Although AMD's third-quarter total revenue and the most important datacenter revenue both reached new highs, the midpoint of the revenue guidance range for the fourth quarter is slightly below expectations. Some analysts suggest that supply chain constraints prevent them from meeting the high demand for ai chips from customers. The company has raised its AI chip revenue forecast for 2024 to over $5 billion, and expects the AI accelerator market to reach an annual size of $500 billion by 2028.

On Tuesday, October 29, after the US stock market closed, in the datacenter GPU field, it is making a strong chase of Nvidia, the semiconductor giant. $Advanced Micro Devices (AMD.US)$ Released the financial report for the third quarter of the 2024 fiscal year, investors closely watched its full-year sales guidance for the MI300 AI accelerator chip.

Although AMD's total revenue and most important data center revenue hit record highs in the third quarter, the midpoint of the revenue guidance range for the fourth quarter is slightly below market expectations. Some analysts say that supply chain constraints have prevented it from meeting the huge demand for AI chips from customers.

The stock fell more than 7% in post-market trading at one point, rose nearly 4% before the release of Tuesday's financial report, and has risen nearly 13% year to date, but the Nasdaq has risen nearly 25% over the same period. Competitors Nvidia and Intel also experienced slight declines in post-market trading.

The stock fell more than 7% in post-market trading at one point, rose nearly 4% before the release of Tuesday's financial report, and has risen nearly 13% year to date, but the Nasdaq has risen nearly 25% over the same period. Competitors Nvidia and Intel also experienced slight declines in post-market trading.

During the financial report conference call at 5 p.m. Eastern Time, AMD management raised its 2024 AI chip revenue expectation to over $5 billion. Previously, the expectation was $4.5 billion after the second quarter report, mentioning that the upcoming MI accelerator products look promising. It is estimated that the AI accelerator market will reach an annual scale of $500 billion by 2028, but the stock price did not recover after the post-market trading.

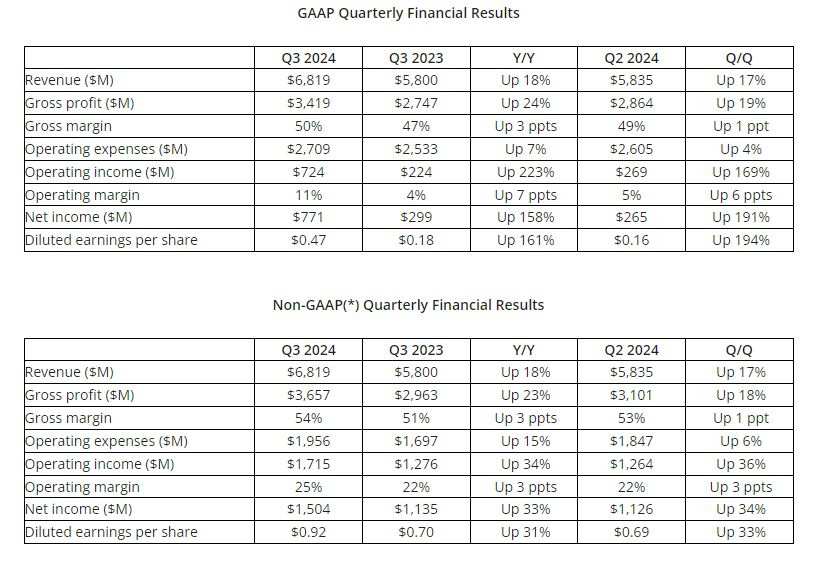

1) Main financial data

Quarterly revenue: $6.82 billion reached a record high, an 18% year-on-year increase, a 17% increase from the previous quarter, market expectations were $6.71 billion, with the company guiding a range of $6.4 billion to $7 billion.

Gross margin: 50% under GAAP, compared to 47% in the same period last year; 54% under non-GAAP, compared to 51% in the same period last year.

Operating profit: $0.724 billion under GAAP, a significant increase of 223% year-on-year; $1.72 billion under non-GAAP, an increase of 34% year-on-year, 36% quarter-on-quarter, showing a comprehensive acceleration from the previous quarter.

Net income: $0.771 billion under GAAP, an increase of 158% year-on-year; $1.5 billion under non-GAAP, an increase of 33% year-on-year, 34% quarter-on-quarter, showing a comprehensive acceleration from the previous quarter.

Diluted EPS: $0.47 under GAAP, an increase of 161% year-on-year; $0.92 under non-GAAP, an increase of 31% year-on-year, 33% quarter-on-quarter, with the market expecting $0.92.

2) Outlook

Fourth-quarter revenue: expected to be $7.2 billion to $7.8 billion, with a midpoint of $7.5 billion, representing a year-on-year growth of about 22% and a quarter-on-quarter growth of about 10%, analysts expect $7.55 billion.

