Financial giants have made a conspicuous bullish move on Affirm Holdings. Our analysis of options history for Affirm Holdings (NASDAQ:AFRM) revealed 20 unusual trades.

Delving into the details, we found 55% of traders were bullish, while 35% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $334,950, and 16 were calls, valued at $849,725.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $32.5 to $57.5 for Affirm Holdings during the past quarter.

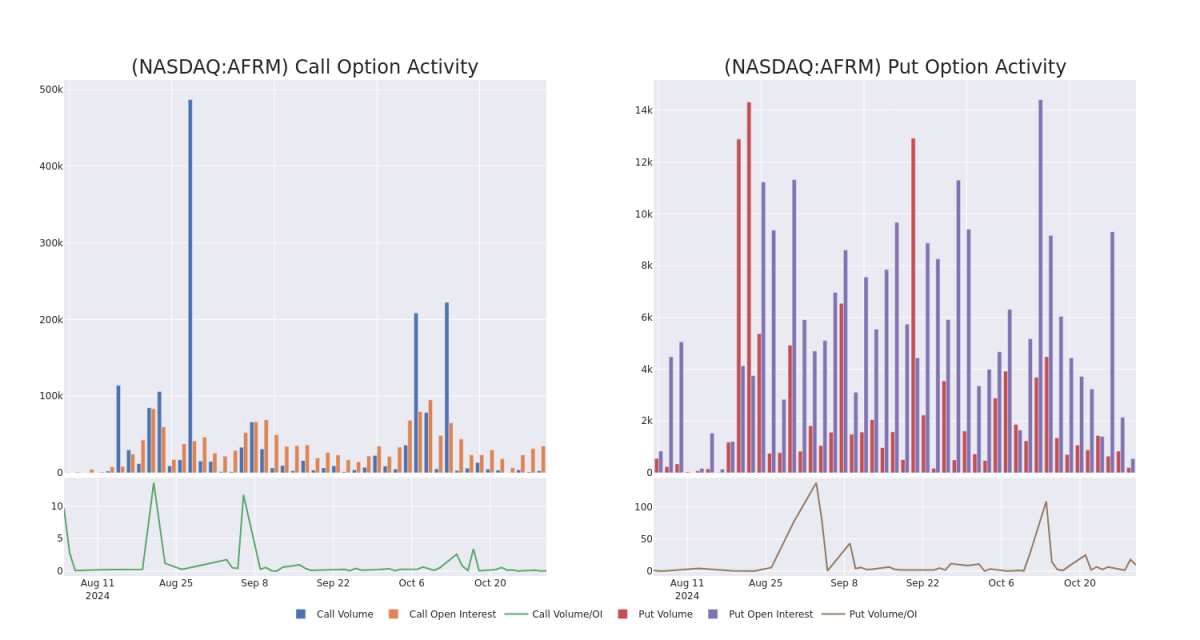

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Affirm Holdings's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Affirm Holdings's whale trades within a strike price range from $32.5 to $57.5 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Affirm Holdings's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Affirm Holdings's whale trades within a strike price range from $32.5 to $57.5 in the last 30 days.

Affirm Holdings Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AFRM | CALL | TRADE | BULLISH | 01/17/25 | $5.85 | $5.7 | $5.8 | $47.50 | $147.3K | 2.8K | 327 |

| AFRM | PUT | SWEEP | BULLISH | 01/16/26 | $19.25 | $19.1 | $19.1 | $55.00 | $120.3K | 186 | 63 |

| AFRM | CALL | SWEEP | BEARISH | 11/08/24 | $2.59 | $2.58 | $2.58 | $48.50 | $110.2K | 27 | 377 |

| AFRM | PUT | SWEEP | BULLISH | 01/16/26 | $17.6 | $17.4 | $17.4 | $52.50 | $92.2K | 99 | 53 |

| AFRM | CALL | SWEEP | NEUTRAL | 11/08/24 | $4.85 | $4.75 | $4.85 | $44.00 | $72.7K | 399 | 247 |

About Affirm Holdings

Affirm Holdings Inc offers a platform for digital and mobile-first commerce. It comprises a point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app. The firm generates its revenue from merchant networks, and through virtual card networks among others. Geographically, it generates a majority share of its revenue from the United States.

Following our analysis of the options activities associated with Affirm Holdings, we pivot to a closer look at the company's own performance.

Current Position of Affirm Holdings

- With a trading volume of 8,273,583, the price of AFRM is down by -1.0%, reaching $42.44.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 8 days from now.

What Analysts Are Saying About Affirm Holdings

5 market experts have recently issued ratings for this stock, with a consensus target price of $51.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from BTIG has elevated its stance to Buy, setting a new price target at $68. * An analyst from Wells Fargo upgraded its action to Overweight with a price target of $52. * In a positive move, an analyst from Wedbush has upgraded their rating to Neutral and adjusted the price target to $45. * In a positive move, an analyst from Morgan Stanley has upgraded their rating to Equal-Weight and adjusted the price target to $37. * An analyst from Goldman Sachs has decided to maintain their Buy rating on Affirm Holdings, which currently sits at a price target of $54.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Affirm Holdings options trades with real-time alerts from Benzinga Pro.