Source: China International Capital Corporation Strategy. Author: Wang Hanfeng, Liu Gang et al. After a significant sell-off in the early part of last week, overseas Chinese capital stocks rebounded strongly in the middle of the week. At the beginning of the week, investors' sentiment deteriorated further due to multiple domestic and international factors. Under the pressure of external fund outflows, there was an impact on liquidity in the market and the market performance plummeted. Fortunately, this liquidity shock eased somewhat after policy stabilization signals on Wednesday, and the market subsequently showed an almost linear upward trend. After the roller coaster market last week, we tend to believe that the panic-style rapid sale in the early stage may be temporarily over, and the market may gradually enter a consolidation and bottoming period. However, the recovery of emotions still needs some time, mainly due to: 1) The outflow of overseas funds, especially the reduction of large-scale sovereign funds, is difficult to see a significant reversal in the short term; 2) The short selling ratio in the market is still high; 3) The geopolitical tensions, Sino-US relations, epidemic, domestic policies, and uncertainties in regulation have not yet completely weakened. Therefore, looking ahead, whether the market rebound can continue depends on: 1) Whether positive policy signals can be specifically implemented; 2) Whether external uncertainties will be alleviated.

Authors: Liu Gang, Li Yujie, Yang Xuanting

At the November FOMC meeting that ended today, the Federal Reserve cut interest rates by 25 basis points to 4.5-4.75%, as expected. Powell answered questions during the press conference regarding recent employment and inflation situations, the impact of the US elections on rate cuts, and even whether he would resign. Overall, this meeting was neutral in tone with an open attitude towards future actions. The market responded positively, with US bond yields and the dollar falling, while the Nasdaq and gold rebounded.

Since the unexpected 50 basis point rate cut in September, the Federal Reserve has faced higher-than-expected inflation (September CPI), two non-farm reports, one exceeding expectations and the other falling short (for September and October), as well as Trump winning the election. Market expectations have also undergone another swing from pessimism to optimism: from concerns about a September rate cut leading to a recession in the US, to the reality of a slower decline with a 'soft landing,' and then worries about the Fed cutting rates too quickly and concerns of potential second inflation risks after Trump's victory.

With US bond yields hitting a new high in the phase, with Trump being elected, the issue of general concern in the market is, why did US bond yields fall instead of rise after the Fed cut interest rates? How many more interest rate cuts does the Fed have? How will the US presidential election affect the prospects for future interest rate cuts?

With US bond yields hitting a new high in the phase, with Trump being elected, the issue of general concern in the market is, why did US bond yields fall instead of rise after the Fed cut interest rates? How many more interest rate cuts does the Fed have? How will the US presidential election affect the prospects for future interest rate cuts?

Q1. What adjustments did the Fed make to its policy and statements? A 25 basis point rate cut as expected, minor changes in wording, and a narrowing of the rate cut path in the market.

The Fed's 25 basis point rate cut this time brought the benchmark rate down to 4.5-4.75%, in line with market expectations. In the meeting statement, the Fed made slight modifications to its language on employment and inflation, such as changing 'slowed' to 'generally eased' for the job market, as data over the past two months have been significantly disrupted by temporary factors like hurricanes and strikes. They removed the phrase about inflation continuing to fall ('further'), and deleted the committee's greater confidence in inflation returning to 2%, because September's inflation exceeded expectations and the market then worried about the risk of inflation fluctuation due to Trump's policies. It is clear that the Fed's assessment has shifted slightly, but overall, they do not see significant risks of deviating greatly from the target (Powell stated, 'the job market is not the main source of inflationary pressures').

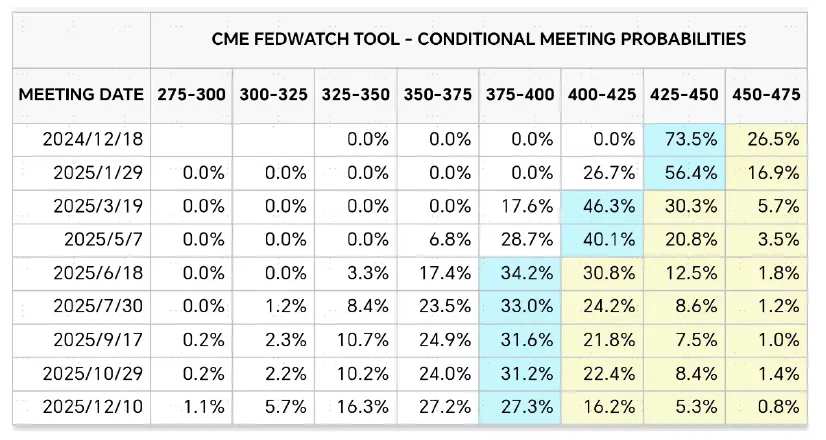

Regarding future rate-cutting paths, Powell emphasized that decisions will depend on the economic situation at each meeting ('not on any preset course'). This is understandable, as the impact of the upcoming US elections on growth and inflation will still need time to assess. Powell mentioned that before the December FOMC meeting, there will be one more non-farm report and two inflation reports that could provide more policy guidance. Currently, the implied rate-cutting path in CME futures has substantially narrowed to a total of 3 remaining cuts, one each in December this year, March and June next year, with the federal funds rate expected to reach 3.75-4% by June 2025.

