Marriott International (NASDAQ:MAR) reported worse-than-expected third-quarter financial results and issued FY24 adjusted EPS guidance below estimates on Monday.

The company reported a third-quarter adjusted EPS of $2.26, missing the street view of $2.31. Quarterly sales of $6.26 billion marginally missed the analyst consensus of $6.27 billion.

CEO Anthony Capuano highlighted Marriott's strong quarter, noting solid net room and fee growth, active development, and a 3% rise in global RevPAR. He added that third-quarter international RevPAR increased by 5.4%, driven by substantial growth in APEC and EMEA regions, steady domestic and cross-border demand, and strong ADR gains.

Marriott expects fourth-quarter 2024 gross fee revenues to range between $1.29 billion and $1.31 billion, with adjusted EPS projected to be $2.31-$2.39, compared to a $2.31 estimate.

Marriott expects fourth-quarter 2024 gross fee revenues to range between $1.29 billion and $1.31 billion, with adjusted EPS projected to be $2.31-$2.39, compared to a $2.31 estimate.

Marriott projects full-year 2024 adjusted EPS of $9.19-$9.27 (prior $9.23-$9.40), compared to the $9.36 estimate, with gross fee revenues of $5.126 billion-$5.146 billion (prior $5.13 billion-$5.18 billion).

Marriott shares fell 1.6% to close at $256.43 on Monday.

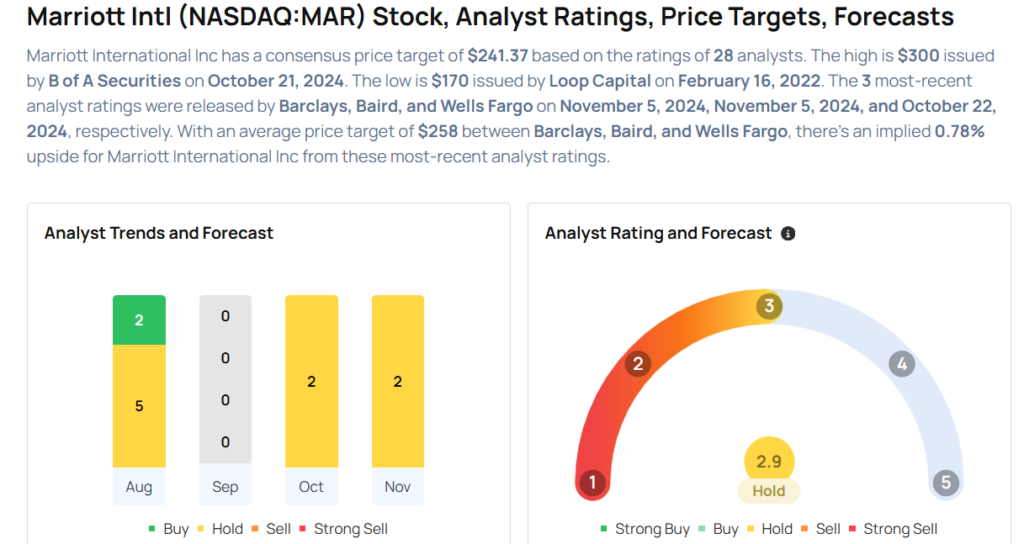

These analysts made changes to their price targets on Marriott following earnings announcement.

- Baird analyst Michael Bellisario maintained Marriott Intl with a Neutral and raised the price target from $258 to $264.

- Barclays analyst Brandt Montour maintained the stock with an Equal-Weight and raised the price target from $240 to $249.

Considering buying MAR stock? Here's what analysts think:

Read More:

- Top 3 Consumer Stocks That May Keep You Up At Night This Quarter