If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the long term shareholders of Elastic N.V. (NYSE:ESTC) have had an unfortunate run in the last three years. Regrettably, they have had to cope with a 53% drop in the share price over that period. Furthermore, it's down 26% in about a quarter. That's not much fun for holders.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

We don't think that Elastic's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last three years, Elastic saw its revenue grow by 21% per year, compound. That is faster than most pre-profit companies. The share price has moved in quite the opposite direction, down 15% over that time, a bad result. This could mean hype has come out of the stock because the losses are concerning investors. When we see revenue growth, paired with a falling share price, we can't help wonder if there is an opportunity for those who are willing to dig deeper.

In the last three years, Elastic saw its revenue grow by 21% per year, compound. That is faster than most pre-profit companies. The share price has moved in quite the opposite direction, down 15% over that time, a bad result. This could mean hype has come out of the stock because the losses are concerning investors. When we see revenue growth, paired with a falling share price, we can't help wonder if there is an opportunity for those who are willing to dig deeper.

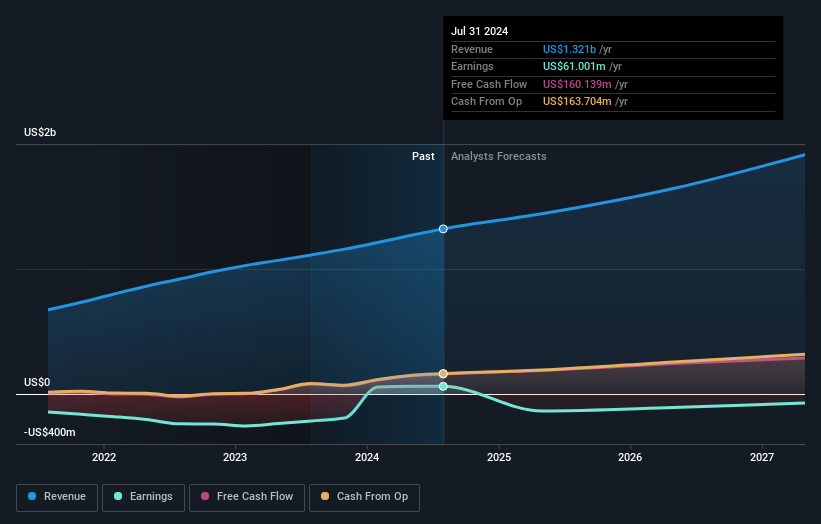

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. If you are thinking of buying or selling Elastic stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Elastic shareholders gained a total return of 7.9% during the year. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 1.5% over half a decade This suggests the company might be improving over time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Elastic is showing 3 warning signs in our investment analysis , and 1 of those is potentially serious...

Elastic is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.