Chart: The current path of interest rate cuts implied by CME futures has significantly contracted, with a total of 3 more rate cuts to go.

Q2. Why did the U.S. bond interest rates rise instead of fall after the rate cuts? Correcting pessimistic expectations, interest rate reflexivity and the 'Trump trade.'

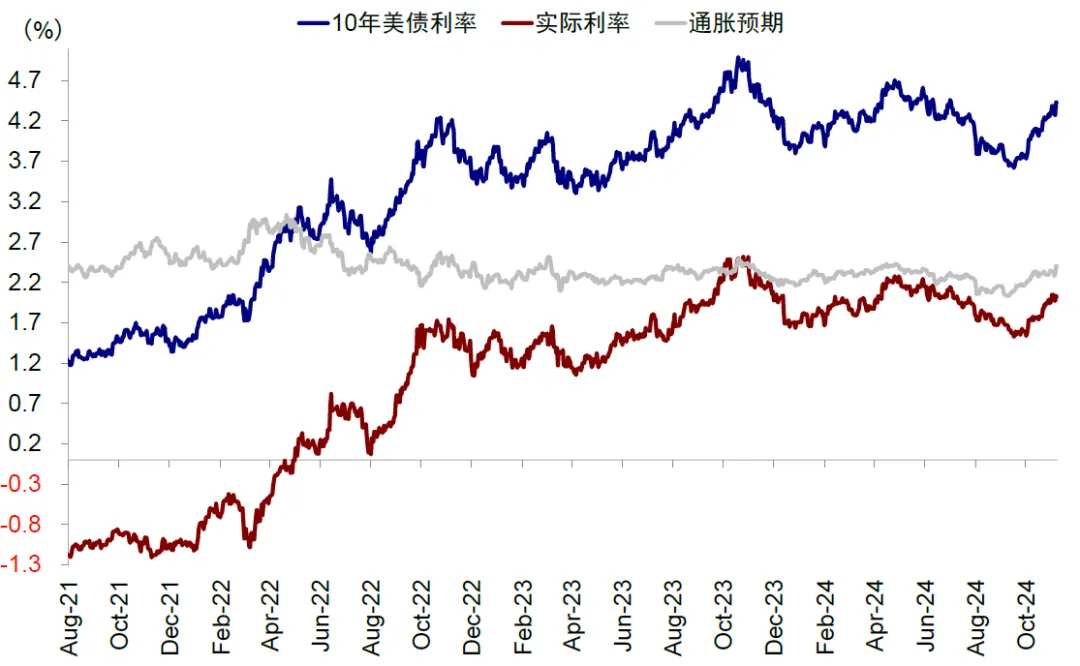

An apparently strange phenomenon is that after the Fed's rate cuts, U.S. bond interest rates rose instead of falling, becoming the low point of U.S. bond rates, rising from 3.6% to 4.4%, an increase of 81 basis points. Among them, inflation expectations rose by 31 basis points, and real interest rates rose by 50 basis points. This is consistent with the view that rate cuts may bottom out and rise when U.S. bond rates are realized, similar to the rate cut cycle in 2019.

There are three main reasons: Firstly, it corrects the overly pessimistic recession expectations, not agreeing with the amplified recession concerns influenced by emotions, especially after some data improved, correcting the market's pessimistic expectations. Secondly, there is the 'reflexivity' of interest rates declining too fast. The Fed's unconventional rate cuts can actually increase the probability of a 'soft landing' because by guiding U.S. bond rates and all other financing costs based on it downward, it can rekindle some demand, which in turn improves long-term growth expectations, leading to the rise in U.S. bond rates. This reflexivity is also evident when rates rise. Thirdly, there is a boost from the 'Trump trade.' The Trump election results, especially the potential for a win, have further raised growth and inflation expectations, pushing up interest rates.

If the expectation of the third point may be more of a game of emotions, without much solid evidence, the first two points are at least sufficient to support U.S. bond rates rebounding to a certain level after the rate cut bottoms out. In other words, the current level may be somewhat oversold, but the direction of the rebound is generally clear. Our reasonable range is around 3.8-4%, so the previous U.S. bond rate of 3.6% is obviously too low, and it remains to be seen if 4.5% will effectively break through due to emotional and event factors, otherwise it will also provide trading opportunities.

