Financial giants have made a conspicuous bullish move on AppLovin. Our analysis of options history for AppLovin (NASDAQ:APP) revealed 22 unusual trades.

Delving into the details, we found 36% of traders were bullish, while 36% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $175,080, and 18 were calls, valued at $2,385,700.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $55.0 to $255.0 for AppLovin over the last 3 months.

Volume & Open Interest Trends

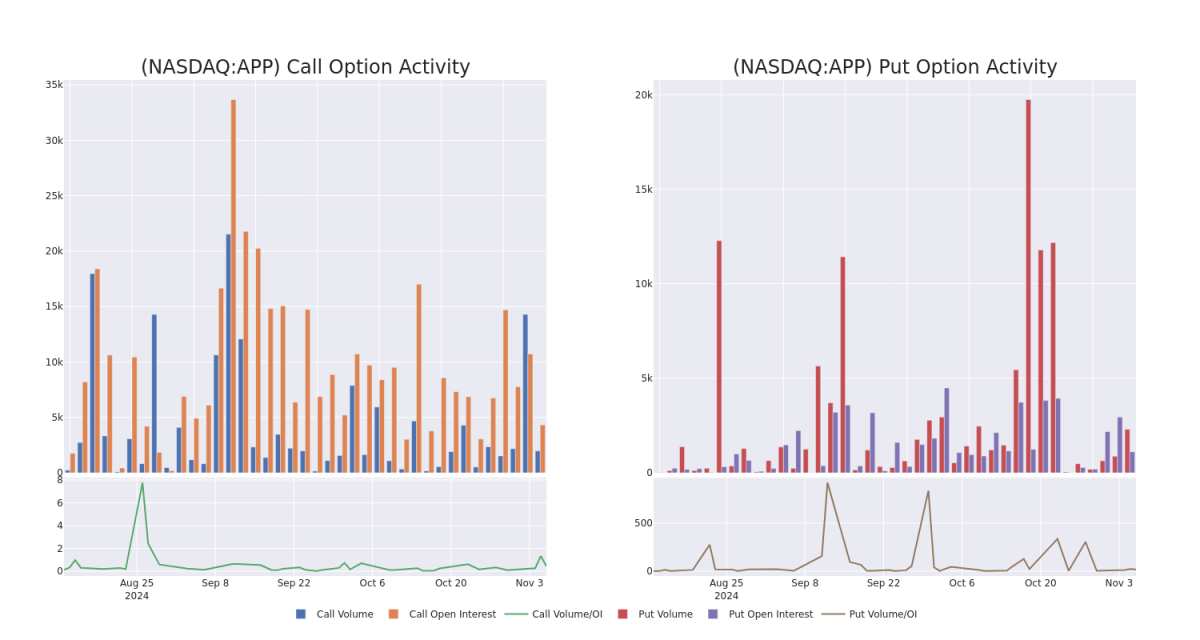

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for AppLovin's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of AppLovin's whale activity within a strike price range from $55.0 to $255.0 in the last 30 days.

AppLovin Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| APP | CALL | SWEEP | BEARISH | 01/17/25 | $114.1 | $109.1 | $109.1 | $120.00 | $633.3K | 2.6K | 200 |

| APP | CALL | SWEEP | NEUTRAL | 11/08/24 | $80.1 | $77.8 | $79.0 | $167.50 | $568.8K | 911 | 259 |

| APP | CALL | TRADE | BULLISH | 11/15/24 | $33.5 | $31.4 | $33.5 | $200.00 | $231.1K | 1.4K | 186 |

| APP | CALL | SWEEP | BEARISH | 01/17/25 | $114.1 | $109.2 | $109.1 | $120.00 | $207.4K | 2.6K | 18 |

| APP | CALL | TRADE | BEARISH | 01/15/27 | $189.5 | $185.5 | $186.28 | $70.00 | $186.2K | 10 | 10 |

About AppLovin

AppLovin Corp is a mobile app technology company. It focuses on growing the mobile app ecosystem by enabling the success of mobile app developers. The company's software solutions provide tools for mobile app developers to grow their businesses by automating and optimizing the marketing and monetization of their applications.

In light of the recent options history for AppLovin, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of AppLovin

- Trading volume stands at 3,805,544, with APP's price up by 44.32%, positioned at $243.25.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 97 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for AppLovin with Benzinga Pro for real-time alerts.