In a complex and ever-changing macro environment, all industries are facing severe challenges, but a few tracks have shown rapid development momentum, with cross-border e-commerce being one of them.

According to statistics from the Ministry of Commerce, in the past 5 years, China's cross-border e-commerce trade volume has grown by more than 10 times. According to preliminary statistics from the General Administration of Customs, in the first three quarters of 2024, China's cross-border e-commerce import and export volume reached 1.88 trillion yuan, a year-on-year increase of 11.5%, which is 6.2 percentage points higher than the overall growth rate of China's foreign trade during the same period.

In addition, according to eMarketer's data, the global e-commerce penetration rate increased from 10.4% in 2017 to 19.5% in 2023, while the global cross-border e-commerce penetration rate during the same period increased from 5.2% to 8%. Compared to China's 27.6% e-commerce penetration rate, there is still significant room for growth in the global online rate, which also lays a solid foundation for the long-term growth of cross-border e-commerce.

Cross-border e-commerce is accelerating, bringing excellent development opportunities to a large number of Chinese enterprises. A few forward-looking enterprises have seized early development dividends with their first-mover advantage and have become a business card of the cross-border e-commerce industry, with Inc. being one of them.

Cross-border e-commerce is accelerating, bringing excellent development opportunities to a large number of Chinese enterprises. A few forward-looking enterprises have seized early development dividends with their first-mover advantage and have become a business card of the cross-border e-commerce industry, with Inc. being one of them.

On November 8, Inc. was officially listed on the Hong Kong Stock Exchange. Looking back, the development path of this cross-border e-commerce enterprise was actually not smooth, but a mature enterprise often achieves transformation only after going through trials and tribulations and scrutiny.

I. Returning to the high-quality growth track

In 2010, Inc. was founded in Shenzhen and riding the wave of economic globalization, began a rapid growth miracle, growing from a small start-up to a revenue scale of nearly 10 billion at its peak within a few years.

But the story took a turn at this point. In 2021, the 'Amazon store closure wave' dealt a huge blow to the entire Chinese cross-border e-commerce industry at the time. Inc. also faced its biggest test since its establishment, but based on subsequent operating results, Inc.'s performance quickly returned to an upward growth path after a brief decline.

In 2023, Aoke's revenue was 8.683 billion yuan, a year-on-year increase of 22.3%. This growth trend has also continued to this year. In the first four months of 2024, the company achieved revenue of 2.834 billion yuan, a year-on-year increase of 16.87%.

Profitability has also improved. In 2023 and the first four months of 2024, the company's net income was 0.52 billion yuan and 0.189 billion yuan respectively, with year-on-year growth rates of 133.02% and 96.17%.

From this perspective, Aoke's adaptability and adjustment capabilities are extraordinary. It should be noted that the closure wave event in 2021 lasted for more than half a year. For an enterprise of this scale with tens of billions in revenue, the resulting sales and inventory pressures can be imagined. But now, Aoke not only sees a return to double-digit revenue growth but also achieves a doubling of profits.

To a large extent, this is also attributed to Aoke's decisive transformation.

From the current business structure perspective, Aoke's main revenue source is commodity sales, and the main category of this business is furniture and home furnishings. This is completely different from the previous model of '3C-centric, multi-category coverage,' appearing to move towards a more 'narrow' track, but upon closer inspection, it is not the case.