Chart: The Fed's rate cuts have instead become the low point of U.S. bond rates, rising from 3.6% in September to 4.4%, an increase of 81 basis points.

Charts: The changes in the credit cycles of China and the USA will determine the trend of assets.

Will the Q3 elections affect the Fed's decision? In the short term, no, but in the long term it is inevitable, with the risk of interest rate hikes greater than rate cuts.

There is no direct impact in the short term, but the long term will affect growth and inflation. Powell stated that there is no direct impact in the short term, but over time, policies after the elections will have economic implications. This response was also expected. We believe that the implication is that the Fed's rate decision is not political and will not change due to the election results. However, in the long term, many of Trump's policy proposals are likely to impact future growth and inflation prospects, and in turn will affect the Fed's rate decisions.

When asked if he would resign if required, Powell stated he would not and also mentioned legally Trump cannot dismiss him. Previously, Trump had stated he was not seeking to dismiss Powell prematurely, but welcomed a more dovish monetary policy. One of Trump's policies is low interest rates, and during his previous term, he publicly criticized Powell's rate hikes multiple times, causing concerns in the market about the Fed's independence. However, he explicitly stated that 'despite past disagreements, he will not seek to prematurely remove Powell from the position of Fed Chair'. Powell's second term as Fed Chair will continue until May 2026 and his 14-year term on the Fed's Board of Governors will end in January 2028.

Especially under a Trump presidency, particularly under 'Republican all wins,' the risk of interest rate hikes is greater than rate cuts. In Trump's policy framework, disturbances in interest rates, whether due to stimulus from tax cuts and increased investment, supply disruptions from tariffs and immigration, or the somewhat vague but more impactful weak dollar policy, all tend to push rates up rather than down. The Tax Foundation predicts that tax cuts for residents and businesses could boost GDP growth by 2.4 percentage points over the next 10 years, while tariff policies could suppress GDP growth by 1.7 percentage points, with a comprehensive effect possibly boosting by 0.8 percentage points. The Peterson Institute for International Economics estimates that the CPI may rise by 4-7 percentage points in the next 1-2 years under a baseline scenario of 1.9% due to tariff effects. Recent surges in U.S. bond yields, especially rising sharply to 4.4% on election day, are reactions to the impact of his policies.

How many more rate cuts are there? Around 3.5% is the appropriate level, the market swinging from overly optimistic to overly pessimistic.

Market expectations for future rate cuts, especially after recent economic data post-election, have been experiencing swings from one extreme to another. Currently, CME interest rate futures only expect 3 more rate cuts, in December this year, March, and June next year, reaching 3.75-4%. Although we have never agreed with the market's previous overly optimistic view, assuming a starting point of a continuous 50bp rate cut, and expecting to cut rates by over 200bp next year, the current expectations may now be overly pessimistic. Based on our comprehensive calculations, a rate cut of around 3.5% (equivalent to another 100bp cut) would be an appropriate level.

