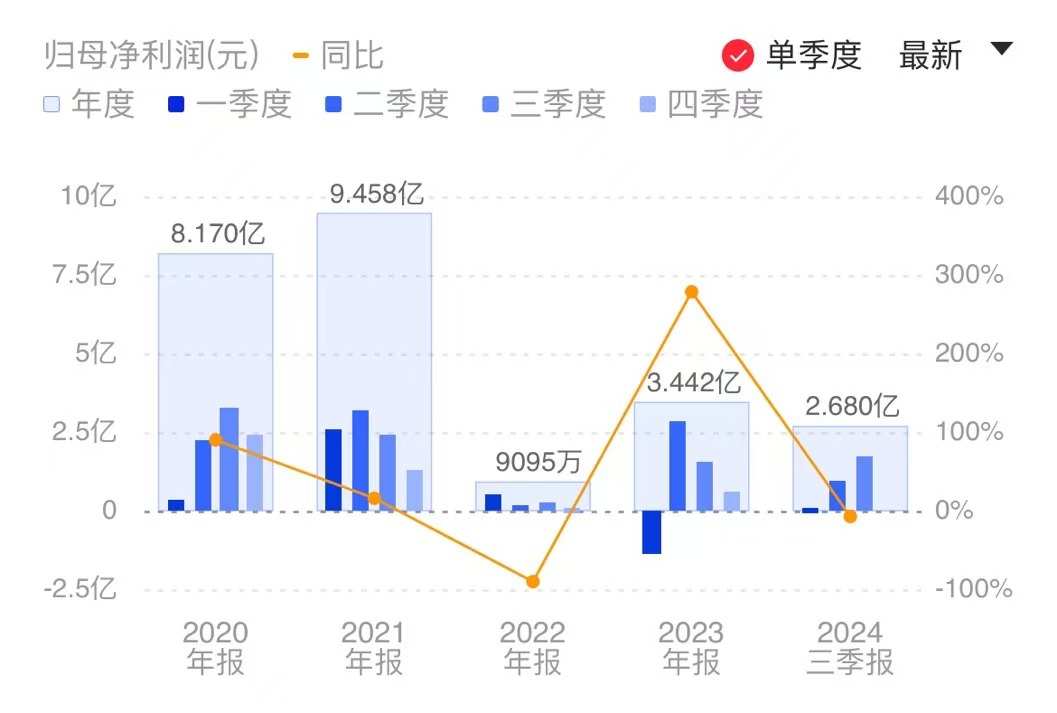

Looking at the performance of Zhuhai Guanyu in recent years, the performance has fluctuated significantly, but there is a trend of quarter-on-quarter and year-on-year growth in the third quarter. Zhuhai Guanyu once again announced providing loans to its subsidiaries, already disclosing a loan amount not exceeding 1.65 billion yuan within the year.

On October 28, Zhuhai Guanyu released the third quarter financial report for 2024 in the 'Star Market Daily' (Reporter: Yu Jiaxin) today (October 28).

In the first three quarters of this year, Zhuhai Guanyu's revenue was 8.517 billion yuan, a decrease of 0.27% year-on-year; realized net profit attributable to shareholders was 0.268 billion yuan, a decrease of 7.47% year-on-year.

Looking at Zhuhai Guanyu's performance, the company has experienced significant performance fluctuations in recent years, but in the third quarter of this year, there is a trend of quarter-on-quarter and year-on-year growth. The company's Q3 revenue was 3.17 billion yuan, an increase of 3.39% year-on-year; realized net profit attributable to shareholders was 0.166 billion yuan, an increase of 11.43% year-on-year, an increase of approximately 81.05% quarter-on-quarter.

Looking at Zhuhai Guanyu's performance, the company has experienced significant performance fluctuations in recent years, but in the third quarter of this year, there is a trend of quarter-on-quarter and year-on-year growth. The company's Q3 revenue was 3.17 billion yuan, an increase of 3.39% year-on-year; realized net profit attributable to shareholders was 0.166 billion yuan, an increase of 11.43% year-on-year, an increase of approximately 81.05% quarter-on-quarter.

