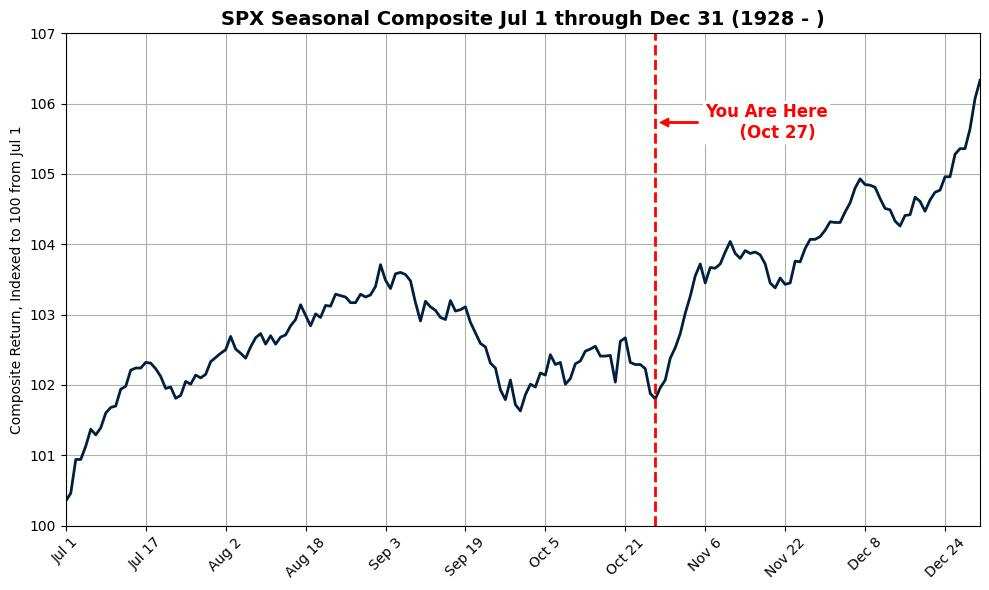

Goldman Sachs expert Rubner said that this Monday is the start of the best fourth quarter trading period for US stocks based on data since 1928, and also the start of the best trading period of the year during election years. The window for buybacks of the largest buyer of US stocks, public companies, also reopened on Monday; Since 1928, in election years, the median return rate of the S&P 500 Index from October 27 to December 31 is 6.25%.

Nearly two weeks ago, Goldman Sachs research capital flow expert Scott Rubner, who accurately predicted the pullback in US stocks at the end of this summer, is bullish on the year-end performance of US stocks in his report, expecting the S&P 500 Index to surpass 6,000 points by the end of this year. Now he has made it known that US stocks are entering the best fourth quarter trading phase in nearly a century.

There are only 44 trading days left in 2024, and trading this year is entering its final sprint phase. In a report released on Monday, October 28, Eastern Time, by Rubner, Managing Director of the Global Markets Division of Goldman Sachs, he revealed that he received more questions over the weekend than at any other time this year. He warned traders to be cautious of FOMO, and pointed out that

Today marks the beginning of the best fourth quarter trading period for US stocks based on data since 1928, and also the beginning of the best trading period of the year during election years. October 28th is one of the best trading days of the year and a positive seasonal trading period with nine consecutive days of gains.

The report stated that on October 18th, the S&P 500 Index hit a historic high for the 47th day of the year, reaching a record high about 20 points higher than the pre-market level on Monday. Summarizing, Rubner described the latest situation facing the US stock market as:

At the end of this month, the largest sellers of US stocks - retirement funds and mutual funds in their fiscal year-end are reducing supply, while the largest buyers of US stocks - the public companies involved in buybacks - are back online as the companies' buyback window reopened on Monday, with 50% of companies in the buyback window.

Customers' concerns have shifted from hedging the left tail to hedging the right tail.

The so-called fear index VIX, which measures US stock volatility, fell on Monday. If volatility continues to decrease, there is still room for further extension.