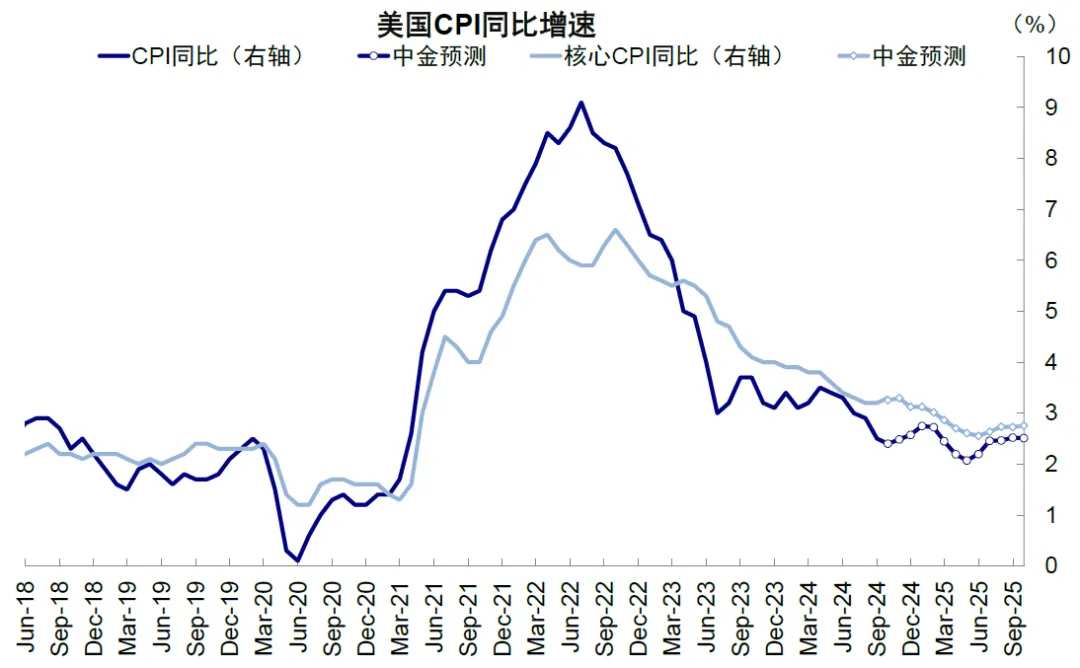

In terms of pace, inflation and economic data may gradually rebound in mid-2025, leading to a gradual halt in rate cuts. We estimate that due to base effects, inflation will have a year-on-year tailwind in the fourth quarter of this year, but driven by declining rents, inflation and core inflation will fall to a lesser extent in the first quarter of 2025. By mid-2025, the housing sub-index with the highest weight in the CPI may once again turn upward, and in addition, as demand recovers, the pressure for other sub-indices to rise will also be greater. The CPI is expected to be above 2% year-on-year in 2025, with around 2.5% in Q3 2025. The upward risks to inflation are greater than the downward risks, coming from the early recovery in demand, as well as current disruptions in the supply chain, such as the situation in the Middle East, port strikes, and potential trade frictions and immigration restrictions.

Chart: The risk of interest rate hikes is greater than the risk of cuts, especially under a 'Republican sweep' with Trump's election.

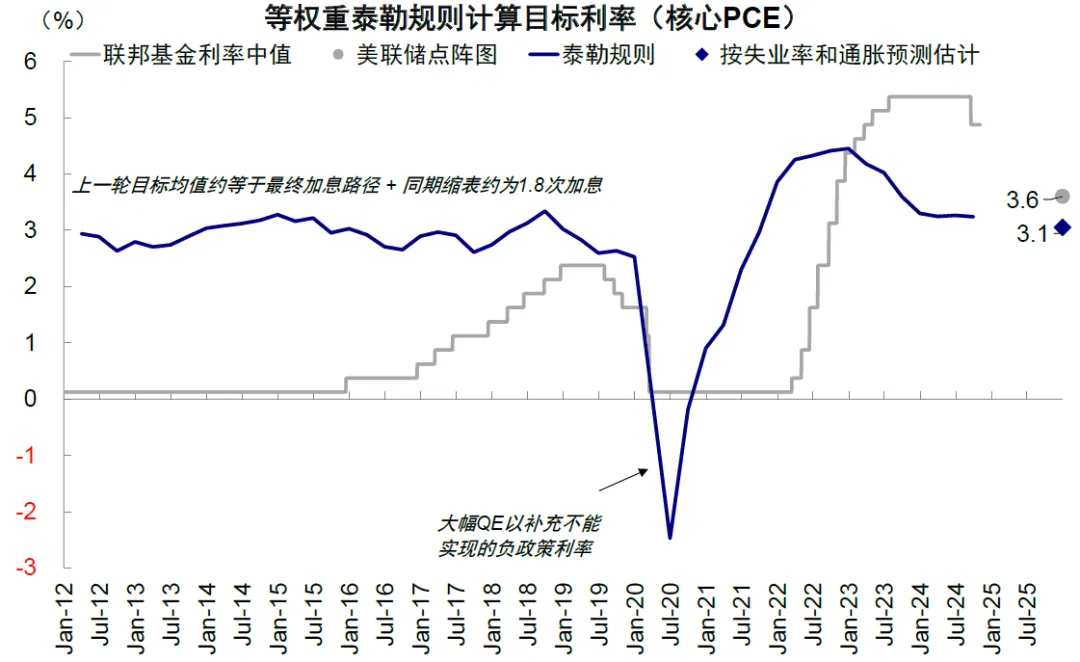

In terms of magnitude, lowering the interest rate to around 3.5% is a reasonable level. 1) Returning monetary policy to a neutral perspective: Referring to the average value of the natural interest rate calculated by the Fed model and dot plot, the actual natural interest rate in the US is around 1.4%, considering short-term PCE may be around 2.1% to 2.3%, lowering interest rates by 4 to 5 times by 25bp to 3.5% to 3.8% is a reasonable level. 2) Taylor rule perspective: Assuming the Fed assigns equal weight to achieving inflation and employment goals in 2025, with long-term inflation and unemployment rate targets of 2% and 4.2%, respectively, estimating the long-term federal funds rate at 2.9%. Based on our estimates of year-end unemployment and inflation levels of 4.2% and 2.3% (core PCE year-on-year), the appropriate federal funds rate under the equally weighted Taylor Rule is 3.1%, but the tailwind and risks in year-end inflation may result in a smaller rate cut.

