Dow rises to the best level in two years, small cap index rises nearly 6%, banking stocks rise over 10%, oil, steel, and crypto stocks surge, European and American solar stocks all collapse, Trump media technology rises by almost 35% before closing up by about 6%, Tesla rises by nearly 15% to a two-year high, Qualcomm rises by 10% after the bell. Chinese concept stocks narrow their declines, NIO Inc and Zeekr drop over 5%. 10-year US Treasury yield rises the most by 20 basis points nearing 4.48%, reaching a four-month high along with a 1.7% rise breaking 105 in the USD index, Bitcoin rises by 9% nearing $0.076 million, offshore RMB drops by a thousand points to below 7.20, a three-month low, Euro and Yen once fell by 2%. Gold drops over 3%, London copper drops over 4%.

According to CCTV News, Harris called Trump to congratulate him on being elected President of the United States. Meanwhile, in this election, Trump swept the swing states, the Republicans regained the Senate, and the situation in the House of Representatives remains tense, with the Republicans expected to lead with a slight advantage. Analysts generally believe that the Republican control of the White House and both houses of Congress will bring significant changes in spending and tax policies, which will also be beneficial to the growth of the U.S. economy. In addition to Trump's trading igniting the market, people are also highly focused on Thursday's Federal Reserve monetary decision.

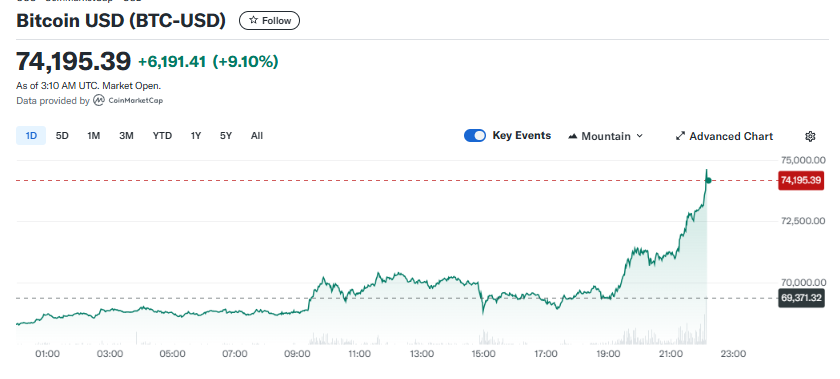

"Trump Trading" surged, supporting the three major U.S. stock indices to reach historic highs, with Tesla, Trump MediaTech (DJT), prison stocks, energy stocks, crypto concept stocks, and bank stocks all rising sharply. Solar stocks suffered a collective defeat, China concept stocks generally fell but narrowed their losses at the close. The market worries that Trump's implementation of tariff plans will put pressure on European stocks. Concerns about Trump's policies causing inflation have led to a rise in the U.S. dollar and bond yields, suppressing a broad decline in commodities such as gold, silver, copper, and oil. Bitcoin futures broke above the $77,000 mark, reaching a historic high.

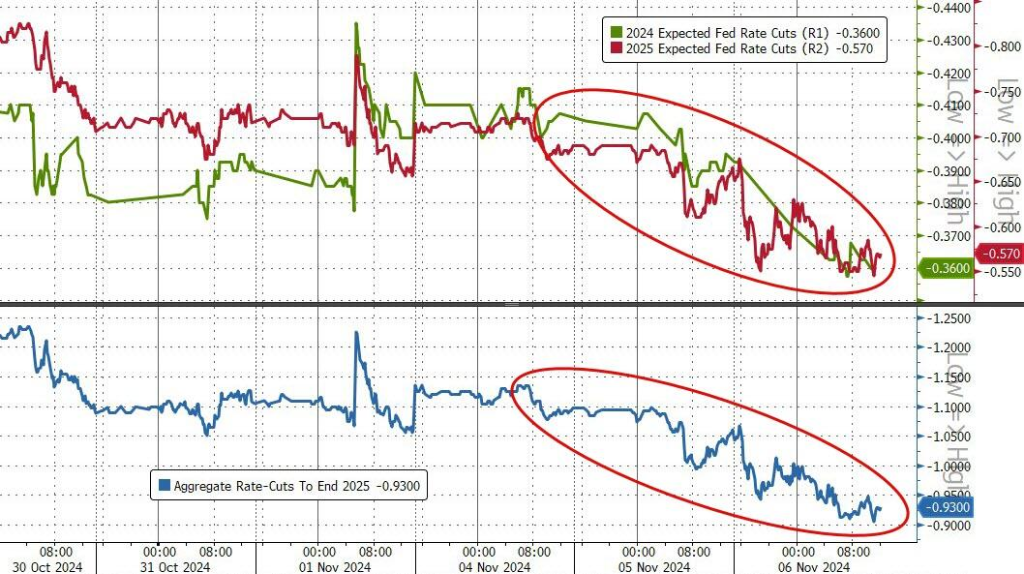

Expectations for a Fed rate cut in December have dropped significantly, with the market currently expecting only a 57 basis point rate cut by 2025. The total rate cut expectation from now until the end of 2025 is less than 100 basis points. JPMorgan predicts that the Fed will cut rates only once a quarter from March 2025. Nomura economists predict that the Fed may only cut rates once in 2025 and raise their terminal rate forecast by 50 basis points to 3.625%. They expect Trump to increase tariffs, which will increase inflation in the short term and lead to moderate growth slowdown.

Expectations for a Fed rate cut in December have dropped significantly, with the market currently expecting only a 57 basis point rate cut by 2025. The total rate cut expectation from now until the end of 2025 is less than 100 basis points. JPMorgan predicts that the Fed will cut rates only once a quarter from March 2025. Nomura economists predict that the Fed may only cut rates once in 2025 and raise their terminal rate forecast by 50 basis points to 3.625%. They expect Trump to increase tariffs, which will increase inflation in the short term and lead to moderate growth slowdown.

Trump's tariff policy has sparked global inflation concerns. ECB Vice President Guindos stated that if Trump implements his tariff plan, global economic growth and inflation could face catastrophic impact. ECB Governing Council member and Governor of the Bank of France, Villeroy, stated that Trump's victory adds to the risks facing the global economy. However, Goldman Sachs expects the ECB to increase the size of rate cuts. Additionally, the Eurozone's October composite and services PMI final values have both been revised upwards, returning to expansion territory.