The global consensus on Wall Street is that the US stocks will decline after the US election, with investors waiting for the decline to happen, expecting a 5% drop.

Rubner believes that we will not see this left tail. He said the US election will be a risk asset liquidation event, risk preferences, adventurous actions may quickly return, possibly in previously unpopular industries and undervalued themes.

Rubner mentioned some key factors he is currently tracking in the report.

In terms of fund flows, Rubner points out that target date funds (TDF), private wealth management (PWM) allocations, and retail investors usually rebalance their portfolios in January, April, and November. Investors holding US treasuries may be looking for new destinations for their funds.

He cited some figures: Since 2019, the funds inflow into US assets was 55 billion USD to stocks, 2.029 trillion USD to bonds, and 3.465 trillion USD in cash. The global fund flow since 2019 has been 974 billion USD into stocks, 2.505 trillion USD into bonds, and 3.95 trillion USD in cash.

Regarding seasonal factors, although there are only 7 trading days left until the US election, don't rush, Rubner says, everyone loves the year-end rebound, and there is data to prove it:

Since 1928, from October 27 to December 31 each year, the median return of the S&P 500 index is 5.22%; In election years since 1928, from October 27 to December 31 each year, this index's median return is 6.25%.

Since 1985, from October 27 to December 31 each year, the median return of the Nasdaq 100 index is 11.74%; In election years since 1985, from October 27 to December 31 each year, this index's median return is 7.17%.

Since 1979, the median return rate of the e-mini russell 2000 index from October 27th to December 31st each year is 7.99%; in election years since 1979, the median return rate of the index from October 15th to December 31st is 9.88%.

Regarding share buyback, USA companies are the largest buyers in the US stock market. Goldman Sachs believes that the window for share buybacks will open on Monday, October 28. Data from the Goldman Sachs trading desk shows that since 2007, November has historically been the month with the largest buyback volume, accounting for 10.40% of the annual buyback volume. Goldman Sachs estimates that the value of stocks to be bought back in 2024 will be $960 billion, with the value of stocks bought back in November being $100 billion.

Rubner stated that he estimates a daily volume-weighted average price demand of around $6 billion for the 19 trading days in November this year: this might also have a greater potential demand impact on days with lower liquidity during the holidays.

In terms of mutual funds, the largest sellers of mutual funds in the US stock market will be fading out by the end of this month, as a total of 756 mutual funds with assets totaling $1.853 trillion will end this fiscal year on October 31, 2024.

Rubner also mentioned that he will closely monitor Goldman Sachs' momentum factor, as November to January is the worst-performing three months of the year in terms of momentum. Rubner raised a question: if AI winners dominate the 2024 fiscal year earnings report, will there be enough time after November 1 to identify winners for 2025.

Regarding retail investors, Rubner noticed an increase in activity on the message boards by retail investors, and he is monitoring this retail investor group through options and ETFs.

In terms of election day volatility, Rubner stated that the Election Day implied movement of the s&p 500 index hit a new cycle low.

Concerning global fixed income, Rubner mentioned that the global fixed income exposure of CTA has significantly improved. Goldman Sachs Futures sales estimates that CTAs sold bonds worth $109 billion in the past week and sold bonds worth $309 billion in the past month, with positions returning to a neutral level for the first time in a month.

In addition, Rubner mentioned that Goldman Sachs' global prime brokerage business reflects the main trend of clients towards reducing risks. Hedge funds net sold US stocks this week, accounting for about a quarter of the recent long positions, driven almost entirely by macro products. The nominal short selling volume of macro products this week is the largest since early January, indicating increased hedging activities.

Editor/new

今天是1928年来数据显示美股最佳四季度交易期的开始,也是选举年期间一年中最佳交易期的开始。10月28日是一年中最好的交易日之一,也是连涨九日的积极季节性交易期。

今天是1928年来数据显示美股最佳四季度交易期的开始,也是选举年期间一年中最佳交易期的开始。10月28日是一年中最好的交易日之一,也是连涨九日的积极季节性交易期。