Chart: The CPI is expected to be above 2% year-on-year in 2025, with around 2.5% in Q3 2025

Q5. When will the balance sheet reduction stop? Financial liquidity tightening may prompt the Fed to gradually exit the balance sheet reduction program soon.

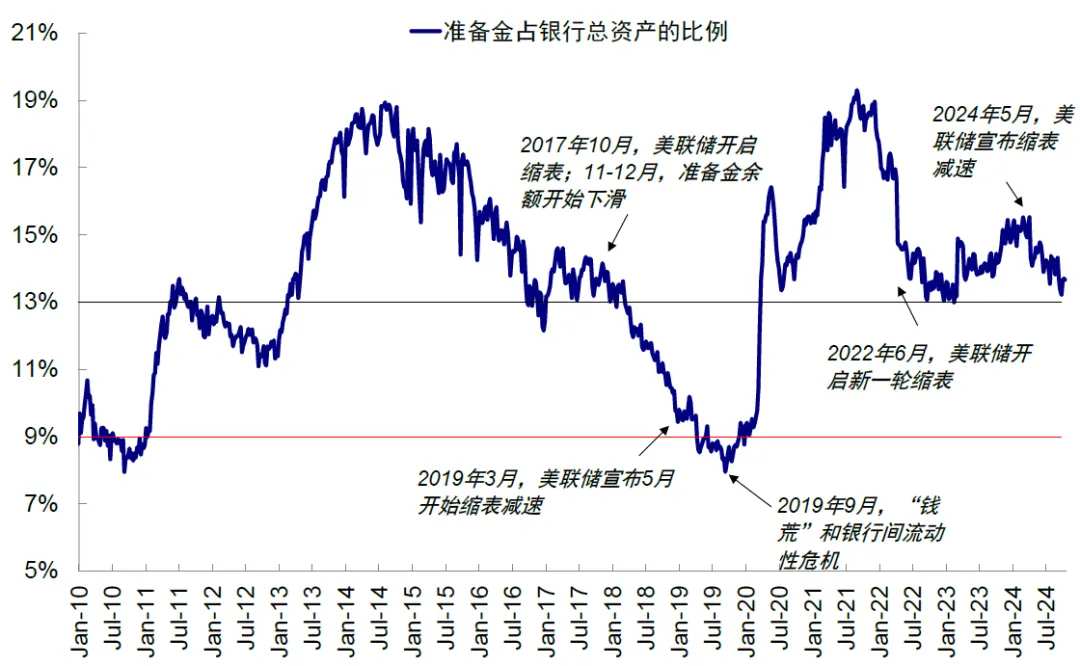

The main basis for the pace of balance sheet reduction lies in the adequacy of reserves. The adequacy of reserves undergoes nonlinear changes, so closely tracking and preventing it in advance is very important. To some extent, in 2019, the Fed 'miscalculated' the impact of balance sheet reduction and the scale of reserves needed by the financial system, which led to a money shortage in the repo market and ultimately forced an expansion of the balance sheet. This lesson learned also provided ample reason for the deceleration of the balance sheet reduction pace in May this year. The New York Fed's survey of major US banks in July this year showed that the majority of banks expect quantitative tightening to end by April next year.

