①Multiple financial stocks were bought by institutions and speculative funds, with First Capital receiving 0.118 billion in institutional purchases and 0.272 billion in purchases from the Orient Shanghai Yuanshen Road Business Department of Dongfang Securities. ②CPO concept stock Cambridge Technology was bought by three quantitative fund seats, with a total purchase amount exceeding 0.23 billion.

The total turnover of Shanghai and Shenzhen Stock Connect today was 263.665 billion, with Citic Securities and Contemporary Amperex Technology ranking first in the turnover of Shanghai and Shenzhen Stock Connect respectively. In terms of sector main funds, the main funds inflow of the electronic sector ranked first. In terms of ETF turnover, the turnover of China Southern CSI 1000 ETF Index ETF (159845) increased by 422% month-on-month. As for futures positions, major contracts of the four major futures increased significantly on both long and short sides. In terms of the dragon and tiger list, SGSG Science&Technology was bought by institutions for over 50 million, with institutional buying for two consecutive days; Tianjin Printronics Circuit Corporation was sold by institutions for over 60 million; spic industry-finance holdings were sold by institutions for over 50 million; Cambridge Technology was bought by 0.16 billion from the Orient Shanghai Yuanshen Road Business Department of Dongfang Securities, while being sold by two first-tier speculative fund seats; First Capital received nearly 100 million in buying from a quantitative seat.

I. Top ten trading volumes of the Shanghai-Hong Kong Stock Connect

Today, the total turnover of Shanghai Stock Connect was 125.38 billion, and the total turnover of Shenzhen Stock Connect was 138.285 billion.

Today, the total turnover of Shanghai Stock Connect was 125.38 billion, and the total turnover of Shenzhen Stock Connect was 138.285 billion.

Looking at the top ten stocks by turnover on the Shanghai Stock Connect, Citic Securities ranked first; Kweichow Moutai and Chongqing Sokon Industry Group Stock ranked second and third respectively.

Looking at the top ten stocks by turnover on the Shanghai Stock Connect, Citic Securities ranked first; Kweichow Moutai and Chongqing Sokon Industry Group Stock ranked second and third respectively.Looking at the top ten trading stocks in HK->SZ Stock Connect, Contemporary Amperex Technology ranked first; East Money Information and Wuliangye Yibin ranked second and third respectively.

II. Bulk orders of individual stocks in different sectors

In terms of sector performance, military industry, software, internet finance, and semiconductors sectors led the gains, with no sectors experiencing declines.

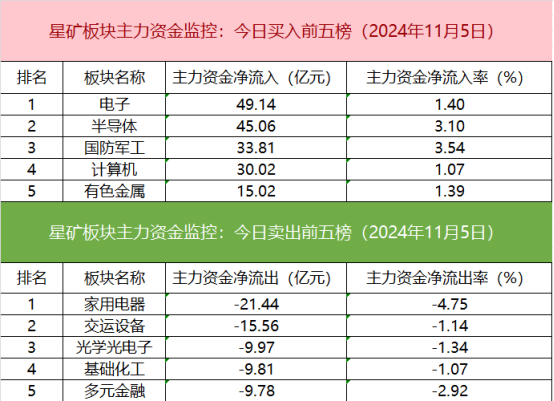

From the fund monitoring data of the main sector, the electronics sector has the highest net inflow of main funds.

From the fund monitoring data of the main sector, the electronics sector has the highest net inflow of main funds.In terms of sector fund outflows, the household appliances sector has the highest net outflow of main funds.

From the main fund monitoring data of individual stocks, the sectors of the top ten stocks with net inflows of main funds are quite mixed, with Talkweb Information System leading in net inflow.

From the main fund monitoring data of individual stocks, the sectors of the top ten stocks with net inflows of main funds are quite mixed, with Talkweb Information System leading in net inflow.The sectors of the top ten stocks with main fund outflows are quite diversified, with shijiazhuang changshan beiming technology ranking first in net outflows.