On Wednesday, November 6, Trump announced his victory, triggering a surge in the "Trump Trading" that propelled S&P, Nasdaq, and Dow to achieve historic highs. The Dow soared over 1,550 points, the highest gain in two years, with the Russell small-cap index rising over 5.8% leading the gains. Tesla surged nearly 15% to a two-year high, Trump MediaTech rose over 34.8% before closing nearly 6%, triggering a trading halt at one point. Expectations of relaxed regulations boosted oil, steel, and crypto stocks, with the Philadelphia Bank Index ending up over 10%. Solar stocks suffered a collective defeat, while Chinese concept stocks narrowed their losses towards the end of the session.

- U.S. three major indices all rise. S&P 500 index closes up 146.28 points, up 2.53%, at 5929.04 points. Dow, closely related to economic cycles, closes up 1508.05 points, up 3.57%, at 43729.93 points. Nasdaq, dominated by tech stocks, closes up 544.29 points, up 2.95%, at 18983.47 points. Nasdaq 100 index rises by 2.74%. The Nasdaq Technology Market Cap-weighted Index (NDXTMC), which reflects the performance of tech components in the Nasdaq 100, closes up by 2.65%. The Russell 2000 small-cap index, more sensitive to economic cycles, closes up by 5.84%. The VIX fear index drops by 20.11%, at 16.37.

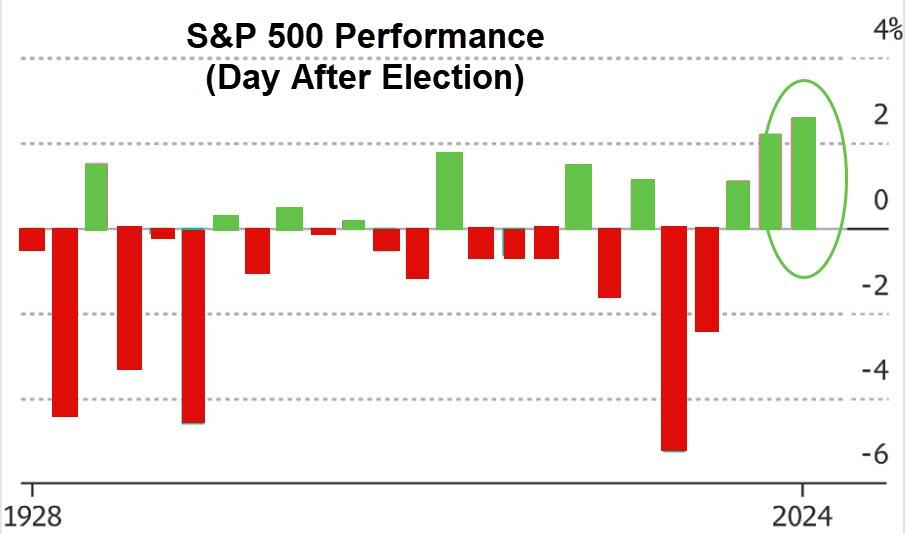

S&P 500 index surges 2.53%, marking the largest post-election day gain in history.

U.S. industry ETFs close mostly higher. Regional bank ETF rises over 13%, banking ETF rises nearly 12%, financial ETF surges over 6%, air travel ETF jumps over 5%, energy ETF, consumer discretionary ETF, and internet index ETF all rise at least 3%, science and semiconductor ETFs rise at least 2.5%. Meanwhile, consumer goods ETF and utilities ETF both drop over 1%.

- Most of the 11 sectors of the S&P 500 index rise. Financials close up 6.16%, industrial, consumer discretionary, and energy sectors rise by over 3.5%, technology sector closes up by 2.52%, telecom sector rises by about 2.4%, consumer staples sector drops nearly 1.6%, real estate sector drops over 2.6%.

- In terms of investment research strategy, Vincent Juvyns, global market strategist at Morgan Asset Management, believes that after Trump's election victory, tax cuts and fiscal measures may benefit a wide range of industries and domestic companies, leading to the spread of the U.S. stock market rally from technology and blue chip stocks to other sectors, especially mid-and small-cap stocks.

- "Tech's Big Seven" rose more than fell. Tesla rose by 14.75%, Google Class A rose by 3.99%, Nvidia rose by 4.07% to a new high, surpassing Apple as the world's largest market cap. Microsoft rose by 2.12%, Amazon rose by 3.8% to a historic high. Apple fell by 0.33%. Meta fell by 0.07%.

Tesla's stock price rose by almost 15%, reaching the highest level since July 2023.

- Most chip stocks rose. The Philadelphia Semiconductor Index rose 3.12%. The industry ETF SOXX rose 2.92%. Nvidia's double long ETF rose 8.08%. AMD rose 2.43%, Broadcom rose 3.25%, ON Semiconductor rose 2.95%. Arm Holdings rose 2.87%, Micron Technology rose 6.01%, Intel rose 7.42%. Qualcomm rose 4.27%, with positive third-quarter earnings and stronger smartphone demand brightening the outlook for the fourth quarter, rising over 12% after hours. ASML ADR fell 2.22%. Taiwan Semiconductor ADR fell 1.3%, KLA Corp fell 0.1%

- AI concept stocks mostly rose. Super Micro Computer fell 18.05%, preliminary sales estimate for the third quarter and guidance for the fourth quarter were below expectations, Barclays lowered the target stock price for Super Micro Computer from $42 to $25, JPMorgan downgraded the rating to "hold" with a target price of $23. Loop Capital lowered the target price from $100 to $35. BigBear.ai fell 9.66%, Palantir rose 8.61%. Dell Technologies rose 3.66%. AI voice company SoundHound AI, held by Nvidia, rose 5.96%, CrowdStrike rose 4.04%, C3.ai rose 4.17%, Snowflake rose 4.22%, Oracle rose 5.51%, BullFrog AI rose 8.19%, Serve Robotics rose 2.85%.

- Chinese concept stocks generally fell. After a 3.8% drop, the Nasdaq Golden Dragon China Index fell 1.83%. In ETFs, the China Technology Index ETF (CQQQ) fell 2.11%. The Chinese Internet Index ETF (KWEB) fell 2.01%. The FTSE China 3x Long ETF (YINN) fell 8.73%. The FTSE A50 Futures Index continued to fall in the overnight session by 0.32% to 13551.000 points.

