Microchip Technology Incorporated (NASDAQ:MCHP) reported upbeat earnings for its second quarter on Tuesday.

The company posted quarterly earnings of 46 cents per share which beat the analyst consensus estimate of 43 cents per share. The company reported quarterly sales of $1.164 billion which beat the analyst consensus estimate of $1.152 billion.

"Our September quarter results were consistent with our guidance, as we continued to navigate through an inventory correction that's occurring in the midst of macro weakness for many manufacturing businesses, accentuated by heightened weakness in our European business which is concentrated with Industrial and Automotive customers," said Ganesh Moorthy, President and Chief Executive Officer. "The 'green shoots' we saw in recent quarters have progressed unevenly with essentially flat sequential bookings, normalized cancellation rates and much higher expedite requests, which we believe are all positive signs for a potential bottom formation despite limited visibility."

Microchip said it sees third-quarter adjusted earnings of 29 cents to 32 cents per share on net sales of $1.025 billion to $1.095 billion.

Microchip said it sees third-quarter adjusted earnings of 29 cents to 32 cents per share on net sales of $1.025 billion to $1.095 billion.

Microchip shares fell 1.8% to trade at $73.76 on Wednesday.

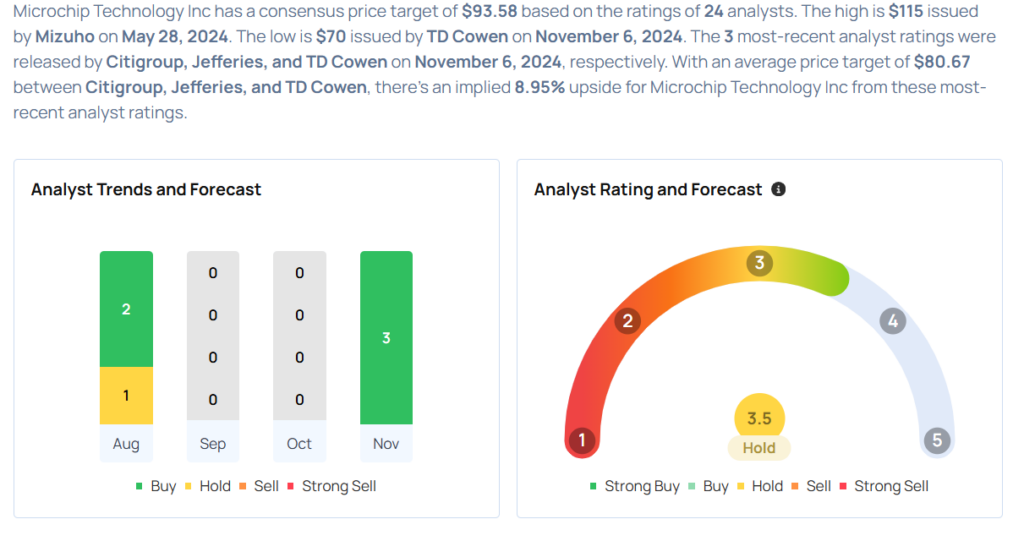

These analysts made changes to their price targets on Microchip following earnings announcement.

- Needham analyst Quinn Bolton maintained Microchip Technology with a Buy and lowered the price target from $96 to $85.

- Piper Sandler analyst Harsh Kumar maintained the stock with an Overweight and lowered the price target from $100 to $85.

- Keybanc analyst Weston Twigg maintained Microchip with an Overweight and lowered the price target from $100 to $95.

- Susquehanna analyst Christopher Rolland maintained Microchip Technology with a Positive and lowered the price target from $95 to $90.

- Evercore ISI Group analyst Mark Lipacis reiterated Microchip with an Outperform and lowered the price target from $101 to $95.

- TD Cowen analyst Joshua Buchalter maintained the stock with a Hold and lowered the price target from $80 to $70.

- Jefferies analyst Blayne Curtis maintained Microchip with a Buy and cut the price target from $100 to $90.

- Citigroup analyst Christopher Danely maintained the stock with a Buy and slashed the price target from $92 to $82.

Considering buying MCHP stock? Here's what analysts think:

Read More:

- Amazon, Disney, DuPont, Leidos And A Financial Stock On CNBC's 'Final Trades'