United Microelectronics announced its performance for the third quarter of 2024.

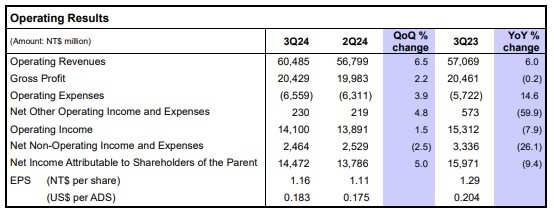

According to the app "Zhītōng Cáijīng", United Microelectronics (UMC.US) announced its performance for the third quarter of 2024. The financial report shows that UMC's Q3 revenue was 60.49 billion yuan (New Taiwan dollars, same below), a year-on-year growth of 6.0%; net income attributable to the parent was 14.47 billion yuan, a year-on-year decrease of 9.4%; and earnings per share were 1.16 yuan, compared to 1.29 yuan in the same period last year.

Benefiting from strong demand for the 22/28nm process (accounting for 35% of revenue), UMC's wafer shipments in the third quarter increased by 7.8% to 0.896 million units compared to the previous quarter, with a wafer manufacturing capacity utilization rate of 71%.

The gross margin reached 33.8%, and the operating margin reached 23.3%.

The gross margin reached 33.8%, and the operating margin reached 23.3%.

United Microelectronics Co-President Jason Wang said: "Regarding the outlook for the fourth quarter, we see demand gradually stabilizing in various end markets, and inventory levels showing a clear downward trend."

The company expects wafer shipments in Q4 to remain stable, average selling prices (ASP) to remain stable, the appreciation of the New Taiwan Dollar to lead to a decline in fourth-quarter revenue calculated in New Taiwan Dollars, gross margin to be close to 30%, high end of capacity utilization rate in the range of 60-69%, with annual capital expenditure of 3 billion US dollars.

Wang added: "Our expansion of the new factory in Singapore is nearing completion, and our collaboration with Intel (INTC.US) is progressing as planned. These projects will further enhance our value proposition to customers and strengthen UMC's leading position in the wafer foundry industry."

毛利率达33.8%,营业利润率达23.3%。

毛利率达33.8%,营业利润率达23.3%。