Financial giants have made a conspicuous bullish move on Eli Lilly. Our analysis of options history for Eli Lilly (NYSE:LLY) revealed 13 unusual trades.

Delving into the details, we found 53% of traders were bullish, while 15% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $190,238, and 11 were calls, valued at $638,091.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $500.0 to $1440.0 for Eli Lilly over the recent three months.

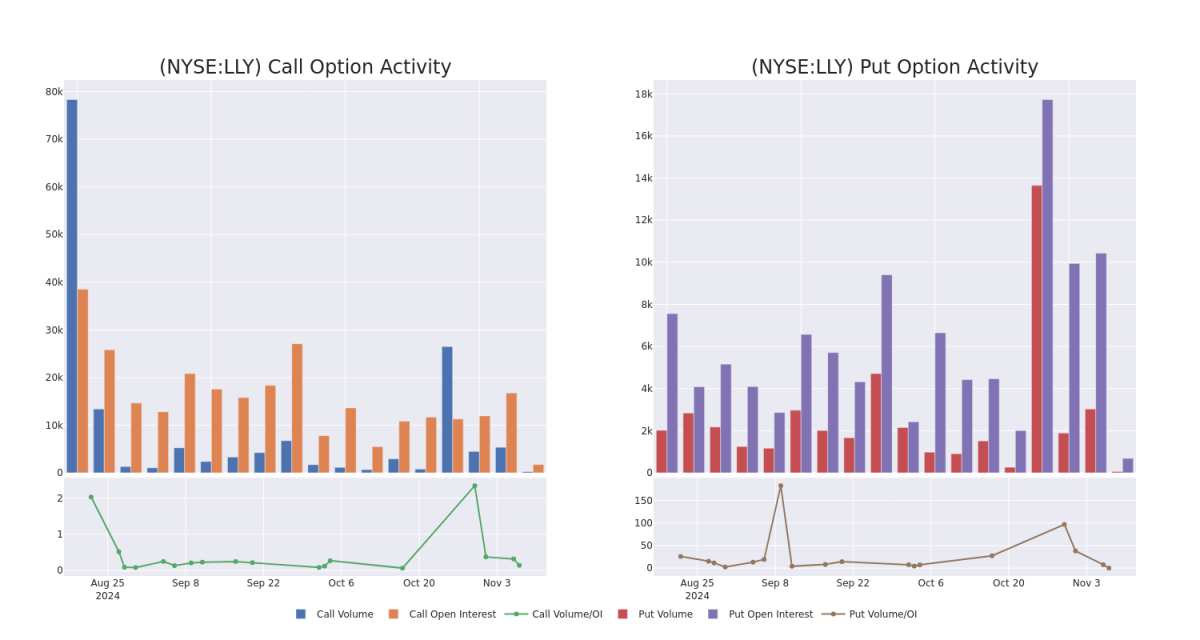

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Eli Lilly's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Eli Lilly's substantial trades, within a strike price spectrum from $500.0 to $1440.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Eli Lilly's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Eli Lilly's substantial trades, within a strike price spectrum from $500.0 to $1440.0 over the preceding 30 days.

Eli Lilly Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LLY | CALL | SWEEP | BULLISH | 02/21/25 | $22.9 | $21.6 | $22.9 | $880.00 | $160.3K | 189 | 105 |

| LLY | PUT | TRADE | NEUTRAL | 11/08/24 | $26.2 | $24.3 | $25.31 | $810.00 | $146.7K | 636 | 61 |

| LLY | CALL | TRADE | BULLISH | 02/21/25 | $59.5 | $59.5 | $59.5 | $780.00 | $119.0K | 131 | 43 |

| LLY | CALL | TRADE | BEARISH | 12/18/26 | $22.85 | $21.6 | $21.6 | $1440.00 | $62.6K | 44 | 30 |

| LLY | CALL | TRADE | BULLISH | 06/20/25 | $300.5 | $296.1 | $300.5 | $500.00 | $60.1K | 4 | 2 |

About Eli Lilly

Eli Lilly is a drug firm with a focus on neuroscience, cardiometabolic, cancer, and immunology. Lilly's key products include Verzenio for cancer; Mounjaro, Zepbound, Jardiance, Trulicity, Humalog, and Humulin for cardiometabolic; and Taltz and Olumiant for immunology.

After a thorough review of the options trading surrounding Eli Lilly, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Eli Lilly

- With a volume of 648,226, the price of LLY is up 1.08% at $784.78.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 89 days.

What Analysts Are Saying About Eli Lilly

5 market experts have recently issued ratings for this stock, with a consensus target price of $1074.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Consistent in their evaluation, an analyst from Truist Securities keeps a Buy rating on Eli Lilly with a target price of $1033. * An analyst from Citigroup persists with their Buy rating on Eli Lilly, maintaining a target price of $1250. * An analyst from Deutsche Bank has decided to maintain their Buy rating on Eli Lilly, which currently sits at a price target of $1015. * An analyst from Barclays persists with their Overweight rating on Eli Lilly, maintaining a target price of $975. * An analyst from B of A Securities has decided to maintain their Buy rating on Eli Lilly, which currently sits at a price target of $1100.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Eli Lilly with Benzinga Pro for real-time alerts.