Supply shortages are expected to drive prices strongly upward.

Since June this year, the price of germanium has continued to rise, with the current quote reaching about 18,700 yuan/kg, with a cumulative increase of over 90% so far this year.

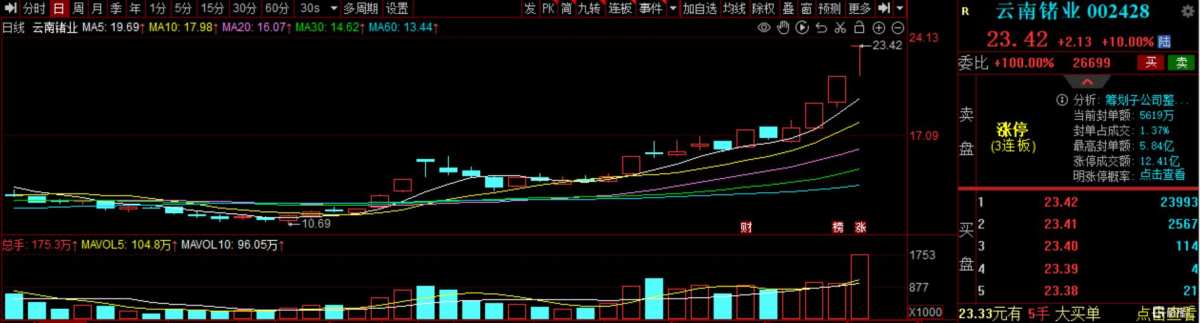

Benefiting from this, the industry leader Yunnan Lincang Xinyuan Germanium Industry's quarterly performance soared 15 times, with the company's stock price hitting the limit up for three consecutive trading days. During the continuous trading halt, the company's stock price rose by 33.14%, with the latest A-share market value reaching 15.296 billion yuan.

Third-quarter net income exceeds the sum of the past 10 years.

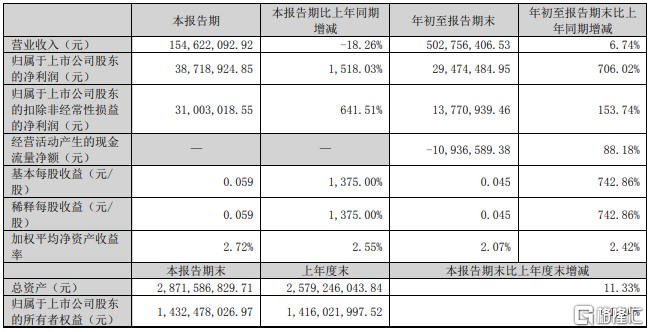

On October 27, Yunnan Lincang Xinyuan Germanium Industry released its third-quarter report, showing that the company achieved operating income of 0.503 billion yuan in the first three quarters, a year-on-year increase of 6.74%; net profit attributable to shareholders of the listed company was 29.4745 million yuan, a year-on-year increase of 706.02%. Among them, the net profit attributable to the mother in the third quarter was 38.7189 million yuan, a year-on-year increase of 1518.03%.

On October 27, Yunnan Lincang Xinyuan Germanium Industry released its third-quarter report, showing that the company achieved operating income of 0.503 billion yuan in the first three quarters, a year-on-year increase of 6.74%; net profit attributable to shareholders of the listed company was 29.4745 million yuan, a year-on-year increase of 706.02%. Among them, the net profit attributable to the mother in the third quarter was 38.7189 million yuan, a year-on-year increase of 1518.03%.

According to statistics, the total net profit attributable to the mother in the past 10 years is approximately 22.19 million yuan. This also means that the company's net profit in Q3 this year has exceeded the sum of the past ten years.

Yunnan Lincang Xinyuan Germanium Industry stated that the sharp increase in performance in this period was mainly due to the increase in gross margin of its main products:

On one hand, changes in product selling prices drove an increase in operating income by 31.7648 million yuan compared to the same period last year. In the first three quarters of this year, the selling prices of compound semiconductor materials, fiber-grade germanium products, and material-grade germanium products increased compared to the same period last year, while the selling prices of infrared-grade germanium products and photovoltaic-grade germanium products decreased.

