Despite an already strong run, Talkspace, Inc. (NASDAQ:TALK) shares have been powering on, with a gain of 27% in the last thirty days. The last month tops off a massive increase of 103% in the last year.

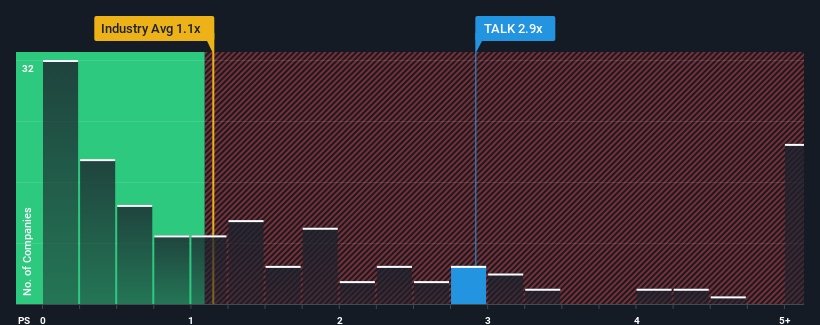

After such a large jump in price, you could be forgiven for thinking Talkspace is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.9x, considering almost half the companies in the United States' Healthcare industry have P/S ratios below 1.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

What Does Talkspace's P/S Mean For Shareholders?

Recent times have been advantageous for Talkspace as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Talkspace will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Talkspace?

Talkspace's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Talkspace's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 31% gain to the company's top line. The latest three year period has also seen an excellent 65% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 22% per year during the coming three years according to the three analysts following the company. That's shaping up to be materially higher than the 7.4% per year growth forecast for the broader industry.

In light of this, it's understandable that Talkspace's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Talkspace's P/S Mean For Investors?

The large bounce in Talkspace's shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Talkspace shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for Talkspace that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.