Fourth-quarter non-GAAP gross margin: expected to be around 54%.

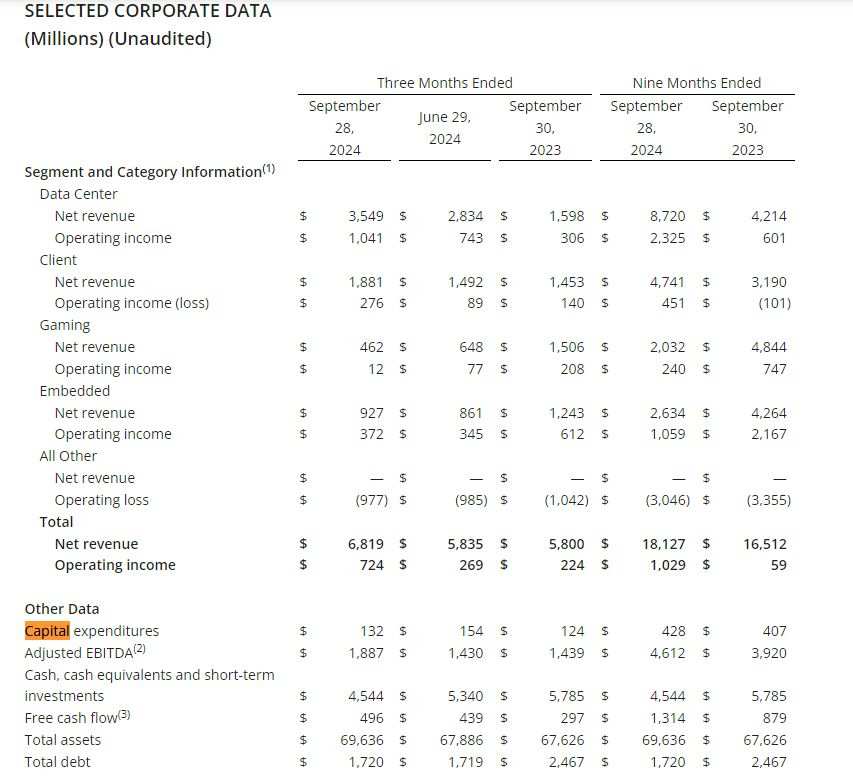

3) Segment business data

Datacenter business unit: revenue reached a record high of $3.5 billion, a year-on-year increase of 122%, a quarter-on-quarter growth of 25%, market expectations $3.52 billion.

Client business unit: revenue was $1.9 billion, a year-on-year increase of 29%, quarter-on-quarter growth of 26%.

Gaming business unit: revenue was $0.462 billion, a year-on-year decrease of 69%, quarter-on-quarter decrease of 29%.

Embedded business unit: revenue was $0.927 billion, a year-on-year decrease of 25%, quarter-on-quarter growth of 8%.

Highlights of the third quarter: Datacenter AI revenue doubled year-on-year for two consecutive quarters and grew faster than the previous quarter, achieving a new high for three consecutive quarters.

In the second quarter of this year, AMD's datacenter business unit revenue hit a new high for two consecutive quarters at $2.8 billion, a year-on-year increase of 115%, quarter-on-quarter growth of 21%. It can be seen that in the third quarter, the revenue for this heavyweight business has hit a new high for three consecutive quarters, with the growth rate increasing each quarter this year. Datacenter revenue in the first quarter increased by 80% year-on-year and 2% quarter-on-quarter.

