FX168 Financial News Agency (Asia Pacific) News On Monday, November 4th, the odds of the U.S. November election on the large-scale crypto betting platform Polymarket saw a huge shake-up, with Vice President Kamala Harris's odds soaring to 44%, reaching a short-term high of 47.1%, while former President Donald Trump's odds sharply declined. Chinese on-chain analyst Yu Jin found that a crypto whale bet on Harris winning the election, investing $5 million in Polymarket, causing a strong surge in Harris's odds.

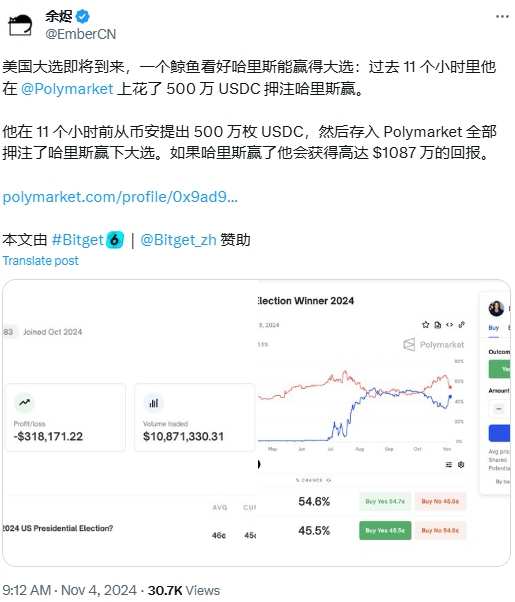

Yu Jin wrote on Monday: "The U.S. election is approaching, and a whale is bullish on Harris winning the election. In the past 11 hours, he has spent $5 million USDC stablecoin on Polymarket to bet on Harris's victory." #USAElection#

(Source: Twitter)

He further explained: "11 hours ago, he withdrew 5 million USDC from Binance, then deposited it all into Polymarket to bet on Harris winning the election. If Harris wins, he will receive a return of up to $10.87 million in USD."

He further explained: "11 hours ago, he withdrew 5 million USDC from Binance, then deposited it all into Polymarket to bet on Harris winning the election. If Harris wins, he will receive a return of up to $10.87 million in USD."

According to the personal account link he provided, the whale's nickname is leier.

(Source: Polymarket)

Previously, a trader claiming to be Théo from France bet on Trump winning on Polymarket, wagering over $30 million, expecting Trump to win with a significant advantage. Théo insists he has no political motives, only aiming to make money, but due to the large sum of money, he can hardly withdraw these bets, facing huge risks.

According to The Wall Street Journal, the mysterious individual who bet over $30 million on Trump winning, said: "I do not intend to manipulate the U.S. election."

The mysterious person who placed a bet of over 30 million USD on Trump's victory hopes the public understands that he has no intention of manipulating the US election. "My goal is just to make money," the man known as Théo said in an interview with a Wall Street Journal reporter earlier last week on Zoom. He introduced himself as a Frenchman who had lived in the USA and previously worked as a trader in multiple banks.

Théo's huge bet on Polymarket has attracted widespread attention, although the prediction market is not open to Americans.

Earlier in October, the Wall Street Journal reported that on the platform, there were 4 accounts systematically buying bets on Trump's victory, raising the odds of Trump defeating Harris.

Blockchain data shows that the funds in these accounts all come from the same crypto exchange, sparking debates about the motives of the 'Trump big bettors'.

New York-based Polymarket pointed out that they have contacted the 'Trump big bettor' and are investigating the bet. The company's introduction stated that the bettor is a French financial professional with extensive trading experience.

"According to the investigation, we learned that this individual took a directional stance based on personal views on the elections. Polymarket's statement details align with Théo's self-description, confirming that he has communicated with members of Polymarket's legal and compliance team.

Currently, election observers are actively analyzing various data in an attempt to predict the outcome of what is considered the most intense and closest US presidential election in history. Prediction markets, as a platform allowing people to bet on various potential events, have become one of the ways to anticipate election results. Historical research shows that candidates with the highest win rates in prediction markets right before election day usually end up winning the presidency.

However, the emergence of the 'Trump big bettors' has exposed the limitations of the current prediction market: despite the significant increase in Polymarket's trading volume this year, the market size is still relatively small and susceptible to manipulation by a wealthy and outspoken investor who can control prices through multi-million dollar bets.

Within two weeks, Théo sent dozens of emails to journalists at The Wall Street Journal, criticizing what he saw as biased mainstream media polls favoring Harris. During a Zoom call, he claimed that the media supported by the Democratic Party is paving the way for societal unrest by promoting intense competition in the election, while he anticipates an overwhelming victory for Trump.

Théo expressed surprise at the attention his trades received from the public. He started low-key betting in August, purchasing millions of dollars' worth of Trump winning contracts under the username Fredi9999. At that time, the odds of Trump and Harris winning on Polymarket were roughly equal.

To avoid drastic price fluctuations, Théo spread his bets over multiple days. However, as the betting amount increased, Théo noticed that other traders tended to avoid the quotes when purchasing on Fredi9999, making it difficult for him to place bets at the desired price. Consequently, he created three additional accounts in September and October to mask his buying activity.

If Trump wins the election as he expects with a landslide victory, Théo could potentially profit over $80 million, doubling his investment. His main bet is on Trump winning electoral votes, with additional bets of millions of dollars on Trump winning the popular vote - a scenario many observers consider unlikely. In addition, he placed bets on Trump winning in swing states like Pennsylvania, Michigan, and Wisconsin.

If Harris wins the election, Theo may lose most of his $30 million - which represents a large portion of his liquid assets.

Due to his massive position on Polymarket, Théo would have difficulty closing his positions without affecting the market. According to Polymarket Analytics data, four 'Trump whales' accounts collectively hold about 25% of the Trump electoral college win contracts and over 40% of the popular vote win contracts.

Théo admitted to feeling nervous. While he is confident in a Trump victory, with a winning probability between 80-90%, he also worries about last-minute breaking news that could impact the betting outcome.