Article Source - WeChat Official Account: Brother Wang Loves Coriander

Recent expectations are that Bitcoin will break the previous high before the general election at the beginning of next month. As a result, today Bitcoin has broken through 71,000 US dollars, hitting a record high for the fourth time.

The market over the past few days is different from what was expected; that is, Bitcoin isTechnical indicatorsAfter falling below, it did not continue to fall.

Meanwhile, with Bitcoin rising before today, with the exception of a few, most of them are relatively sluggish, and some have even broken new lows for nearly a month.

Meanwhile, with Bitcoin rising before today, with the exception of a few, most of them are relatively sluggish, and some have even broken new lows for nearly a month.

I thought about the situation in the cottage. Therefore, in the previous two articles, everyone was reminded that the pullback should first consider Bitcoin, and copycats should be cautious.

Next, if Bitcoin can stabilize at this level, the longer it remains stable, the increase in copycats will increase day by day.

Flatbread was 0.07 million for the first time, 4000 Ether.

Flatbread was 0.07 million for the second time, 3,900 Ether.

Flatbread was 0.07 million for the third time, 3,300 Ether.

Flatbread is 0.07 million for the fourth time, 2,500 Ether.

Looking at the statistics above, it seems that this is indeed the case. This round of Ether seems to be in crisis. A few months ago, I wrote an article saying that the value of Ethereum is either 0.01 million or zero. This round of Ether will take this turn.

A long time ago, it must have been a year. I remember writing an article saying that the Ethereum series exploded excessively in the last round of the bull market, so there were still many related VC tokens in the early stages of this bull market, but these coins generally had a high TVL.

The original saying was “Maybe the death of the Ethereum series will greatly reduce the bubble in the coin industry, and a bull market will come.”

This statement is extreme, but it's not unreasonable. There are actually too many parasites on Ethereum.

Although I had fantasies about Ethereum in the later stages when the exchange rate difference reached a certain extent, it was only laid out as a very small sector. Even if the layout was already very poor, the Ether series could still be worse.

Wang Ge summed up a few reasons for the downturn in Ethereum:

1. God focuses on women, and the Foundation focuses on selling coins.

2. Before the ETF was approved, I mentioned the issue of selling 2% of grayscale positions after approval, reminding everyone to pay attention. So far, Grayscale has sold over 1 million Ethereum.

3. Some new and old Ethereum concepts, such as ETHFI, LDO, ENA, BB, etc., generate huge profits and are also huge bubbles. The price of ETH doesn't seem high, but in fact, many large staked players get huge profits from other platforms while holding positions. When ETH itself is sluggish, airdrops obtained by pledging will also be sold. When large players feel that the price of staking and selling ETH is no longer appropriate, they will continue to sell Ethereum. This in turn affects the price of Ether tokens, creating a vicious cycle.

About half a month ago, a large pledger sold tens of thousands of pieces of ether after the pledge expired. This is no exception.

4. Loss of left arm (ICO and DEFI), DEFI regulation, and public chain competition.

In the last round, Ether was almost the biggest bull market. Despite competition, it was still the only one.

In this round, the main thing is that SOL is too strong, and there are other public chains.

In a situation where ETH has lost its advantages in ICO and DEFI, MEME can't catch up with SOL, and there is no innovation, it is also a situation where living space is being squeezed.

..................

These are the reasons why Ethereum has been underperforming recently.

So the question is, the past is over, is there any chance for ETH in the future?

First, it depends on whether V will return to the coast, actively innovate, and strengthen the competitiveness of ETH.

Second, it depends on when Grayscale's ETF reaches outflow balance. If the outflow does not reach the equilibrium point, Zhuang is unwilling to give an institution such as Grayscale a chance to exit the market at a high level. Judging from the data, Grayscale still still has 2.63 million tokens. The outflow rate is not fast, and it will probably take a long time.

Third, it also depends on how the competition develops; it starts to rise one after another.

So does Ethereum still have a chance?

The short answer is: Yes, but it may disappoint people in the short term, but there are still opportunities in the long term.

Ethereum is a trillion-dollar market, and it's hard to beat no matter what, in addition, there is support from ETFs.

However, from the point of view of retail investors, if they already hold positions at a high level, they can only wait patiently; it is also unreasonable to exchange positions, because the exchange rate is already too low.

If you don't own it, if you want to go back to the bottom, it's cost-effective, but judging from now on, it doesn't feel as good as copycat.

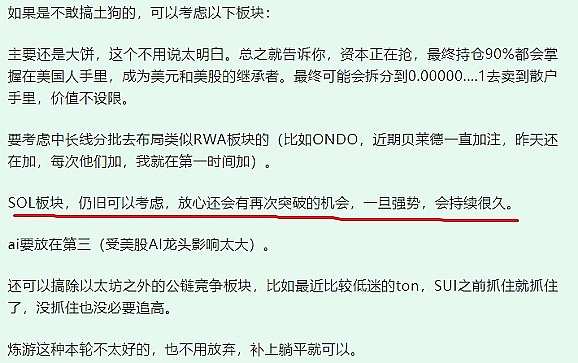

Recent hot topics include: fan coins, SOL sector, new memes.

Fan coins and the new MEME are equivalent to leveraged gamblers, so you don't need to focus too much; they are all inside stories about making money, and the SOL series is once again popular.

The opportunities I mentioned in my article at the beginning of the month were the MEME Tug and SOL sections, RWA. Currently, only RWA is underperforming.

Currently, the SOL position of 183 US dollars is also the third and fourth time to try to break through the pressure. Personally, I think the pressure is still 190-200, so you can consider taking profit and leaving a bottom position.

.................

A piece of news in the US “Investigating Tether” has deceived countless people. Israel and Iran are playing a double whammy, mistakenly injuring countless leeks. A circle full of news and scams... is finance.

As long as he has sufficient judgment, Wang Ge always believes in the saying: the market always leaves regrets, but regrets are often erased over time.

同时比特币在今天之前上涨的情况下,山寨除少数之外,大部分比较低迷,甚至有些破了近一个月新低。

同时比特币在今天之前上涨的情况下,山寨除少数之外,大部分比较低迷,甚至有些破了近一个月新低。