Will it be December or January?

In the Japanese election on Thursday morning, the Bank of Japan "stands pat", in line with general expectations.

In the afternoon, Bank of Japan Governor Kuroda reiterated in his speech the next rate hike timing, the US economy, and Japanese inflation.

Market analysis believes that Kuroda's remarks this time seemed to convey a more explicit "hawkish" signal than before.

Market analysis believes that Kuroda's remarks this time seemed to convey a more explicit "hawkish" signal than before.

He pointed out that risks from overseas economies are decreasing, and if economic and inflation forecasts come true, they will continue to raise interest rates.

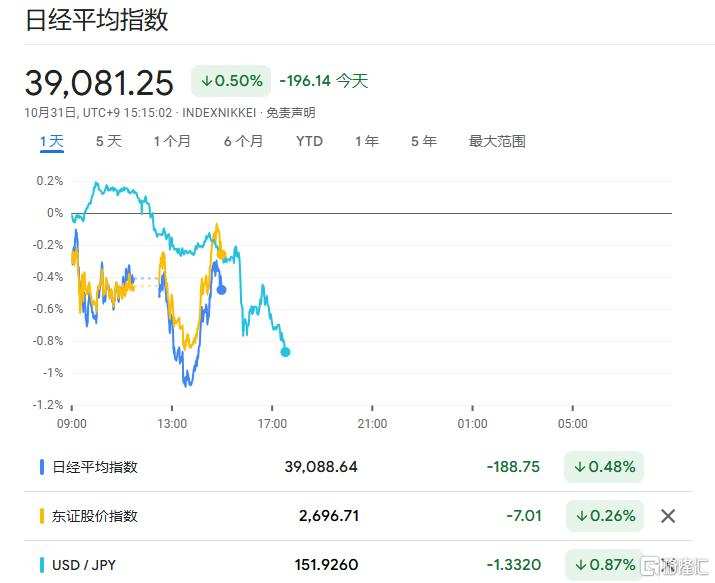

Affected by this, Japanese stocks collectively fell today, with the Nikkei 225 index down 0.5% to 30,081.25 points; the TOPIX index fell 0.3%.

The USD/JPY decline further widened, hitting a daily low at 152.02, falling by about 0.8% during the day.

Hint at rate hike

At the afternoon policy briefing, Ueda's speech was not much different from the morning BOJ rate decision.

However, Ueda hinted that as the risks facing the USA economy diminish, the BOJ is considering raising rates as the economic clouds dissipate in Japan.

The BOJ expects that with the improvement in economic conditions, the inflation rate will hover around the target level of around 2% in the coming years. If the economy continues to recover moderately, the central bank will continue to be determined to raise borrowing costs.

Ueda pointed out that domestic wages and prices have improved somewhat, indicating the direction for future monetary policy.

"From the domestic data, the trends in wages and prices are consistent with our forecasts. As for the downside risks facing the USA and overseas economies, we see that the clouds have already dissipated."

However, he also emphasized that there is no fixed timetable for the next rate hike, and decisions will be made at each policy meeting based on the data available.

"As for the timing of the next rate hike, we have not predetermined it. We will carefully study the data available at each policy meeting and update our views on the economy and outlook when formulating policy."

Regarding the impact of the USA economy, Ueda also cautiously pointed out that there is still no full confidence in the prospects of the USA.

He stated that the Bank of Japan can take time to carefully study the impact of uncertainties in the USA economy and financial market turbulence.

"Recently, we have seen some positive data from the USA, but there is still uncertainty about the impact of the Federal Reserve's past interest rate hikes on the economy and prices. We need to closely monitor the situation."

Regarding inflation in Japan, Ueda mentioned that the October Tokyo CPI data showed that the practice of enterprises passing on costs to consumers by raising service prices has started to spread.

The rate of inflation in the service industry is not significantly rising, and the overall process of exiting the loose monetary policy is expected to be smooth.

"If we see wage growth similar to this year's, it will be a positive development for us. However, this alone will not directly lead to interest rate hikes."

Interest Rate Hike Schedule

In March of this year, the Bank of Japan ended its negative interest rate policy and raised short-term interest rates to 0.25% in July.

Subsequently, Mr. Ueda has repeatedly stated that if the economic trend aligns with his predictions, the Bank of Japan will continue to raise interest rates. However, due to the inflation rate still being at a moderate level, the central bank is not in a rush.

Data released on Thursday showed that factory production and retail sales in Japan increased in September, indicating that the economy is entering a path of mild recovery.

In addition, inflation in Tokyo in October cooled down, with the core inflation rate falling below the 2% target for the first time in five months.

In October, CPI rose by 1.8% year-on-year, higher than expected; excluding fresh food, core CPI rose by 1.8% year-on-year in October, also higher than expected.

However, it is worth noting that the recent uncertainty in the Japanese elections has brought many uncertainties to the market.

Previously, the ruling coalition recently lost a majority of seats in parliament, which has brought potential obstacles to policy implementation and made the normalization of years of ultra-loose policies complex.

It is reported that a special session of the Japanese National Diet will be held on November 11.

This also means that there is not much time left for Mr. Ishiba to seek cooperation with other opposition parties.

Market analysts believe that the ruling coalition's loss of a majority of seats in the weekend elections has heightened concerns about policy paralysis, which may increase the threshold for further interest rate hikes.

As for the timing of the next interest rate hike, the market currently speculates whether the Bank of Japan will act in December or January, with some differences of opinion.

According to survey data, about 87% of Bank of Japan watchers expect the Bank of Japan to raise interest rates by the end of January next year, with 53% expecting an increase in December.

UBS Group stated that once the new government is formed (to be completed within one month), political instability will be resolved, and there is still a possibility of a rate hike by the Bank of Japan in December.

Similarly, Citigroup also noted that there are still uncertainties. If relevant results emerge from the US elections, it will accelerate the depreciation of the yen, potentially forcing the Bank of Japan to raise interest rates in December.

Nomura Securities believes that the tone of Kuroda is more optimistic, suggesting that the Bank of Japan will not wait too long to raise rates again. Maintaining expectations of a rate hike by the Bank of Japan in December.

Chief Economist Toru Suehiro of Daiwa Securities stated that overall, the Bank of Japan will continue its normalization.

"Although domestic political uncertainty is rising, personally I believe that this uncertainty will not stop the Bank of Japan from raising interest rates."

So what impact will this have on the financial markets?

Homin Lee, Senior Macro Strategy at Lombard Odier, pointed out that the Bank of Japan is cautious about policy normalization, which will have a positive impact on the Japanese stock market.

Although political uncertainty is a mild negative factor, it is not the only consideration for the market. In the short term, the Japanese stock market will be supported by economic fundamentals.