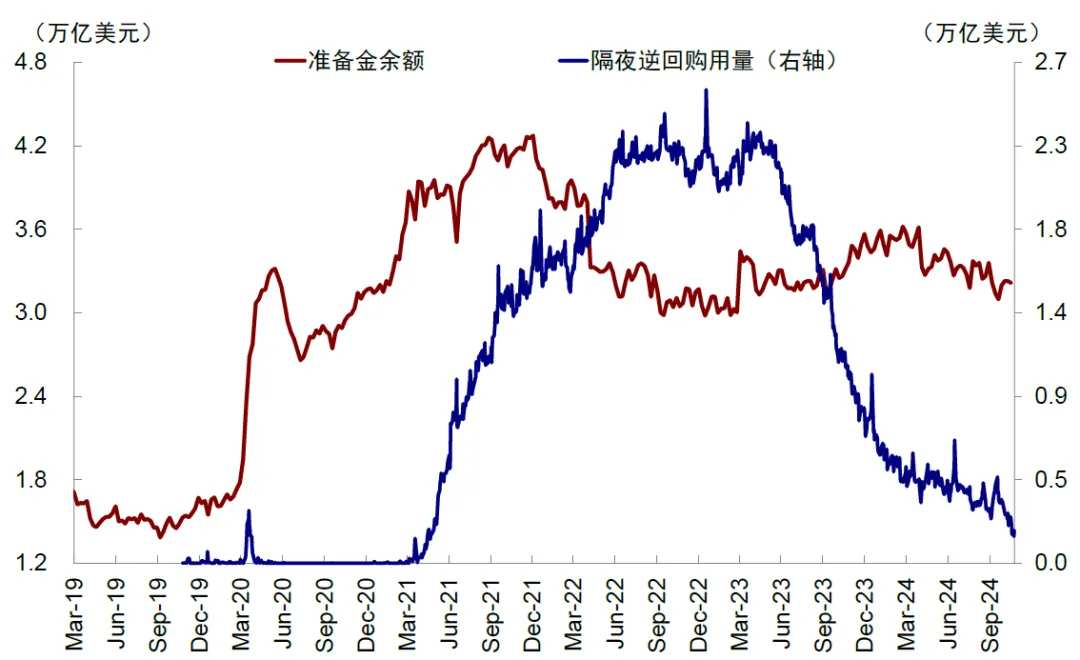

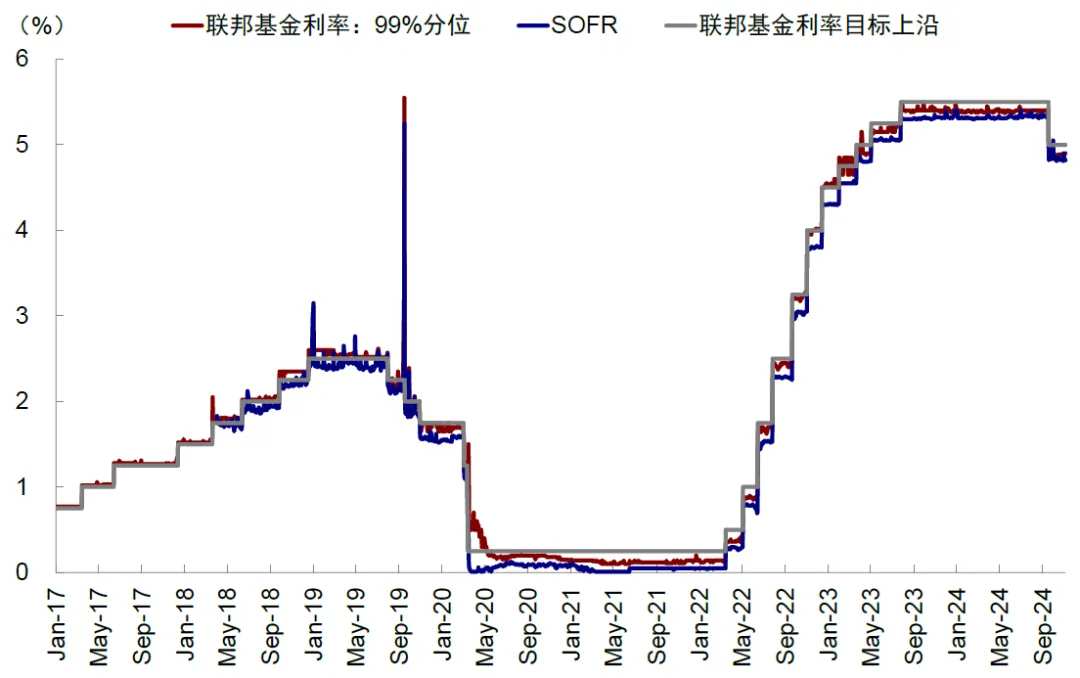

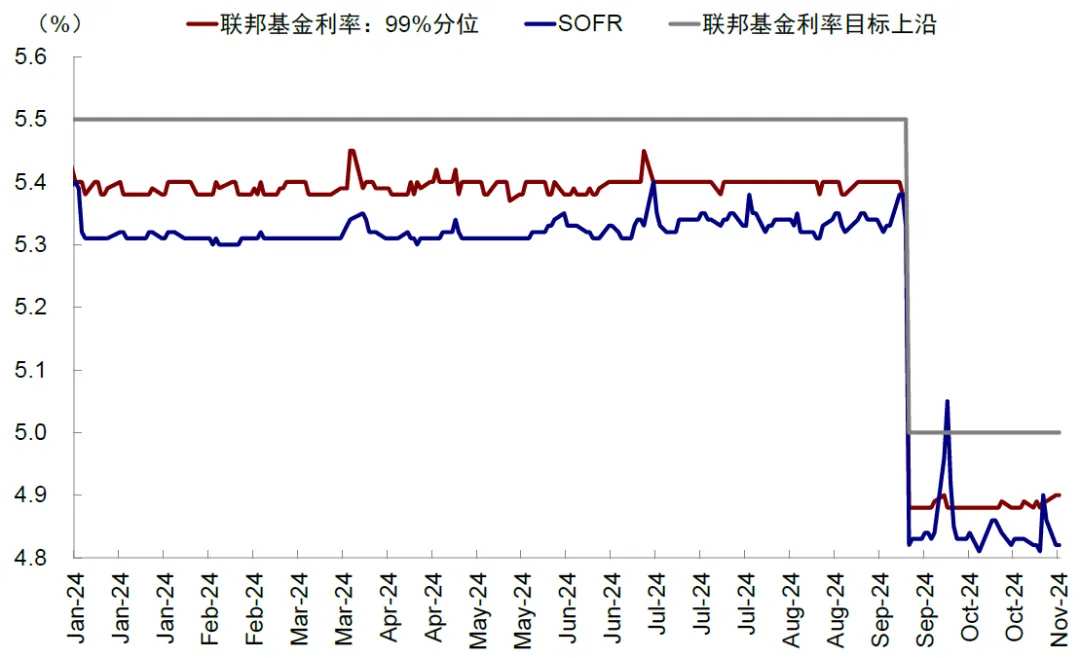

Stop shrinking the balance sheet or gradually entering the field. 1) There is not much overnight repurchase agreement balance left: According to the data from the Federal Reserve, the once high overnight repurchase agreements of over 2 trillion US dollars symbolized ample liquidity in the United States and effectively hedged the impact of the Fed's balance sheet reduction. However, the current scale has dropped to less than 200 billion US dollars. 2) Reserves/bank assets are approaching critical values: The reserve demand curve is nonlinear, and the ratio of reserves to bank assets measures adequacy. The critical points for excessive and reasonable adequacy are 12% to 13%, while 8% to 10% is the caution line for the transition to inadequacy. Currently, this value has dropped to 13.7%. Based on the experience in 2019, there is an increased possibility of non-linear changes in the future. 3) Liquidity indicators are tightening: Unsecured rates like the federal funds rate and secured rates like SOFR are important observation indicators in the interbank market. When there is a liquidity squeeze in the interbank market, the highest premium decomposes the reserve rate (99th percentile of the federal funds rate) very close to or even beyond the upper limit of the target range. SOFR will also increase significantly. In 2019 during the "money crunch," these two rates respectively exceeded the upper limit of the 2.25% federal funds rate set by the Fed at 5.55% and 5.25%. In October this year, SOFR once again exceeded the upper limit, attracting widespread attention.

Chart: Under the Taylor rule with equal weights, the appropriate federal funds rate is 3.1%, but the pace of year-end inflation tails and risks may lead to a smaller rate cut.

Chart: There is not much overnight repurchase agreement balance left

Chart: Reserves/bank assets are approaching critical values

Chart: In 2019 during the "money crunch," these two rates respectively exceeded the upper limit of the 2.25% federal funds rate set by the Fed at 5.55% and 5.25%

