Citi pointed out that the market has partially priced in the possibility of a Trump victory, indicating that the risk-return ratio of related trades has worsened. Analysis shows that investors often achieve positive returns if they make investment decisions in line with market trends after the election results are announced, especially in the s&p 500 index and the usd. Citi maintains an overweight position on US stocks.

As the usa election approaches, global investors are focusing on the intense competition between Trump and Harris. Considering the weakening odds of Trump's victory and the possibility of overpricing the 'Trump trade,' Citigroup believes it is time to take profits from the 'Trump trade' and pay special attention to the trends of American stocks and the US dollar after the election.

Earlier this week, Citigroup's analyst team led by Dirk Willer released research reports indicating that the market has partially priced in the possibility of Trump's victory, suggesting that the risk-return ratio related to Trump has deteriorated. Therefore, Citigroup believes investors should take profits on some Trump-related positions, especially those related to Trump's policies and improvements in opinion polls. These assets have performed well since the last non-farm report, but Citigroup believes that the current risk-return is no longer attractive.

Citigroup wrote in the report:

Citigroup wrote in the report:

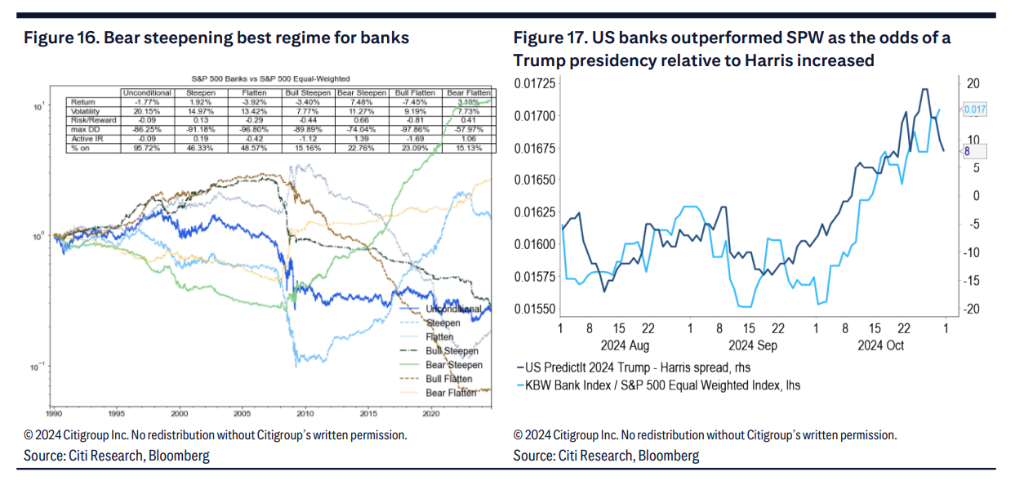

The Trump trade performed very strongly in October, also benefiting from favorable macro tailwinds. At this stage, the risk-return has deteriorated, we continue to take profits, and now we are taking profits in our financial stock outperformance trade.

First, if Harris still manages to win, given the close polling results, the market may misprice the outcome. Second, due to actions that have already taken place, the market may have overpriced; third, when predicting the policy actions Trump may take if re-elected president, the market may also make mistakes.