- Among popular Chinese concept stocks, new energy vehicle companies collectively declined, with Xpeng falling 3.98%, announcing the development of the Ultra vehicle for Robotaxi services, naming the fourth-generation robot Iron. Zeekr fell 5.97%, Li Auto fell 3.25%, Nio fell 5.3%. Solar stocks declined overall, Daqo New Energy fell 8.11%, Canadian Solar fell 19.9%, JinkoSolar fell 14.31%. Fangdd Network fell 7.38%, Trip.com fell 1.99%, Alibaba fell 2.5%, Baidu fell 1.04%, Bilibili fell 4.57%, Tiger Brokers fell 1.34%, Netease fell 0.22%, JD.com fell 3.4%, New Oriental fell 2.93%, and Pinduoduo fell 1.29%.

- Investors speculated that Trump's presidency would benefit fossil fuels, leading to a general rise in energy stocks. Baker Hughes rose by 10.78%, EQT Resources rose by 7.56%, KMI rose by 6.64%, Chevron rose by 2.81%, Exxon Mobil rose by 1.71%.

- Photovoltaic stocks in the US stock market plummeted across the board at the beginning of the trading session. Sunrun fell 29.63%, Array fell 21.94%, Enphase Energy, a photovoltaic inverter supplier, fell 16.82%, and First Solar fell 10.13%.

Sharp decline in photovoltaic stocks.

- Bitcoin surged to a new high, boosting blockchain concept stocks across the board. Coinbase rose by 31.11%, Cipher Mining surged over 31%, Riot Platforms rose more than 26.1%, the double-long Bitcoin ETF rose over 19.7%, Robinhood surged over 19.6%. "Bitcoin whale" MicroStrategy investment MSTR rose by about 13.2%, Canaan ADR rose by about 13%, Ethereum ETF ETHV surged over 11.4%, Bitcoin ETF BITB rose by about 9.9%.

- Trump's victory has investors envisioning a loosening of regulations by U.S. regulatory authorities, propelling the Philadelphia Bank Index up by over 10%. Regional bank index closed up 13.47% at 133.26 points. Among Wall Street giants, Wells Fargo & Co. rose by 13.11%, Morgan Stanley rose by 11.61%, Goldman Sachs rose by 13.1%, Citigroup rose by 8.42%, JPMorgan rose by 11.54%, and Bank of America rose by 8.43%.

- Other key stocks: (1) Trump Media & Technology (DJT) initially surged over 34.8% but closed up 5.94%. (2) Novo Nordisk ADR fell by 4.33%, Q3 net income increased by 21%, Wegovy's revenue surged by 79%, but narrowed the full-year sales guidance range. (3) CVS Health rose by 11.33%, beating expectations for the third quarter net income. (4) Private prison stocks CoreCivic, Inc. rose by 28.98%, The GEO Group Inc. rose by 42.1%.

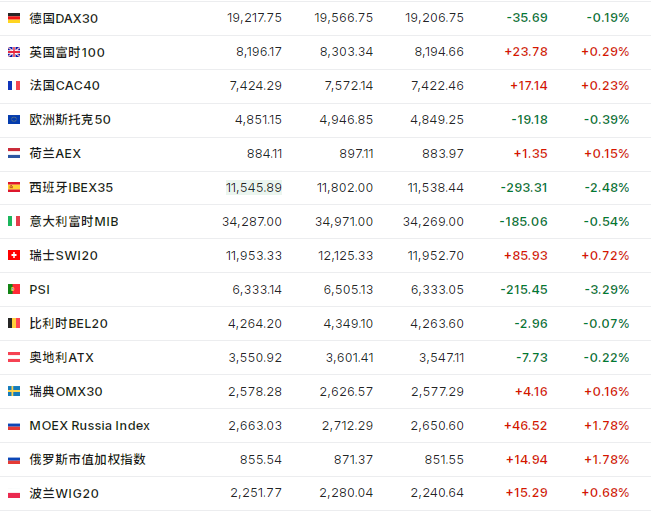

Trump's election caused European stocks to give back earlier gains and close lower. Market concerns over Trump's tariff imposition plans led to a general decline in European auto stocks, with BMW down by 6.58%, Daimler AG down by 6.44%, Volkswagen down by 4.27%, Stellantis rising by 1.75%, but announcing layoffs of over 1000 people. Worries about the Trump administration possibly pausing approval of new projects caused European renewable energy stocks to fall by over 10%, Vestas Wind Systems closed down by 12.82%, and Orsted down by 12.79% over two days.

- The pan-European STOXX 600 index closed down by 0.54%. The Eurozone STOXX 50 index closed down by 1.43%. The FTSE All-World 300 Index closed down by 0.47%. BMW fell by 6.58%, with third-quarter automotive sector revenue at 27.85 billion euros, a 13% year-on-year decrease, bringing the company's profit margin to the lowest level in four years.

- Germany's DAX 30 index fell by 1.13%. France's CAC 40 index fell by 0.51%. The Netherlands AEX index fell by 0.83%. Italy's FTSE MIB index fell by 1.54%. The UK's FTSE 100 index fell by 0.07%. Spain's IBEX 35 index fell by 2.9%.

Trump's re-election has made investors fearful of the risk of the U.S. federal government expanding the fiscal deficit, as well as concerns about inflation caused by tax cuts and tariff policies. Traders have cut back on bets for a rate cut by the Fed next year, and U.S. bonds were heavily sold across the board. The U.S. 30-year treasury bond yield rose by 23 basis points at one point, marking the largest single-day increase since 2020. The U.S. 10-year treasury bond yield also surged by 20 basis points, reaching the largest increase since April 10th.

U.S. Bonds: At the close, the yield on the 10-year benchmark U.S. Treasury bonds rose by 15.48 basis points to 4.4256%, opening lower at 08:00 Beijing time and hitting a daily low of 4.2481%, but then rebounding rapidly to form a significant uptrend, reaching 4.4768% at 20:28, nearing the peaks of 4.4911% on July 1st and 4.6357% on May 29th. The yield on the 2-year U.S. Treasury bonds rose by 8.94 basis points to 4.2659%, reaching 4.3073% at 11:01, approaching the peaks of 4.4059% on July 30th and 4.9975% on May 29th.

- Bank of America Merrill Lynch believes that if Trump takes office and implements fiscal expansion, the Fed may raise its neutral interest rate expectations. In addition, if the new president significantly imposes tariffs, the Fed may pause rate cuts due to concerns about inflation and economic growth impact.

After Trump's re-election, U.S. bond yields soared.

