The most oversold stocks in the health care sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

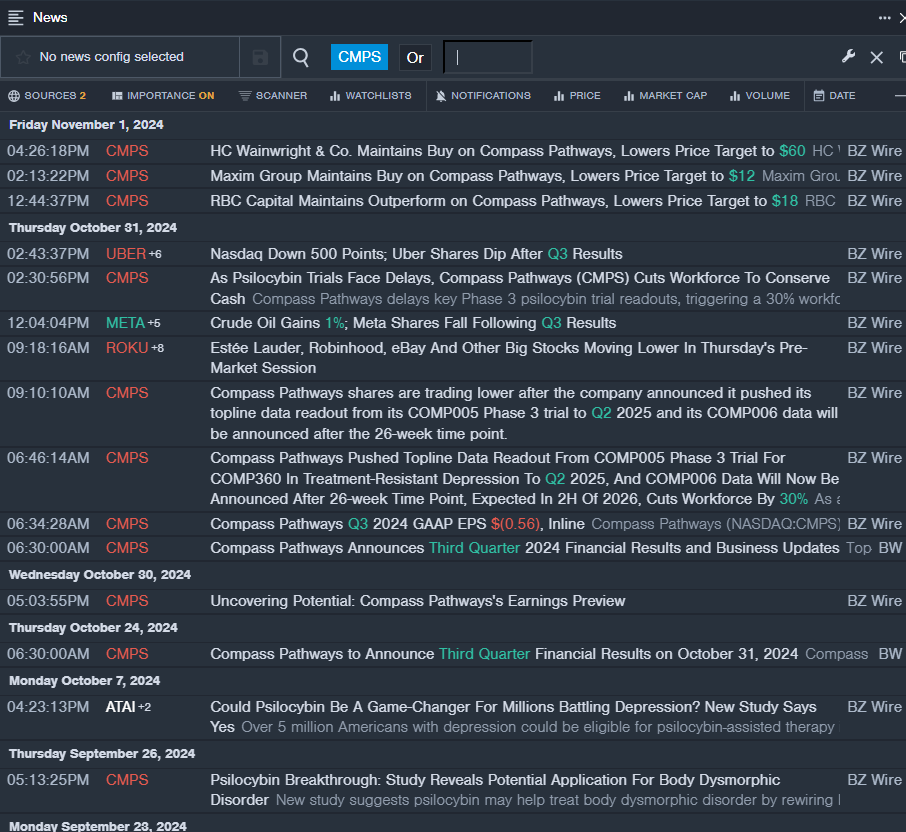

Compass Pathways PLC (NASDAQ:CMPS)

- On Oct. 31, Compass Pathways announced it pushed its topline data readout from its COMP005 Phase 3 trial to Q2 2025 and its COMP006 data will be announced after the 26-week time point. The company's stock fell around 26% over the past five days and has a 52-week low of $4.05.

- RSI Value: 23.17

- CMPS Price Action: Shares of Compass Pathways fell 1.5% to close at $4.68 on Monday.

- Benzinga Pro's real-time newsfeed alerted to latest CMPS news.

Sight Sciences Inc (NASDAQ:SGHT)

- Sight Sciences will report financial results for the third quarter ended Sept. 30, after the market close on Thursday, Nov. 7. The company's stock fell around 18% over the past month and has a 52-week low of $1.58.

- RSI Value: 27.02

- SGHT Price Action: Shares of Sight Sciences fell 10.6% to close at $4.66 on Monday.

- Benzinga Pro's charting tool helped identify the trend in SGHT stock.

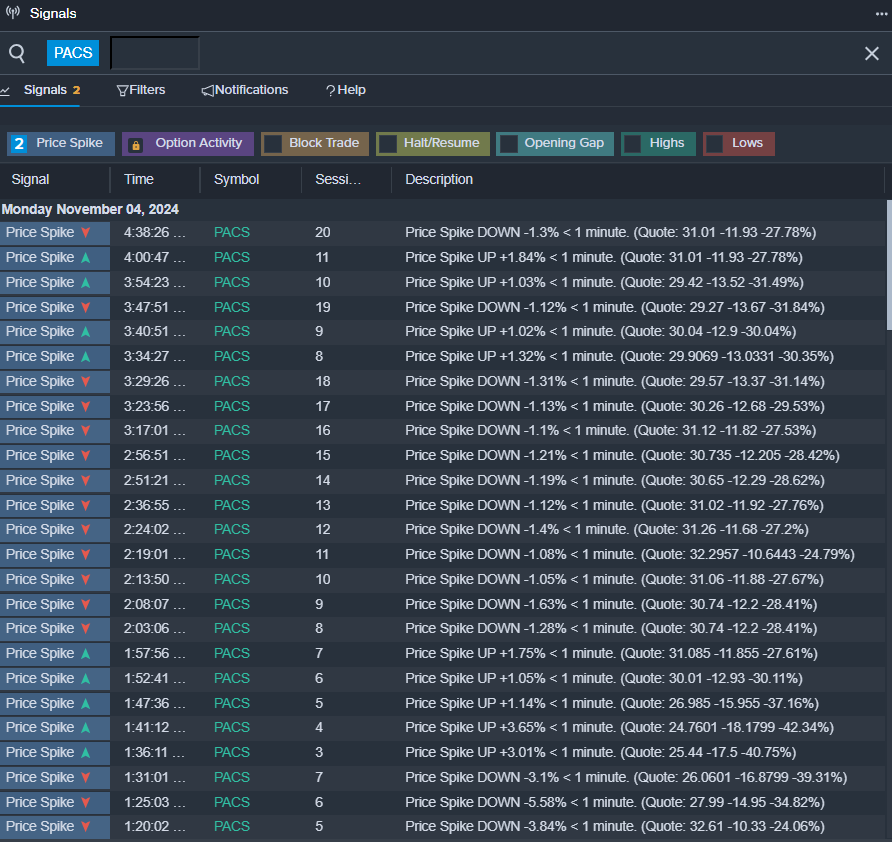

PACS Group Inc (NYSE:PACS)

- PACS Group shares fell sharply on Monday, following the publication of an explosive short report by activist short seller Hindenburg Research. The company's stock fell around 25% over the past five days and has a 52-week low of $22.30.

- RSI Value: 13.66

- PACS Price Action: Shares of PACS Group fell 27.8% to close at $31.01 on Monday.

- Benzinga Pro's signals feature notified of a potential breakout in PACS shares.

Read More:

Read More:

- Dow Tumbles 250 Points As Investors Brace For High-Stakes Presidential Election: Greed Index Enters 'Fear' Zone