This is a cross-asset trading guide on the USA presidential election.

In 2016, when Donald Trump unexpectedly defeated Hillary, it caused a widely spread anecdote in the global market. At the time, billionaire investor Carl Icahn left the early morning victory party, reportedly placing a $1 billion bet on the stock market. Despite the overnight drop in the stock market, Icahn believed that Trump's election as president would boost Wall Street. He was quickly proven right.

Now, as Americans vote again for two candidates with drastically different policy agendas, traders from Singapore to New York have new opportunities to make huge unexpected profits or suffer painful losses.

Nationwide opinion polls indicate a neck-and-neck competition, but the betting markets recently predicted a clear victory for Trump and his tax cuts and high tariff agenda. The gambling spirit on Wall Street is also active, with support for Trump boosting small-cap stocks, inflation-sensitive rate bets, and once-mocked cryptos. However, with the latest polls showing continued fierce competition, this momentum has lost steam.

Nationwide opinion polls indicate a neck-and-neck competition, but the betting markets recently predicted a clear victory for Trump and his tax cuts and high tariff agenda. The gambling spirit on Wall Street is also active, with support for Trump boosting small-cap stocks, inflation-sensitive rate bets, and once-mocked cryptos. However, with the latest polls showing continued fierce competition, this momentum has lost steam.

Of course, in recent years, from the Brexit referendum in the UK to the 2016 US elections' impact, investors are often misled in major votes. Therefore, if Harris wins on a seemingly less volatile platform for financial markets, the so-called Trump trade may further reverse.

For risk-loving bulls, the elastic US economy and the accommodative Fed policy are reasons for celebration regardless of who takes the White House. At the same time, firms like Citigroup indicate that if this billionaire businessman can return to the White House, whether Trump-sensitive asset prices will soar again is a pending question, as related assets have already surged sharply before Tuesday's vote.

Another major variable is the partisan composition of both houses of Congress, which will significantly affect the White House's legislative agenda, complicating investment strategies premised on fiscal policy and trends in industries like infrastructure and clean energy.

Chief Investment Officer Alex Chaloff of Bernstein Private Wealth Management stated, "There are not just two possibilities for the outcome, there are six possibilities, what you are seeing is just one," "Everything is still pending."

At the same time, a controversial election is a major uncertainty factor, Jean Boivin from BlackRock Investment Institute warns that investors are not adequately prepared.

After an unprecedentedly disruptive election cycle in American history, here are the assets to watch.

Stocks

Following a U.S. election, the stock market typically experiences a strong rebound once investors have a clearer understanding of the policy direction. However, expectations for such a rebound this time are not high. Despite a drop in the S&P 500 index benchmarks last month, the index has risen by 20% so far this year, with tech stock-driven excitement leading to high stock market valuations.

Citi's equity trading strategy director, Stuart Kaiser, stated that options data suggests traders expect the index to fluctuate by 1.8% on Wednesday. Fluctuations in individual stocks and sectors may be most pronounced, similar to the situation during this election season so far.

Goldman Sachs tracks two indices related to investments tied to the Democratic and Republican victories. After steadily rising since late September, a basket of stocks related to a Trump victory started to fade in October, while a basket of stocks related to a Harris victory remained strong.

"Considering the policy differences between the two candidates, this will be one of the easiest investment results in history," said David Wagner, portfolio manager at Aptus Capital Advisors. "Even if there is not much volatility in the U.S. stock market overall after the election, there could be significant fluctuations in the various sectors and industries of the S&P 500 index."

Both the heavily regulated industries of banking and healthcare companies may face increased scrutiny during a Harris presidency. If she wins, U.S. regulatory agencies may advance an international banking agreement term. According to the plan announced by the Fed last month, capital requirements for companies like Bank of America, Goldman Sachs, Citi, Wells Fargo, and JPMorgan Chase may increase by 9%. If Trump wins, these efforts may be delayed and significantly softened.

According to Bloomberg Intelligence, if the strengthened subsidies under the Obama healthcare reform expire at the end of next year without extension, health insurance companies like Centene and UnitedHealth are expected to face a $25 billion revenue decline in 2026. Under Harris's leadership, these subsidies may be extended, while Trump had once promised to repeal the law. Pharmaceutical companies may also face greater regulatory pressure from the Harris administration as she proposes setting a $2,000 annual limit on out-of-pocket costs for prescription drugs.

Elsewhere, if Lina Khan, who focuses on antitrust, continues to serve as the chair of the Federal Trade Commission, the deals under Harris's leadership may face challenges. The concentration of large tech companies may also continue to be scrutinized.

The positive stance of the Democrats on clean energy issues means that Harris's victory is good news for industry companies, including electric car manufacturers like Rivian Automotive Inc. and Lucid Group Inc., electric vehicle charging network operator ChargePoint Holdings Inc., Beam Global, Blink Charging Co., and battery manufacturers.