- Eurozone Bonds: At the close, the 10-year German bond yield fell by 2.0 basis points to 2.405%. The 2-year German bond yield fell by 12.6 basis points to 2.176%. The 10-year UK bond yield rose by 3.3 basis points. The 2-year UK bond yield remained roughly stable. The 10-year French bond yield rose by 1.1 basis points, and the 10-year Italian bond yield rose by 6.4 basis points.

- Goldman Sachs economist Sven Jari Stehn expects that after Trump is re-elected as U.S. president, the European Central Bank will make an additional rate cut of 25 basis points in July 2025. In addition, it is expected that the Swiss National Bank and the Swedish Central Bank will also make an additional rate cut of 25 basis points, while the forecasts for the Bank of England and the Norwegian Central Bank remain unchanged. The Eurozone's real GDP will be impacted by 0.5%, while the UK will experience a mild impact of 0.4%.

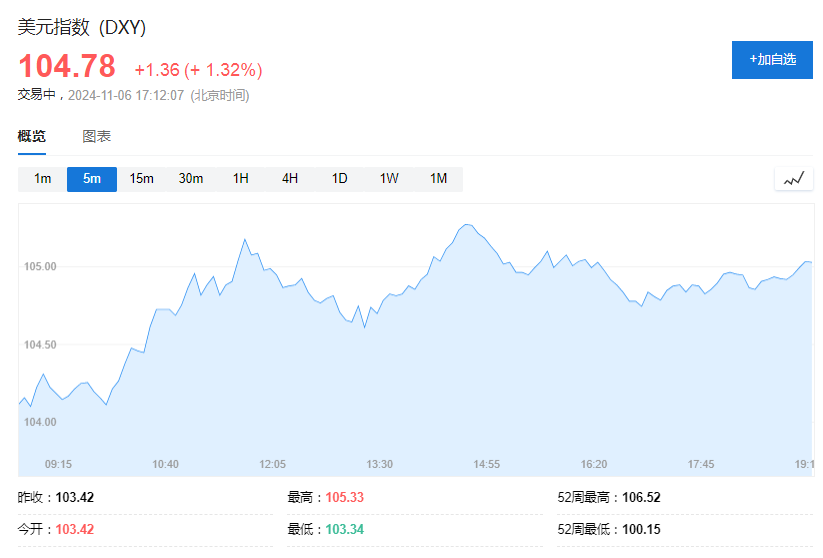

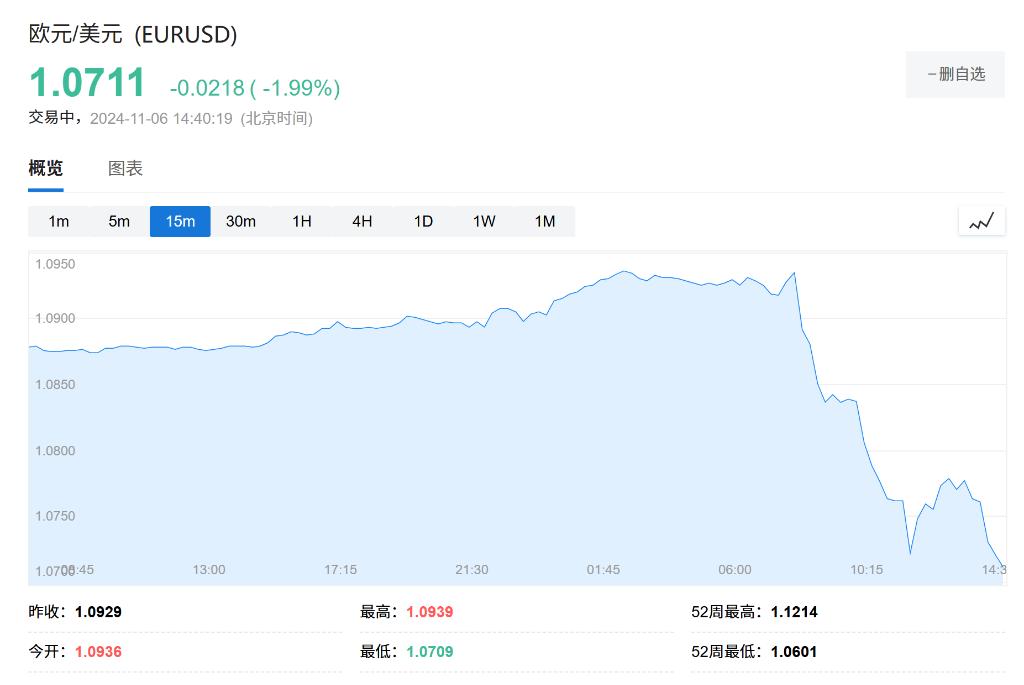

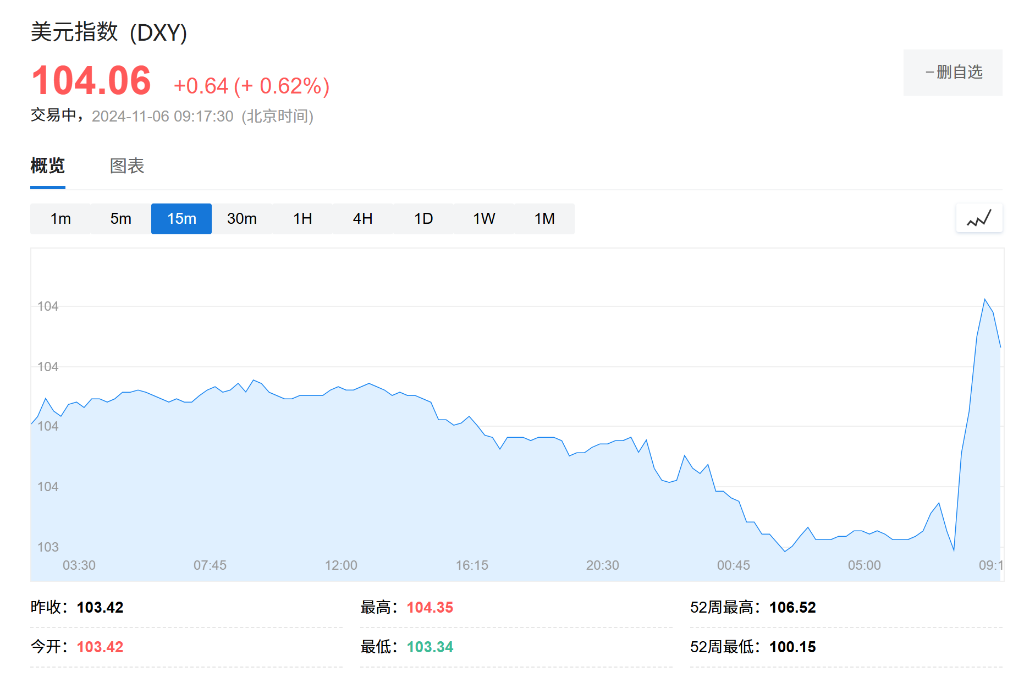

"The day after the U.S. election", the U.S. dollar index rose more than 1.6% to surpass 105, reaching its highest level in nearly four months. The Japanese yen fell more than 1.9% nearing 155, hitting a three-month low. The offshore RMB dropped more than a thousand points, falling below 7.20 Yuan for the first time in over three months. The Euro plummeted over 1.8%, marking the worst day in over four years and hitting a more than four-month low. However, the Mexican Peso saw an intraday reversal, while the Brazilian Real led emerging market currencies. Bitcoin Futures surpassed the $7.7 threshold during the trading session, reaching a historic high.

U.S. Dollar: DXY dollar index rose by 1.66% at the close, reaching 105.137 points, crossing above the 200-day moving average (the current technical indicator is at 103.849), trading in an upward trend throughout the day, with an intraday range of 104.043-105.441 points, nearing the high of June 26th at 106.130. Bloomberg Dollar Spot Index rose by 1.26%, reaching 1269.90 points.

The Bloomberg Dollar Spot Index hit a 12-month high, marking the largest single-day increase since February 2023.

Non-U.S. Currency: Euro against the dollar fell by 1.84%, at 1.0729, British pound against the dollar fell by 1.23%, at 1.2883, U.S. dollar against the Swiss franc rose by 1.49%, at 0.8762. Among commodity currencies, the Australian dollar against the dollar fell by 1.01%, New Zealand dollar against the dollar fell by 1.08%, U.S. dollar against the Canadian dollar rose by 0.86%. Swedish Krona against the dollar fell by 1.47%, Norwegian Krone against the dollar fell by 1.04%.

- Japanese Yen: The Japanese Yen against the U.S. dollar fell 1.95% at the close to 154.58 Yen. Wells Fargo Bank pointed out that if U.S. Treasury yields continue to rise, the Yen to Dollar exchange rate may fall below 155, possibly even touching the low of 161.95. In response, the Bank of Japan may signal or hike rates early.

