In the early hours of Wednesday, local time (November 6th), the Republican presidential candidate and former President Donald Trump delivered a speech at the Palm Beach Convention Center in Florida, announcing his victory in the 2024 presidential election.

According to the latest data from the Associated Press, Donald Trump has already secured 277 electoral votes, winning this election.

As of press time, the three major US stock index futures collectively surged, with the Dow Jones futures up nearly 3%,$S&P 500 Index (.SPX.US)$Futures are expected to rise by more than 2% and potentially break through the 6000 mark, with Nasdaq 100 index futures up nearly 2%.

One of the concepts considered by the industry as a "Donald Trump trade" $Bitcoin (BTC.CC)$ The price has already exceeded $75,000 today, setting a new all-time high.

One of the concepts considered by the industry as a "Donald Trump trade" $Bitcoin (BTC.CC)$ The price has already exceeded $75,000 today, setting a new all-time high.

In the US stock market, stocks related to donald trump are collectively rallying. $Trump Media & Technology (DJT.US)$ Surging more than 30% before the market opens. $Phunware (PHUN.US)$ Up over 24%, stocks related to cryptos. $MicroStrategy (MSTR.US)$ Surging more than 12% before the market opens. $Coinbase (COIN.US)$ Up more than 13%, and as one of the big winners of this usa election - under Musk's. $Tesla (TSLA.US)$ Also surged more than 15%.

On November 6th local time, 'diehard fan' of Musk and American investment bank Wedbush analyst Dan Ives tweeted, expressing his bullishness towards Musk and Tesla without reservation:

The biggest beneficiary of Trump's victory will be Tesla/Musk. We believe that Trump winning is negative for the electric car industry as EV discounts/tax incentives may be revoked, but it is positive for Tesla, which has a huge advantage in scale/price. Trump's victory could boost Tesla's stock price by $40-50.

What should we continue to pay attention to?

According to the Minsheng macro team, the current focus should be on what issues are worth paying attention to after the election, to be continued.

The first and foremost is the control of the other half of Congress, the House of Representatives, which will directly affect the progress of US re-inflation and the external environment China will face next year.

Another issue is Trump's true policy demands. We still believe that there will be differences between Trump's policy layout during the new term and his statements during the campaign. Seize the time window after the election for the president's speech and personnel nominations to capture clues.

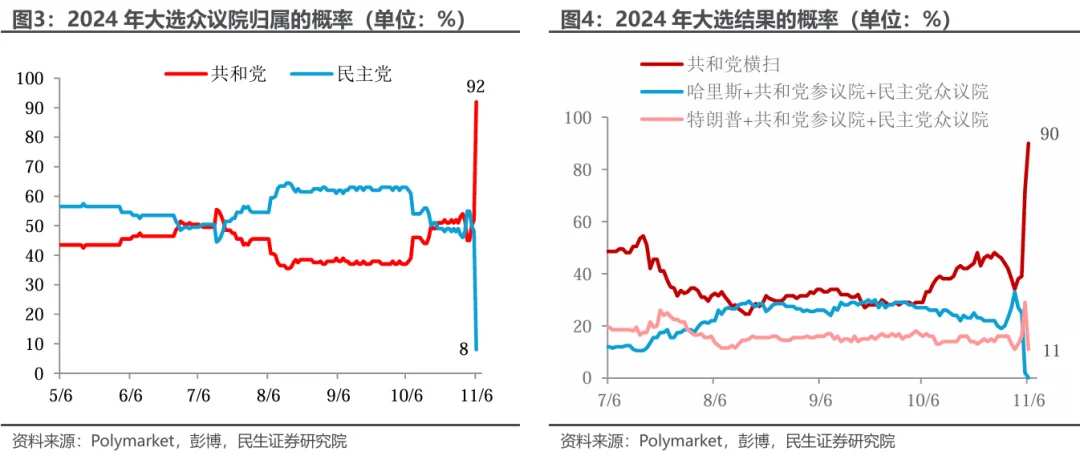

Currently, the Senate is the first to yield results, with the Republicans securing more than half of the seats, as expected. The House of Representatives is still undecided. As of 16:40 on November 6th, Beijing time, the current situation of the 435 seats is: 175 seats for Democrats, 194 seats for Republicans, and 66 seats with results not disclosed. The Polymarket website shows that the probability of the Republican Party winning the House of Representatives has reached 90%.

Minsheng Securities believes that when it comes to Trump's policies, the bank follows two principles: what is said after the election is more important than before the election; actions speak louder than words.

First, pay attention to the newly elected president's victory speech and governing declaration, which may provide clues to the policy sequence for 2025, with executive orders on immigration possibly taking priority.

Second, pay attention to the appointments of the new government. Trump and his transition team may gradually announce the new cabinet candidates from November to December, to be sworn in between February and March next year after Senate approval. Focus on key positions like the Secretary of the Treasury and Trade Representative.

Third, pay attention to the prospects of the Federal Reserve's policies. During Trump's first term, there were frequent verbal interventions with the Federal Reserve. Similar verbal interventions may reoccur next year. In addition, Trump may intervene through a "shadow Federal Reserve" method, for example, nominating a successor to Chairman Powell before his term ends in May 2026, diverting market attention from Powell.

Investors also need to pay attention to the upcoming process, as follows:

The Electoral College in each state of usa will officially vote on December 17. On January 6 next year, Vice President Harris will preside over the Electoral College count and officially announce the election results at the joint session of Congress. On January 20 next year, President-elect Donald Trump and Vice President JD·Vance will be sworn in officially and take office at the White House.

How to find Donald Trump trades?

Mooers can open Futubull > usa Stocks >Investment themesDiscover the Donald Trump concept stocks at a glance!

Editor/Somer