Source: 36Kr Holdings

Author: Neil Cybart

Translator: Junichi

Editor's note: over the past decade, Apple Inc has almost changed our understanding and view of science and technology products, and it has even become a weather vane of science and technology trend at one time. However, in recent years, Apple Inc Company in product sales, especially iPhone sales, also began to appear downward pressure. Not long ago, Apple Inc, which just released its financial results for the first quarter of fiscal year 2020 (October 1-December 31, 2019), has recorded record revenue and profits as a whole. What difficulties will Apple Inc face in the coming year?

In this article, the original title is The Big Question Now Facing Apple, the author Neil Cybart analyzed the next problems that Apple Inc Company needs to face in the article, hoping to enlighten you.

The so-called prediction is nothing more than trying to analyze and infer a clearer direction for those areas that are already unknown.

In the case of forecasts for the new year, two things need to happen. First, the person or institution that publishes the forecast needs to infer what is likely to happen. Second, the inferred things must happen at any time. In the process of such inference and prediction, the possibility of really finding value is very low.

As for the prediction of the trend of Apple Inc Company as always, with the arrival of the new year, compared with the relevant inference and prediction, it is better to embrace the unknown areas and focus on the problems the company is currently facing. So, as in previous years, I raised the problems that Apple Inc may have to face in the new year.

The strange thing behind the problem is that asking the right question is like successfully chasing waves in an unknown ocean with a surfboard.

The problems that Apple Inc needs to face in 2020

In view of the problems that Apple Inc needs to face in 2020, as far as the core direction is concerned, it is mainly divided into two categories: growth plan and asset benchmark optimization.

I. growth plan

IPhone business. The iPhone business has been declining for years. This business, which used to be the core business and main source of income of Apple Inc, is now subject to all kinds of questions and cold words. There are too many rumors that the arrival of 5G will bring new big upgrades to the iPhone lifecycle. However, these rumors ignore another fact: iPhone business has become more and more mature. This has also brought a series of challenges to Apple Inc, and Apple Inc also needs to adjust the existing strategy appropriately. Among them, it includes the adjustment of product portfolio, release plan, pricing and function.

Paid content distribution. For Apple Inc's content distribution team, the past year has been a busy and fulfilling year. However, next, we will continue to watch whether Apple Inc will bundle all paid content services together. After all, in order to support the relatively weak service business and enhance the stickiness of the overall service business, Apple Inc can tie all the paid content together.

Wearable device. In fiscal year 2019, Apple Inc's wearable device business is booming, selling a total of about 65 million wearable devices for the whole year. According to my analysis of the user base of Apple Inc watches, about 7 per cent of iPhone users own Apple Watch. In addition, the proportion of iPhone users with AirPods is almost 7%, except that AirPods debuts later than Apple Watch. The problem that Apple Inc faces now is not whether the momentum of wearable devices will continue to grow, but the speed of growth.

Profit. Apple Inc adopted a pricing strategy based on "optimizing revenue and gross profit". As a result of this strategy, Apple Inc's gross profit margin has fallen by 10 per cent in the past two years, even though the gross profit margin has fallen by only 2 per cent. If it can increase consumer demand for Apple Inc's products, Apple Inc is also willing to sacrifice gross profit margin. The core key point is, in order to maximize gross profits, how to set the pricing level of Apple Inc's products?

Product research and development. As far as Apple Inc's car-building plan "Project Titan" and Apple Inc's planned AR glasses are concerned, they both face two same themes: first, to ensure continuous progress; second, to extend the relevant timeline.

II. Optimization of asset benchmark

Leader. Now, with the departure of Jony Ive, the former chief design officer, Jeff Williams, Apple Inc's chief operating officer, has formally taken over the leadership of the design team. As for whether Apple Inc will make corresponding adjustments to the management structure, it remains to be seen.

The Chinese market. With the signing of the first phase of the economic and trade agreement between China and the United States, we can next focus on Apple Inc's long-term strategy for the Chinese market. In the face of a variety of options, Apple Inc can continue to rely on the Chinese market in terms of supply chain and product assembly, or he can accelerate the implementation of his diversification strategy for the Chinese market, or he can maintain the existing strategy. accept that it is still dependent on the Chinese market and the resulting benefits (and disadvantages).

Capital expenditure. In fiscal year 2019, Apple Inc's capital expenditure was only $7.6 billion. There has been a significant decrease compared with capital expenditure of $16.7 billion in the previous fiscal year. The main reason for the sharp decline in capital expenditure may be the decline in investment in product tooling and manufacturing process-related equipment. In addition, Apple Inc's investment in corporate facilities and infrastructure is also relatively small. In addition, since Apple Inc did not provide relevant information on capital expenditure for fiscal year 2020, this variable may make people more curious about what Apple Inc's product pipeline will be like in the short term.

Return on capital. Apple Inc's overall share price rose 89% in 2019, more than three times the 29% rise of the s & p 500 index. Since Tim Tim Cook became Apple Inc's CEO, Apple Inc is now trading at an excessive premium to the overall market in terms of price-to-earnings multiples. Many financial writers also called on Apple Inc to slow down the pace of buybacks and further increase cash dividends in the fourth quarter. If Apple Inc's market valuation exceeds its intrinsic value, it is not clear what Apple Inc will do with the excess cash on his balance sheet of more than $10 billion, not including Apple Inc's free cash flow of about $60 billion a year. From a tax point of view, special dividends are not a good solution. There are also some limitations if all the excess cash is used to pay out fourth-quarter cash dividends.