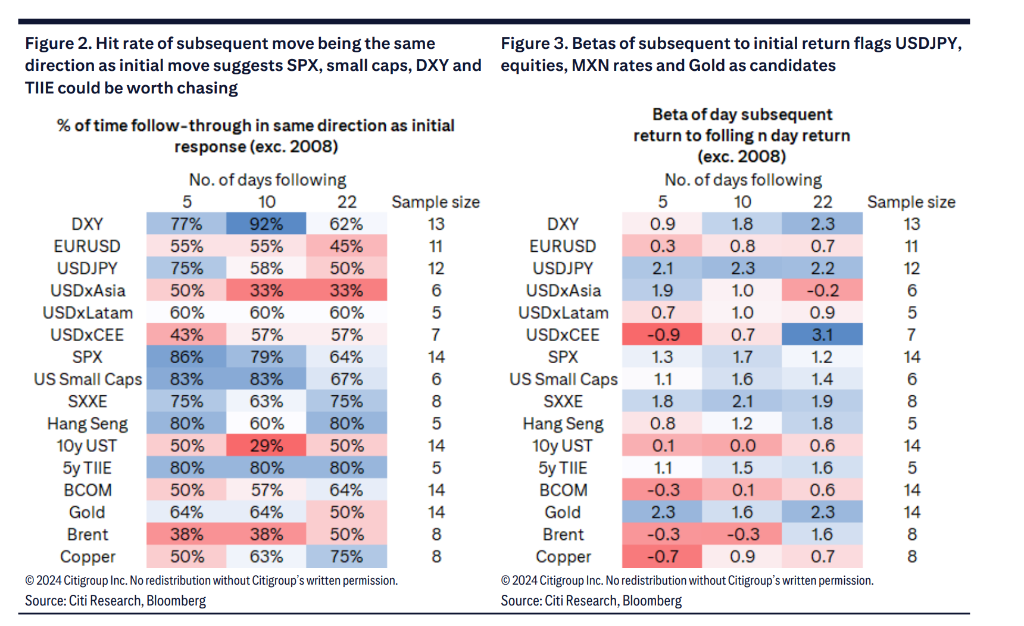

The report shows that based on analysis of historical data and market behavior, investors often achieve positive returns when making investment decisions based on market trends after the election results, especially in the S&P 500 index (SPX) and the US Dollar Index (DXY).

Citigroup maintains an overweight position in American stocks, especially against the backdrop of year-end seasonal factors and the risk value pricing (VRP) signal. Citigroup believes that although the market may experience volatility due to tariff issues or rising interest rates, these risks have already been partially priced in by the market.

Are Bank of America stocks not doing well?

Citi specifically mentioned the long position of Bank of America stocks relative to the equal-weighted S&P 500 index and believes that this position should be closed.

The core of this strategy is the expectation that Bank of America stocks will outperform the average performance of other stocks in the S&P 500 index, and based on this, positions are established to seek relative returns. The institution's research department had previously established a similar investment position, which has brought a return of 1.03% to Citi's global macro strategy investment portfolio since October 10, 2024.

However, now Citi believes that this position should be closed. The institution believes that the possibility of a Trump victory has been overpriced by the market, while the actual election results remain very uncertain as polls show a very close competition. In this scenario, Citi believes that the risk-return ratio of continuing to hold this position is no longer attractive.

Focus on U.S. stocks and the U.S. dollar

Citi believes that despite the market partially pricing in expectations of a Trump victory, U.S. stocks will still perform well until the end of the year. This optimistic outlook is based on two main arguments: first, the implementation of any tariff policy takes time, so it is unlikely to have an immediate negative impact on the market; second, even in the case of a Harris victory, as long as the Senate is not also controlled, the impact on the stock market is limited as the status quo is positive for the U.S. stock market.

Despite market concerns that rising interest rates may pressure the stock market, Citi's analysis shows that a sharp increase in rates does not necessarily harm the market. In a stress scenario, even if the U.S. 10-year treasury notes yield may rise by 30-40 basis points, historical data shows that such changes do not significantly impact the stock market and in some cases, stock market returns may be positive.

Citi found through VRP signals that the market may be tactically oversold, indicating that the market may have overreacted to the election's uncertainty. They believe that despite pre-election market uncertainty, signs of 'excessive fear' are evident in the market and there may be a rebound in case of a positive election outcome. In addition, seasonal factors also support a market rebound before the end of the year, prompting Citi to maintain an overweight position on U.S. stocks.

As for the USD, Citigroup believes that the USD against the Japanese Yen will be more influenced by the outcome of the US election rather than the Japanese election or policy changes by the Bank of Japan.

Editor/rice

花旗在报告中写道:

花旗在报告中写道: