① Byd property insurance achieved insurance business income of 0.478 billion yuan in the third quarter, a staggering increase of 611.09% from the previous quarter; ② Byd property insurance incurred a net loss of 0.106 billion in the third quarter, a conversion from profit to loss compared to the second quarter; ③ In the first three quarters of 2024, Byd property insurance accumulated an average vehicle insurance premium of 4700 yuan, a decrease of 200 yuan from the previous quarter.

Financial link news on November 6 (Reporter Xia Shuyuan) As a sample of an electric vehicle manufacturer personally entering the insurance business, the actions of Byd property insurance are attracting attention in the car insurance market. Recently, with the disclosure of the third quarter solvency report of insurance companies, some operating indicators of Byd property insurance have also come to light.

The data shows that in the first three quarters of 2024, Byd property insurance achieved insurance business income of 0.546 billion yuan, with the business income of a single quarter in the third quarter approaching 0.5 billion yuan. As a newcomer in the car insurance market, under the rapid growth of Byd property insurance business, it has not yet broken the industry curse of not increasing profits under the rapid growth of insurance premiums in the new energy vehicle sector. In the first three quarters of 2024, the company recorded a net loss of 87.8097 million yuan, and by the end of the third quarter, the average vehicle insurance premium had decreased to 4700 yuan.

Industry insiders say that in the current situation where sales of electric vehicles exceed gasoline vehicles, new energy vehicle insurance is in the early stages of vigorous development. Due to the high maintenance costs of electric vehicles and pricing risks, property insurance companies face widespread profitability pressures. Rating agency Moody's recently released a report stating that although property insurance companies charge higher premiums for new energy vehicle insurance, most property insurance companies still incur losses due to high maintenance costs.

Industry insiders say that in the current situation where sales of electric vehicles exceed gasoline vehicles, new energy vehicle insurance is in the early stages of vigorous development. Due to the high maintenance costs of electric vehicles and pricing risks, property insurance companies face widespread profitability pressures. Rating agency Moody's recently released a report stating that although property insurance companies charge higher premiums for new energy vehicle insurance, most property insurance companies still incur losses due to high maintenance costs.

Byd property insurance achieved insurance business income of 0.546 billion yuan in the first three quarters, with a net loss of 87.8097 million yuan.

On the first anniversary of the equity transfer in May this year, Byd Property Insurance was approved to operate car insurance as desired.

On May 9th, the approval document disclosed by the China Banking and Insurance Regulatory Commission shows that Byd Property Insurance was allowed to use the national unified compulsory insurance terms, basic insurance rates, and corresponding rate adjustment factors in Anhui, Jiangxi, Shandong (excluding Qingdao), Henan, Hunan, Guangdong, Shaanxi, and Shenzhen.

Just five months after officially entering the auto insurance market, Byd Property Insurance's business is showing rapid development.

According to the solvency report for the third quarter, byd company limited property and casualty insurance achieved insurance business income of 0.546 billion yuan in the first three quarters. Among them, the insurance business income in the third quarter was 0.478 billion yuan, a staggering increase of 611.09% compared to the insurance business income of 0.067 billion yuan in the second quarter.

It is worth noting that even with the active participation of new energy car companies, byd company limited property and casualty insurance has still been unable to break the curse of increasing revenue without profitability in the new energy vehicle insurance business. In the third quarter of 2024, byd company limited property and casualty insurance had a net income of -0.106 billion yuan, a turnaround from profit to loss compared to the 6.0372 million yuan net income in the second quarter, accumulating a loss of 87.8097 million yuan in the first three quarters.

With the rapid growth of business, the minimum capital requirements have correspondingly increased, leading to a rapid decline in the solvency adequacy ratio in the short term. At the end of the third quarter of 2024, byd's comprehensive solvency adequacy ratio was 1778.83%, a decrease of 2838.65 percentage points from the end of the previous quarter; the core solvency adequacy ratio was 1778.66%, down by 2838.31 percentage points from 4616.97% at the end of the previous quarter.