- Offshore Renminbi (CNH): The offshore renminbi against the dollar fell by 1019 points at the close, at 7.2036 yuan, trading within the range of 7.0906-7.2096 yuan throughout the day, nearing the low of August 2nd at 7.2521 yuan.

Cryptocurrencies: The largest leading cryptocurrency, bitcoin futures, rose by 9.63% at the end of the day, reaching $76,585.00, and briefly rose to $77,140.00 at 04:59 Beijing time, hitting a new all-time high. Spot bitcoin has risen by over 9.7% in the last 24 hours, reaching a historical high of $76,475.38 at 04:54. The second largest ethereum futures rose by 11.11%, reaching $2,711.00, and briefly rose to $2,730.50 at 05:17 Beijing time.

Bitcoin futures surged to a new high of $0.077 million.

On the news front, Citigroup believes that Trump winning the U.S. election is bearish for the outlook of oil prices. The U.S. Energy Information Administration (EIA) data shows that U.S. crude oil supply hit a new high since August, with an increase of 2.149 million barrels last week, higher than analysts' expectations of 1.35 million barrels. The week before saw a decrease of 0.515 million barrels, but gasoline and refined oil inventories also rose instead of falling.

- US Oil: WTI December crude oil futures fell by $0.30, a decrease of nearly 0.42%, to $71.69 per barrel. US oil continued its earlier decline, hitting a pre-market low of over 3.1% at $69.74, then quickly rebounding. US stocks rose nearly 0.9% to break through $72.60 in early trading.

- Brent Crude Oil: Brent January crude oil futures fell by $0.61, a decline of about 0.81%, to $74.92 per barrel. Brent oil continued its earlier decline, with a pre-market low of nearly 2.9% near $73.30 before quickly rebounding. US stocks rose nearly 0.6% to approach $76 in early trading.

- Natural Gas: U.S. December natural gas futures closed up 2.88% at $2.7470 per million British thermal units. European TTF Netherlands natural gas futures rose by 0.25% to 40.500 euros per megawatt-hour, with a V-shaped rebound and a late-session reversal. ICE UK natural gas futures fell by 0.33% to 102.350 pence per kilocalorie.

- On the news front, Citigroup believes that Trump winning the U.S. election is bearish for the outlook of oil prices. The U.S. Energy Information Administration (EIA) data shows that U.S. crude oil supply hit a new high since August, with an increase of 2.149 million barrels last week, higher than analysts' expectations of 1.35 million barrels. The week before saw a decrease of 0.515 million barrels, but gasoline and refined oil inventories also rose instead of falling.

美油震荡,跌破70美元后回升至72美元上方,最终仍收跌

特朗普胜选提振美元走强触及四个月高点,加之潜在关税政策可能抬高通胀并致使美联储降息步伐停滞,两大因素均施压现货金走低创五个月来最大单日跌幅,盘中最深跌逾3%失守2660美元至三周低点,现货银盘中最深跌近5.6%至逾三周最低水平:

黄金:COMEX 12月黄金期货尾盘跌2.97%至2668.00美元/盎司,持续脱离10月30日所创历史最高位2801.80美元。现货黄金全天维持跌势,美股盘前最低跌超3.3%下逼2650美元,为10月16日以来首次,尾盘跌3.09%,报2659.06美元/盎司,10月31日曾涨至2790.10美元创历史新高以来,一度累计回调超过4.57%。

