In October, due to the continued fermentation of the bullish new policies in core first and second-tier cities, the overall transaction volume returned to a high level for the year, and in November, with the diminishing positive effects of the new policies, coupled with seasonal factors, the market growth momentum is expected to slow down slightly.

According to the CCN Financial APP, Ke Rui Real Estate stated in a document that thanks to the positive impact of the new policies and the active promotion of major discounts by real estate companies for self-rescue, the new housing supply in October dropped by nearly 40% while transactions continued the U-shaped trend, reaching the second highest level of the year. The monthly transaction volume in October increased by 44% month-on-month, compared to an average monthly increase of 45% in the third quarter. Second-hand housing transactions strengthened, with a 25% increase month-on-month and an 18% year-on-year increase, remaining flat with the same period last year. Land transactions continued to decline compared to the same period last year, with slightly less activity, an average premium rate of 3.8% in October, a decrease of 0.3 percentage points from the previous month.

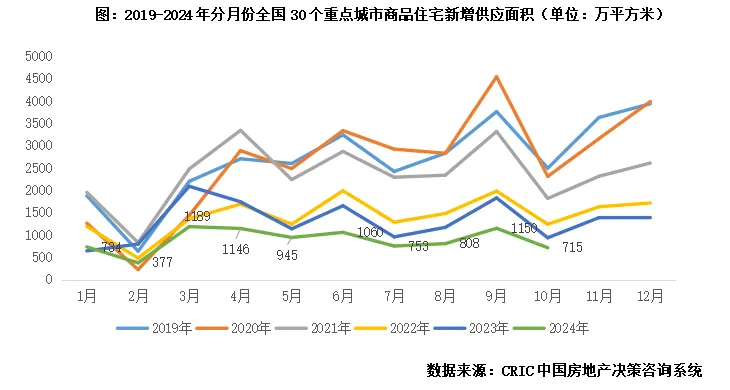

New Supply: Significantly lower than the average monthly supply in Q3, significant decrease in Guangzhou, Hangzhou, Tianjin, and Suzhou.

The scale of supply in October temporarily decreased, falling below the monthly average in the third quarter. In 30 key cities, new supply reached 7.15 million square meters, a decrease of 38% month-on-month and 24% year-on-year, with a 21% decrease compared to the monthly average in the third quarter. The year-to-date cumulative year-on-year decrease for the first ten months was 32%.

The scale of supply in October temporarily decreased, falling below the monthly average in the third quarter. In 30 key cities, new supply reached 7.15 million square meters, a decrease of 38% month-on-month and 24% year-on-year, with a 21% decrease compared to the monthly average in the third quarter. The year-to-date cumulative year-on-year decrease for the first ten months was 32%.

First-tier city supply significantly decreased, returning to levels seen in July and August. The overall expected supply area in the four first-tier cities is 1.64 million square meters, a 38% decrease month-on-month and 8% year-on-year, with a steeper 12% decrease compared to the monthly average in the third quarter. Only Shenzhen saw a simultaneous month-on-month and year-on-year increase of 12% and 65%, respectively, significantly higher than the 54% increase in the third quarter monthly average. Based on the positive market feedback after the new policies and the lower base from the previous month, real estate companies have generally intensified their pace of listing, leading to a stable increase in overall supply. Shanghai and Guangzhou both decreased compared to the previous month; Beijing doubled year-on-year due to a low base last year, with a year-to-date cumulative decrease of only 2%.

The decrease in supply in second and third-tier cities is not as significant as in first-tier cities, with a year-on-year decrease of over 30%. The total supply in 26 key second and third-tier cities was 5.51 million square meters, a 38% decrease month-on-month and 28% year-on-year, resulting in a cumulative year-on-year decrease of 34%. In terms of changes, cities such as Wuhan, Tianjin, Foshan, Kunming, Changsha, Suzhou, Nanning, and Xuzhou experienced decreases of over 50% month-on-month. For cities like Wuhan and Suzhou, which saw a surge in supply last month, October witnessed a period of inactive listings; while some cities like Kunming, Nanning, and Xuzhou had low enthusiasm from real estate companies due to slow market recovery. Cities like Changchun, Zhuhai, and Ningbo saw a stable increase in supply, mainly due to the low base from the previous month, continuing the year-on-year declining trend.

New home transactions: a 44% increase reaching the second highest monthly level this year, with significant increased transactions in first-tier cities due to positive new policies.

