Key Insights

- LifeVantage to hold its Annual General Meeting on 7th of November

- Salary of US$537.5k is part of CEO Steve Fife's total remuneration

- The overall pay is 48% below the industry average

- LifeVantage's total shareholder return over the past three years was 114% while its EPS was down 31% over the past three years

Shareholders may be wondering what CEO Steve Fife plans to do to improve the less than great performance at LifeVantage Corporation (NASDAQ:LFVN) recently. At the next AGM coming up on 7th of November, they can influence managerial decision making through voting on resolutions, including executive remuneration. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. In our opinion, CEO compensation does not look excessive and we discuss why.

Comparing LifeVantage Corporation's CEO Compensation With The Industry

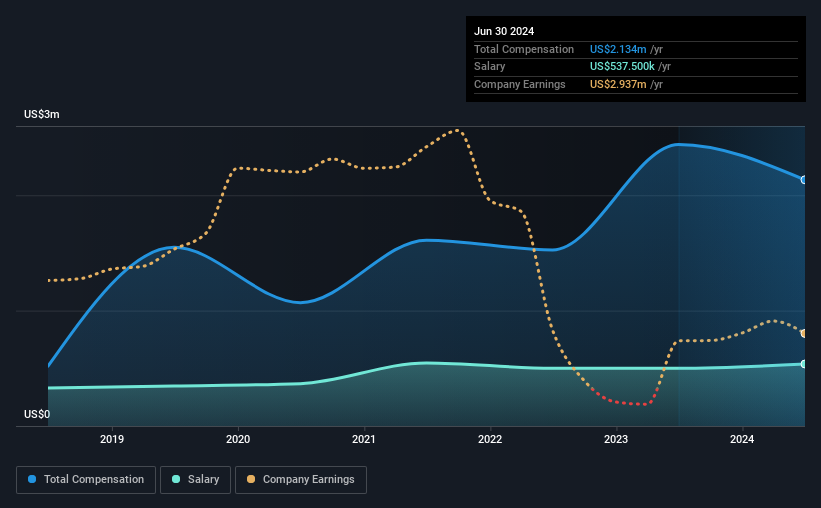

According to our data, LifeVantage Corporation has a market capitalization of US$163m, and paid its CEO total annual compensation worth US$2.1m over the year to June 2024. That's a notable decrease of 13% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$538k.

In comparison with other companies in the American Personal Products industry with market capitalizations ranging from US$100m to US$400m, the reported median CEO total compensation was US$4.1m. Accordingly, LifeVantage pays its CEO under the industry median. Furthermore, Steve Fife directly owns US$8.3m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | US$538k | US$500k | 25% |

| Other | US$1.6m | US$1.9m | 75% |

| Total Compensation | US$2.1m | US$2.4m | 100% |

Talking in terms of the industry, salary represented approximately 39% of total compensation out of all the companies we analyzed, while other remuneration made up 61% of the pie. LifeVantage pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Talking in terms of the industry, salary represented approximately 39% of total compensation out of all the companies we analyzed, while other remuneration made up 61% of the pie. LifeVantage pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at LifeVantage Corporation's Growth Numbers

Over the last three years, LifeVantage Corporation has shrunk its earnings per share by 31% per year. It saw its revenue drop 8.0% over the last year.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has LifeVantage Corporation Been A Good Investment?

Boasting a total shareholder return of 114% over three years, LifeVantage Corporation has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us wonder if these strong returns can continue. Shareholders might want to question the board about these concerns, and revisit their investment thesis for the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 3 warning signs for LifeVantage you should be aware of, and 1 of them is concerning.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.