Zhuhai Guanyu is mainly engaged in the research and development, production, and sales of consumer batteries, and is also advancing in the field of power and energy storage batteries. In the first three quarters of this year, the company's R&D investment was 1.053 billion yuan, an increase of 30.46% year-on-year, accounting for 12.36% of revenue, an increase of 2.91 percentage points year-on-year.

In the field of consumer electronics, during an institutional survey in September this year, the company indicated its active participation in multiple foldable phone projects, with some products already in mass production. Some models will adopt a dual-cell layout structure, increasing the number of cells. Foldable models usually have limited space for batteries, requiring higher structural and performance standards, thus enhancing the value.

In the field of power and energy storage business, Zhuhai Guanyu stated that it positions low-voltage lithium batteries for cars as its core business with competitive advantages and differentiation. In the low-voltage lithium battery sector for cars, it has successively gained recognition from automotive enterprises such as SAIC, Zhiji, Jaguar Land Rover, Stellantis, GM, and certain top German car manufacturers. Multiple product models have now begun to ramp up production.

On the same day (October 28), Zhuhai Guanyu released an announcement of provision for impairment of assets, showing that in the first three quarters of 2024, the company confirmed a total asset impairment loss of 0.174 billion yuan, with inventory impairment loss of 0.166 billion yuan, accounting for 95.30%.

"The company's power business is still in the initial stage, and economies of scale are not yet obvious. The indirect costs of unit product allocation, such as labor costs and equipment depreciation, are also high. At the same time, due to the certain debugging period of the company's new product line, the yield of these new products is low during the production capacity climbing process, resulting in high unit production costs," said Zhuhai Guanyu.

Zhuhai Guanyu further mentioned that when the products are actually sold in the future, the provision for inventory impairment will be reversed and correspondingly offset against the cost of goods sold. In the first three quarters of 2024, the company reversed the provision for inventory impairment by 0.192 billion yuan.

On the same day (October 28), Zhuhai Guanyu also announced providing loans to its subsidiary. It stated that the company and its subsidiary intend to use their own funds to provide Zhjiang Guanyu and its subsidiaries with a loan limit not exceeding 0.15 billion yuan, with a term of 3 years from the date of approval by the board of directors, and this limit can be used on a revolving basis during the validity period (with the highest balance not exceeding 0.15 billion yuan).

"Science and Technology Innovation Board Daily" reporters noticed that Zhuhai Guanyu has announced Zhejiang Guanyu-related matters multiple times this year. On June 6, it disclosed the plan to provide a loan of up to 1.5 billion yuan to Zhejiang Guanyu using its own funds. As early as January 23, the company announced that it was planning to increase capital and introduce external investors for Zhejiang Guanyu. From the current disclosure, it appears that Zhuhai Guanyu is still increasing its capital in Zhejiang Guanyu through loans.

It is introduced that Zhejiang Guanyu's main business is in power and energy storage. In the full year of 2023, Zhejiang Guanyu had revenue of 0.486 billion yuan and a net loss of 0.271 billion yuan. From January to September this year, the company's revenue was 0.38 billion yuan, with a net loss of 0.183 billion yuan. The semi-annual report shows that Zhejiang Guanyu achieved a total operating income of 0.406 billion yuan in the first half of the year, with the revenue share of autos low-voltage lithium batteries and lithium batteries for the drone industry accounting for 69.33%.

Minority shareholders of Zhejiang Guanyu, Zhuhai Guanqi, Hangzhou Haoyi, and Anqing Huijia, are related parties of Zhuhai Guanyu. Among them, Zhuhai Guanyu holds 73.69% of the equity of Zhejiang Guanyu; Zhuhai Guanqi, Hangzhou Haoyi, and Anqing Huijia hold equity stakes in Zhejiang Guanyu at 5.62%, 0.62%, and 1.63% respectively.

纵观珠海冠宇业绩表现,该公司近年来业绩波动幅度较大,不过其今年第三季度业绩现同、环比增长趋势。该公司Q3营收31.7亿元,同比增长3.39%;实现归母净利润为1.66亿元,同比增加11.43%,环比增加约81.05%。

纵观珠海冠宇业绩表现,该公司近年来业绩波动幅度较大,不过其今年第三季度业绩现同、环比增长趋势。该公司Q3营收31.7亿元,同比增长3.39%;实现归母净利润为1.66亿元,同比增加11.43%,环比增加约81.05%。