Benefiting from the sustained effects of the new policies and traditional marketing peak season, transactions in October stabilized after the previous decline, continuing the upward trend in September, reaching the second highest level of the year. According to CRIC monitoring data, overall transactions in 30 key cities in October reached 14.05 million square meters, an increase of 44% month-on-month, flat year-on-year compared to last year, growing by 45% compared to the monthly average in the third quarter, with a year-to-date cumulative decline of 30%.

First-tier cities are direct beneficiaries of the new policy, with transactions increasing both monthly and quarterly. The month-on-month increase in the four first-tier cities is 61%, a year-on-year increase of 21%, compared to an average monthly growth of 49% in the third quarter, with the cumulative year-on-year decline narrowing to 22%. Apart from Beijing's year-on-year decline, Shanghai, Guangzhou, and Shenzhen, the other three first-tier cities, have all seen increases in both monthly and quarterly transactions, with significant increases in Guangzhou and Shenzhen, both showing a significant increase of 70% or more, mainly due to the stimulus of the new policy leading to an accelerated entry of existing customers who desire to buy real estate in the short term. Shanghai, on the other hand, is mainly affected by the limited bullish effect of the new policy, combined with supply constraints and the impact of the second-hand housing diversion, resulting in the stimulus effect of the new policy on transactions not being as significant as in Guangzhou and Shenzhen.

(1) Leading cities in terms of transactions such as Chengdu, Wuhan, Tianjin, Xi'an, and Hangzhou saw a month-on-month increase but a year-on-year decline. Although the short-term market enthusiasm continues, it is no longer comparable to the same period last year. Tianjin is worth noting for completely lifting restrictions on purchases and prices in mid-October, which did stimulate a wave of first-time and improved demand customers to enter the market, indicating signs of a stabilizing and recovering overall property market.

(1) Leading cities in terms of transactions, such as Chengdu, wuhan, tianjin, Xi'an, Hangzhou, have seen a steady increase in transactions month-on-month, but a decrease year-on-year. Although the short-term market heat continues, it is incomparable to the same period last year. It is worth noting that Tianjin completely lifted purchase restrictions and price limits in mid-October, which indeed stimulated a wave of first-time home buyers to enter the market, indicating a sign of overall stabilization and recovery in the real estate market.

(2) Nearly half of the weaker second and third-tier cities have seen increases in transactions month-on-month, with cities like Suzhou, Ningbo, Nanjing, Jinan, Kunming, Nanning, Xiamen, Fuzhou, Foshan, Huizhou, Changzhou as typical representatives. After experiencing a deep adjustment in the previous period, due to the positive impact of the central government's new policy in October which stabilized market confidence and some real estate companies strengthening marketing efforts, there has been a trend of transaction recovery, and the cumulative year-on-year decline has continued to narrow.

(3) Cities like Changchun and Zhuhai have continued their decline month-on-month, with overall transactions remaining at a low level.

Inventory clearance: Reduced opening volume while improving quality, with the average turnover rate increasing by 6 percentage points to 34%.

In October, real estate developers were less proactive in launching new projects compared to September. However, the volume of new projects continued to be significantly higher than in July and August. In 21 key cities, a total of 243 first-time and new releases were made in October, a slight decrease of 4% month-on-month. Market heat remains stable with an average opening turnover rate of 34% in key cities in October, with a month-on-month increase of 6 percentage points. Compared to the third quarter, the growth rate is 7 percentage points, continuing the trend of weak recovery.

Looking at different cities, Chengdu, Tianjin, and Chongqing lead in terms of market heat, with the turnover rate in October all above 50%. In terms of trend changes, they can be broadly categorized as follows: First, cities benefiting from the bullish new policy, with Guangzhou, Shenzhen, and Tianjin as typical representatives, have seen a steady increase in project visits and subscriptions in the short term, with continued release of existing customers in the previous period; compared to this, the extent of the bullish new policy loosening in Beijing and Shanghai is limited, thus the boosting effect on opening turnover rates is not significant, and individual projects continue to show differentiated trends. Second, cities like Xi'an, Nanjing, Hefei, and Xiamen, due to supply structure reasons, have a stable or decreasing turnover rate. Third, half of the cities have benefited from positive central government signals and real estate companies' efforts to strengthen marketing and self-rescue actively, leading to a steady increase in turnover and a phased recovery.

