Investors with a lot of money to spend have taken a bullish stance on Pinterest (NYSE:PINS).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with PINS, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with PINS, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 13 options trades for Pinterest.

This isn't normal.

The overall sentiment of these big-money traders is split between 76% bullish and 23%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $25,625, and 12, calls, for a total amount of $423,451.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $32.0 and $45.0 for Pinterest, spanning the last three months.

Analyzing Volume & Open Interest

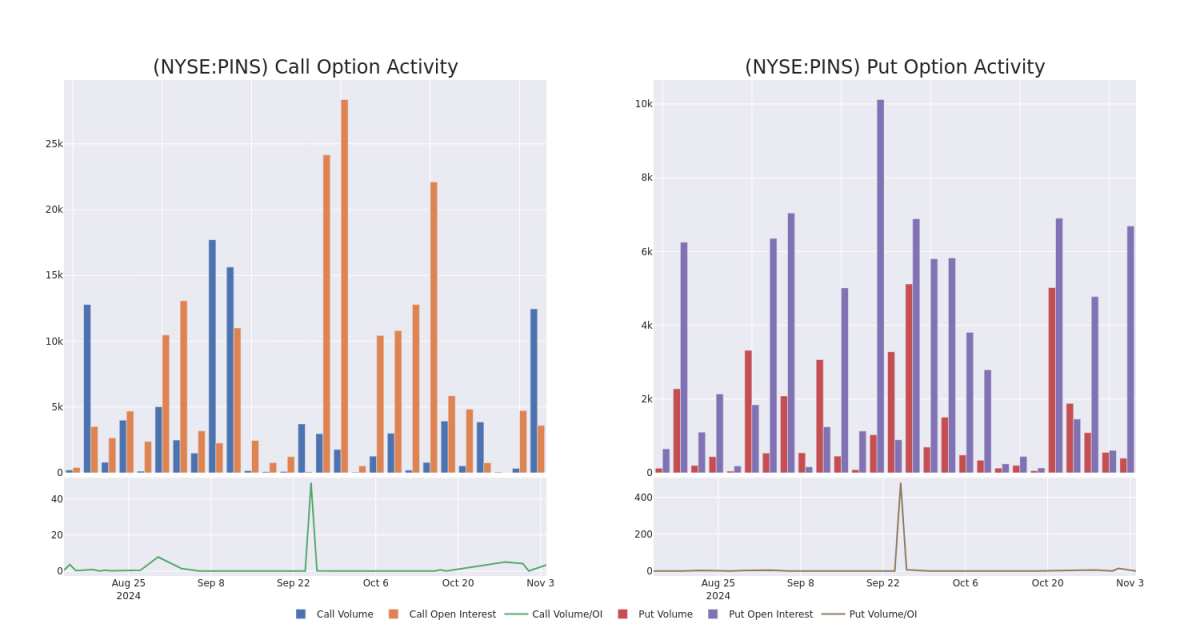

In today's trading context, the average open interest for options of Pinterest stands at 2413.25, with a total volume reaching 8,145.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Pinterest, situated within the strike price corridor from $32.0 to $45.0, throughout the last 30 days.

Pinterest Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PINS | CALL | SWEEP | BEARISH | 11/08/24 | $1.15 | $1.1 | $1.15 | $35.50 | $53.0K | 104 | 762 |

| PINS | CALL | SWEEP | BULLISH | 11/08/24 | $2.76 | $2.73 | $2.76 | $32.00 | $41.3K | 475 | 156 |

| PINS | CALL | SWEEP | BULLISH | 11/08/24 | $1.13 | $1.12 | $1.13 | $35.50 | $37.1K | 104 | 1.2K |

| PINS | CALL | SWEEP | BULLISH | 01/16/26 | $3.4 | $3.35 | $3.4 | $45.00 | $34.0K | 4.1K | 1.0K |

| PINS | CALL | SWEEP | BULLISH | 01/16/26 | $3.4 | $2.88 | $3.4 | $45.00 | $34.0K | 4.1K | 800 |

About Pinterest

Pinterest is an online product and idea discovery platform that helps users gather ideas on everything from cooking recipes to travel destinations. Founded in 2010, the platform consists of a largely female audience, which accounts for roughly two thirds of its nearly 500 million monthly active users. The company generates revenue by selling digital ads and is now rolling out more in-platform e-commerce features. About 20% of users reside in the US and Canada, but the region accounted for about 80% of revenue in 2023.

Following our analysis of the options activities associated with Pinterest, we pivot to a closer look at the company's own performance.

Current Position of Pinterest

- Trading volume stands at 1,662,589, with PINS's price up by 1.89%, positioned at $32.89.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 2 days.

Expert Opinions on Pinterest

1 market experts have recently issued ratings for this stock, with a consensus target price of $45.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Keybanc persists with their Overweight rating on Pinterest, maintaining a target price of $45.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.