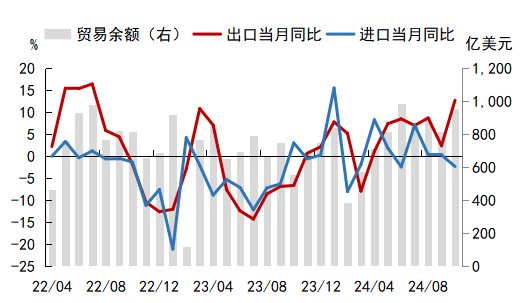

Jingu financial news | Data released by the General Administration of Customs shows that in October, China's exports increased by 12.7% year-on-year in US dollars, up from 2.4% in the previous period; imports decreased by 2.3%, up from 0.3% in the previous period; the trade surplus was $95.72 billion, up from $81.71 billion in the previous period. Compared to September, China's export growth rate in October has shown a significant rebound, reaching a new high in nearly two years on a year-on-year basis, but the import growth rate has continued to decline for three consecutive months, returning to negative growth. The macro team at JF Financial Research Institute believes that in the import and export data for October, the following points are worth noting:

Figure 1: China's Import and Export Growth Rates and Trade Balances

Data Source: Wind, JF Financial Research Institute

First, seasonal warming of exports in October. In October this year, China's export growth rate soared to 12.7% year-on-year, hitting the highest growth rate for the month since August 2022. Looking at a month-on-month comparison, China's export growth rate in October reached 1.76%, setting a record high for the same period in statistics. We believe that this is partly due to the rebound in low export growth rates in September (seasonally, the month-on-month growth rate in September was significantly low), and may also be influenced by the rush of enterprises to export before the US presidential election.

First, seasonal warming of exports in October. In October this year, China's export growth rate soared to 12.7% year-on-year, hitting the highest growth rate for the month since August 2022. Looking at a month-on-month comparison, China's export growth rate in October reached 1.76%, setting a record high for the same period in statistics. We believe that this is partly due to the rebound in low export growth rates in September (seasonally, the month-on-month growth rate in September was significantly low), and may also be influenced by the rush of enterprises to export before the US presidential election.

Second, in terms of product exports, the exports of machinery and labor-intensive products improved simultaneously. In October, the export growth rate of mechanical and electrical products increased by 10.8 percentage points to 13.7%, a rise similar to overall exports. Within mechanical and electrical products, machinery equipment and household appliances showed the most significant improvement in growth rates, but mobile phone exports continued to decline, and auto exports were also affected to some extent due to the EU's imposition of anti-subsidy tariffs. Among labor-intensive products, the performance of various categories was relatively balanced, with exports of plastic products, bags, textiles, clothing, footwear, and furniture all showing improvements of over 10 percentage points.

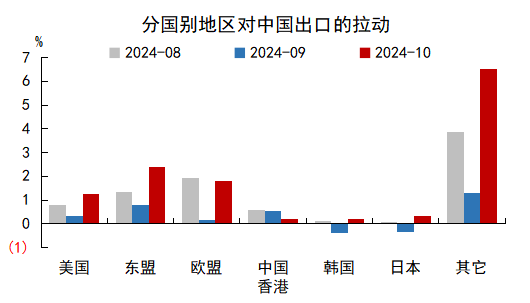

Third, in terms of export countries, improvements in exports to the EU, ASEAN, Japan, and South Korea were more pronounced. In terms of developed countries, export growth rates to the United States and the European Union increased by 5.9 and 11.4 percentage points to 8.1% and 12.7%, respectively. Export growth rates to the United Kingdom and Japan and South Korea saw even more pronounced increases, all exceeding 10 percentage points, mainly due to a significant decline in exports to these regions in September. In terms of developing countries, ASEAN remains a major driver of export growth, with October's export growth to ASEAN increasing by 10.3 percentage points to 15.8%. Apart from ASEAN, there have been significant improvements in export growth rates to India, Africa, Russia, Brazil, and other economies.

Figure 2: Export Growth Rates to Major Trading Partners in China

Data Source: Wind, JF Financial Research Institute

Fourth, the import growth rate continues to decline, with upstream raw material prices falling in tandem. In October, China's imports decreased by 2.3% year-on-year, with a growth rate significantly lower than September's 0.3%, and a relatively weaker performance on a month-on-month basis. Looking at the product level, although the import growth rate of electromechanical products in October has declined slightly, it still reached 2.4%, exerting a certain pull on overall imports. However, upstream raw materials such as crude oil, copper, and iron ore have continued to perform poorly in imports. This is partly due to the impact of the base effect of commodity prices and the decline in import quantity may also be a significant drag.

Exports are an important driver of economic growth in our country. In the third quarter of this year, the net exports of goods and services drove the year-on-year GDP growth rate by 1.97 percentage points, with a contribution rate of 42.9%. The better-than-expected rebound in October exports is expected to significantly boost the overall economy in the fourth quarter, stabilizing the year-on-year GDP growth rate in the short term. In addition, considering the 'export rush' behavior of enterprises, the immediate stimulus from consumption subsidies, accelerated construction of infrastructure, and the recovery in real estate sales leading to a rebound in the third industry's prosperity, we believe that the domestic GDP growth rate in the fourth quarter is expected to rise to over 5% and may achieve the annual growth target of 5%.

Author: Li Xiaojian

Jufang Financial Research Institute is a financial research institution established under Jufang Smartinvest Holdings (09636). Guided by the principles of 'focus on finance, strive for innovation, lead the industry, and build the brand,' Jufang Financial Research Institute is committed to creating a first-class, distinctive investment research service platform in China, providing investors with long-term stable, systematic, and trustworthy professional research services. The institute has a securities research service team of over 100 people, covering areas such as macroeconomics, industry companies, securities investment strategies, and index and investment tool design.