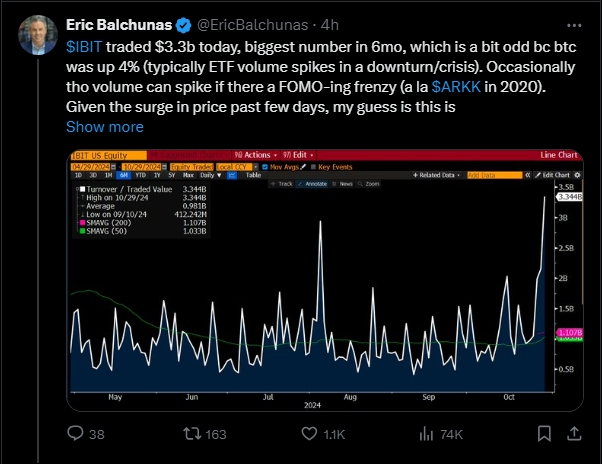

Bloomberg's senior ETF analyst Eric Balchunas stated on social media that blackrock's bitcoin spot etf (IBIT) had a trading volume of $3.3 billion on the day, reaching a six-month high. While ETF trading volume usually surges during economic downturns or crises, Balchunas believes that this surge in trading volume is more likely caused by market 'fear of missing out' (FOMO) sentiment. He expects a significant inflow of funds later this week.

According to monitoring data from SoSoValue, on October 29th, the USA$Bitcoin (BTC.CC)$Spot ETF saw a net inflow of 0.87003 billion US dollars, including:

$iShares Bitcoin Trust (IBIT.US)$Net inflow of 0.64287 billion US dollars;

$Grayscale Bitcoin Trust (GBTC.US)$Net outflow of $17.3 million;

$Grayscale Bitcoin Trust (GBTC.US)$Net outflow of $17.3 million;

$Fidelity Wise Origin Bitcoin Fund (FBTC.US)$Net inflow of $0.13386 billion;

$Bitwise Bitcoin ETF (BITB.US)$Net inflow of $52.49 million;

$ARK 21Shares Bitcoin ETF (ARKB.US)$Net inflow of $12.39 million;

$VanEck Bitcoin Trust (HODL.US)$Net inflow of $16.52 million.

$Grayscale Bitcoin Mini Trust (BTC.US)$Net inflow of $29.2 million.

USA$Ethereum (ETH.CC)$Spot ETF net inflow of 7.65 million USD, including:

$iShares Ethereum Trust ETF (ETHA.US)$Net inflow of 13.62 million US dollars;

$Grayscale Ethereum Trust (ETHE.US)$Net outflow of $5.97 million.