Inventory: The inventory turnover of 0.51 led to a simultaneous decrease in inventory on a month-on-month basis in 20 cities, including Xiamen, Ningbo, and Foshan.

In October, due to a decline in supply, transaction volume increased, and the overall supply-demand ratio of 30 key monitored cities decreased from 1.18 last month to 0.51. Only Shenzhen and Xi'an maintained a stable supply-demand, with the remaining 28 cities having a supply-demand ratio below 1. The inventory area of the 30 cities was 233.38 million square meters, a decrease of 2.9% month-on-month and 2% year-on-year.

The digestion period in 22 cities has slightly shortened compared to the previous month, mostly by less than 10%. Due to a short-term increase in supply in Ningbo, Foshan, and Xiamen, the digestion period and month-on-month decline are more significant. However, the digestion period in the current 30 key cities is higher than the same period last year, indicating an increase in inventory pressure. In absolute terms, 70% of cities still have a digestion period exceeding 18 months.

Second-hand housing: The year-on-year and month-on-month transactions increased by 25% and 18% respectively, especially in first-tier cities where month-on-month transactions increased by 50%.

In October, the estimated transaction area of second-hand houses in 18 key cities is 9.71 million square meters, an increase of 25% month-on-month and 18% year-on-year. The cumulative transaction area for the first 10 months is estimated to be 88.04 million square meters, with a cumulative year-on-year increase of 2%.

Looking at the month-on-month trend, under a series of policy stimulations, the second-hand housing market warmed up in October. Except for 4 cities like Suzhou and Yangzhou, the transactions in the other 14 cities rebounded, especially in leading cities like Shenzhen and Shanghai where the month-on-month transaction increments reached 90% and 65% respectively. Shenzhen even hit a monthly high since 2022.

From a year-on-year perspective, the performance of key cities is mixed, with core cities like Beijing, Shanghai, Shenzhen, and Hangzhou generally having higher transaction volumes than the same period last year. Especially Shenzhen has doubled year-on-year, while Beijing and Shanghai have also increased by around 50%. However, cities like Suzhou, Chengdu, and Foshan still have weaker transaction performance compared to the same period last year. Looking ahead, with the combined effects of policies and end-of-year rush, it is expected that next month's second-hand housing transactions will continue to show growth momentum, although the month-on-month growth rate may slightly narrow.

Land market: Transaction volume and prices both declined, and the premium rate decreased, with Shanghai's land auction heat hitting a new low.

In October, the pace of land supply in the market is lower than the same period last year. As of October 27, the operating land transaction volume in 300 cities nationwide in October was 73.7 million square meters, with year-on-year and month-on-month decreases of 40% and 11% respectively. The land transaction amount was 215.8 billion yuan, with year-on-year and month-on-month decreases of 48% and 18% respectively. In terms of intensity, by the deadline, the average premium rate in October was 3.8%, a decrease of 0.3 percentage points from the previous month. The intensity of land auctions in various places in October continued to differentiate. Only cities like Hangzhou and Yangzhou saw a single-month average premium rate exceeding 10%, while more cities mainly transacted at low premiums. In cities like Beijing, Shanghai, Xi'an, and Changsha, the vast majority of land plots in October were still transacted at the base price.

Cities of different levels performed differently, with first and third-tier cities seeing a decrease in volume and an increase in price both yearly and monthly, while second-tier cities saw a simultaneous decrease in volume and price.

According to CRIC monitoring data, as of October 27, first-tier cities completed a total land transaction of 1.16 million square meters in October, a 53% decrease from the previous month and a significant 76% decrease year-on-year. The transaction amount was 29.8 billion yuan, down 35% month-on-month and a large drop of 72% year-on-year. Due to high-priced land transactions in Beijing and Shanghai in October, the average transaction price rose to 25,756 yuan per square meter, an increase of 37% from the previous month.

Specifically, Shanghai had the highest transaction volume of 0.56 million square meters, involving 4 residential land plots and 4 commercial land plots, with a total value of 15 billion yuan. Except for a low-premium transaction in Yangpu Dinghai land plot at 2.32%, the remaining 7 residential land plots were transacted at base price, with an overall premium rate of only 0.5%. Generally, the market intensity remains relatively low. Shenzhen followed with a transaction volume of 0.31 million square meters, involving 1 residential land plot and 1 commercial land plot, both transacted at base price, with a total value of 68 billion yuan. Beijing transacted 4 residential land plots in a month in Tongzhou, Fengtai, Changping, and Yanqing districts, all at base price, with a total value of 7.8 billion yuan. In addition, Guangzhou transacted 4 commercial land plots at base price, with a transaction amount of only 0.2 billion yuan.

