Financial giants have made a conspicuous bullish move on Salesforce. Our analysis of options history for Salesforce (NYSE:CRM) revealed 12 unusual trades.

Delving into the details, we found 66% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $115,475, and 9 were calls, valued at $1,109,561.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $240.0 to $440.0 for Salesforce over the last 3 months.

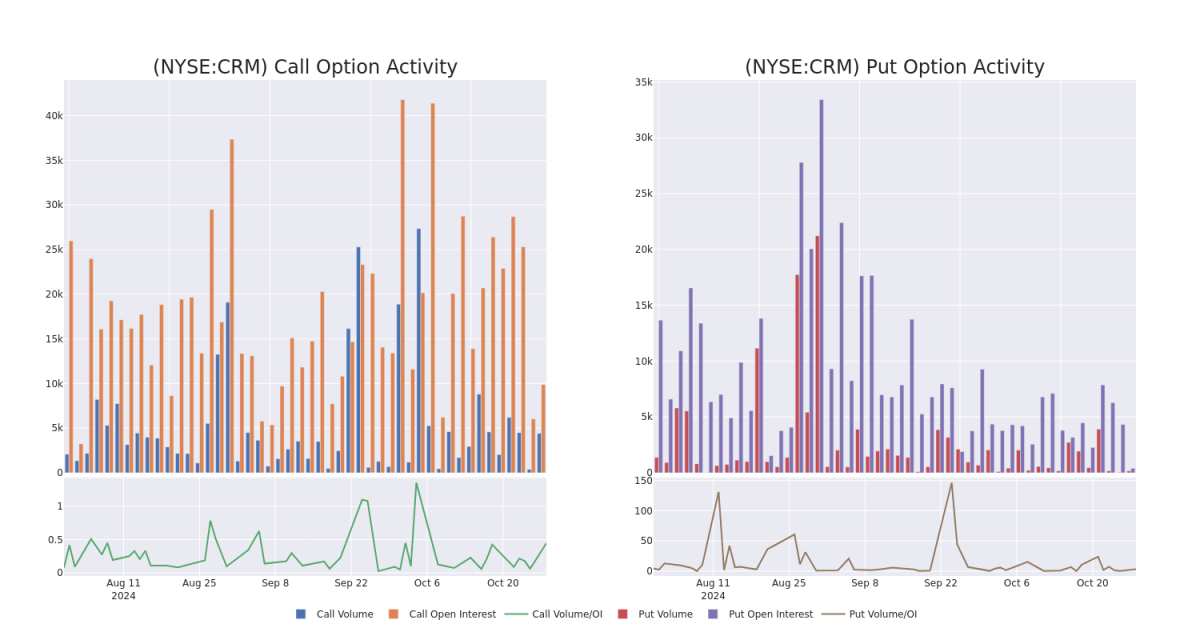

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Salesforce options trades today is 856.67 with a total volume of 4,596.00.

In terms of liquidity and interest, the mean open interest for Salesforce options trades today is 856.67 with a total volume of 4,596.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Salesforce's big money trades within a strike price range of $240.0 to $440.0 over the last 30 days.

Salesforce Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRM | CALL | TRADE | BULLISH | 05/16/25 | $1.57 | $1.24 | $1.45 | $440.00 | $580.0K | 0 | 4.0K |

| CRM | CALL | TRADE | BULLISH | 01/17/25 | $34.5 | $33.9 | $34.5 | $270.00 | $258.7K | 2.4K | 75 |

| CRM | CALL | TRADE | BULLISH | 11/15/24 | $26.15 | $26.05 | $26.15 | $270.00 | $73.2K | 2.3K | 41 |

| CRM | CALL | SWEEP | BULLISH | 06/20/25 | $2.36 | $2.35 | $2.36 | $440.00 | $49.7K | 282 | 211 |

| CRM | PUT | TRADE | BEARISH | 11/22/24 | $4.9 | $4.1 | $4.7 | $285.00 | $47.0K | 53 | 120 |

About Salesforce

Salesforce provides enterprise cloud computing solutions. The company offers customer relationship management technology that brings companies and customers together. Its Customer 360 platform helps the group to deliver a single source of truth, connecting customer data across systems, apps, and devices to help companies sell, service, market, and conduct commerce. It also offers Service Cloud for customer support, Marketing Cloud for digital marketing campaigns, Commerce Cloud as an e-commerce engine, the Salesforce Platform, which allows enterprises to build applications, and other solutions, such as MuleSoft for data integration.

Salesforce's Current Market Status

- With a trading volume of 1,405,716, the price of CRM is up by 1.02%, reaching $293.44.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 30 days from now.

What The Experts Say On Salesforce

In the last month, 3 experts released ratings on this stock with an average target price of $360.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Stifel has decided to maintain their Buy rating on Salesforce, which currently sits at a price target of $350. * In a cautious move, an analyst from Oppenheimer downgraded its rating to Outperform, setting a price target of $330. * In a positive move, an analyst from Northland Capital Markets has upgraded their rating to Outperform and adjusted the price target to $400.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Salesforce options trades with real-time alerts from Benzinga Pro.