Stocks of solar companies like First Solar Inc., Sunrun Inc., and Enphase Energy Inc. are expected to perform better under Harris's leadership as well. Meanwhile, Trump has stated that he will end Biden's electric vehicle policy on his 'first day' in office.

However, regardless of the election results, Tesla may ultimately emerge as a winner. Biden's Inflation Reduction Act will drive the entire electric vehicle ecosystem, so Harris's victory will benefit the company. Additionally, Elon Musk's verbal support for Trump leaves an impression that investors may interpret a Republican victory as good news for his company.

Traditional energy companies are seen as beneficiaries of 'Trump 2.0' as he pledged to lift restrictions on domestic oil production. Noteworthy stocks include Baker Hughes, Exxon Mobil, ConocoPhillips, Occidental Petroleum, Williams, Halliburton, Devon Energy, and Chevron.

Another clear Trump beneficiary indicator is the former president's social media company, Trump Media & Technology Group.

During the campaign, tariffs have been one of the most discussed policies. Bloomberg Intelligence estimates a 70% chance of tariffs being imposed under any elected US president. However, under the self-proclaimed 'Tariff Man' Trump, the risks will be higher. Companies to watch include sportswear manufacturers like Nike and Adidas, as most of their footwear products come from China, as well as Lululemon Athletica Inc. and Allbirds Inc., with the latter known for its supply chain from Vietnam.

Given Trump's hardline protectionist stance, small cap stocks mainly focused on domestic business will benefit more from Trump's victory.

"Investors expect that in addition to the big gains made by the Republican Party, large-cap stocks will lead under all election outcomes. In the event of Republican domination of the White House and Congress, investors believe small-cap stocks will lead," wrote Dennis DeBusschere, co-founder and chief market strategist of 22V Research, in a recent report to clients.

Bonds

Wall Street's recent predictions on interest rates and economic trends have been mixed. However, this has not deterred a group of financial speculators from going all in on inflation trades in recent weeks, as the gambling market shows a significantly increased chance of Trump winning.

In this view, a big Republican win is seen as a clear threat to bond buyers. In this scenario, Trump will advance his tax and tariff plans, expand the fiscal deficit, and rekindle inflation. For example, JPMorgan's strategists pointed out that under similar conditions, this outcome would lead to higher yields on 10-year U.S. bonds.

"The market is most concerned about the 'red wave' and the lack of checks and balances," said John Flahive, Head of Fixed Income at BNY Mellon Wealth Management in New York.

On the other hand, a Harris victory in a divided Congress may trigger a relief rally in bonds, as it increases the likelihood of a political stalemate that could control government spending.

Events unfolding under other circumstances are almost contentious. JPMorgan strategists predict that a big Democratic win will lead to more government spending, pushing up U.S. bond yields. Conversely, Royal Bank of Canada Capital's view is that this scenario is most beneficial for bonds, as it will result in increased corporate taxes, exacerbate a 'less business-friendly' environment, and dampen risk appetite.

What makes this analysis tricky is that investors can hardly figure out how much the bond market has already factored in Trump's potential victory.

Since the Fed's rate cut in September, the yield on the 10-year U.S. Treasury has soared by over half a percentage point to 4.3%. However, despite the significant surge in U.S. bond yields occurring during heightened competition, it also coincides with a series of better-than-expected U.S. economic data releases, complicating expectations for a significant future rate cut by the Fed.

Bond investors – typically seen as savvy investors rather than belligerent stock traders – could easily make mistakes. If the recent bond sell-off (the most severe in two years in October) was mainly driven by robust economic data, there could be further downside in the event of a Trump victory.

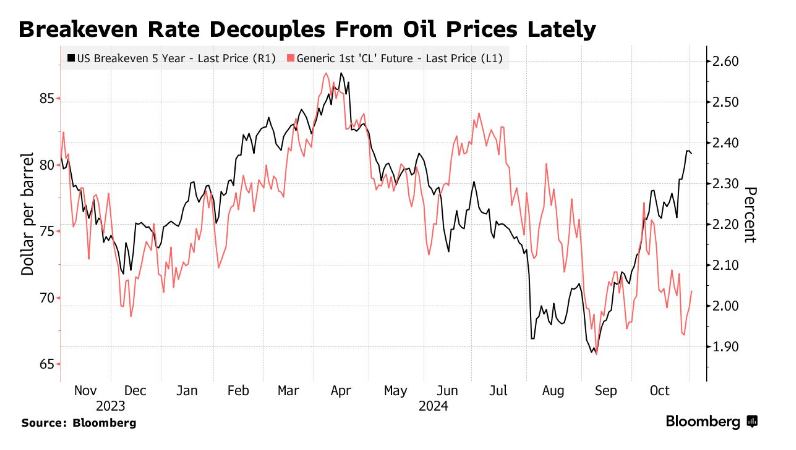

Another key indicator to watch is the so-called breakeven rate, which measures investors' inflation expectations. A Trump victory is widely believed to boost inflation. The five-year breakeven inflation rate, the difference between the yield on five-year inflation-linked bonds and U.S. Treasuries, has risen from under 1.9% in early September to 2.4%.

