"Dual excellence" rotates the throne.

After the market closed on November 1 local time, S&P Global issued a statement that S&P Dow Jones adjusted the Dow Jones Industrial Average Index, with Nvidia replacing Intel as a component stock, officially effective on November 8.

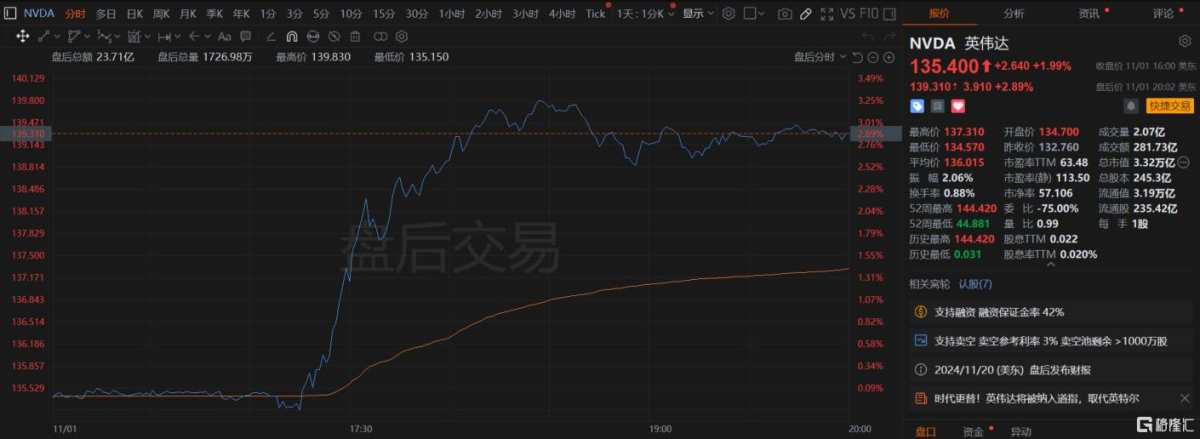

As a result, Nvidia surged nearly 3% after hours, while Intel fell nearly 2%.

Over the past two years, driven by the AI wave, Nvidia's stock price has skyrocketed by 800%. Since the beginning of this year, Nvidia's stock price has risen by over 170%, while Intel's market cap has shrunk by more than half.

Over the past two years, driven by the AI wave, Nvidia's stock price has skyrocketed by 800%. Since the beginning of this year, Nvidia's stock price has risen by over 170%, while Intel's market cap has shrunk by more than half.

This means that the Dow Jones Industrial Average, a symbol of stability that has been established for 128 years, has finally recognized the power of AI and included Nvidia in its elite ranks.

As Scott Colyer, CEO of Advisors Asset Management, said: "Nvidia is a company that creates heroes in the right place at the right time. Just when it is at its peak, the Dow included it to confirm its strong momentum."

Intel exits with regret.

Intel was once the dominant force in the chip manufacturing industry, a darling of the 1990s, but in recent years, its manufacturing advantage has been surpassed by its competitor Taiwan Semiconductor, and it has missed out on the AI boom due to mistakes, including missing the investment in ChatGPT owner OpenAI.

Since the beginning of this year, Intel's stock price has dropped by 54%, becoming the worst-performing stock in the index, and also the lowest-priced stock in the price-weighted Dow Jones Industrial Average.

The day before, Intel expressed optimism about the future of its personal computer and server business, expecting revenue to exceed expectations this quarter, but warned that "there is still a lot of work to do."

Hargreaves Lansdown's funds and market director Susannah Streeter said: "Losing its position in the Dow Jones index will be another blow to Intel's reputation as it struggles with painful transformation and loss of confidence."

Intel's revenue in 2023 is $54 billion, down nearly a third from the year Pat Gelsinger took over as CEO in 2021. Analysts predict that Intel will see its first annual net loss since 1986 this year.

Nvidia Shines

Nvidia has emerged as a well-deserved leading company, thanks to the crucial role its chips play in AI technology, driving its stock price to soar over 800% in the past two years. Nvidia's market cap has reached $3.32 trillion, closing in on Apple.

Companies like Microsoft, Meta, Google, and Amazon are heavily buying Nvidia's Graphics Processing Units (GPU) to build data centers for AI work. Nvidia's revenue has grown over 100% year-on-year in the past five quarters, with income at least doubling in three of those quarters.

The company's CEO, Huang Renxun, has repeatedly stated that the demand for the next generation AI GPU Blackwell is "crazy".

Nvidia's emergence seems to herald the beginning of a new era: AI has become the new engine of global growth, and Nvidia is a key driver of this.

In May of this year, Nvidia announced a stock split of common stock at a ratio of 1 to 10, after the split, the stock price per share changed from just over $1,000 to slightly above $100. At that time, people speculated that Nvidia's move might be to prepare for possible inclusion in the Dow Jones Industrial Average.

With Nvidia's inclusion, now four out of the six trillion-dollar technology companies are included in the Dow Jones Industrial Average. The two companies not included in the Dow Jones Industrial Average are Alphabet and Meta, while Amazon only joined in February of this year.

过去两年,受AI浪潮的推动,英伟达的股价已经疯涨了800%。今年以来,英伟达股价已累计上涨逾170%,而英特尔的市值则缩水了一半以上。

过去两年,受AI浪潮的推动,英伟达的股价已经疯涨了800%。今年以来,英伟达股价已累计上涨逾170%,而英特尔的市值则缩水了一半以上。