High-rolling investors have positioned themselves bullish on Peloton Interactive (NASDAQ:PTON), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in PTON often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 10 options trades for Peloton Interactive. This is not a typical pattern.

The sentiment among these major traders is split, with 70% bullish and 20% bearish. Among all the options we identified, there was one put, amounting to $37,147, and 9 calls, totaling $815,418.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $6.0 to $9.0 for Peloton Interactive over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $6.0 to $9.0 for Peloton Interactive over the last 3 months.

Volume & Open Interest Development

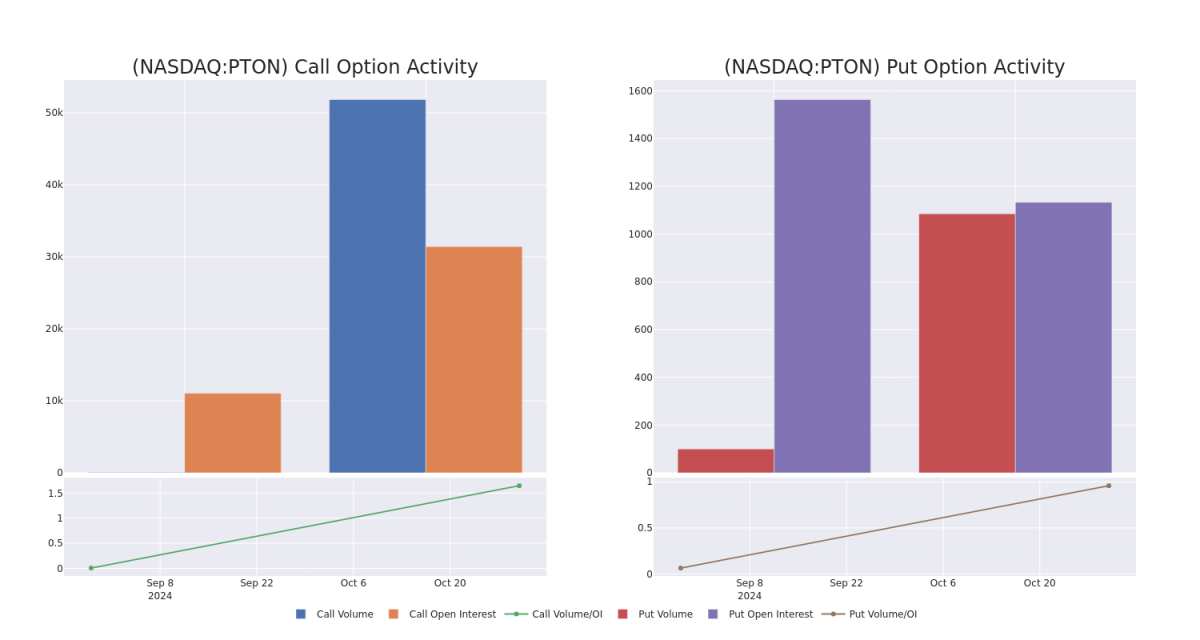

In terms of liquidity and interest, the mean open interest for Peloton Interactive options trades today is 6509.6 with a total volume of 52,899.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Peloton Interactive's big money trades within a strike price range of $6.0 to $9.0 over the last 30 days.

Peloton Interactive 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PTON | CALL | SWEEP | BEARISH | 11/15/24 | $1.16 | $1.13 | $1.13 | $6.00 | $211.5K | 15.4K | 3.8K |

| PTON | CALL | SWEEP | BULLISH | 11/15/24 | $0.74 | $0.65 | $0.65 | $7.00 | $192.2K | 10.7K | 3.4K |

| PTON | CALL | SWEEP | BEARISH | 11/15/24 | $0.71 | $0.68 | $0.68 | $7.00 | $127.7K | 10.7K | 7.0K |

| PTON | CALL | SWEEP | NEUTRAL | 11/15/24 | $1.17 | $1.14 | $1.15 | $6.00 | $62.8K | 15.4K | 662 |

| PTON | CALL | SWEEP | BULLISH | 11/15/24 | $0.7 | $0.69 | $0.7 | $7.00 | $53.8K | 10.7K | 14.9K |

About Peloton Interactive

Peloton Interactive Inc operates an interactive fitness platform. It operates its business in two reportable segments: Connected Fitness Products and Subscription. Connected Fitness Product revenue consists of bike and tread and related accessories sales, associated fees for delivery and installation, and extended warranty agreements. Subscription revenue is generated from monthly Connected Fitness Subscription and Digital Subscription. The company generates maximum revenue from the Subscription segment. Geographically, the company derives a majority of its revenue from North America and the rest from the International markets.

In light of the recent options history for Peloton Interactive, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Peloton Interactive

- Trading volume stands at 8,193,886, with PTON's price down by -2.06%, positioned at $6.64.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 1 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.