Preparation: Deng Tong, Golden Finance; Data Source: Golden Finance, Bloomberg, CoinDesk, Bankless, Blockworks

In the early hours of November 8th, Beijing time, the Federal Reserve announced a 25 basis point rate cut, lowering the federal funds rate target range to 4.5% to 4.75%. This is the second rate cut by the Fed this year, in line with market expectations. As early as September 18th this year, the Fed announced a 50 basis point rate cut, reducing the target range for the federal funds rate to between 4.75% and 5%, officially starting this round of rate cuts.

Why did the Federal Reserve cut interest rates? What impact does the rate cut have on the crypto market? Will there be further rate cuts in the future? Golden Finance has compiled the following information.

1. Why did the Federal Reserve cut interest rates?

In September, the Federal Reserve made a significant 50 basis point rate cut, initiating the so-called period of liquidity easing, which is a positive development for risk assets, including cryptocurrencies.

In September, the Federal Reserve made a significant 50 basis point rate cut, initiating the so-called period of liquidity easing, which is a positive development for risk assets, including cryptocurrencies.

Before the rate cut announcement, federal funds futures data indicated an expected 25 basis point cut on Thursday, a similar move in December, a pause in January, and multiple rate cuts before 2025. In addition, many voices anticipate rate cuts: Wells Fargo expects a 25 basis point cut by the Fed, with a tendency to keep rates unchanged; Morgan Stanley expects the Fed to cut by 25 basis points in both November and December, elevate the assessment of economic growth in statements, and continue to acknowledge progress in inflation.

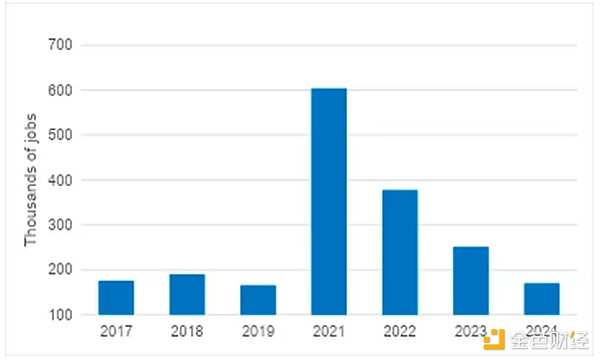

1. Employment data

The target range for the federal funds rate (benchmark borrowing cost) is 4.75% to 5%, significantly higher than the 'neutral' level (estimated at 3%-3.5%). Therefore, it was widely believed in the market before the rate cut that the Fed had enough room to normalize overly tight monetary policy through rate cuts, especially since the labor market cooled significantly since October. So far this year, the US has added an average of about 0.17 million new jobs per month.

The Federal Reserve's FOMC statement shows that the target faces "roughly balanced" risks, with the labor market conditions "generally easing"; maintaining the size of the balance sheet unchanged, discount rate reduced from 5.00% to 4.75%; overnight reverse repo rate lowered from 4.80% to 4.55%, and overnight repo rate decreased from 5.00% to 4.75%.

2. Inflation

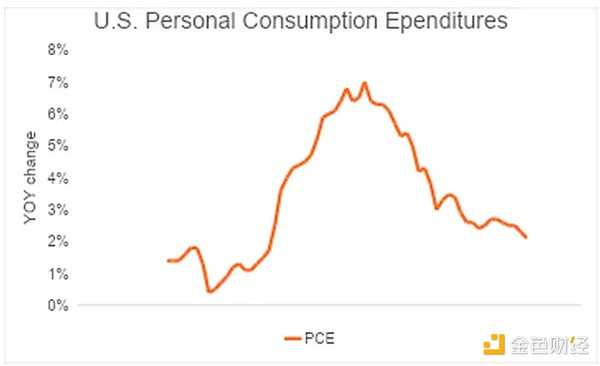

From 2020 to 2023, stimulus funds had a significant impact on prices. The chart below shows the changes in the Personal Consumption Expenditures (PCE) Index by the Bureau of Economic Analysis in the past five years. The Federal Reserve prefers to use this indicator to measure the Consumer Price Index (CPI) because it measures not only the dollars consumers pay, but also what they pay, such as medical benefits. By examining this indicator, policymakers can better understand consumer spending. Currently, PCE has fallen to pre-pandemic levels.