In terms of performance indicators, in the first three quarters of 2024, byd company limited property and casualty insurance had a comprehensive expense ratio of -179.12%, a comprehensive loss ratio of -235.1%, and a comprehensive cost ratio of -414.22%. Industry experts believe that as the company only resumed business operations in May 2024, lacking historical business turnaround, it resulted in negative earned premiums for the current year, thereby causing negative comprehensive cost ratios, comprehensive expense ratios, and comprehensive loss ratios.

Byd company limited property and casualty insurance stated: "With the gradual progress of the business cycle, newly signed policies this year will gradually reach maturity, and the above indicators will gradually turn positive."

Direct sales channels dominated absolute in the premiums for new policies signed in the first three quarters, with a per-vehicle premium decreasing to 4700 yuan.

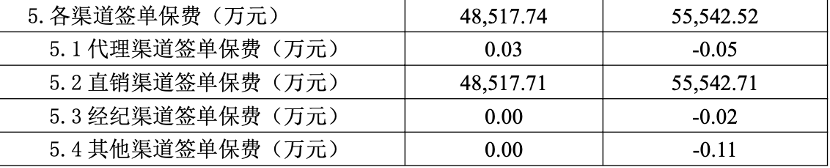

In terms of business structure, the premium income of byd company limited property and casualty insurance is predominantly from car insurance business, with new policies signed in the first three quarters amounting to 0.555 billion yuan.

From a channel perspective, almost all policies of byd company limited property and casualty insurance currently come from direct sales channels. Industry insiders indicate that by cutting out the intermediary steps, direct sales channels can effectively reduce costs for insurance companies.

An insurance industry professional who prefers not to disclose their name stated that companies like BYD, where direct sales dominate, are currently unique in the insurance industry. From what we can see now, this model is mainly to maintain cash flow.

"After all, BYD's overall series of vehicles have relatively high claims costs, so achieving profits in the short term is still difficult," the above-mentioned individual said. As a company focusing on electric vehicles, BYD's product claims are high, so BYD Property Insurance will definitely be selective in its short-term business. For example, focusing on family-use models, especially high-end models, these cars have sufficiently high premiums and relatively low accident rates. On the other hand, the online car-hailing market, which has high accident rates, expensive parts, and relatively low premiums, will be handed over to other traditional property insurance companies.

In addition to the premium under the direct sales dominant model, BYD's average vehicle insurance premium indicators have also attracted high attention in the industry.

In the third quarter of 2024, BYD's average vehicle insurance premium reached 4700 yuan, a decrease of 200 yuan from the second quarter, but still significantly higher than the old big three in property insurance - Ping An Property Insurance (2908 yuan), CPIC Property Insurance (2865 yuan), and PICC Property Insurance (2533 yuan).

Industry insiders stated that the level of average vehicle insurance premiums is mainly related to the differences in the business structure of the types of insurance. BYD Property Insurance covers new energy private cars and online car-hailing, while the old big three cover a large number of traditional fuel cars, lowering the average vehicle insurance premium.

In recent years, with the rapid deployment of new energy vehicles, new application scenarios and risks continue to emerge, forcing insurance institutions to continuously innovate pricing models and develop more products and services suitable for new energy vehicles. This market shift has pried open a gap in the long-standing car insurance market, driving the evolution of the market landscape.

"It can be affirmed that as BYD deepens its layout in the field of new energy vehicle insurance, market competition will become more intense, and consumers will be the ultimate beneficiaries," the above-mentioned individual stated.

业内人士表示,在新能源汽车销量超过油车的当下,新能源车险则处于蓬勃发展的初期阶段。由于新能源汽车高昂的维修成本以及定价风险,财险公司面临着普遍的盈利压力。评级公司穆迪近期发布报告称,尽管财险公司对新能源车险收取的保费更高但绝大多数财险公司仍因维修成本过高而亏损。

业内人士表示,在新能源汽车销量超过油车的当下,新能源车险则处于蓬勃发展的初期阶段。由于新能源汽车高昂的维修成本以及定价风险,财险公司面临着普遍的盈利压力。评级公司穆迪近期发布报告称,尽管财险公司对新能源车险收取的保费更高但绝大多数财险公司仍因维修成本过高而亏损。