On the other hand, changes in unit manufacturing costs led to a year-on-year decrease in operating costs by 37.1677 million yuan, with the unit costs of infrared-grade germanium products, fiber-grade germanium products, and photovoltaic-grade germanium products decreasing, and the unit costs of compound semiconductor materials and material-grade germanium products increasing.

Currently, germanium has been included in the strategic reserve resources of multiple countries. Bohai Securities pointed out that global germanium production is mainly concentrated in China and Russia, with China being the largest producer of germanium worldwide. In 2023, germanium was included in China's list of strategic critical minerals.

Overall, the supply of germanium is relatively rigid, and the price of germanium has considerable elasticity; with demand growth, the central price of germanium is expected to rise. It is estimated that by 2026, the global supply and demand gap of metal germanium will expand to 22.6 tons, and the price of germanium is expected to run strongly.

Planning for the integration and capital increase of subsidiaries

On the evening of November 3, Yunnan Lincang Xinyuan Germanium Industry issued an announcement on the abnormal fluctuations in stock trading, and also revealed important recent information about the company.

The announcement stated that the company is planning to integrate its Zhongke Xinyuan and Xinyao companies, while Xinyao Company is also considering introducing domestic industrial investment funds through capital increase and share expansion as new investors.

The integration method is for all shareholders of Zhongke Xinyuan to increase the capital of Xinyao Company by pricing all their equity based on net assets, after which Zhongke Xinyuan will become a wholly-owned subsidiary of Xinyao Company. The company's control over these two companies remains unchanged, the scope of consolidation remains unchanged, and the financial situation will not be significantly affected by this capital increase, which does not constitute a major asset restructuring and has entered the board of directors' review stage.

In another development, Xinyao Company is also planning to introduce new investors through capital increase and share expansion, with the intended investors being domestic industrial investment funds.

Currently, the specific content of the capital increase and share expansion transaction scheme has not been finalized, and commercial negotiations are ongoing. Apart from confidentiality agreements, the company has not yet signed any cooperation agreements with the intended investors. This matter will not affect the company's controlling interest in Xinyao Company, and the scope of consolidated financial statements will remain unchanged.

Industry insiders point out that introducing new investors can not only bring new financial support to the company but also introduce advanced management expertise and technology, further enhancing the company's competitiveness. The intended investors are relevant domestic industrial investment funds, indicating market confidence in Yunnan Lincang Xinyuan Germanium Industry.

In the announcement, Yunnan Lincang Xinyuan Germanium Industry also disclosed the situation of price increases for its products.

From early June to the end of October 2024, due to short-term market supply and demand changes, the prices of the company's main product, grade Ge products (mainly polycrystalline Ge ingots), rose rapidly. According to publicly available information from Asia Metal, the average quote for polycrystalline Ge ingots (average of highest and lowest prices) increased from 9,900 yuan/kg at the beginning of June to 18,700 yuan/kg, showing a significant increase in the short term.

Citic Sec pointed out that this year's Ge prices have risen rapidly mainly due to factors such as the environmental pressures leading to production cuts and suspensions in some lead-zinc smelters causing Ge supply shortages, intensified geopolitical conflicts driving demand growth for military infrared devices, and the rapid development of the satellite internet industry.

Future native germanium production growth is limited, and the proportion of recycled germanium is expected to continue to increase with technological progress. The global germanium supply in 2024-2026 is expected to be 191.7 tons, 202.5 tons, and 214.3 tons respectively. At the same time, the demand for germanium in areas such as infrared, optical fiber, and satellite is expected to continue to rise. The global germanium demand in 2024-2026 is projected to be 193.9 tons, 219.2 tons, and 257.5 tons, with germanium industry supply gaps of 2.2 tons, 16.7 tons, and 43.2 tons. The supply shortage is expected to drive germanium prices to continue to be strong.

10月27日,云南锗业发布的三季报显示,前三季度公司实现营业收入5.03亿元,同比增长6.74%;归属于上市公司股东的净利润2947.45万元,同比增长706.02%。其中,第三季度归母净利润为3871.89万元,同比增长1518.03%。

10月27日,云南锗业发布的三季报显示,前三季度公司实现营业收入5.03亿元,同比增长6.74%;归属于上市公司股东的净利润2947.45万元,同比增长706.02%。其中,第三季度归母净利润为3871.89万元,同比增长1518.03%。