Second-tier cities saw a simultaneous decrease in volume and price. Specifically, as of the 27th, second-tier cities transacted a total construction area of 9.31 million square meters, down 32% from the previous month and a significant 55% drop year-on-year. The floor price also saw a decrease from the previous month by 11%, down to 4757 yuan per square meter.

Looking at specific cities, Xi'an took the lead with a transactional construction area of 1.6 million square meters, with a total value of 5.9 billion yuan, involving 13 residential plots and 6 commercial plots, all transacted at base price. Changsha followed with a transactional construction area of 1.29 million square meters, with a total value of only 2.8 billion yuan, involving 11 plots and all transacted at base price. Ranking third, Ningbo transacted a construction area of 1.05 million square meters, involving 7 residential plots and 3 commercial plots. Except for one plot at Yuelong Street, Ninghai County, which was auctioned after 154 rounds at a premium rate of 77%, the rest were transacted at base price. Other cities transacted construction areas of less than 0.5 million square meters, indicating lower transaction volumes.

In terms of intensity, except for Hangzhou's relatively high land intensity due to the influence of two high-premium land transactions in Gongshu District and Shangcheng District, the intensity of land transactions in other cities remains low, with premium rates mostly below 1%.

The performance of third and fourth-tier cities showed a decrease in volume and an increase in price both yearly and monthly. As of October 27, the total transaction area reached 63.24 million square meters, down 6% from the previous month and a significant 30% drop year-on-year. The average transaction price increased by 4% month-on-month, reaching 2241 yuan per square meter. In the key monitored third and fourth-tier cities by CRIC, the three cities of Xuzhou, Yancheng, and Yangzhou had transaction volumes exceeding 1 million square meters, with Xuzhou leading the way at 1.92 million square meters, followed by Yancheng and Yangzhou at 1.54 and 1.41 million square meters respectively.

The city with the highest popularity in October is Yangzhou. Multiple pure residential land transactions with extremely high premiums in Yizheng City have significantly increased the overall premium rate in Yangzhou in October, making it the most popular city among third and fourth-tier cities. Most other cities mainly transact at the base price, with market activity continuing at a low level.

Overall view: the effect of the new policy of "high before low" decreasing in popularity is expected to slow down or slightly decline in transaction momentum in November.

Predicting November, Ke Ruixi believes that in October, due to the continued fermentation of favorable new policies in core first and second-tier cities, overall transactions return to the high level of the year. In November, with the diminishing effect of the new policy favor and combined with seasonal factors, the market's growth momentum is expected to slow down, resulting in a slight decline.

In fact, looking at the weekly changes in new house transaction areas in core first and second-tier cities in October, there is indeed a trend of "rising first then falling." In the fourth week of October (10.21-10.27), the transaction area of new houses in 30 cities decreased slightly by 2% compared to the previous week, transitioning from growth to decline. In cities like Guangzhou and Shenzhen, there has also been a softening trend in visitation and subscription. The same is true for second-hand houses. According to CRIC monitoring, in the fourth week of October (10.21-10.27), the transaction area of second-hand houses in 14 key monitored cities was 1.945 million square meters, with a total of 20,351 units sold, both showing a 2% decrease week-on-week. It can be seen that the diminishing effect of the new policy favor is showing a decreasing trend, and the release of existing customers is approaching the end of a phase.

Looking at individual cities, Guangzhou, Shenzhen, and Tianjin have seen a relatively greater relaxation in the intensity of the "four limits" policy, with an overall small and marginal increase expected in new home transactions. Peking and Shanghai have limited favorable space, with the continuous release of existing customers likely to slow down the growth momentum. However, for most second and third-tier cities, the short-term market entry of just-demand or just-changed customers driven by major discounts from real estate developers is expected to decline again as the discount intensity is reduced.

The second-hand housing market is still experiencing a high-level fluctuating market, with its market share expected to further increase. Due to a large customer base for just-demand home purchases, combined with the strategy of exchanging volume for price by existing second-hand housing owners, the market's resilience is slightly better than new houses. It is expected that the overall transaction volume will continue to be at a high level in November.