Some market observers believe that U.S. bond yields may rise further as neither candidate has shown a willingness to rein in a runaway government debt. The bond sell-off in October has reignited discussions about the return of the “bond vigilantes,” a phrase coined by Wall Street veteran Ed Yardeni in the 1980s to describe investors selling government debt in protest against fiscal profligacy.

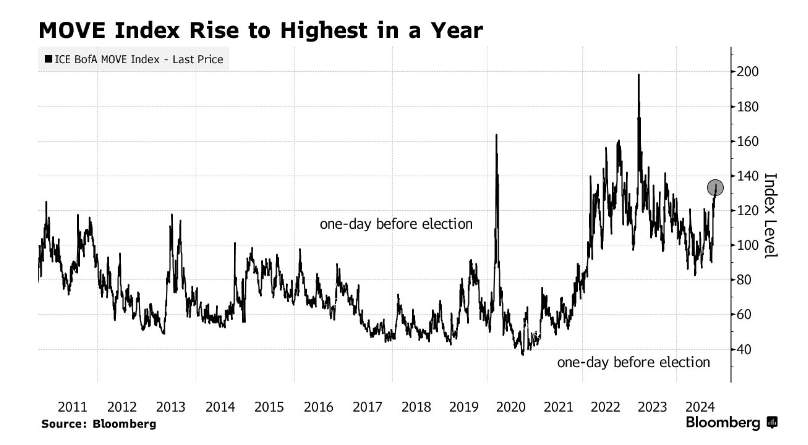

Regardless of the outcome, one thing is certain: investors in the $28 trillion U.S. Treasury market are expecting turbulence in the bond market. The ICE BofA Move Index is the “fear gauge” of the bond market, its trading levels being twice those of the days before the 2020 and 2016 elections.

Currency

Wall Street strategists generally believe that Trump's tariff plan will support the US dollar in the short term and damage currencies such as the Mexican peso.

At JPMorgan, analysts led by Meera Chandan estimate that a Republican landslide, along with tariffs and larger fiscal spending, will boost the dollar by 7% on a trade-weighted basis and weaken the euro against the dollar to near parity. On the other hand, JPMorgan states that a Harris victory could lead to a comprehensive decline in the dollar in the short term, with the elimination of tariff threats driving a rebound in the euro.

Implied volatility in options pricing indicates that the Mexican peso, the Renminbi, and the euro are among the most sensitive currencies to the US election. The expected indicator of future peso price volatility in the next week is currently at its highest level in over four years.

Cryptos

At first glance, the narrative of cryptocurrencies seems simple: Bitcoin is expected to benefit from a Trump victory. He vows to consider cryptocurrencies as strategic reserve assets and appoints regulators friendly to the industry. However, a Harris victory may not necessarily have a negative impact on the industry.

In the short term, the optimistic sentiment of crypto investors may have already been partially digested by the market. The trading price of Bitcoin is not far from its historical high of $73,798, with exchange-traded funds (ETFs) tracking it seeing the largest inflow of funds to date. Coupled with the fact that the election remains highly contested, the demand for hedging in the crypto options market has significantly increased.

In recent weeks, the implied volatility of put options on Bitcoin, a measure of the options' prices, has surged significantly as traders paid higher prices for contracts that give them the right to sell Bitcoin at a fixed price.

Furthermore, option traders are expected to make substantial profits in the future. According to data compiled by the largest crypto options exchange Deribit, for contracts expiring in March, the largest open interest contracts are centered around $100,000 and $110,000. This type of position may reflect the fact that while Trump has solidified his support for crypto, Harris has also implied that she will not continue Biden administration's positive clampdown on the industry.

"Regardless of the next administration, there will be a very different approach to regulating cryptocurrencies, which has always been the biggest obstacle before," said Chris Rhine, Head of Liquid Strategies at Galaxy Digital.

全美范围的民意调查表明,这是一场势均力敌的竞争,但博彩市场最近预测特朗普及其减税和高额关税议程将取得明显胜利。华尔街的赌博精神也很活跃,支持特朗普的势头提振了小盘股、对通胀敏感的利率押注和一度被嘲笑的加密货币。不过,随着最新民调显示竞争一如既往地激烈,这种势头又失去了动力。

全美范围的民意调查表明,这是一场势均力敌的竞争,但博彩市场最近预测特朗普及其减税和高额关税议程将取得明显胜利。华尔街的赌博精神也很活跃,支持特朗普的势头提振了小盘股、对通胀敏感的利率押注和一度被嘲笑的加密货币。不过,随着最新民调显示竞争一如既往地激烈,这种势头又失去了动力。