The big problems facing Apple Inc

After a careful study of a series of unknown areas faced by Apple Inc mentioned above, you may find that the product pipeline, which was once the main engine of Apple Inc's new user growth, is maturing rapidly, while the new product pipeline is mainly driving the growth of average revenue per user (ARPU).

Worldwide, more than 500m users own at least one iPhone phone. This part of the user group is Apple Inc's core target group when selling other Apple Inc products. Apple Inc has completed a growth cycle and is about to start a new growth cycle.

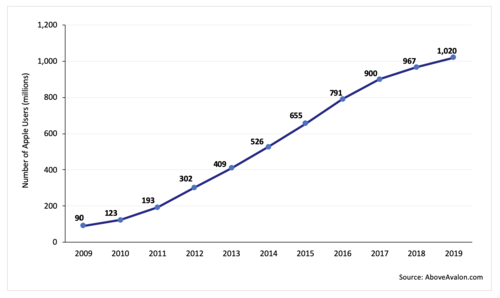

The following figure shows the growth curve of the number of Apple Inc users from 2009 to 2019, also known as the user base.

According to my personal estimate, Apple Inc's user base has grown from about 90 million at the end of 2009 to just over 1 billion users at the end of 2019.

In terms of new user growth, this part of the growth is much lower by comparison. Thanks mainly to iPhone, Apple Inc's new users grew by about 25% to 60% in the five years from 2010.

In recent years, Apple Inc's new user growth rate has only remained at around 5 per cent.

Apple Inc user base (number of users) Source: Above Avalon

For Apple Inc, achieving a billion-level user group is indeed an achievement. after all, Apple Inc's products are not given away for free.

For Apple Inc's future development, the biggest problem is not how to sell more products and tools to the existing user base, but whether the management has the ability to further expand Apple Inc's user base. This question leads to a more important question, which may also contain the greatest challenges and opportunities for Apple Inc:

How will Apple Inc achieve the growth of the next billion users?

We may simply think that it is not too difficult and hard for Apple Inc to achieve the first billion users. It seems that these users are "handy". But in fact, this billion user groups mainly come from the top groups of several industries in which Apple Inc competes. This means that Apple Inc will inevitably need to adjust his strategy if he wants to get the next billion users.

"next billion users" strategy

For Apple Inc, the main deployment has been made to achieve the growth of the next billion users. Apple Inc will launch tools or devices that can make technology more personalized. The investment in this area will bring new user interfaces and interactive ways, and let users enjoy more dividends brought by technology on the premise that technology will not affect or dominate users' lives.

Judging from the geographical distribution of Apple Inc's existing user groups, there are still many potential new user groups in developed countries. In emerging markets, however, the possibility of developing a whole new user base is a completely different story.

For Indonesia, Brazil, the Philippines and Vietnam, the total population is more than twice that of the United States. In addition, the total population of China and India (2.6 billion) also exceeds that of the countries with the third to 22nd largest population in the world.

You might think that as long as Apple Inc cuts the price of his products, he can easily get the next billion users. However, the results of this strategy may be more complicated. Every year, due to the trend of social and economic development, Apple Inc's potential market size can be further expanded by tens of millions of people.

In addition, for Apple Inc, relying on the grey market, which allows second-hand products to flow into the middle and bottom social groups, may be a more effective strategy. In this way, Apple Inc can not only give up thinking about launching cheaper products with lower performance and less functionality, but also benefit more from continuous product updates and upgrades in the supply chain and product assembly.

If you want to achieve sustained growth in the existing user base, I think Apple Inc can consider the following strategies:

A truly independent Apple Watch. The so-called truly independent Apple Watch refers to the normal use of Apple Watch without the use of other Apple Inc devices by improving and improving the performance and function of the product. If this function can be achieved, the potential market for Apple Watch can be rapidly quadrupled.

Continue to launch more and newer wearable devices. With the help of brand-new products, let users and science and technology closer, can enable Apple Inc to open up a wider range of target user market. With the help of new form factors such as glasses, Apple Inc's design can make technology more personalized on the basis of the current Apple Watch and AirPods.

The equipment has a longer service life. By providing more durable hardware and extra years of software update services, it is bound to attract more users over a long period of time. For Apple Inc equipment, if it has a longer service life, it can also have direct benefits to the grey market. After all, more devices can be re-circulated and eventually flow into the hands of the middle and bottom user groups.

Expand equipment maintenance and support network. As far as Apple Inc's current retail store is concerned, if we add another billion users, we will not be able to provide additional products, services and support. This problem will be particularly prominent in the markets of developed countries. By establishing and expanding the equipment maintenance and support network, including authorized third parties, Apple Inc can further ensure that the next billion users can enjoy the after-sales experience valued by Apple Inc's existing user base.

For Apple Inc, it is not an easy task to break through 2 billion user groups. In the process of achieving the goal of the second billion users, the strategy adopted by Apple Inc may be very different from that of achieving the first billion users. However, it seems that nothing will change for Apple Inc's long-term mission of building products that change people's way of life.

Edit / Jeffy