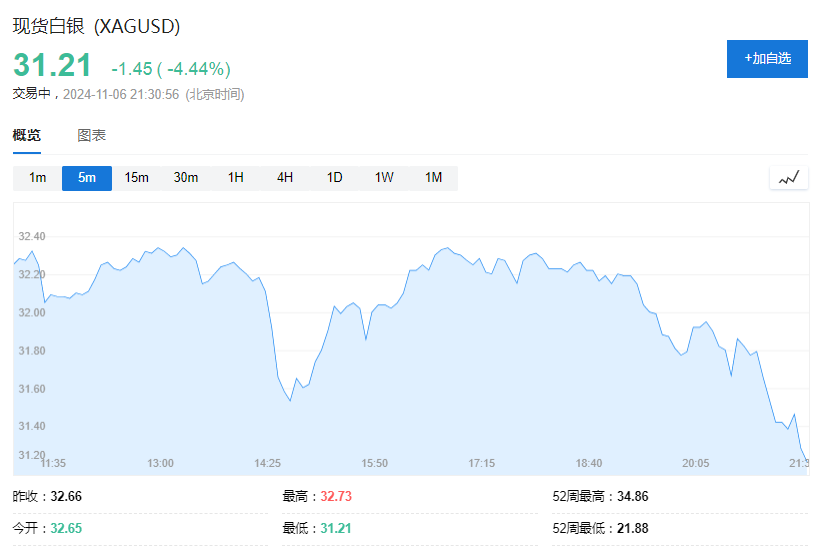

Silver: COMEX December silver futures fell 4.59% to $31.270 per ounce at the close. Spot silver remained bearish throughout the day, hitting a low of nearly 5.6% below $30.80 before the US stock market opened, the first time since October 15, closing down 4.53% at $31.1778 per ounce.

- In London industrial metals, copper and zinc both closed down over 4%, while tin also dropped over 3%: copper fell by $396, a decrease of more than 4.06%, to $9343 per ton. COMEX copper futures fell by 5.28% to $4.2387 per pound. Aluminum in London closed down by $44 to $2616 per ton. Zinc in London fell by $130, a drop of approximately 4.19%, to $2973 per ton. Lead in London rose by $20 to $2048 per ton. Nickel in London rose by $4 to $16127 per ton. Tin in London fell by $1002, a drop of approximately 3.10%, to $31347 per ton. Cobalt in London remained flat at $24300 per ton.

The strong US dollar continues to suppress gold prices, leading to a continued decline.

The following content will be updated before 23:00 on November 6th Beijing time.

On Wednesday, November 6th, Trump declared victory, triggering an explosive surge in "Trump trades" supporting the S&P, Nasdaq, and Dow to hit historic highs simultaneously. The Dow surged nearly 1350 points at one point, and the Russell small-cap index surged over 4.8%, marking the largest intraday gain in nearly two years. Tesla soared over 15%, Trump media technology rose over 34.8% before giving back most of the gains. The "Bitcoin hodlers" at MicroStrategy surged nearly 15.7% before narrowing gains. Trump's victory has investors envisioning loosened regulations by U.S. regulatory authorities, strengthening Wall Street giants collectively. The Philadelphia Banking Index surged around 8.5% at one point, and Wells Fargo jumped nearly 16%.

- U.S. major indices all rose. The S&P 500 surged over 2.1% to hit a historic high. The Dow, closely related to the economic cycle, surged nearly 1350 points or 3.2% to reach a historic high. The Nasdaq, dominated by tech stocks, surged nearly 2.3% to reach a historic high. The Russell 2000 small-cap index, more sensitive to the economic cycle, surged over 4.8%, marking the largest intraday gain since January 2023.

- In early U.S. trading, the banking industry ETF rose by 9.16%, the financial industry ETF rose by 5.19%, energy industry ETF and consumer discretionary ETF rose by around 2.6%, while the semiconductor ETF lagged behind with a gain of over 1.8%.

- From the research strategy perspective: Vincent Juvyns, Global Market Strategist at J.P. Morgan Asset Management, believes that post Trump's election victory, U.S. stock market performance will shift from tech and blue-chip stocks to other sectors, especially small-cap stocks. Trump's proposed tax cuts and fiscal measures might benefit a wide range of industries and domestic companies, boosting mid-cap companies.

- Most of the 'Tech Seven Sisters' rose. Tesla surged nearly 15.2%, Google Class A surged over 3.4%, Nvidia surged over 3.3%, Microsoft surged nearly 1.6%, Amazon surged nearly 1%, hitting intraday historical highs. Apple opened lower, dropped over 1%, then rose nearly 1%. Meta dropped over 3% at one point.

- Most chip stocks are up. The Philadelphia Semiconductor Index rose over 2.5% at one point, with Nvidia's double-long ETF surging over 6.5% at one point, Intel rising over 5.8% at one point, Broadcom rising over 3.4% at one point, AMD rising over 2.6% at one point, while Taiwan Semiconductor dipped nearly 2.7% at one point.

- AI concept stocks are mostly up. C3.ai surged over 6.3% at one point, Palantir surged over 6% at one point, while Super Micro Computer dropped nearly 25.6% at one point. Q3 sales estimated and Q4 sales guidance of Super Micro underperformed, causing Barclays to lower the target stock price from $42 to $25, Morgan Stanley downgraded the rating to 'hold' with a target price of $23. Loop Capital lowered its target price from $100 to $35.

- Chinese concept stocks generally fell. The Nasdaq Golden Dragon China Index fell nearly 3.8% at one point. Among popular Chinese concept stocks, Xpeng dropped over 8% at one point as the company is developing the Ultra model to serve Robotaxi, naming the fourth-generation robot 'Iron'. Zeekr dropped over 11% at one point, photovoltaic stocks declined across the board with Daqo New Energy falling nearly 8.4%, Canadian Solar dropping over 16.3%, JinkoSolar dropping nearly 14%, Fangdd Network falling over 9%. Alibaba dropped over 4% at one point, JD.com fell over 7.4% at one point.

- U.S. solar stocks suffered a collective defeat in early U.S. trading. Sunrun dropped approximately 22.59% at one point, Array dropped around 19.2%, solar inverter supplier Enphase Energy dropped around 16.98%, First Solar dropped over 15.7% at one point.

- Expectations of regulatory easing led to a surge in the Philadelphia Banking Index by over 8% at one point. The U.S. Philadelphia Banking Index rose by over 8.5% at one point, marking the largest intraday increase since November 2020. Trump's election victory has investors hopeful about regulatory easing in the U.S. banking sector. Among Wall Street giants, Wells Fargo surged nearly 16% at one point, Morgan Stanley rose around 9.69%, Goldman Sachs rose around 9.63%, Citigroup rose around 8.63%, JPMorgan rose around 7.88%, Bank of America rose around 7.29% at one point.

- Other key stocks: (1) Trump Media Tech (DJT) surged over 34.8% in pre-market trading, then gave back most of the gains. (2) Novo Nordisk ADR dropped over 3.1% at one point, with Q3 net income growing by 21%, Wegovy's revenue surging by 79%. (3) Pharmacy chain CVS surged over 14.3% at one point, exceeding expectations in the third quarter net income.