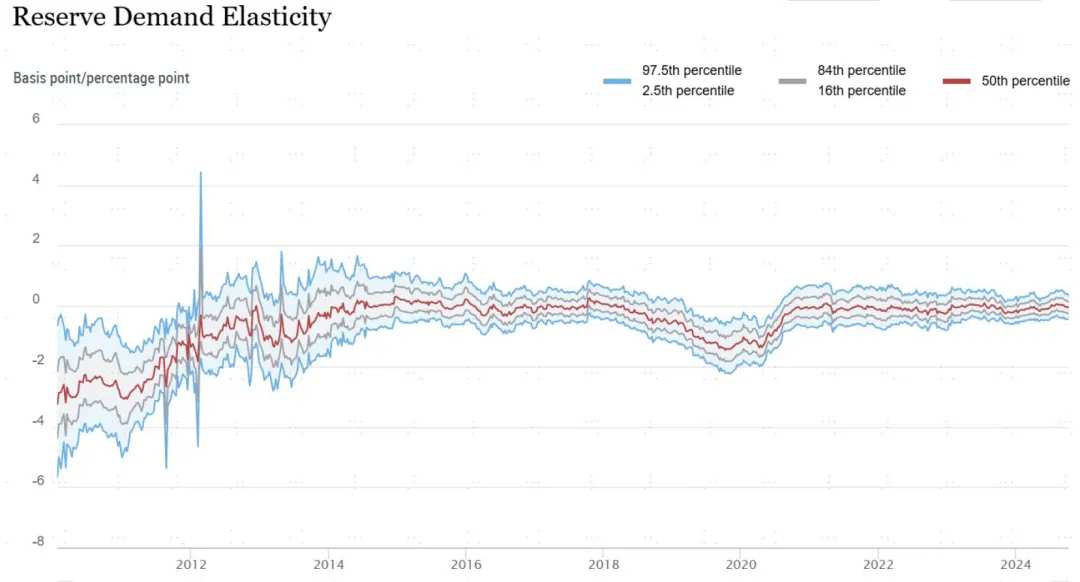

It is because of these changes that discussions on liquidity and balance sheet reduction have increased in the market and the Federal Reserve. In October, the Federal Reserve introduced a new observation tool - the Reserves Demand Elasticity indicator (RDE). The lower the value of this indicator, the more significant the interest rate changes caused by reserve changes, indicating a shortage of reserves. As of October data, this indicator is close to 0 (usually in the negative to 0 range), suggesting that reserves are still abundant. Overall, in the short term, there is unlikely to be a severe liquidity impact, but it is getting closer to the threshold of ending balance sheet reduction, which also signifies a comprehensive relaxation of monetary policy.

Chart: SOFR broke through the upper limit again in October this year

Q6, What impact does it have on assets? Short-term election trading dominance, providing trading opportunities after the high

A Trump victory, especially if it is a 'Republican victory,' will provide inertia for related assets to rise, benefiting risk assets and US dollar assets. However, considering the time needed for expectations and policy implementation, there are also trading opportunities to 'do the opposite' after the rise, such as US bond rates. 1) Overall, there is further room for Trump trades to rise and play out, 'let the bullets fly for a while'; 2) For assets with less or even no expectations of Trump's reelection reflected, such as copper, oil, export chains, etc., if subsequent policies are implemented, the need for compensation will be greater; 3) After reaching a certain high point, such as US bonds and the US dollar, they will provide trading opportunities to 'do the opposite.' There is an excessive expectation of gold inclusion, which is contrary to the direction of increased risk, thus carrying the risk of being overdrawn, as was the case in both the 2016 and 2020 elections. We have always pointed out that the beginning of rate cuts is also the end of rate cut trades. Looking back, the Federal Reserve's 50bp 'unconventional rate cut' in September actually marked the bottom of interest rates, and this seemingly 'divergent' trend is consistent with our repeated emphasis in reports on the idea of 'thinking and acting in the opposite way.'

In the medium term, the election will bring significant changes to the internal growth and inflation prospects of the United States and China's external and domestic demand responses. However, the mild restart of the US credit cycle and the cessation of the contraction in China's credit cycle remain the benchmark scenarios. At this time, US assets remain strong, while China continues to focus on structural aspects.

Chart: The Reserves Demand Elasticity indicator constructed by the Federal Reserve is close to 0, indicating that reserves are still abundant

► The US stock market is likely to perform well, with technology and cyclical sectors leading the way. In the short term, high valuations and policy uncertainty may cause disruptions, but the long-term growth prospects are positive. The momentum comes from technology trends and the cyclical sectors following the restart of the natural private credit cycle, making it a key allocation focus. Therefore, a dip in prices also presents an opportunity for allocation.

► US bonds are likely to face challenges, but there are trading opportunities. We have consistently pointed out that the realization of interest rate cuts may actually mark the low point for long-term US bond yields, leading to a flattening yield curve. Looking ahead, the low point in interest rates has passed, but due to short-term overshooting, there may still be trading opportunities.

► The US dollar is relatively strong, but intervention policies are being monitored. The natural recovery of the US economy and incremental policies post-election will provide support for the US dollar. Our calculations indicate a range of 102-106. However, more importantly, Trump and his key economic advisor Kudlow have repeatedly advocated for a competitive devaluation of the US dollar.

► Commodities are generally neutral to bullish. Copper demand is more linked to China, while oil is influenced more by geopolitical factors and supply. Considering the credit cycles in China and the US, we believe that further bearishness at current levels may not be significant. However, the upward momentum and timing remain unclear at the moment, requiring catalysts for clarity.

► Gold is in a neutral position. Gold has already surpassed the levels our fundamental quant models based on real interest rates and the US dollar index could support at $2400-2600 per ounce. Yet, geopolitical tensions, central bank gold purchases, and partial "de-dollarization" demands bring additional risk premium. Since the Russia-Ukraine situation, we estimate an average of $100-200 as a geopolitical risk premium. Gold can still serve as a hedge against uncertainty in the long term, but we recommend a neutral stance in the short term.

Editor/rice

随着美债利率创出阶段新高,特朗普当选,市场普遍关心的问题是,

随着美债利率创出阶段新高,特朗普当选,市场普遍关心的问题是,