III. ETF trading

Looking at the top ten ETFs by trading volume, E Fund CSI Hongkong Bond Investment Theme ETF (513090) ranks first in trading volume; Yifangda GEM ETF (159915) ranks second in trading volume.

Looking at the top ten ETFs by trading volume, E Fund CSI Hongkong Bond Investment Theme ETF (513090) ranks first in trading volume; Yifangda GEM ETF (159915) ranks second in trading volume. From the top ten ETFs in terms of month-on-month growth in trading volume, several broad-based index ETFs are among the top ten, with China Southern CSI 1000 ETF Index ETF (159845) ranking first with a month-on-month growth of 422%, and China Securities 500 ETF Huaxia (512500) ranking second with a month-on-month growth of 256%.

From the top ten ETFs in terms of month-on-month growth in trading volume, several broad-based index ETFs are among the top ten, with China Southern CSI 1000 ETF Index ETF (159845) ranking first with a month-on-month growth of 422%, and China Securities 500 ETF Huaxia (512500) ranking second with a month-on-month growth of 256%.IV. Futures positions

Both the long and short positions of the four major stock index futures main contracts have significantly increased their positions, with IH contract's long and short positions increasing approximately the same amount; the short positions of IF, IC, and IM contracts have more significant increases.

Both the long and short positions of the four major stock index futures main contracts have significantly increased their positions, with IH contract's long and short positions increasing approximately the same amount; the short positions of IF, IC, and IM contracts have more significant increases.V. Dragon-Tiger List

1. Institutions

In terms of institutional buying activities on the daily dragon tiger list today, Internet finance concept stock sgsg science&technology received institutional purchases exceeding 50 million, with institutional buying for two consecutive days; first capital received institutional buying of 0.118 billion.

In terms of institutional buying activities on the daily dragon tiger list today, Internet finance concept stock sgsg science&technology received institutional purchases exceeding 50 million, with institutional buying for two consecutive days; first capital received institutional buying of 0.118 billion.On the selling side, PCB concept stock tianjin printronics circuit corporation was sold by institutions for over 60 million; restructuring concept stock spic industry-finance holdings was sold by institutions for over 50 million.

2. Institutional investors

The activity of first-tier private equity funds has slightly decreased, with a decrease in individual stock trading volume. Internet finance concept stock shenzhen ysstech info-tech received purchases from three first-tier private equity funds, with a total purchase amount exceeding 0.2 billion; first capital received purchases from two first-tier private equity funds, including orient's shanghai yuanshen road business department with a purchase of 0.272 billion; pcb concept stock cig shanghai received purchases from orient's shanghai yuanshen road business department amounting to 0.16 billion, while being sold by two first-tier private equity funds at the same time.

The activity of first-tier private equity funds has slightly decreased, with a decrease in individual stock trading volume. Internet finance concept stock shenzhen ysstech info-tech received purchases from three first-tier private equity funds, with a total purchase amount exceeding 0.2 billion; first capital received purchases from two first-tier private equity funds, including orient's shanghai yuanshen road business department with a purchase of 0.272 billion; pcb concept stock cig shanghai received purchases from orient's shanghai yuanshen road business department amounting to 0.16 billion, while being sold by two first-tier private equity funds at the same time. Quantitative fund activity is relatively high, with cig shanghai receiving purchases from three quantitative fund seats, with a total purchase amount exceeding 0.23 billion; first capital received purchases from a quantitative fund seat close to one hundred million.

Quantitative fund activity is relatively high, with cig shanghai receiving purchases from three quantitative fund seats, with a total purchase amount exceeding 0.23 billion; first capital received purchases from a quantitative fund seat close to one hundred million.

今日沪股通总成交金额为1253.8亿,深股通总成交金额为1382.85亿。

今日沪股通总成交金额为1253.8亿,深股通总成交金额为1382.85亿。