The following is the content updated before 22:30.

After Trump's announcement of victory, pre-market trading in U.S. stocks continued to rise sharply, leading to a surge in 'Trump trading', with a collective increase in the U.S. dollar, U.S. bond yields, and Bitcoin, while gold, silver, and oil prices plummeted. Trump Media Tech Group (DJT) surged nearly 60% in pre-market trading, now narrowed to 30%, Tesla rose over 12% in pre-market trading, and European stocks saw a slight decline.

According to CCTV News, based on the latest preliminary calculations released by multiple U.S. media outlets, Trump has currently obtained 277 electoral votes, exceeding the 270 electoral votes required to win, locking in victory in advance. Harris currently has 224 votes.

In other individual stocks, Novo Nordisk rose more than 5%. Financial report data shows that the company's sales of the weight-loss drug Wegovy surged in the third quarter. Super Micro Computer fell more than 19% in pre-market trading as the company's third-quarter sales preliminary estimate and fourth-quarter sales guidance were both below expectations.

U.S. stock index futures continued to rise, with Dow futures up more than 3%, soaring over 1300 points for the first time since November 2022; S&P 500 index futures expanded to a 2% increase, Nasdaq futures rose 1.8%, and Russell 2000 small-cap stock index futures surged more than 6%.

European stocks narrowed their gains, with the Euro Stoxx 50 index turning lower with a decline of 0.39%, the Euro Stoxx 600 index's increase narrowing to 0.2%, Germany's DAX30 index falling by 0.19%, and the UK's FTSE 100 and France's CAC40 index gains narrowing to 0.2%.

In the U.S. stock market, the Trump Media Technology Group (DJT) saw its pre-market gain expand to 58% at one point, now falling back to 30%. Tesla rose more than 15% in pre-market trading.

The U.S. dollar index rose to its highest level in a year, now at 104.78.

Various maturities of U.S. bonds suffered heavy losses, with the U.S. 30-year Treasury bond yield rising by 23 basis points, marking the largest single-day increase since 2020, the 10-year Treasury bond yield soaring by 20 basis points to 4.47%, and the 2-year Treasury bond yield rising by over 12 basis points.

Bitcoin hits a historic high, reaching a peak of $75,000 per coin, up more than 8% intra-day. The largest U.S. cryptocurrency exchange Coinbase rose more than 12% in pre-market trading, while the publicly listed company holding the most Bitcoin globally, Microstrategy, saw a gain of over 9%.

Global commodity prices are falling, with gold, silver, and oil prices all declining. Spot gold fell below $2700 per ounce, with a rapid decline of 3%; spot silver plummeted by 4% at one point, to $31.34 per ounce; WTI crude oil plunged by 3.00% intraday, to $69.82 per barrel, while Brent crude oil dropped by 2.7%, to $73.28 per barrel. COMEX copper futures fell by over 4.5%, to $4.2715 per pound. LME copper futures fell by nearly 3%, to $9452 per ton.

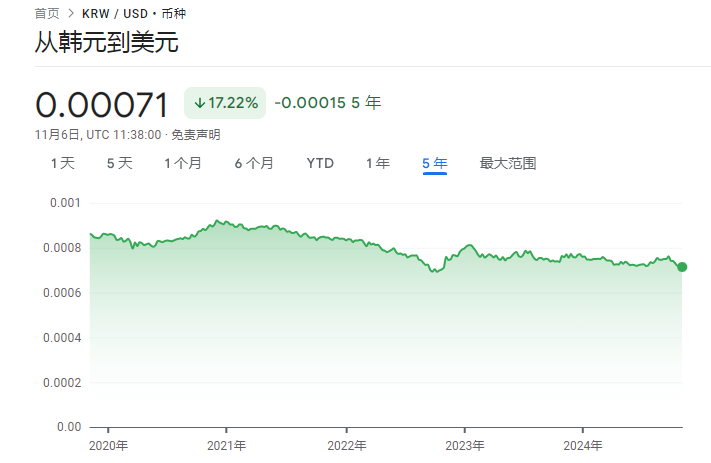

Non-U.S. currencies against the U.S. dollar collectively weakened: the Mexican peso against the U.S. dollar widened its decline to 3%, marking its largest drop in three months; the euro against the U.S. dollar fell by 1.88% to 1.0724. The U.S. dollar against the Japanese yen expanded by 1.7% to 154.19. The British pound rapidly fell towards the late October low against the U.S. dollar, breaking below the 200-day moving average. The Australian dollar widened its decline by 1%, the South Korean won hit a new low since 2022 against the U.S. dollar, and the offshore renminbi fell by over 1000 points, now at 7.2083.

【21:47 Update】

Spot gold's decline widened to 3%, now at $2662.13 per ounce.

European stocks narrowed gains, with both the European Stoxx 50 index and the German DAX30 index turning lower.

【21:29 Update】

Spot gold fell by 2%, hitting a low of $2677.97 per ounce.

Spot silver fell by more than 4% intraday, trading at $31.21 per ounce.

Brent oil and WTI crude oil both fell by 3% at one point.

LME copper futures fell by nearly 3%, hitting a low of $9350 per ton.

Updated at 19:56

Spot gold falls below $2700, with an intraday decline of over 1.6%.

Offshore Renminbi against USD intraday decline reaches 1065 points, now at 7.2083.

Updated at 19:37

U.S. 30-year Treasury bonds yield rose by 23 basis points, marking the largest single-day increase since 2020.

The South Korean won has fallen to a new low against the US dollar since 2022.

[Update at 19:12]

U.S. 30-year Treasury bonds yield rose by over 20 basis points to 4.649%.

The US dollar index briefly climbed to its highest level since November 2023, currently up by 1.32% to 104.78.

[Update at 18:16]

The three major U.S. stock index futures are accelerating their rise, with the Dow futures approaching a 3% increase, jumping over 1000 points in a single day for the first time since November 2022.

European stocks continue to rise, with the UK FTSE 100 index and the France CAC 40 index up over 1%.

The U.S. dollar remains at high levels, currently at 104.78.

U.S. bond yields across all maturities are trending upwards, with the 10-year Treasury bond yield increasing by over 14 basis points intraday, and the 2-year Treasury bond yield rising by over 12 basis points.

