Overview

The trend of gold may vary greatly due to different economic, geopolitical, and market factors.

Historical data shows that during a rate cut cycle, gold often performs well as investors seek safe-haven assets.

Gold has long been seen as a safe-haven asset, with investors flocking to this precious metal during periods of economic uncertainty. However, the trend of gold may vary significantly due to different current economic conditions. Considering the possibility of the Fed opening a rate cut cycle, then historically, how does gold perform under different combinations of economic growth rates and inflation levels during a downward interest rate or stable period?

1. Interest rates decline, economic slowdown while inflation falls (soft landing).

During a period of declining interest rates, economic slowdown, and falling inflation, gold usually performs moderately. A typical example occurred in the early 21st century, especially during the period from 2001 to 2003.

At that time, following the burst of the internet bubble and the 9/11 terrorist attacks, the US economy slowed significantly. The Federal Reserve took aggressive rate cut measures, reducing rates from 6.5% in January 2001 to 1% in June 2003. At the same time, inflation decreased from 3.4% in 2000 to 1.6% in 2002.

Gold generally trended upward during this period, but the increase was not spectacular. The price of gold rose from around $270 per ounce in early 2001 to around $350 per ounce by the end of 2003, with a cumulative increase of about 30% over three years.

Affected by multiple factors, gold performed relatively mildly during this period. Although low interest rates typically support the gold price by reducing the opportunity cost of holding this non-yielding asset, deflationary environment and slowing economic growth have brought opposite pressures.

Looking ahead to the decisions of the Federal Reserve in September and subsequent meetings, in a mixed scenario of controlled inflation without triggering a recession (manifested by gradual rate cuts and stable economic growth), the gold price may still find support due to persistent inflation concerns and implementation of loose policies. This may make gold an effective hedge tool in the coming months.

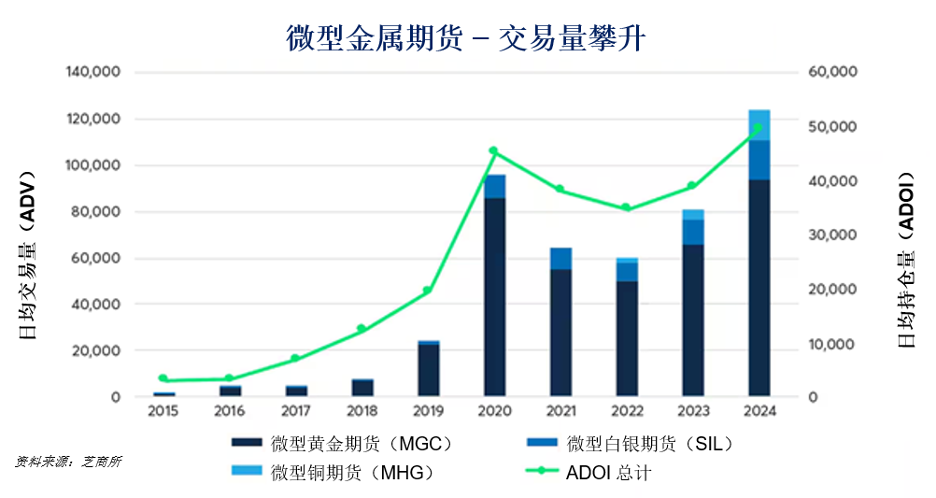

Due to market price fluctuations, the average daily trading volume of mini gold futures increased by 27% from early 2024 to the end of the second quarter, reaching 93,000 contracts. The latest data for August shows that the average daily trading volume of mini gold futures in that month increased by 170% compared to August 2023, reaching 124,000 contracts.

2. Rapid interest rate declines, sharp economic slowdown, and decreasing inflation often bode well for gold as investors typically demand safe-haven assets during this period.

During periods of rapid interest rate declines, sharp economic slowdown, and decreasing inflation, investor demand for safe-haven assets like gold is usually bullish. A typical example occurred during the global financial crisis of 2008.

To address the crisis, the Federal Reserve slashed interest rates from 5.25% in September 2007 to near zero by December 2008. The U.S. economy sharply contracted, with real GDP falling by 2.5% in 2009. Inflation also dropped from 3.8% in 2008 to -0.4% in 2009.

Gold performed exceptionally well during this period of economic turmoil. From the end of 2007 to the beginning of 2009, the gold price surged from around $700 per ounce to surpass $1,000 per ounce, continuing to rise in the subsequent years and peaking at nearly $1,900 per ounce in 2011.

Gold's strong performance in this crisis is closely related to its status as a safe-haven asset. As the financial system is on the verge of collapse, traditional assets such as stocks and real estate plummet in value, making investors increasingly favor the safety attributes of gold. Although as of early September the US economy remained relatively stable, any signs indicating a more serious recession could prompt the Federal Reserve to take more aggressive actions, thereby highlighting gold's role as a safe-haven asset.

3. The decline in interest rates, stable economic operation, and rising inflation.

The period from 2003 to 2006 provided another interesting case study material. During this time, the US economy operated relatively smoothly, with an average annual GDP growth rate of about 3%. Inflation rose slightly from 1.6% in 2002 to 3.2% in 2006. The Federal Reserve had maintained low-interest rates in the early 21st century, gradually entering a tightening cycle from 2004 while maintaining an overall accommodative stance.

The price of gold performed strongly during this period, rising from around $350 per ounce in early 2003 to over $700 by mid-2006, achieving nearly a 100% increase in a little over three years.

Gold's outstanding performance during this period was due to the combined effect of multiple factors. Rising inflation sparked investors' demand for gold as an inflation hedge, while the opportunity cost of holding gold remained relatively low due to the gradual increase in interest rates. As of early September, the Federal Reserve hinted at a possible rate cut in the situation where inflation remains above the target level. Similar to the period from 2003 to 2006, this scenario could be bullish for gold.

The gold price pattern is difficult to predict.

Historical evidence shows that the performance of gold assets may vary greatly depending on the current economic conditions. However, gold prices also exhibit some common patterns:

· Gold often performs well in periods of economic uncertainty, especially when investors seek safe-haven assets in a declining interest rate cycle.

- Inflation rising, especially if accompanied by low interest rates or rate cuts, can create a particularly favorable environment for the price of gold.

- In a deflationary environment, the performance of gold may be relatively flat, but gold can still attract investors seeking a means of preserving value during economic downturns.

- Stable economic growth can create a favorable environment for gold investments, especially in situations accompanied by loose monetary policies and rising inflation expectations.

It should be noted that although these historical patterns can be useful for reference, the gold market is still influenced by the interaction of economic, geopolitical, and market factors, and the price of gold may sometimes deviate from historical patterns. As the Federal Reserve continues to assess and adjust U.S. monetary policy, gold will become an asset of interest to many market participants.