3. Economic Output

Last week, the Bureau of Economic Analysis reported that GDP grew by 2.8% in the third quarter. This is a quite impressive figure. However, when combined with the 1.4% and 3% growth rates in the first and second quarters respectively, we arrive at an average annual growth rate of about 2.4%, slightly higher than the normal growth rate of 2.3% since the financial crisis.

According to the latest PCE data, the real interest rate (effective federal funds rate minus PCE) is 2.8%. This means that the central bank could further lower interest rates by 280 basis points, so that borrowing costs no longer drag down inflation growth.

According to the latest PCE data, the real interest rate (effective federal funds rate minus PCE) is 2.8%. This means that the central bank could further lower interest rates by 280 basis points, so that borrowing costs no longer drag down inflation growth.Loose fiscal policy.

Trump has secured a majority in the Senate, and potential control of the House will enhance his ability to fulfill election promises - tax cuts and loose fiscal policy. Trump is a supporter of dollar depreciation, believing it will help boost demand for US manufactured goods and stimulate the domestic economy. Lowering borrowing costs is the remedy to achieve this goal, as lower rates mean the dollar will become more abundant, thereby lowering its value.

Professionals point out that "Powell expressed multiple logics in different answers: first, the current monetary policy is still restrictive, the Fed cut rates in September, and this rate cut should be regarded as 'another step'; second, the Fed does not want or need to see further cooling of the labor market; third, the Fed believes that inflation in some areas such as rents mainly reflects a 'catch-up' effect, reflecting past inflationary pressures rather than current ones, so it tends to believe that inflation will continue to move towards 2%." For more details, click the article: 'Why insist on rate cuts? - Interpretation of the Fed's November 2024 interest rate meeting.'

Second, how does the Fed rate cut affect the crypto market?

Affected by the Fed's rate cut, US stocks, bonds, and commodities have all seen increases, and Asian stocks also rose on Friday.

Australian, Japanese, South Korean, and Chinese stock markets all rose, supporting the consecutive second-day rise of regional stock market indices. Previously, the S&P 500 index rose by 0.7%, the Nasdaq 100 index rose by 1.5%, both reaching new highs. In Asian markets, US Treasury prices edged lower, while US stock index futures remained almost unchanged.

In the short term, the impact of the Fed's rate cut on the crypto market is very limited: the crypto market has already absorbed the expectation of the Fed continuing to cut rates; Trump's victory in the US election has greatly boosted the trend of cryptocurrencies. In the short term, the crypto market seems to be facing a dilemma of running out of bullish catalysts, but in the long run, the outlook for the crypto market is bright.

The lower interest rates are expected to alleviate the pressure of private sector contraction and support housing affordability; rate cuts reduce borrowing costs and the cost of borrowed capital, thereby increasing liquidity in the entire financial market, which has a strong positive impact on cryptos as a liquidity-driven asset class.

This rate cut further opens the liquidity floodgates, encouraging capital to flow down the risk curve. This environment is particularly favorable for cryptos. Historically, Bitcoin and similar assets have flourished during periods of expanded liquidity, attracting investors seeking high returns at low borrowing costs. As the Fed focuses on ensuring the resilience of the private sector, especially in the case of receding inflation, cryptos become the preferred asset class for more capital inflows into domestic and global systems.

Three, Future Rate Cut Expectations of the Fed

According to CME's 'FedWatch', the probability of the Fed maintaining the current interest rate by December is 32.6%, the probability of a cumulative 25-basis-point rate cut is 66.8%, and the probability of a cumulative 50-basis-point rate cut is 0.6%. The probability of maintaining the current interest rate by January next year is 17.9%, the probability of a cumulative 25-basis-point rate cut is 51.5%, and the probability of a cumulative 50-basis-point rate cut is 30.4%.