Gold continues to decline, with an intraday drop of 0.65%, trading at $2725.94 per ounce.

Bitcoin's intraday gain narrowed to 7.05%, trading at $0.0736 million per coin.

【Updated at 17:00】

Tesla's pre-market trading in the US rose more than 11%, Trump Media Technology surged over 58%; "Bitcoin Whale" Microstrategy Investment rose by over 11%; Novo Nordisk surged over 5%, with a sharp increase in third-quarter sales of weight-loss drug Wegovy.

【Updated at 16:15】

The STOXX 600 index in Europe expanded by 1.2%.

[16:03 Update]

European stocks opened slightly higher, with the German DAX30 index up 0.47%, the UK FTSE 100 index up 0.79%, the France CAC40 index up 0.34%, and the STOXX 50 index up 0.27%.

[15:43 Update]

S&P 500 index futures expanded by 2%, while Nasdaq futures rose by over 1.7%. India's Nifty and Sensex indices both rose by 1%.

[14:40 Update]

The Euro fell 2% against the US dollar, currently at 1.0710. STOXX 50 index futures rose 0.1% during the day, after a previous 1% drop.

【13:54 Update】

Euro Stoxx 50 index futures extended losses to 1%, hitting the day's low.

【11:42 Update】

US Dollar Index widened its gains to 1.64%, reaching 105.12. Euro against the US Dollar dropped by 1.88% to 1.0724. US Dollar against the Japanese Yen increased by 1.7% to 154.19. Offshore Chinese Yuan against the US Dollar fell by 1% to 7.1719.

【11:08 Update】

Bitcoin hit a new all-time high, peaking at $75,000 per coin.

Updated at 11:00.

U.S. stock futures extended gains, with Dow Jones futures up over 1.2%, S&P 500 and Nasdaq 100 index futures up over 1.1%.

Updated at 10:35.

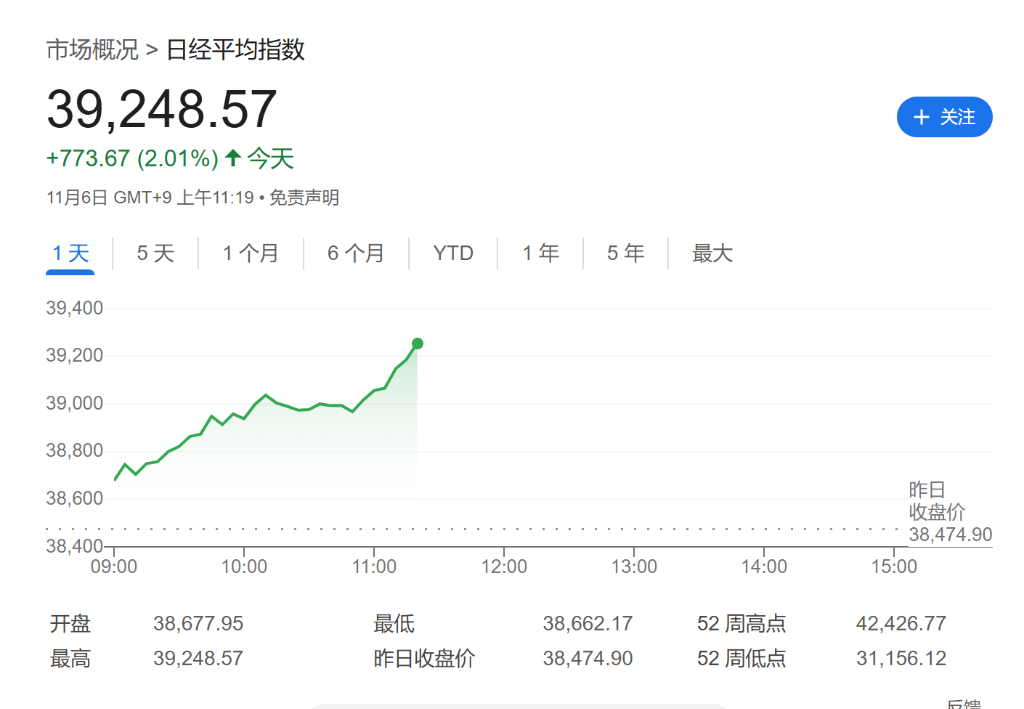

As of the morning session close, the Nikkei 225 index rose by 2.3%, while the TOPIX index rose by 1.9%.

The U.S. dollar index expanded its gains to 1.1%. Bitcoin's intraday increase expanded to 5%.

【10:23】

The US dollar strengthened, with the Mexican peso falling by 2%. The Nikkei 225 index saw its increase expand to 2%.

US stock futures extended gains, with Dow futures up 1.1%, S&P 500 index futures up over 0.9%, and Nasdaq 100 index futures up nearly 0.6%.

[10:13 Update]

The US dollar index rose nearly 1% intraday to a new high since July. The euro against the US dollar weakened, with the Euro/USD intraday decline expanding to 1%. The USD/JPY intraday increase expanded to 1%.

The yield on US 10-year Treasury bonds increased by 10 basis points.

【9:04 Update】

The U.S. dollar index continues to rise in the short term, currently up 0.75% at 104.20. The euro is falling against the U.S. dollar, down 0.82% at 1.0839. The offshore Chinese Yuan falls below 7.14, down nearly 400 points intraday. The U.S. dollar against the Japanese yen has expanded to 0.83%, at 152.89. Bitcoin's gains have expanded to nearly 3%.

【8:44 Update】

The Mexican Peso against the U.S. Dollar widens its decline to 1%.

【8:37 Update】

Nikkei 225 index expanded to 1%. Japan's 10-year treasury bond futures fell to 144.2.

美联储降息预期大跌,市场目前预计2025年仅降息57个基点,从现在到2025年底的总降息预期不到100个基点。摩根大通预计美联储将从2025年3月开始一个季度仅仅降息一次。野村经济学家预测,美联储在2025年可能只会降息一次,并将终端利率预测上调50个基点至3.625%。他们预计特朗普将提高关税,这将短期内推高通胀并导致增长适度放缓。

美联储降息预期大跌,市场目前预计2025年仅降息57个基点,从现在到2025年底的总降息预期不到100个基点。摩根大通预计美联储将从2025年3月开始一个季度仅仅降息一次。野村经济学家预测,美联储在2025年可能只会降息一次,并将终端利率预测上调50个基点至3.625%。他们预计特朗普将提高关税,这将短期内推高通胀并导致增长适度放缓。