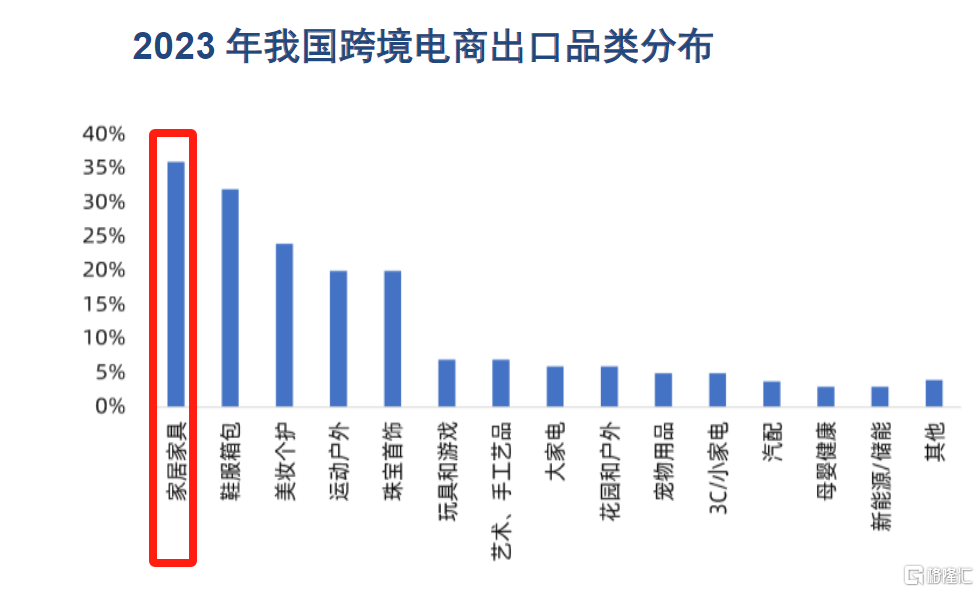

In fact, furniture and home furnishings have always been hot-selling categories for cross-border e-commerce. In 2023, furniture and home furnishings became the largest category. The GMV of the global furniture and home furnishings product market online channels increased from 203 billion US dollars in 2018 to 437.3 billion US dollars in 2023, with a compound annual growth rate of 16.6%.

(Source: Yibang Think Tank, IoT Cloud Digital Research Institute, Dongxing Securities Research Institute)

This is greatly related to the differences in consumer environments at home and abroad. Chinese consumers are more likely to consider furniture as durable goods, but overseas, especially in Europe and the United States, people often need to buy furniture again each time they move, with a higher probability of considering it as fast-moving consumer goods. At the same time, young consumers have a unique pursuit for product design and quality, naturally preferring high cost-effective Chinese manufacturing.

It is not difficult to see that Aoji is still running on a sufficiently large track, but it is more focused than before, and the scale effect of its business helps to enhance the quality of the company's development.

Although Aoji's revenue scale is still a short distance from its peak period, its profitability not only has accelerated its recovery, but even outperforms its performance during good years. The company's net profit margin was 6% in 2023, and in the first four months of 2024, this figure increased to 6.67%.

Looking back, the negative impact of the Amazon incident on Aoji has long passed, but some still believe that Aoji's "Amazon dependence syndrome" has not been cured.

From a certain perspective, this statement is not accurate. It is important to note that Amazon remains an indispensable part of international e-commerce. It is neither realistic nor reasonable to completely avoid Amazon, the key is how to keep the risks at a lower level.

After the store closure incident, Aoji established a dedicated risk control department, established corresponding training systems, and invited Amazon platform employees for internal training to enhance overall operational compliance. In order to mitigate the volatility caused by accidental impacts of a single platform, in recent years, Aoji has also allocated more resources for multi-platform layout. Revenue shares from Walmart, Wayfair, and other channels have increased from 10.7% in 2021 to 27.2% in 2023.

In this regard, through continuous self-innovation and strategic adjustments, Aoji has successfully emerged from the shadow of the "Amazon store closure trend," and has found the lever to return to a high-quality growth path, and has found its positioning and growth points in the new market environment.

Secondly, accelerate towards evolution into a brand business.

So, how should we view the current status of Wayfair?

From the perspective of business form and market position, Wayfair is an online retailer that provides furniture and home furnishing products. In the B2C furniture and home furnishing category, it has already achieved fifth place globally and first place in China.

It seems that the focus of what Wayfair is selling is more prominent than before, but in essence, there is no difference. However, the author believes that Wayfair is undergoing a transformation, which can now be seen as a different stage from before.