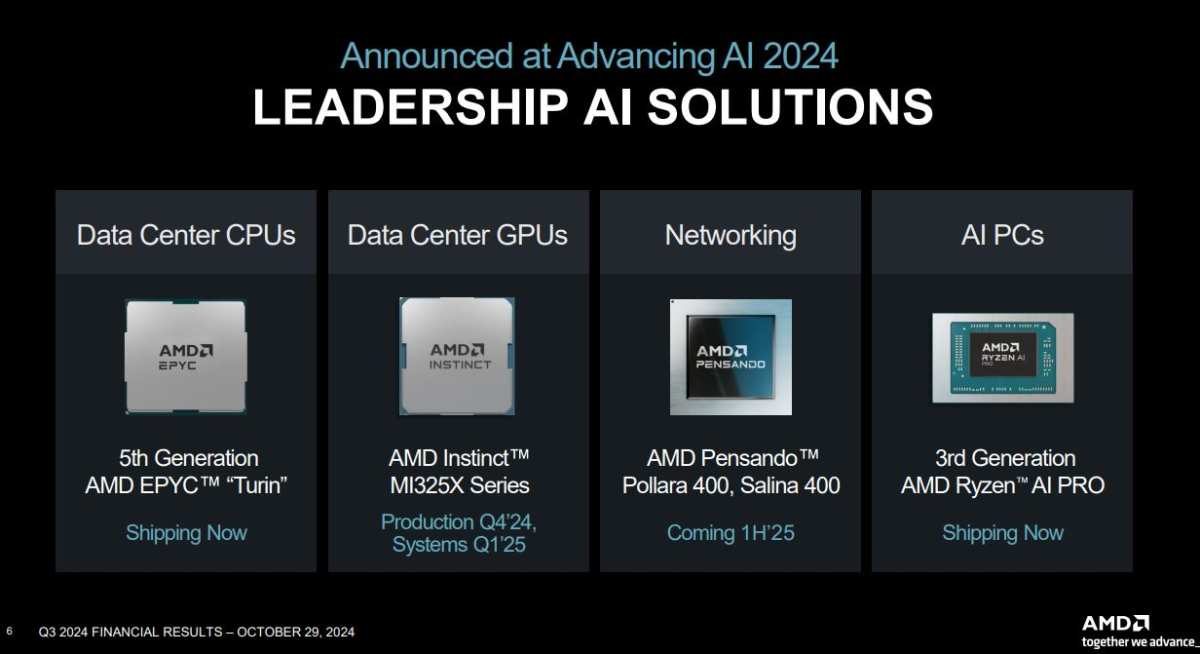

The company stated that this is mainly due to the strong growth in shipments of AMD Instinct GPUs and the increase in sales of AMD EPYC (Sky Dragon) CPUs.

The Client business unit, including personal computer processors, also performed strongly, mainly driven by demand for the 'Zen 5' AMD Ryzen processors. However, some analysts have noted that the growth rate in the personal computer market is lower than some investors' expectations.

The gaming department was mainly affected by the decline in semi-custom revenue, while the embedded department, including cheaper chips for industrial and other applications, experienced a sharp year-on-year decline in revenue due to customers normalizing inventory levels. The sequential revenue growth was attributed to the improvement in demand from multiple terminal markets.

AMD's chairman and CEO, Su Zifeng, once again gave an optimistic assessment of the financial report, stating that total revenue hit a new high in the third quarter, benefiting from the sales growth of Epyc and Instinct datacenter products, as well as the strong demand for Ryzen PC processors:

"Looking ahead, we see tremendous growth opportunities in the datacenter, client, and embedded businesses, largely driven by the increasing demand for more computing."

"The Chief Financial Officer emphasized the significant year-on-year increase in gross margin and earnings per share in the third quarter, stating:"

"With the significant growth in the datacenter and client departments, we expect to achieve record-high annual revenue in 2024."

Analysis: Supply chain constraints led to weak fourth-quarter revenue guidance, but institutions remain optimistic about AMD gaining share in the AI accelerator market.

AMD's fourth-quarter revenue guidance may have multiple interpretations, with the market's biggest concern being the indication of a slowdown in AI demand. However, some analysts also argue that the health of AI demand is unquestionable, and AMD is primarily constrained by the supply chain's inability to meet the surge in orders for AI chips.

The world's largest chip foundry, Taiwan Semiconductor, previously warned in July that until 2025, the global capacity for AI chips will be extremely tight, signaling significant obstacles for the supply of these advanced semiconductor processes.

Earlier this month, AMD hosted the Advancing AI event, unveiling the next generation of AI chips. However, there was no update on the annual sales guidance for the current MI300 AI accelerator, nor were there any announcements of additional new major customer partnerships.

Northland Capital Markets released a bullish research report this week, stating that AMD's market share in AI accelerator chips will continue to grow, especially as Nvidia's strongest Blackwell product line faces manufacturing delays.

The institution expects AMD's market share to double within two years, with artificial intelligence revenue reaching 18 billion to 28 billion US dollars by 2027, representing up to 9.7% of the AI accelerator market. In 2023, it accounted for less than 1% (specifically 0.7%), but the report also states:

"With AMD investing billions of dollars (in AI) to secure potential future annual revenues of hundreds of billions of dollars, slowing profit growth could be an issue with operating expenses."

According to AMD's financial report, capital expenditures in the third quarter amounted to 0.132 billion US dollars, a 6.5% year-on-year increase, but a more than 14% decrease from the previous quarter. Cumulative capital expenditures for the first nine months of this year reached 0.428 billion US dollars, a 5.2% year-on-year increase.

Editor/Lambor

该股盘后一度跌逾7%,周二财报发布前收涨近4%,今年累涨近13%,但纳指同期累涨近25%。竞争对手英伟达和英特尔也盘后小幅下挫。

该股盘后一度跌逾7%,周二财报发布前收涨近4%,今年累涨近13%,但纳指同期累涨近25%。竞争对手英伟达和英特尔也盘后小幅下挫。