alto Networks, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Palo Alto Networks

- With a volume of 467,414, the price of PANW is down -0.29% at $385.88.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 12 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Palo Alto Networks options trades with real-time alerts from Benzinga Pro.