Early Wayfair acted more like a top seller on Amazon, playing more of a role as a trader, mainly relying on traffic dividends and efficient operational methods to achieve rapid growth. However, as the competition in cross-border e-commerce intensifies and platform regulations become stricter, the previous tactics are no longer applicable. External impacts have accelerated the reform process, pushing Wayfair towards evolving into a brand owner.

Currently, Wayfair owns furniture and home furnishing brands such as ALLEWIE, IRONCK, LIKIMIO, SHA CERLIN, HOSTACK, and FOTOSOK. In 2023, there are 11 brands under Wayfair with GMV exceeding 0.1 billion yuan.

To make the transition in its role, Wayfair has put effort into both product and delivery aspects.

On the product side, leveraging a strong manufacturing base eliminates concerns in the production process. However, finding suitable long-term suppliers is essential to ensure a continuous supply of high-quality products. By the end of 2023, Wayfair Technology had established stable partnerships with over 810 production partners.

At the same time, Wayfair has delved into the upstream of the supply chain, being able to move new products from the design stage to the sample stage within 40 days, faster than the industry average. This has also added a guarantee to product quality. In 2023, Wayfair's average return rate on all third-party e-commerce platforms was below 3.5%, one of the lowest in the industry.

In terms of delivery, wayfair has been continuously strengthening its own logistics capabilities in recent years.

For cross-border e-commerce, logistics has always been a complex and extremely challenging aspect that tests the seller's internal skills. Especially for furniture and home furnishing products, which are non-standard and large in size, it is a great challenge for the overall logistics system.

Having its own overseas warehouse is the key to breaking the deadlock. Therefore, wayfair has been continuously expanding since 2021. As of the end of April 2024, wayfair's Xiyou Zhicang has operated 27 overseas warehouses overseas, with a total storage area exceeding 5.5 million square feet.

Thanks to the strengthening of logistics capabilities, wayfair's fulfillment efficiency also maintains a leading level in the industry. Wayfair can shelf and sell new products within 50 days of trial production, a speed far higher than the industry's average of 90 days.

Furthermore, in addition to efficiency improvement, excellent logistics capabilities also help the company reduce logistics costs. According to the prospectus, the company's logistics costs decreased from 2.583 billion yuan in 2021 to 1.861 billion yuan in 2023, which is a key factor in the significant improvement of the company's profitability.

The improvement of logistics capabilities not only empowers the core business of commodity sales, but has also grown into a new growth engine.

With the continuous expansion of scale, the order volume has also increased from 3.2 million units in 2021 to 6.1 million units in 2023, with 2.5 million orders completed in the first four months of 2024. From 2021 to 2023, the direct revenue generated by logistics operations increased from 0.49 billion yuan to 1.653 billion yuan, with the proportion of total revenue increasing from 5.4% to 19%. In the first four months of this year, logistics revenue has reached 0.583 billion yuan, further increasing to 20.6% of total revenue.

Persisting in doing difficult yet right things will eventually bring rewards.

III. Conclusion

Looking back on Aoke's path to listing, there have always been doubts in the market, whether it is "relying on Amazon" or "reduced fundraising amount", it seems that they will gradually magnify from a certain point in the past, but lack a comprehensive understanding of the company's fundamentals.

On the ever-changing track of cross-border e-commerce, Aoke not only withstood the test of the market, but also found a new role positioning in the transformation. From a trader relying on a single platform to a globally leading furniture and home furnishing brand with a multi-channel layout, this listing has also brought new choices to investors in the Hong Kong stock market.

Aoke's successful listing once again validates the saying: in the face of market uncertainty, only by continuously innovating and actively adapting can one stand undefeated in competition.

跨境电商加速奔跑,为一大批中国企业带来了绝佳发展机遇,少数具有前瞻性的企业凭借先发优势吃到了早期发展红利,已然成为了跨境电商产业的一张名片,傲基正是其中之一。

跨境电商加速奔跑,为一大批中国企业带来了绝佳发展机遇,少数具有前瞻性的企业凭借先发优势吃到了早期发展红利,已然成为了跨境电商产业的一张名片,傲基正是其中之一。