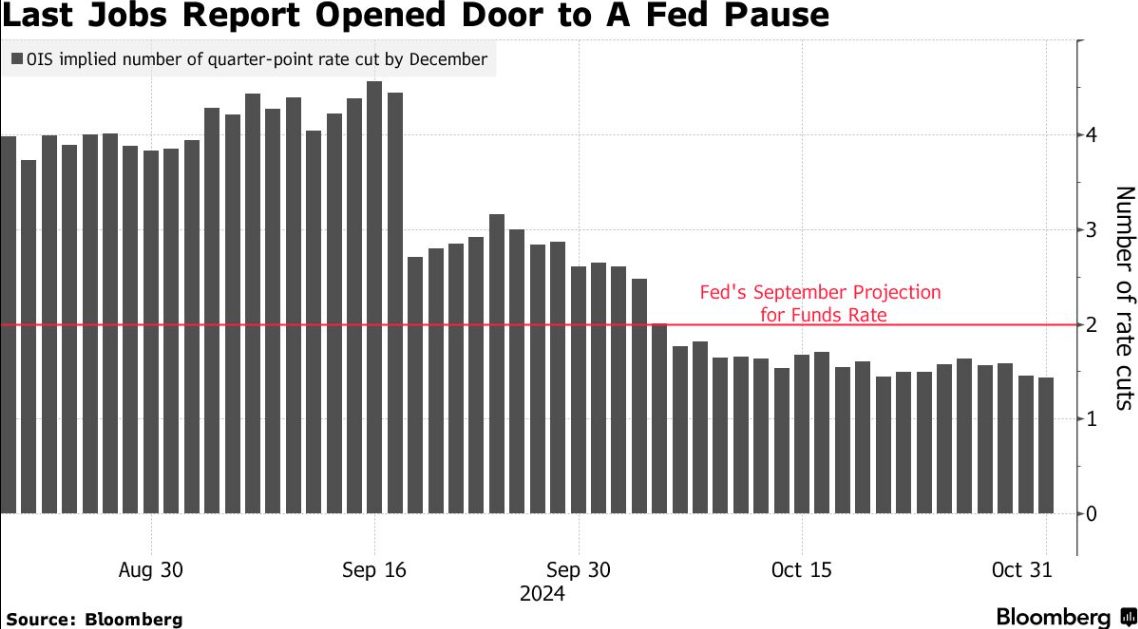

Strong non-farm data will enhance the market's expectation for the Federal Reserve to possibly pause rate cuts early next year.

Investors who have been hedging further sales of usa bonds are preparing for volatility, as the October non-farm payrolls report in the usa, affected by hurricanes, will be released on Friday, providing the final clue for the Fed's policy decision next week.

Due to the uncertainty brought by the strong hurricane and Boeing strike, it is expected that in October Non-farm employmentemployment will drop from 0.254 million in September to approximately 0.113 million, the lowest monthly employment growth rate since December 2020.

After October ended with the worst monthly performance in two years, usa bonds saw little change in Friday's early Asian trading session. With a few days left until the election and the Fed meeting, the indicators measuring daily yield fluctuations reached the highest level in a year, with traders preparing for further declines over the next three weeks, potentially pushing the 10-year Treasury yield to as high as 4.5%, compared to the current yield of about 4.3%.

After October ended with the worst monthly performance in two years, usa bonds saw little change in Friday's early Asian trading session. With a few days left until the election and the Fed meeting, the indicators measuring daily yield fluctuations reached the highest level in a year, with traders preparing for further declines over the next three weeks, potentially pushing the 10-year Treasury yield to as high as 4.5%, compared to the current yield of about 4.3%.

Jack McIntyre, portfolio manager at Brandywine Global Investment Management, said that this pricing makes it difficult for the market to ignore the strong evidence of a robust labor market in the government data to be released on Friday. Although fund managers can interpret weak data as a result of strikes and storms, a strong employment report will relieve pressure on policymakers to cut rates.

He said, "I don't think the Fed likes to surprise the market too much." McIntyre expects a 25-basis-point rate cut at next week's meeting, in line with the expectations of most economists surveyed by Bloomberg, but he expects them to send a hawkish message, "indicating that they won't cut rates again for a while."

In the past month, us Treasury sales have pushed yields up by about 60 basis points, partly due to unexpectedly strong September employment data. Subsequently, due to the Trump and Harris showdown on November 5, as well as the uncertainty of the Fed's policy path, volatility has increased.

The ICE BofA Move index, a closely watched indicator of volatility in the usa bond market, closed at its highest level this year, indicating that traders are guarding against worsening turmoil. A prominent trade on Thursday involved buying volatility with a premium of $10 million through options linked to secured overnight financing rates.

Traders believe there is about a 90% chance of the Fed cutting rates by 25 basis points next week. The forward rate agreement expects a total rate cut of about 117 basis points over the next 12 months, a decrease of about 67 basis points from the expectations at the beginning of October. The latest survey by JPMorgan Chase shows that with an increase in neutral positions, clients have reduced both long and short positions.

In the options market, traders have been preparing for further selling. Thursday's fund flow includes a $6.5 million premium bet, betting that the 10-year US bond yield will reach 4.4% by November 22, with the most options put exercise target rising to 4.5%.

Greg Wilensky, head of the US fixed income department at Janus Henderson Investors, said that while the October employment report is unlikely to change market expectations for the Federal Reserve's November decision, the data could still "alter market expectations for the easing path during future meetings".

Traders will focus on the unemployment rate, with economists predicting the rate to stay steady at 4.1%. Strong data will enhance bond market expectations of a possible pause in rate cuts early next year.

Ian Lyngen, Head of US Rate Strategy at BMO Capital Markets, said in a report: "Although the Federal Reserve is likely to cut rates next week, skipping January and moving to a quarterly pace of 25 basis points rate cuts is still the least resistance path, consistent with our expectations and the currently relatively unanimous view."

Editor/Somer

在以两年来最差的月度表现结束10月份之后,美国国债在周五的亚洲早盘交易中变化不大。由于距离大选和美联储会议还有几天的时间,衡量日收益率波动的指标达到了一年来的最高水平,

在以两年来最差的月度表现结束10月份之后,美国国债在周五的亚洲早盘交易中变化不大。由于距离大选和美联储会议还有几天的时间,衡量日收益率波动的指标达到了一年来的最高水平,