Investors with a lot of money to spend have taken a bearish stance on Upstart Hldgs (NASDAQ:UPST).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with UPST, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with UPST, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 21 uncommon options trades for Upstart Hldgs.

This isn't normal.

The overall sentiment of these big-money traders is split between 47% bullish and 52%, bearish.

Out of all of the special options we uncovered, 10 are puts, for a total amount of $570,583, and 11 are calls, for a total amount of $626,934.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $40.0 and $62.5 for Upstart Hldgs, spanning the last three months.

Insights into Volume & Open Interest

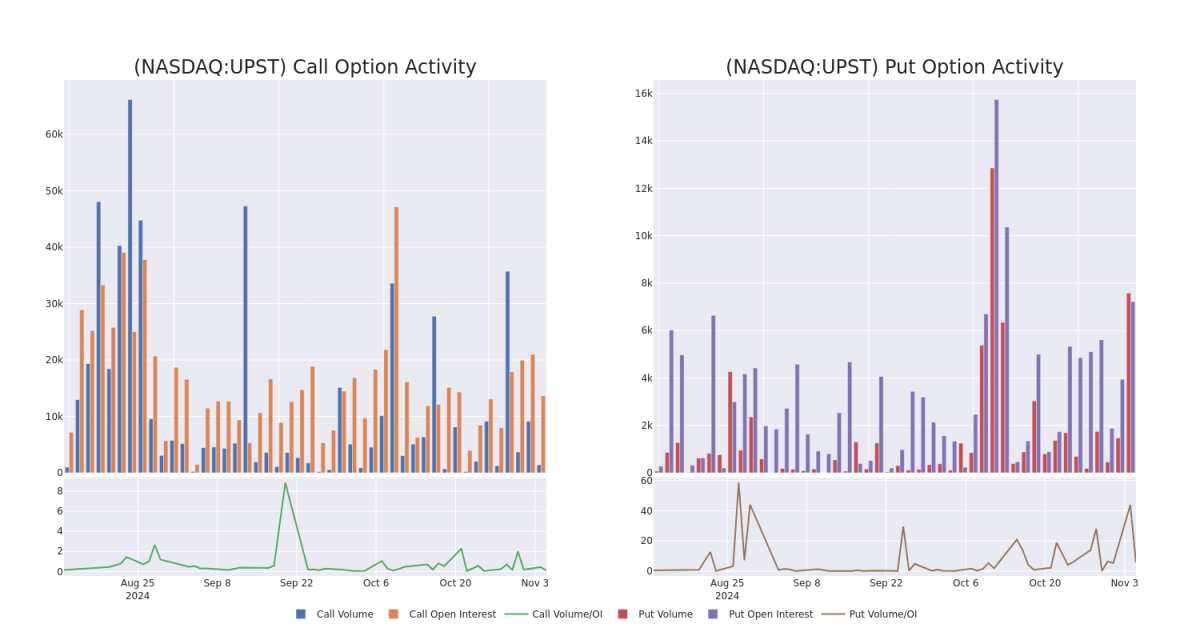

In terms of liquidity and interest, the mean open interest for Upstart Hldgs options trades today is 1489.5 with a total volume of 8,988.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Upstart Hldgs's big money trades within a strike price range of $40.0 to $62.5 over the last 30 days.

Upstart Hldgs 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UPST | PUT | SWEEP | BEARISH | 11/08/24 | $2.93 | $2.92 | $2.92 | $45.00 | $188.9K | 4.5K | 732 |

| UPST | CALL | TRADE | BULLISH | 11/15/24 | $6.9 | $6.85 | $6.9 | $50.00 | $175.9K | 1.7K | 327 |

| UPST | CALL | SWEEP | BULLISH | 11/08/24 | $4.9 | $4.85 | $4.85 | $50.00 | $95.7K | 2.1K | 198 |

| UPST | PUT | SWEEP | BULLISH | 11/08/24 | $4.3 | $4.15 | $4.15 | $49.00 | $75.9K | 1.2K | 466 |

| UPST | CALL | TRADE | BEARISH | 12/20/24 | $8.6 | $8.55 | $8.55 | $50.00 | $68.4K | 3.1K | 126 |

About Upstart Hldgs

Upstart Holdings Inc provides credit services. The company provides a proprietary, cloud-based, artificial intelligence lending platform. The platform aggregates consumer demand for loans and connects it to the network of Upstart AI-enabled bank partners. Upstart's platform includes personal loans, automotive retail and refinance loans, home equity lines of credit and small dollar loans.

Current Position of Upstart Hldgs

- Trading volume stands at 184,533, with UPST's price up by 2.64%, positioned at $48.48.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 2 days.

What Analysts Are Saying About Upstart Hldgs

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $45.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Showing optimism, an analyst from Wedbush upgrades its rating to Neutral with a revised price target of $45.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.