Powell's Response to Rate Cut Expectations:

When asked if the Fed is considering pausing rate cuts in December, Fed Chairman Powell stated at a press conference that as officials shift monetary policy stance to neutral, they have not yet decided on what policy action the central bank will take in December. He said, 'In a situation of uncertain outlook, we are prepared to adjust our assessments of the appropriate pace and ultimate goal of monetary policy. If the labor market deteriorates, the central bank will be prepared to act more quickly. Slowing the pace of reducing the restrictive rate stance may also be appropriate.' Powell stated that the unemployment rate has decreased over the past three months and remains low. If there are no storms or strikes, the hiring pace will be 'slightly higher'. He also stated that improvements in supply conditions support the economy, and consumer spending growth remains resilient.

As the neutral rate approaches, it may be necessary to slow the pace of rate cuts, and the Fed has only just begun to consider adjusting the rate cut pace. It is prepared to adjust the evaluation of the speed and target of rate changes. The Fed also mentioned that it is not eager to reach the neutral rate, and the correct approach to finding the neutral rate is to act cautiously. Rate hikes are not the Fed's plan, and the Fed's fundamental expectation is to gradually adjust rates to a neutral level. Powell stated at a press conference that the central bank will not intentionally lower the inflation rate below 2% to compensate for the past few years of overshooting. He said: 'We believe it is inappropriate to target below 2% deliberately to compensate for periods when it was above target. The Fed currently operates under a policy called average inflation targeting, but this system is expected to change in next year's policy review.'

Short-term outlook: Many industry insiders believe that the Fed will continue to cut rates in December.

Interest rates futures in the USA price in the Federal Reserve cutting rates by another 67 basis points in 2025.

Following the Federal Reserve interest rate decision, the price of US interest rate futures reflects the expectation of another 25 basis point cut in December.

Diane Swonk, from KPMG, mentioned that the Federal Reserve may cut rates in December, but it seems they want to maintain the 'optionality' for the future. One of the main challenges the Fed currently faces is 'communication,' as this is not a period where they can provide 'much forward-looking guidance.'

Whitney Watson, Co-Head of Fixed Income and Liquidity Solutions at Goldman Sachs Asset Management, expects a 25 basis point rate cut by the Federal Reserve in December. Watson stated, "However, stronger data and uncertainties in fiscal and trade policies mean the risk of the Fed slowing down its easing path is increasing. The word 'skipping' may enter our vocabulary in 2025."

Some analysts hold a skeptical view of future rate cuts:

Ben Vaske, Senior Investment Strategist at Orion Portfolio Solutions, noted that the FOMC announced the expected 25 basis point rate cut today, signaling a less aggressive stance compared to the September cut. It is worth noting that long-term rates have been sharply rising since the first rate cut and started to decline after today's announcement. Given the robust US economy, the Fed's future path may be more complex than a gradual rate cut.

Lindsay James, Analyst at Quilter Investors, suggests that the pace of future rate cuts by the Fed seems far less certain than the widely anticipated cuts before the decision. 'Volatility in the job market data casts a shadow over the outlook, as does the victory of Donald Trump,' the investment strategist said. 'Expectations for future Fed rate cuts are significantly diminishing compared to what many initially hoped.'

Jackson Garton, Co-Chief Investment Officer at Makena Capital Management, commented that Powell remained silent on providing new forward guidance during his press conference and made no comments on changing the economic outlook summary. Short-term Treasury yields remained almost unchanged during Powell's speech. Garton still believes the Fed may choose to cut rates in December but is uncertain. He said, 'I think there is over a 50% chance that the next meeting will continue with a 25 basis point cut, but I'm not 100% certain.'

Due to the double bullish factors of Trump's victory and the Fed's interest rate cut, as of press time, BTC is priced at $76,035.89, with a 0.8% increase in the past 24 hours; ETH is priced at $2,919.63, with a 3.7% increase in the past 24 hours; SOL is priced at $198.45, with a 4.5% increase in the past 24 hours.

9 月份,美联储大幅降息 50 个基点,开启所谓的流动性宽松周期,这对包括加密货币在内的风险资产来说是一个积极的发展。

9 月份,美联储大幅降息 50 个基点,开启所谓的流动性宽松周期,这对包括加密货币在内的风险资产来说是一个积极的发展。